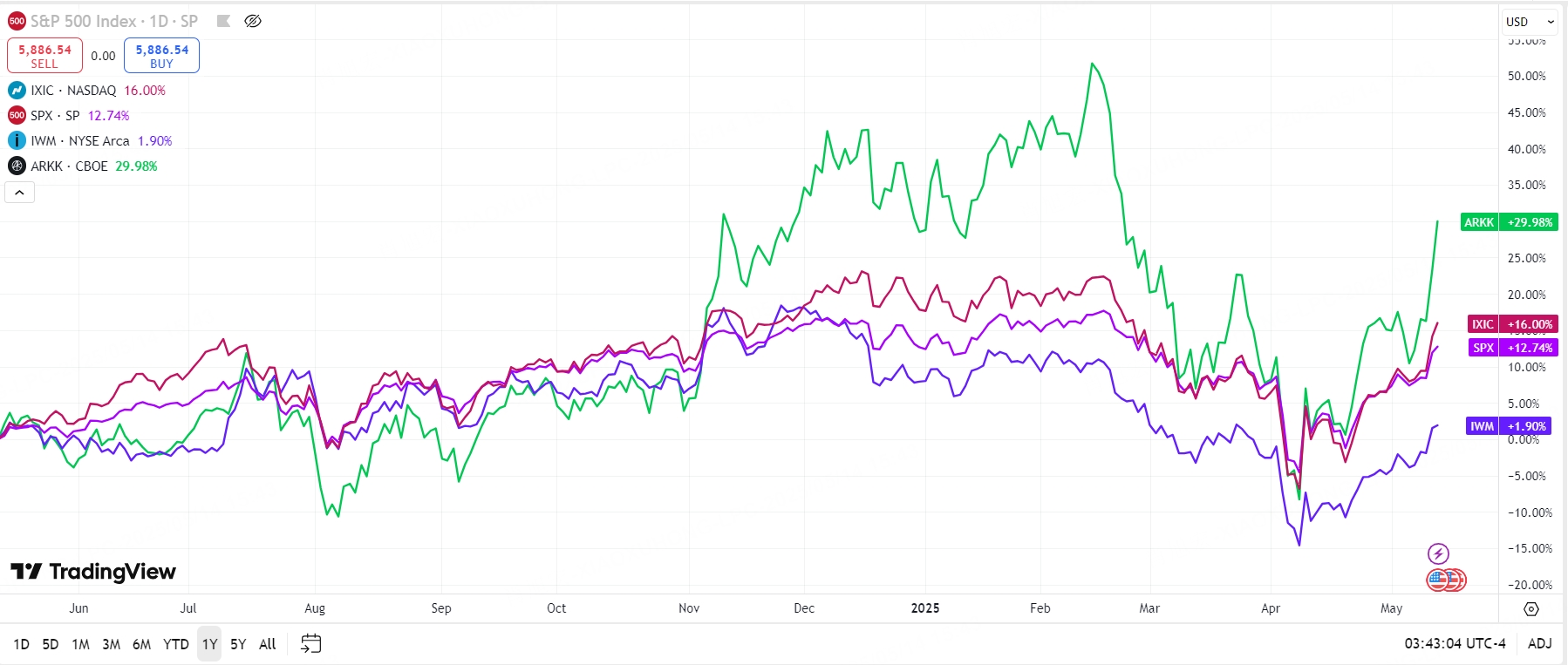

In the past two trading days, $S&P 500(.SPX)$ and $NASDAQ(.IXIC)$ have successfully stood above the 120-day and 200-day price moving averages.

A basket of growth stock ETFs represented by $ARK Innovation ETF(ARKK)$ also stood above these two moving averages. This shows that the overall trend of the growth stock sector is improving, and the market's confidence in innovation and high-growth areas is increasing.

Note: Long-term moving averages are usually regarded as major trend support or pressure prices, and their breakthroughs often indicate a shift or continuation of market trends.

Judging from the performance in the past year, the growth stock ETF $ARK Innovation ETF(ARKK)$ has surpassed the three major indexes and the small-cap stock index.

ARKK is an ETF focused on disruptive innovation technologies. Its constituent stocks include high-growth potential technology companies such as $Tesla Motors(TSLA)$ , $Roku Inc(ROKU)$ , $Block, Inc.(XYZ)$ etc. The breakthrough of this ETF not only reflects the market's optimism about these companies, but also shows that the overall attractiveness of the growth stock sector is increasing.

$ARK Innovation ETF(ARKK)$ has a net asset of $5.92 billion.

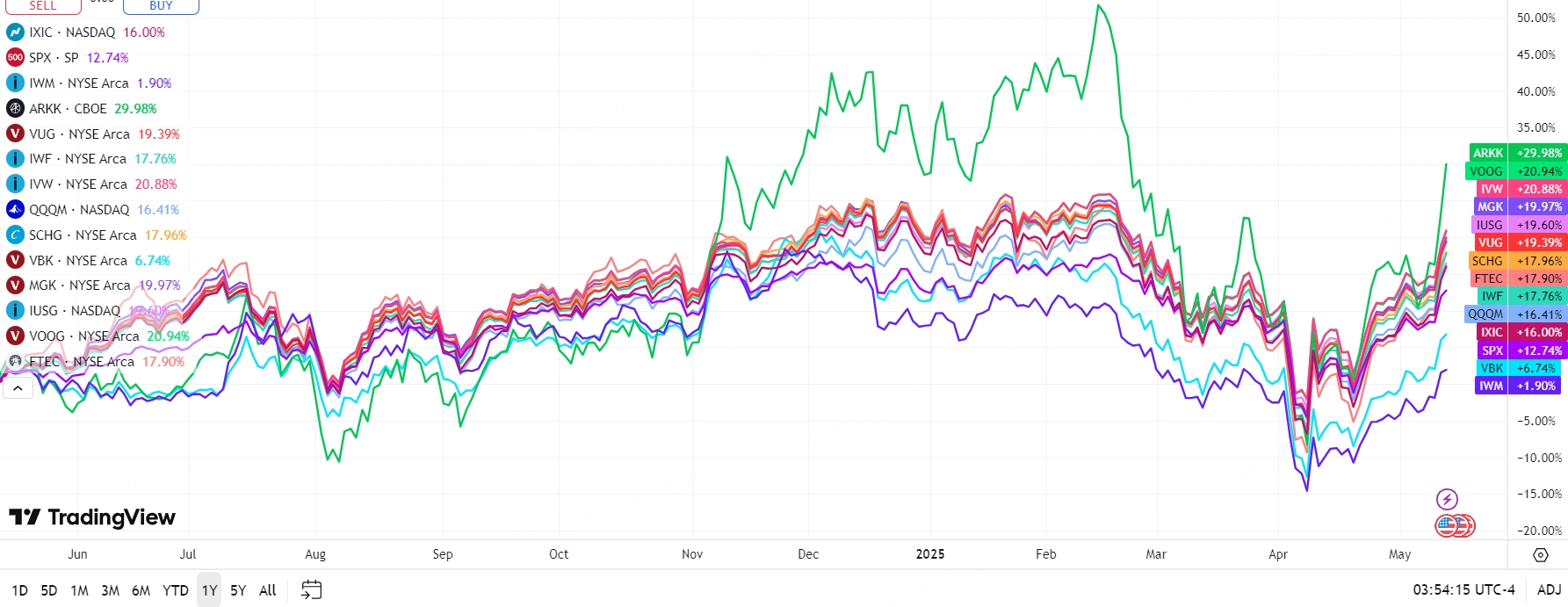

In addition to ARKK, we have sorted out growth stock ETFs with a market value of more than $10 billion. Their recent performance is also outstanding and worth paying attention to:

The performance of the ETFs in the above table over the past year is shown in the figure below. Except for $Vanguard Small-Cap Growth ETF(VBK)$ , the performance of all others is better than the market index.

The specific explanations for the Top 10 growth stock ETFs are as follows:

1. $Vanguard Growth ETF(VUG)$ , net asset: $269.26 billion

Introduction: VUG has approximately $173 billion in assets under management. It covers multiple high-growth industries such as technology, communication, and consumer sectors.

Characteristics: Suitable for long-term investors. Its holdings are mostly leaders in the U.S. technology and innovation sectors, with high growth potential and innovation capabilities.

Suitable for investors who are optimistic about long-term growth.

Top 5 Holdings: AAPL: 12.41%; MSFT: 10.28%; NVDA: 9.2%; AMZN: 6.5%; META: 4.34%.

2. $iShares Russell 1000 Growth ETF(IWF)$ , net asset: $97.97 billion

Introduction: IWF tracks the Russell 1000 Growth Index and has approximately $69 billion in assets under management. Its holdings include leading companies across multiple industries.

Characteristics: Suitable for long-term investors who wish to invest in large-cap and mid-cap growth stocks in the U.S., especially those who are confident in the growth of the U.S. economy and businesses.

Top 5 Holdings: MSFT: 11.35%; AAPL: 10.53%; NVDA: 9.78%; AMZN: 6.71%; META: 4.37%.

3. $iShares S&P 500 Growth ETF(IVW)$ , net asset: $51.75 billion

Introduction: IVW focuses on the growth stocks within the S&P 500 Index and has approximately $34 billion in assets under management. Its holdings are mainly from high-growth sectors such as technology, healthcare, and consumer goods.

Characteristics: This ETF has high liquidity and transparency. It is suitable for investors who pursue stable investments, especially those who wish to diversify their investments in large-cap growth stocks.

Top 5 Holdings: NVDA: 11.68%; MSFT: 6.73%; Apple (AAPL): 5.65%; META: 5.43%; AMZN: 4.43%.

4. $Invesco NASDAQ 100 ETF(QQQM)$, net asset: $42.17 billion

Introduction: QQQM tracks the NASDAQ 100 Index, focusing on the top 100 companies by market value in the NASDAQ.

Characteristics: Suitable for investors interested in high-growth potential technology companies, especially those who wish to capture the growth potential of the industry.

Top 5 Holdings: MSFT: 8.67%; AAPL: 8.22%; NVDA: 7.79%; AMZN: 5.74%; AVGO: 4.46%.

5. $Schwab U.S. Large-Cap Growth ETF(SCHG)$, net asset: $37.47 billion

Introduction: SCHG tracks the Dow Jones U.S. Large-Cap Growth Total Stock Market Index.

Characteristics: Suitable for investors who seek low-cost investments in large-cap growth stocks in the U.S., especially those who are confident in long-term growth.

Top 5 Holdings:MSFT: 10.40%; AAPL: 9.86%; NVDA: 9.38%; AMZN: 6.13%; META: 4.36%.

6. $Vanguard Small-Cap Growth ETF(VBK)$ , net asset: $32.98 billion

Introduction: VBK is an index ETF that tracks the CRSP US Small Cap Growth Index, aiming to provide broad investment opportunities in U.S. small-cap growth stocks.

Characteristics: By investing in small-cap growth stocks, VBK offers investors broad exposure to high-growth potential companies in the U.S. economy.

Top 5 Holdings: CASH: 1.17%; FWONK: 0.79%; RBA: 0.76%; LENNOX INTL INC: 0.73%; NTRA: 0.73%.

7. $Vanguard Mega Cap Growth ETF(MGK)$ , net asset: $23.23 billion

Introduction: MGK tracks the CRSP U.S. Mega Cap Growth Index, focusing on U.S. mega-cap growth stocks.

Characteristics: Suitable for investors who pursue U.S. mega-cap growth stocks, which typically have significant market influence and growth potential.

Top 5 Holdings: AAPL: 14.31%; MSFT: 11.90%; NVDA: 10.68%; AMZN: 7.61%; META: 4.32%.

8. $iShares Core S&P U.S. Growth ETF(IUSG)$, net asset: $15.721 billion

Introduction: IUSG tracks the S&P 500 Growth Index, covering high-growth companies across multiple industries.

Characteristics: Suitable for investors who pursue stability, especially those who wish to invest in large-cap growth stocks with long-term growth potential and innovation capabilities.

Top 5 Holdings: NVDA: 11.05%; MSFT: 6.37%; AAPL: 5.34%; META: 5.13%; AMZN: 4.19%.

9. $Vanguard S&P 500 Growth ETF(VOOG)$,net asset: $14.97 billion

Introduction: VOOG focuses on the growth stocks within the S&P 500 Index.

Characteristics: Suitable for investors who pursue stable growth stock investments, especially those who have confidence in the long-term growth of large-cap growth stocks.

Top 5 Holdings: NVDA: 11.17%; AAPL: 6.46%; MSFT: 6.10%; META: 5.31%; AMZN: 4.38%.

10. $Fidelity MSCI Information Technology Index ETF(FTEC)$ , net asset: $11.63 billion

Introduction: FTEC tracks the MSCI USA Information Technology Index, focusing on growth stocks in the technology sector.

Characteristics: Strict selection of holdings, suitable for investors who are optimistic about the long-term growth of the technology sector.

Top 5 Holdings: AAPL: 15.66%; MSFT: 14.98%; NVDA: 14.76%; AVGO: 4.71%; CRM: 1.73%. TTSLA: 3.70%.

Hey, do you invest in or follow growth stocks?

Feel free to share your thoughts in the comments section.

🏦 Open a CBA today and enjoy privileges of up to SGD 20,000 in trading limit with 0 commission. Trade SG, HK, US stocks as well as ETFs unlimitedly!

Find out more here:

Trade on a Cash Boost Account and enjoy up to 6 months of Commission-Free trading.

💰Join the TB Contra Telegram Group to Get $10 Trading Vouchers Now🎉

💰CBA Mini Course 1: What is Cash Boost Account(CBA)?

Comments