Markets are finally beginning to accept Powell's message that the Fed is not in a hurry to start lowering interest rates.

After Powell reiterated the Fed's "wait-and-see" stance on monetary policy last week,Traders have aggressively increased bets that the benchmark lending rate will fall by less than 75 basis points in 2025, and the first rate cut is not expected to begin until July.

Even more shocking is that options traders are aggressively building hedging positions against the risk that the Fed may not ease monetary policy this year,One of the growing positions does not expect the Fed to cut interest rates in 2025.Before the latest employment data showed that hiring remained strong in April, swap contracts had indicated that interest rate cuts were highly likely as early as next month.

In the coming weeks, the trend of the U.S. economy and inflation data will play a key role in the success or failure of this bet.

Wall Street expects divergence to intensify! Fed faces dilemma between inflation and jobs

Wall Street's forecasts for rate cuts this year range from 0 to 125 basis points,It highlights the market's high degree of uncertainty about the Fed's policy path.Economists at multiple large banks predict two or three rate cuts this year, starting in July or September.

Greg Peters, co-chief investment officer at PGIM Fixed Income, which manages more than $850 billion in assets, notes:

"Bond markets are coming to terms with the fact that inflation will be higher than initially expected,This adds complexity to investors' belief that the Fed will step in and cut rates. "

Sonal Desai, chief investment officer of fixed income at Franklin Templeton, is even more decisive:

"The market has overpriced the rate cut.Barring a recession, the Fed will only cut rates by another 25 basis points this year."

Powell said that as policymakers seek to learn more about tariff policy, the risk of rising inflation and higher unemployment due to Trump's sweeping levy has increased. That leaves the Fed with a dilemma.

Michael Krautzberger, chief investment officer of global fixed income at Allianz Global Investors, believes central banks will ultimately prioritize supporting the labor market, as long as they are convinced that price increases are mainly caused by tariffs. While the inflation spike may be short-lived, the Fed will be wary of possible long-term effects on jobs and growth.

David Rogal, portfolio manager in BlackRock's basic fixed income team, added:

"Powell specifically said it's difficult to take upfront action, which I think is the main revelation. Under this particular combination of tariff policies, and the potential impact on inflation and growth, the Fed needs to see more information."

Amid this uncertainty, institutional investors are adjusting their strategies. John Madziyire, senior portfolio manager at Vanguard, said,His company prefers to hold 5-to 7-year U.S. Treasury Bond,"Because the Fed obviously won't aggressively cut interest rates".

At the same time, investors are also paying close attention to the consumer price index data released on Tuesday, which may cause the market to change its view again. In April, the consumer price index is expected to rebound from March, rising 0.3% monthly, according to estimates compiled by Bloomberg.

"The most frustrating thing right now is that the employment and inflation data we get are actually lagging," Madziyire noted, adding that there may be no data that includes the impact of tariffs until July.

For investors who want to take advantage of the low level of U.S. bonds to buy U.S. bonds at the bottom, they can consider using the diagonal spread strategy.

What is a diagonal spread?

diagonal spread refers to the spread established using options with different strike prices and different expiration dates. Generally, the duration of the long leg in the spread is longer than that of the short leg. Diagonal spreads include diagonal bull spreads versus diagonal bear spreads.

The diagonal bull spread is basically similar to the bull subscription spread strategy, except that it has been upgraded and improved again.The difference is that the two options for the diagonal spread have different expirations, the trader buys a longer-term call option with a lower strike price and sells a shorter-term call option with a higher strike price. The number of call options bought and sold is still the same.

TLT Diagonal Spread Case

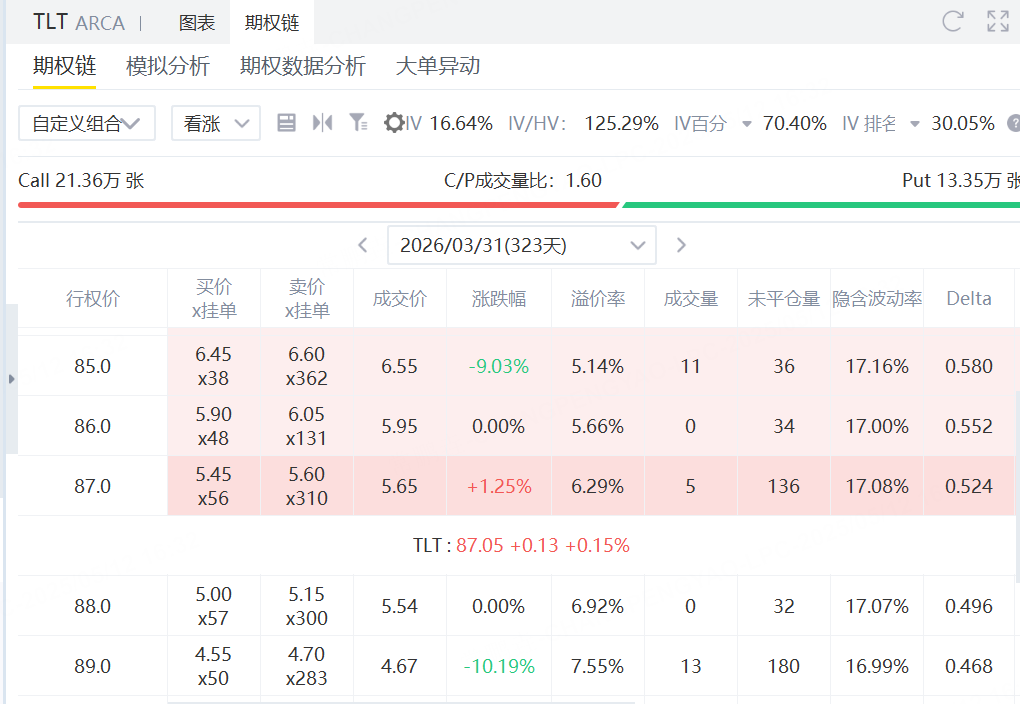

Assuming investors are bullish for the next yearTLT, you can directly buy the call option with an exercise price of 87 and an expiration date of March 31, 2026. This option becomes our long leg, which costs $565 at the latest transaction price.

After the long leg is established, we can establish the short leg according to a shorter cycle than the long leg. Here, we can choose to establish it on a weekly basis. Choose to sell a call option with a strike price of $92 and an expiration date of May 30 and get a premium of $12.

Here, if the call option sold is not exercised, it will generate a profit of $12, which is about 2.12% relative to the cost of $565 on the long side. However, the short leg can be executed once a week. When the remaining date of the long leg is as long as 323 days, investors can sell dozens of call options. If some sold call options can successfully obtain premium, it will greatly reduce the cost of buying the call option itself, and even get the call option for free.

Compared with buying bulls alone, the diagonal spread obtains an additional premium income, which reduces the overall net premium expenditure of the strategy, and the break-even point of the strategy is also shifted to the left, and the winning rate is also increased accordingly. AdditionallyThe selling point of the diagonal spread can be controlled by investors themselves, so different short-selling efforts can be selected in different cycles to facilitate investors to control risks. Diagonal spreadEssentially, it is a low-cost call option strategy that is worth investors studying.

Comments