For fundamentally stable stocks like NVIDIA, while bears and bulls often battle it out, most of the time the market tends to settle on a consensus for the expected trading range, maintaining both bullish and bearish views within a certain zone.

However, starting last week around Labor Day, NVIDIA began showing some signals that diverged from the mainstream market sentiment. The dominant expectation in the market is that NVIDIA will fluctuate around $110 until May 16 (monthly option expiration). Yet, some bullish large orders suggest that NVIDIA may experience a move above $115 before the earnings report.

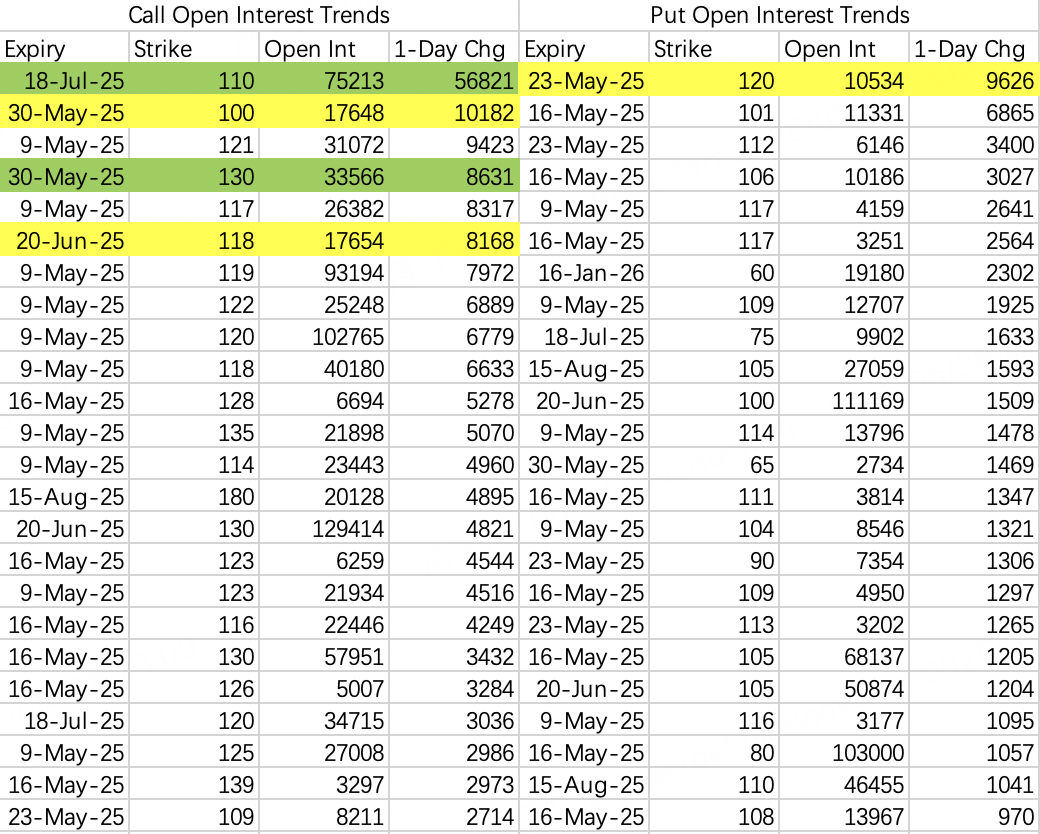

Typical recent bullish large orders are mostly focused on May 23 expiration, and are all single-leg positions:

Buy $NVDA 20250523 115.0 CALL$ , with 76,000 contracts opened in the past five days.

Sell $NVDA 20250523 117.0 PUT$ , with 10,000 contracts opened in the past five days.

Sell $NVDA 20250523 118.0 PUT$ , with 9,984 contracts opened in the past five days.

Aside from these typical large orders, the open interest for May 23 options is notably high. However, if the stock price remains flat before May 16, it seems premature to open bullish positions this early.

By the close of trading on Wednesday, there was no particularly favorable news for NVIDIA's stock price.

The earnings outlook is mixed. While Q1 results are expected to beat market expectations, Q2 guidance may be flat or slightly below expectations due to export restrictions, with additional pressure on gross margins.

In terms of U.S.-China tariff negotiations before the earnings report, the semiconductor sector is likely to be a key focus, and this risk should already be priced into the stock and considered a bearish factor.

Taking all these factors into account, it seems reasonable for NVIDIA's stock price to hover around $110, with no apparent catalysts to push it above $115.

However, long-term bullish large orders have appeared, and they span a basket of semiconductor and software stocks. Examples include:

It was later discovered that NVIDIA also had similar long-term bullish positions opened for the same expiration date:

$NVDA 20270617 110.0 CALL$ , with a transaction value in the tens of millions.

This basket of bullish trades carries significant informational value. Compared to the short-term bullish positions mentioned earlier, these are clearly bets on long-term upside potential.

However, based on ARM's post-earnings drop, the earnings outlook is likely not the primary motivation for these trades.

Looking at the selected underlying stocks, they are all leading names in the semiconductor space. The unusual activity in ASML options, which is rarely seen, stands out in particular.

The trading volumes are relatively restrained and may not be obvious in daily open interest data. However, the transaction values are massive, as these are at-the-money ultra-long-term options.

Combining this with the sudden news on Wednesday, May 7, about plans to lift export restrictions, it’s clear that the trading logic behind these positions is a bullish bet on policy-driven optimism for the entire semiconductor sector.

Why Bet on This Policy with Call Options?

According to analysts, under the current export restriction framework, NVIDIA and its U.S. AI peers face the risk of losing approximately 20% of the long-term AI infrastructure market (worth about $50 billion).

Thus, it seems clear: these large bullish option trades are based on insider information.

The Key Question: Should You Follow These Bullish Trades?

Long-term insider trades generally don’t consider short-term volatility. For instance, ARM's calls didn’t account for the post-earnings drop, which may be why a basket of stocks was chosen to spread the risk of individual stock downsides.

Insider trades can also exit if the market moves against expectations. Take the example of the Chinese ADR bullish trades earlier this year, where large call positions, such as $YINN 20260116 27.0 CALL$ , were closed at the bottom. Even when the rationale for opening insider trades is strong, they often can’t withstand market "bluffs."

Thus, while you can use insider trades as a reference and evaluate the capital commitment behind them, you should still base your short-term outlook on recent options activity.

For example, the short-term bullish large orders mentioned earlier are clearly insider trades, but their outlook is more conservative. The expectation is that the stock price won't drop below $115 and might have a chance to reach $120. You can monitor the closing activity for the following three options:

This kind of rumor-driven bullishness is clearly very divergent from the broader market sentiment. Therefore, opening trades on Wednesday should still align with the original volatility expectations.

Bearish options opening activity has significantly decreased, and many positions were closed after the news was released.

There were two notable call roll trades:

Long-term roll to $NVDA 20250718 110.0 CALL$

Short-term roll to $NVDA 20250530 130.0 CALL$

The $NVDA 20250530 110.0 CALL$ trade was clearly purposeful and deserves close attention.

Comments