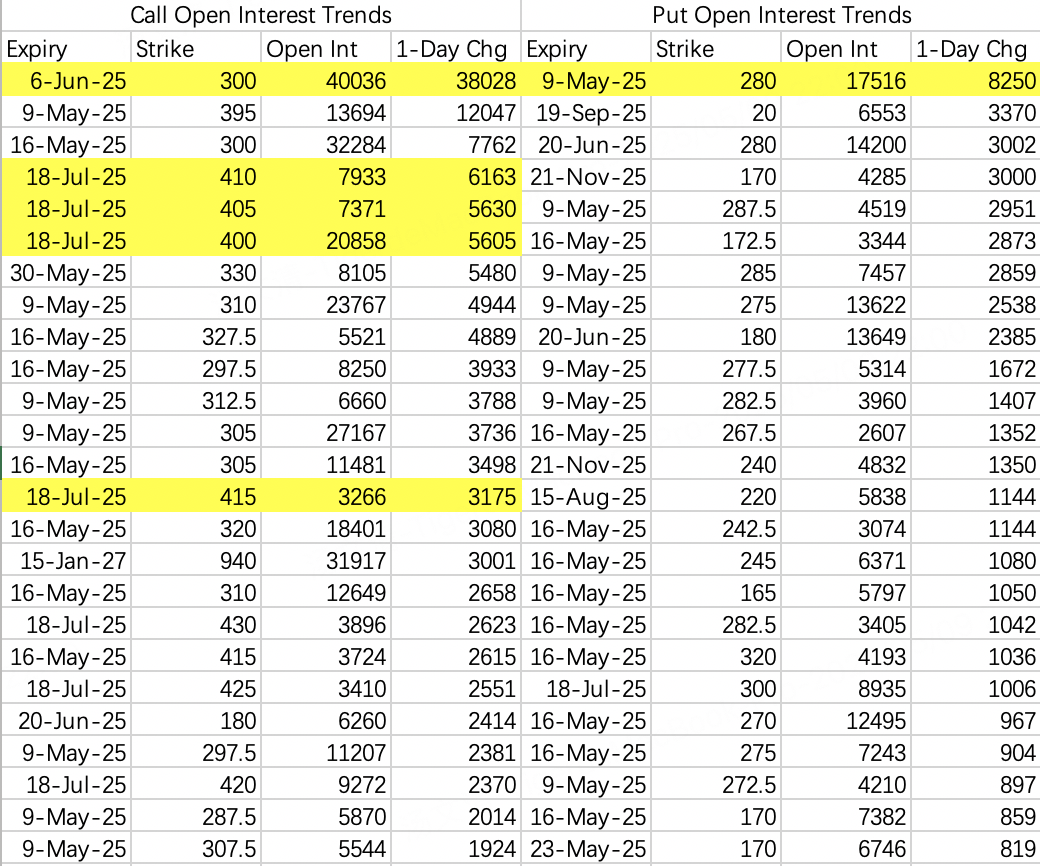

A rare bullish order for Tesla appeared: a short-term bullish option, 300 call $TSLA 20250606 300.0 CALL$ , with 38,000 contracts opened, likely indicating buying activity.

At the same time, the top bearish open interest was the 280 put $TSLA 20250509 280.0 PUT$ , with 8,250 contracts opened, primarily sold.

Additionally, a significant number of new positions were opened for July-expiry 400–415 calls, such as $TSLA 20250718 400.0 CALL$ . This is worth monitoring.

From a trend perspective, 280 has become a new support level, although no specific positive catalysts are apparent.

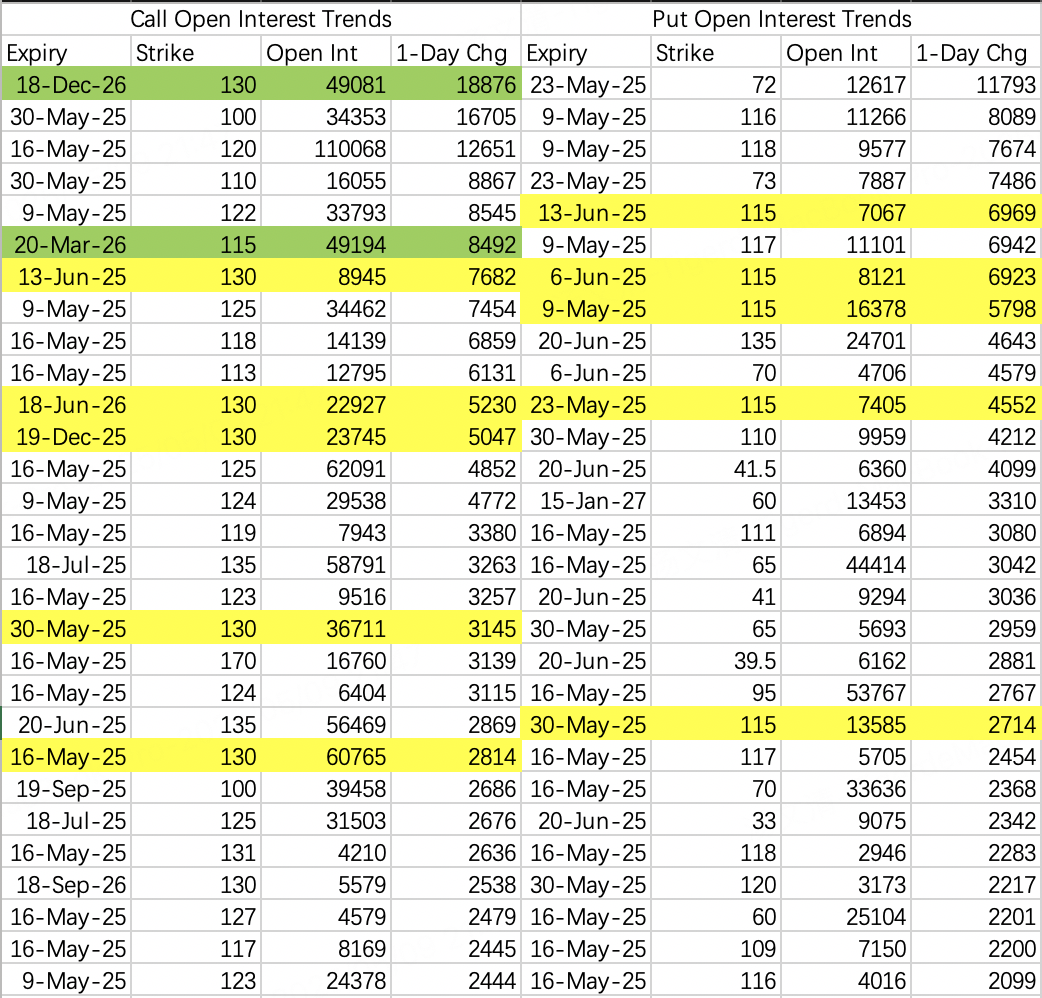

According to options open interest data, NVIDIA's pre-earnings consolidation range has clearly shifted to 115–130.

For all expiration dates, most of the 130 call trades are for selling.

Among bullish options, the 100 call $NVDA 20250530 100.0 CALL$ has seen buying activity. Using deep in-the-money calls for bullish positions suggests cautious optimism, or even the possibility of a decline. Therefore, although the downside before earnings may be limited, the sentiment remains cautiously bullish.

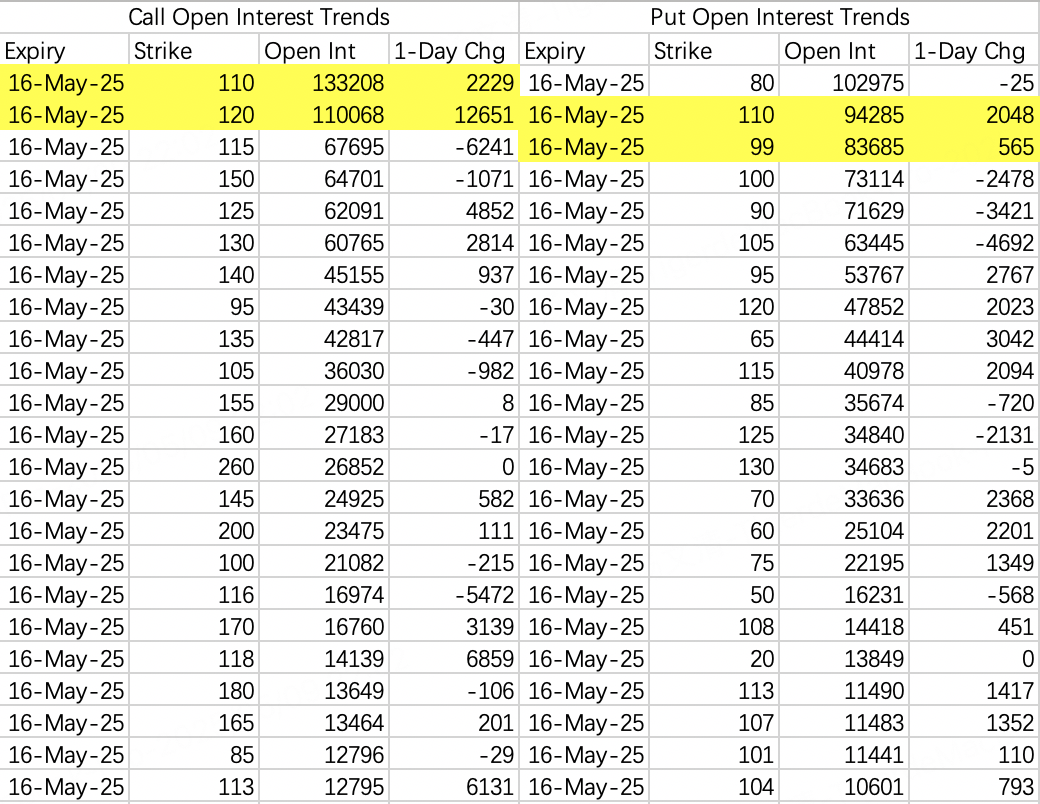

With monthly options expiring on May 16, the stock's price fluctuation range seems locked between 100 and 120. I expect it to hover around 115.

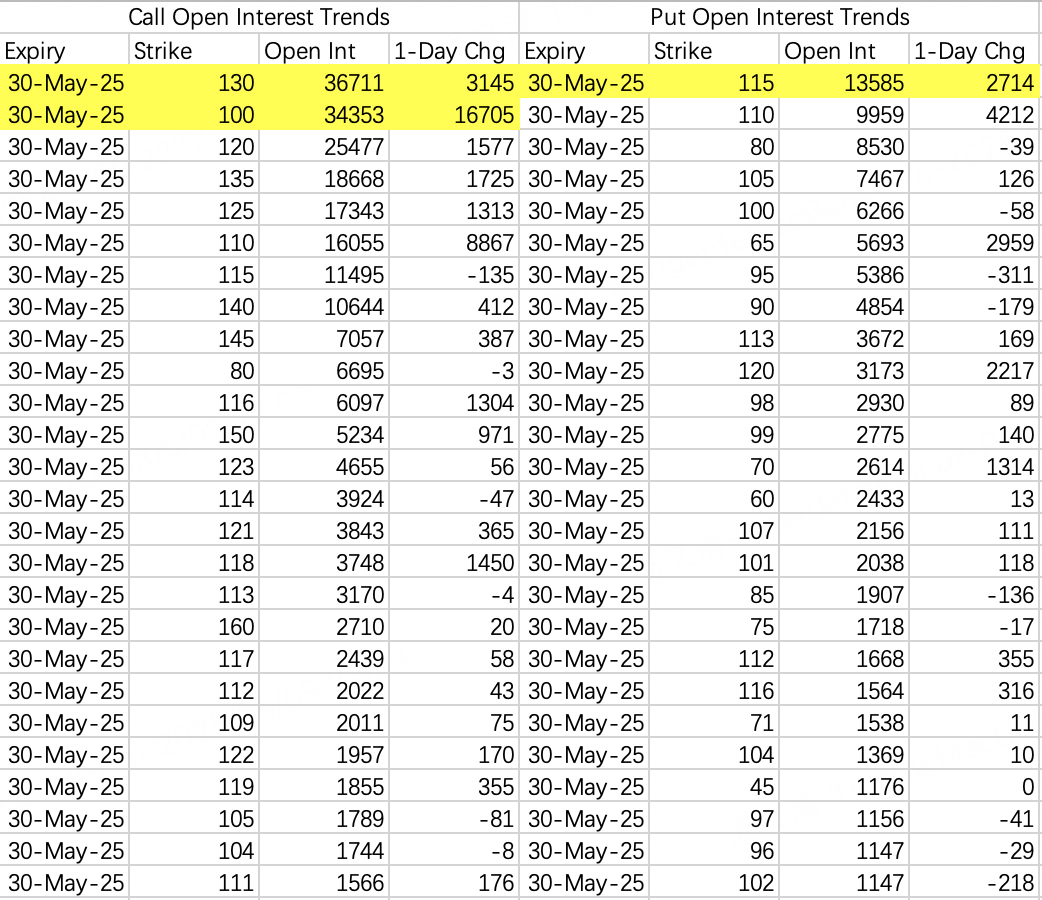

For the May 28th earnings report, options expiring on the 30th predict a fluctuation range of 115–130. Over the next two weeks before earnings, a strategy of waiting for a pullback to 115 to sell puts could be viable.

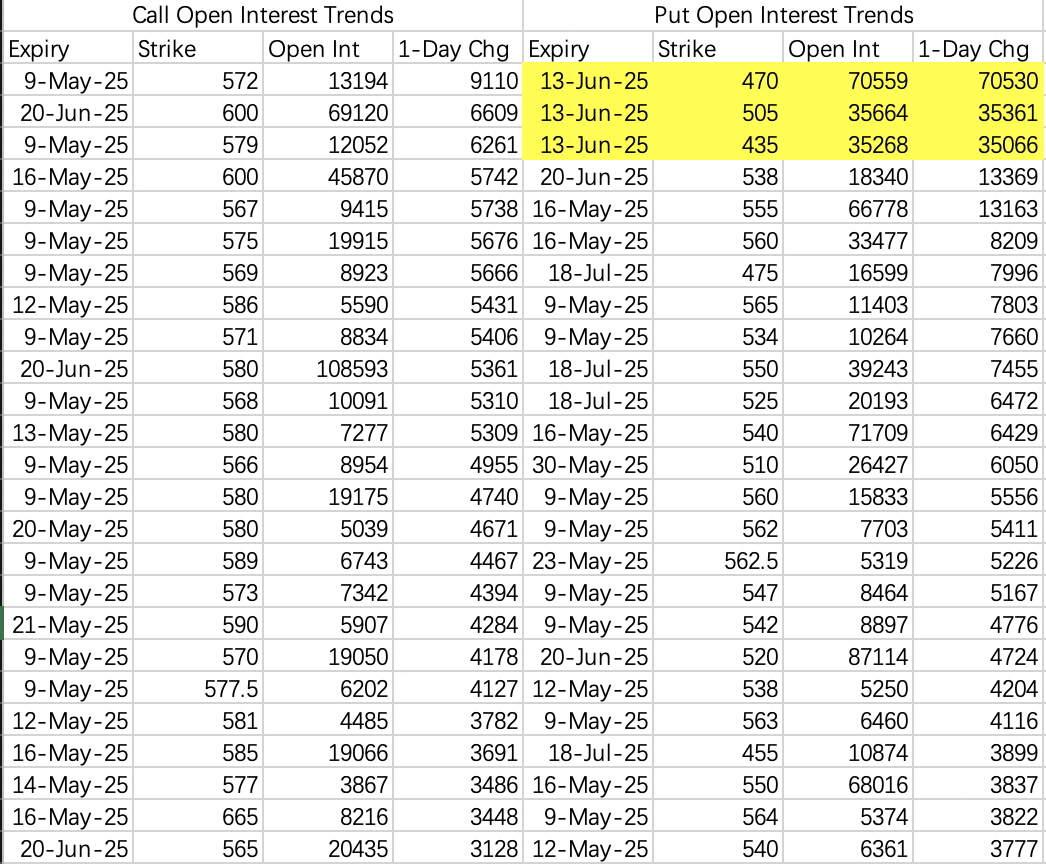

Another trader has opened a bearish butterfly spread, targeting below 505, with an expiration date set for June 13. The current low volatility makes it an opportune time to buy puts. This could also imply a sharp drop before the June 20th triple witching event.

A large order was placed to buy the 480 call $MSFT 20251219 480.0 CALL$ , with 9,905 contracts opened.

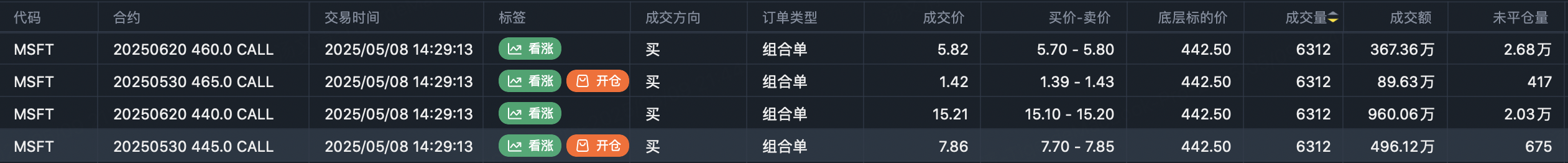

However, another large bullish vertical spread roll suggests caution. The expiration date was rolled from June 20 to May 30, indicating potential significant pullbacks in June despite the long-term bullish outlook:

Rolled buy: $MSFT 20250530 445.0 CALL$

Rolled sell: $MSFT 20250530 465.0 CALL$

Comments