Strategy is the largest holder of Bitcoin, and its shares have gained 7.63% in the past week. This rise was largely due to an increase in the price target at Mizuho Securities. Mizuho Securities analyst Dan Dolev raised his price target to $563 from $515 and maintained a "buy" rating. The upgrade follows Strategy's first-quarter earnings release. Although the earnings report showed Strategy's revenue decline and a loss per share due to the appreciation of Bitcoin, the earnings report still highlighted the company's aggressive Bitcoin acquisition Strategy and improved future earnings targets.

The company's recent purchase of 1,895 Bitcoin pieces for about $180.3 million has boosted investor confidence. Holds 568,840 BTC as of May 11, 2025. The company's ambitious plans to raise its Bitcoin yield target to 25% in 2025 and create $15 billion in value from its Bitcoin assets have further strengthened its market position and driven the share price higher.

Trenchev, co-founder of cryptocurrency trading platform Nexo, said: "Bitcoin's move on Thursday not only returned to the $100,000 mark for the first time in three months, but also once again proved Bitcoin's status as the'ultimate rebound asset 'and also reflected the boost to market sentiment from the improving US trade outlook." Bitcoin is supported by the Trump administration's friendly attitude towards cryptocurrencies, and spot ETF investors are also buying. "He added that recent market uncertainty has instead boosted Bitcoin's gains as investors begin to doubt the dollar's safe-haven status, which may continue to support Bitcoin's move.

Thomas Perfumo, global economist at cryptocurrency exchange Kraken, pointed out: "Bitcoin's return to the six-digit mark comes at a time when global market risk sentiment is recovering. The stock market is performing strongly, and investors' willingness to allocate risky assets is increasing, and this recovering'animal spirit 'has quickly spread to the cryptocurrency field."

Sell Call Short MSTR

Selling a call option (Short Call) is a strategy to obtain income by collecting premium when the underlying is expected to be flat or fall. The seller needs to reserve a margin and assume the obligation to sell the stock at the exercise price at maturity, so the risk of loss is theoretically unlimited.

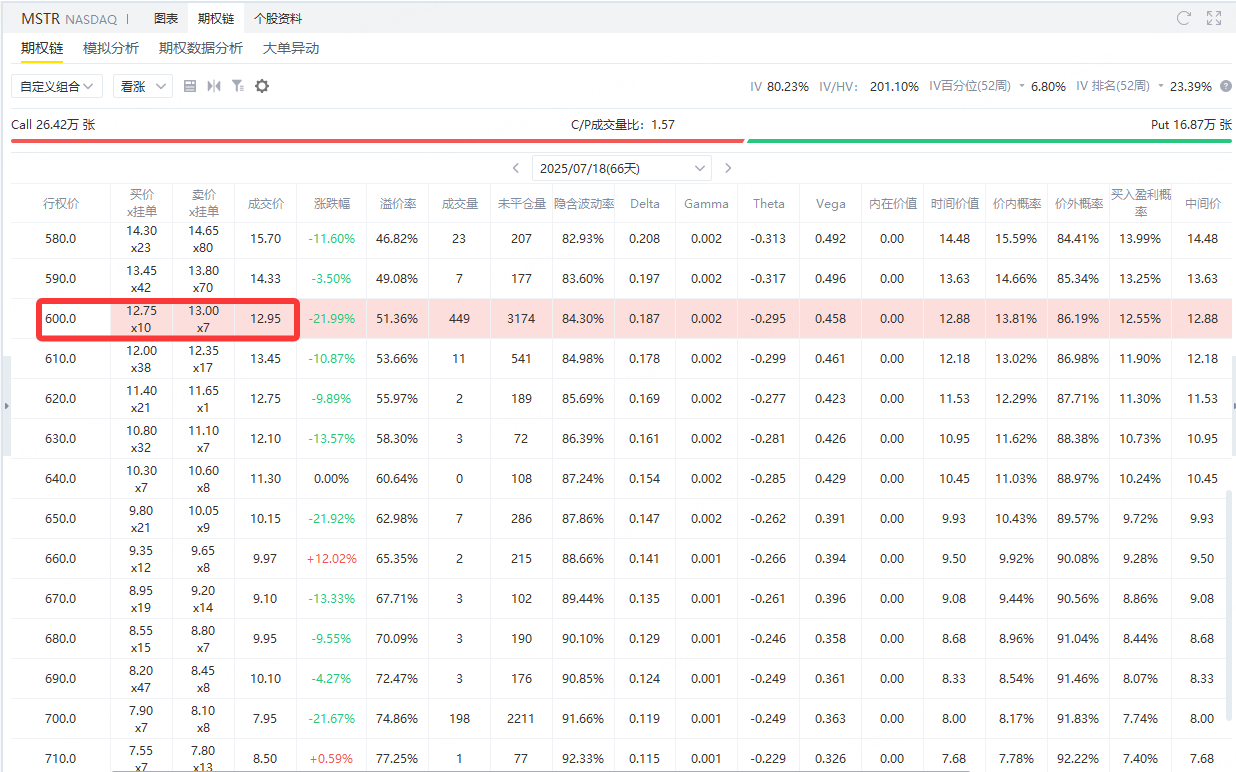

Case: Sell 2025/07/18 MSTR 600 Call

Contract specifications

Subject: MSTR common stock

Due: July 18, 2025

Exercise price: $600

Premium: $1,295 ($12.95 × 100 shares)

Maximum profit: $1,295 (all to the seller when the option expires and is void)

Break-even point:$612.95(600 + 12.95)

Loss information: If the stock price rises to $800, the loss is about $(800 − 600) × 100 − 1,295 = $18,705; Theoretically, the higher the stock price, the greater the loss.

Risk management and control

Controlling risk is key when implementing a sell call strategy. The following three methods can effectively limit potential losses and improve the robustness of the strategy.

First, you can lock in the maximum loss by constructing a Bear Call Spread. The specific operation is to sell the call option with the lower strike price and buy the call option with the higher strike price. The premium difference between the two transactions is the maximum possible profit, while the difference between the two strike prices minus the net premium income is the maximum loss. Through this hedging combination, even if the underlying stock price rises sharply, the loss will not be enlarged indefinitely, thus greatly reducing the "unlimited" risk brought by selling naked call options.

Secondly, a Covered Call strategy can be used to reduce capital occupation and lock in returns. On the premise of holding an equal amount of underlying stocks, sell a corresponding number of call options. In this way, if the stock price rises and touches the exercise price, the investor's cost of delivering the stock is locked in advance; If the stock price holds or falls, the option is invalidated, and premium's income is equivalent to receiving additional coupons for the holdings. Covered calls can not only provide stable gains in volatile markets, but also partially buffer declines when stock prices pull back.

Finally, it is necessary to maintain flexible position management and conduct dynamic liquidation or rolling rollover in time. When the underlying stock price approaches the strike price of the sold option, it is necessary to closely monitor the market trend, and depending on the risk preference, choose to close the position in advance to lock in the current profit and loss, or roll the expiration date to a further month to extend the profit window of time value decay. Through this dynamic adjustment, we can not only avoid "chasing the rise and being beaten" when the expiration date approaches, but also optimize the position structure in time when the market environment changes, further ensuring the margin of safety of the strategy.

Comments