As expected, some traders are taking a bullish stance early.

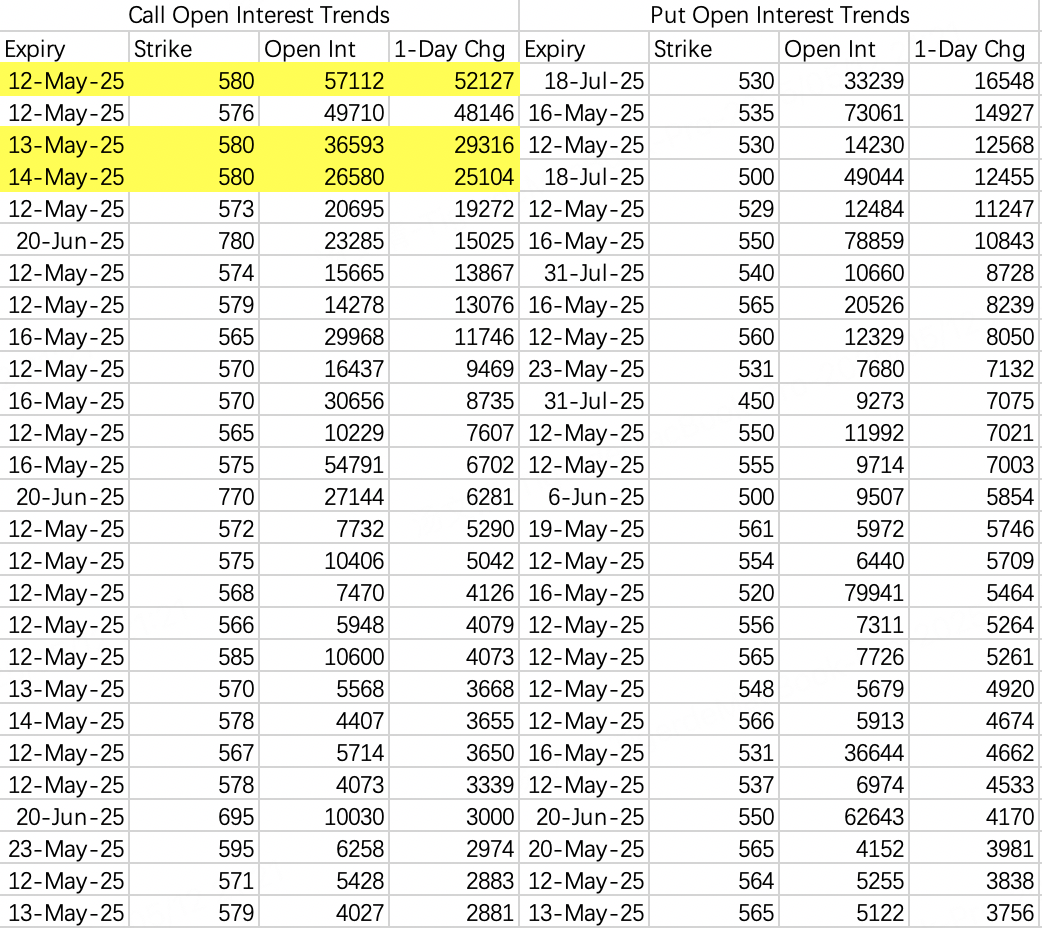

On Friday, three different expiration dates for SPY saw significant bullish call option activity at the 580 strike price:

$SPY 20250512 580.0 CALL$ with 52,000 contracts opened,

$SPY 20250512 580.0 CALL$ with 29,000 contracts opened,

$SPY 20250512 580.0 CALL$ with 25,000 contracts opened.

These large orders were executed just before market close, as identified through unusual options activity filters.

Now, you might wonder: with pre-market prices already rising, is this information still relevant?

The fact that traders chose the 580 strike implies that the pre-market rally has likely reached its peak. Upside potential is limited, making it a good opportunity to sell calls and take a bearish stance.

Without the context of the prior 145% mispricing frenzy, the 30% tariff hike isn’t negligible. In my view, the weekend negotiations don’t qualify as a bullish catalyst.

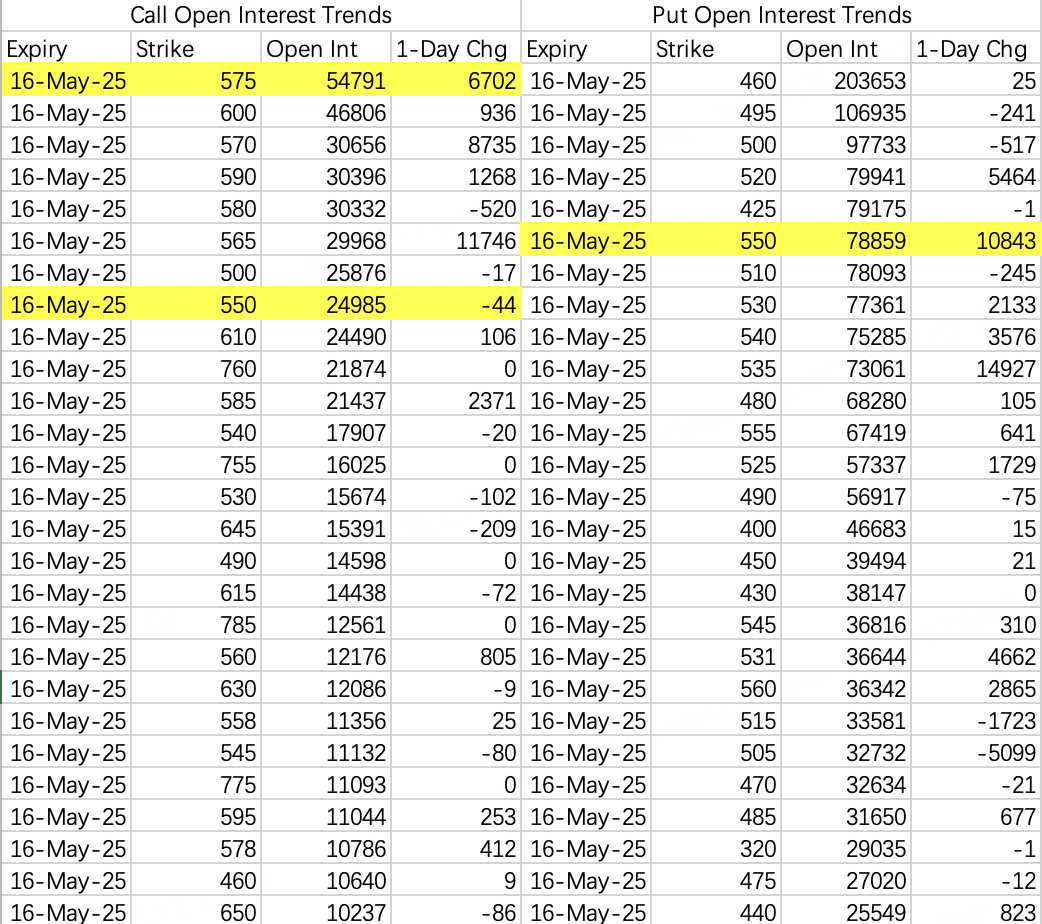

With monthly options expiration this week, I expect SPY to trade within a narrow range of 580–550.

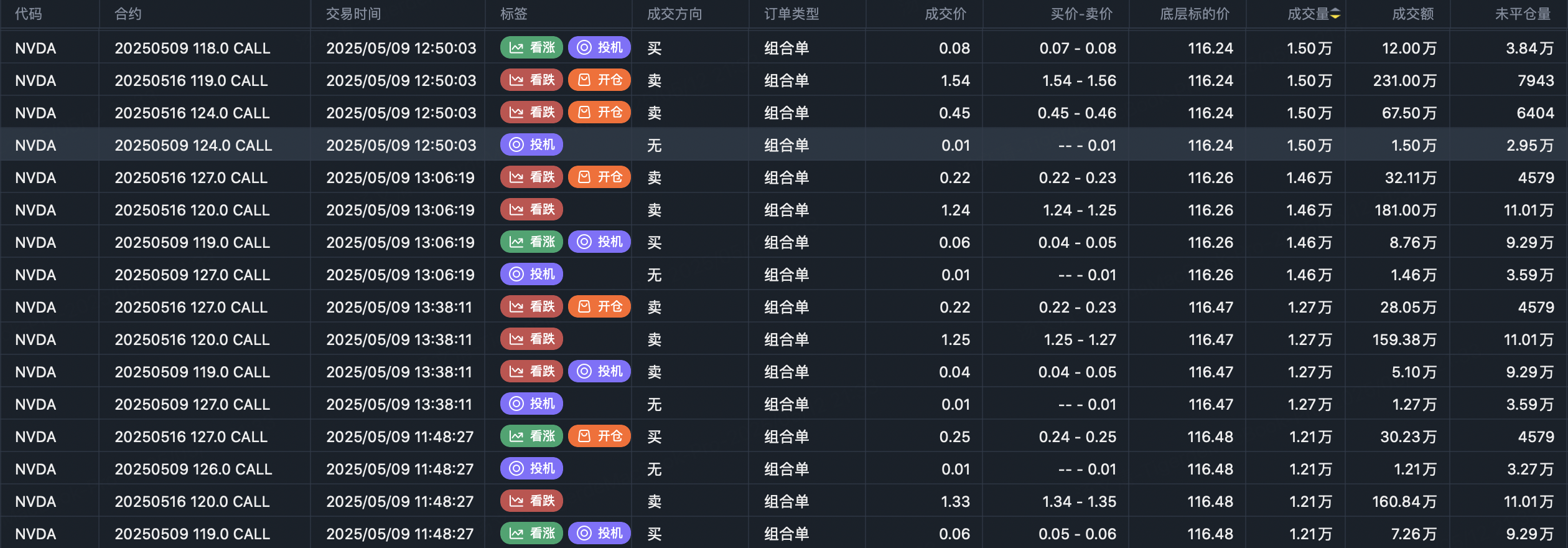

NVIDIA is similarly a good candidate for selling calls. I sold $NVDA 20250620 135.0 CALL$ .

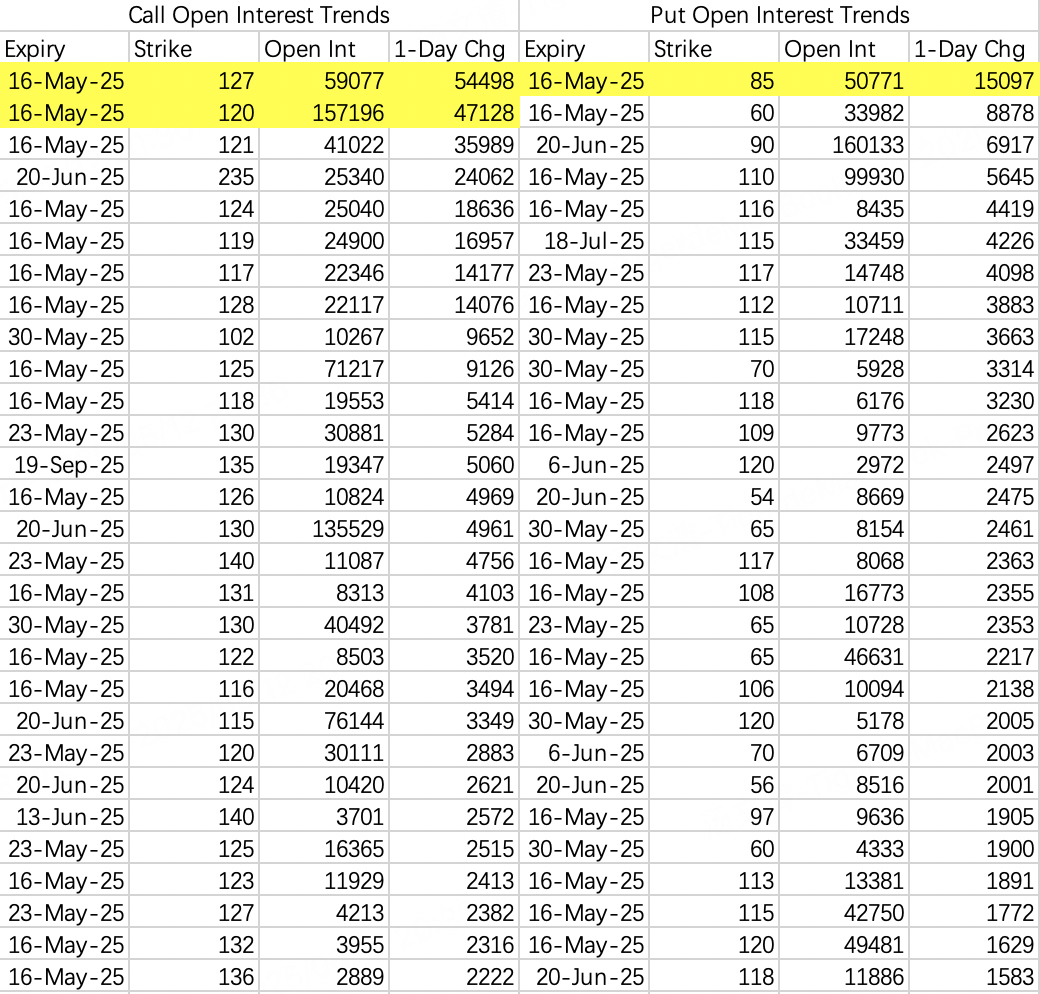

Institutions continued bullish vertical spread strategies last Friday, selling calls in the 119–121 range to hedge buying calls in the 124–128 range. This is similar to last week, with 120 still acting as resistance.

Sold $NVDA 20250516 120.0 CALL$ ,

Bought $NVDA 20250516 127.0 CALL$ .

Although there was a decline in bearish put option activity on Friday, some deep out-of-the-money puts were used for hedging. This doesn’t affect the expected range for this week’s options expiration. NVIDIA is likely to close between 110–120 on Friday.

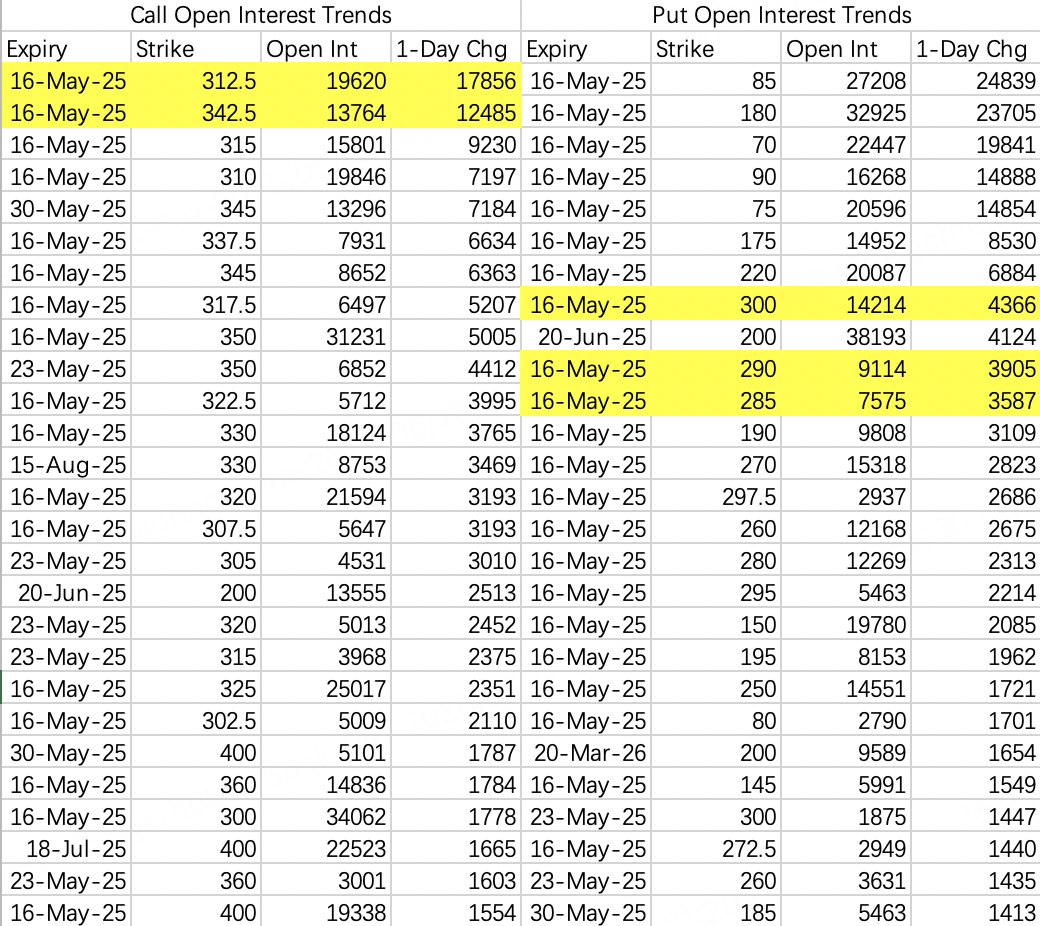

Institutions also pursued bullish vertical spread strategies for Tesla last Friday, selling calls at the 312.5 strike to hedge buying calls at the 342.5 strike. This suggests Tesla’s upside is capped at 312.5 for the week.

Bearish open interest looks pessimistic, but since the negotiations didn’t completely fall apart, deep out-of-the-money puts don’t carry much significance. The expected bottom remains at 280.

Comments