Feeling frustrated. On Tuesday, after institutions rolled their sell call arbitrage positions due to the short squeeze, NVIDIA’s stock price continued to rise. The primary reason seems to be the potential for another short squeeze following the roll.

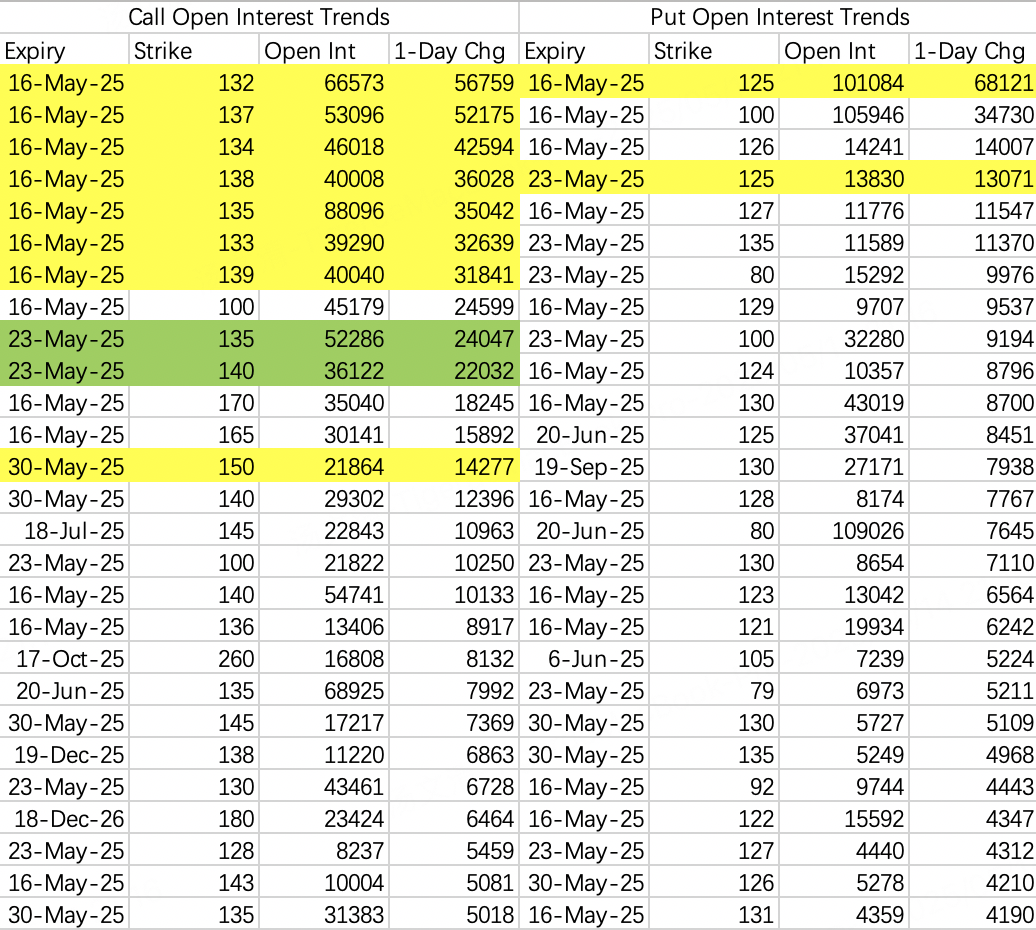

On Tuesday, the call option open interest was as shown in the chart: for this week’s expiration, all call options between the 132 and 139 strikes were part of institutional arbitrage strategies. When large-scale call options are opened consecutively across strike prices, regardless of whether they are bought or sold, there’s a chance it could lead to another short squeeze.

The outcome will likely be one of two extremes: either the stock price shoots straight up to 140, or it pulls back below 132. This market is absolutely crazy.

A large sell order appeared for the May 30th 150 call $NVDA 20250530 150.0 CALL$ , indicating that the stock price is expected to stay below 150 by the end of the month.

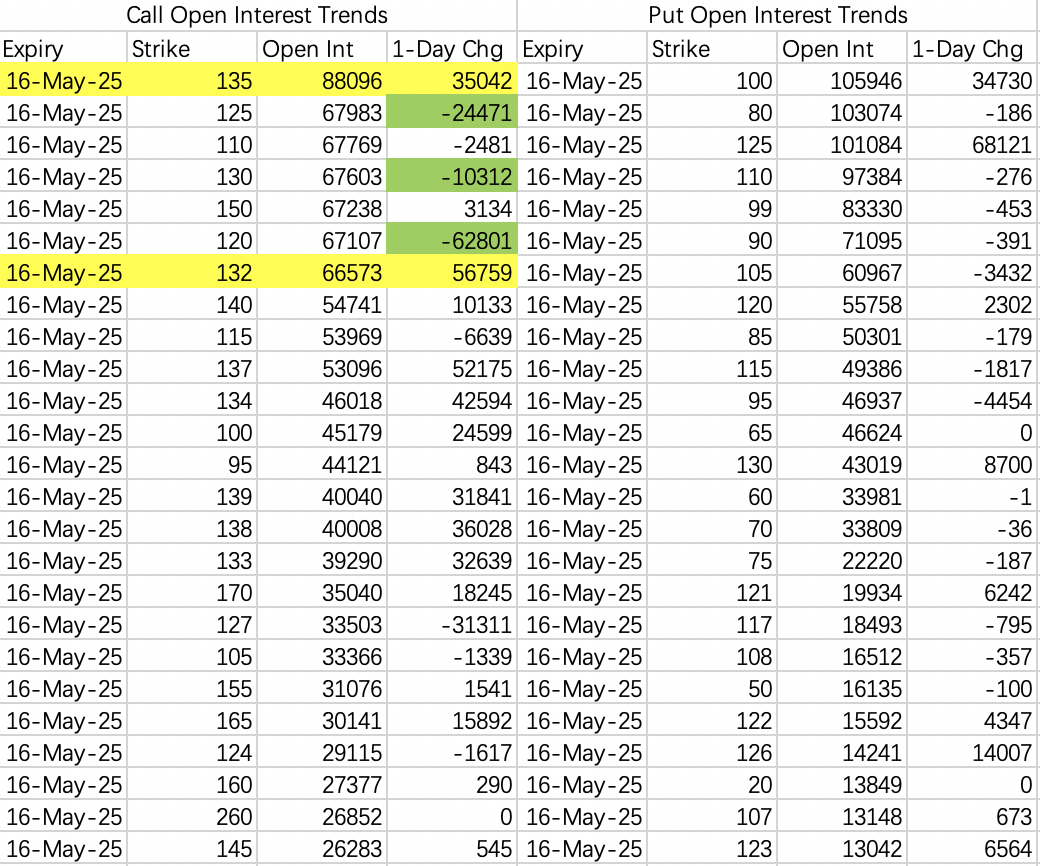

Following the stock’s sharp rally, this week’s expiring 110, 120, and 125 calls saw significant reductions in open interest. Currently, the 135 call has the highest open interest among this week’s expiring call options.

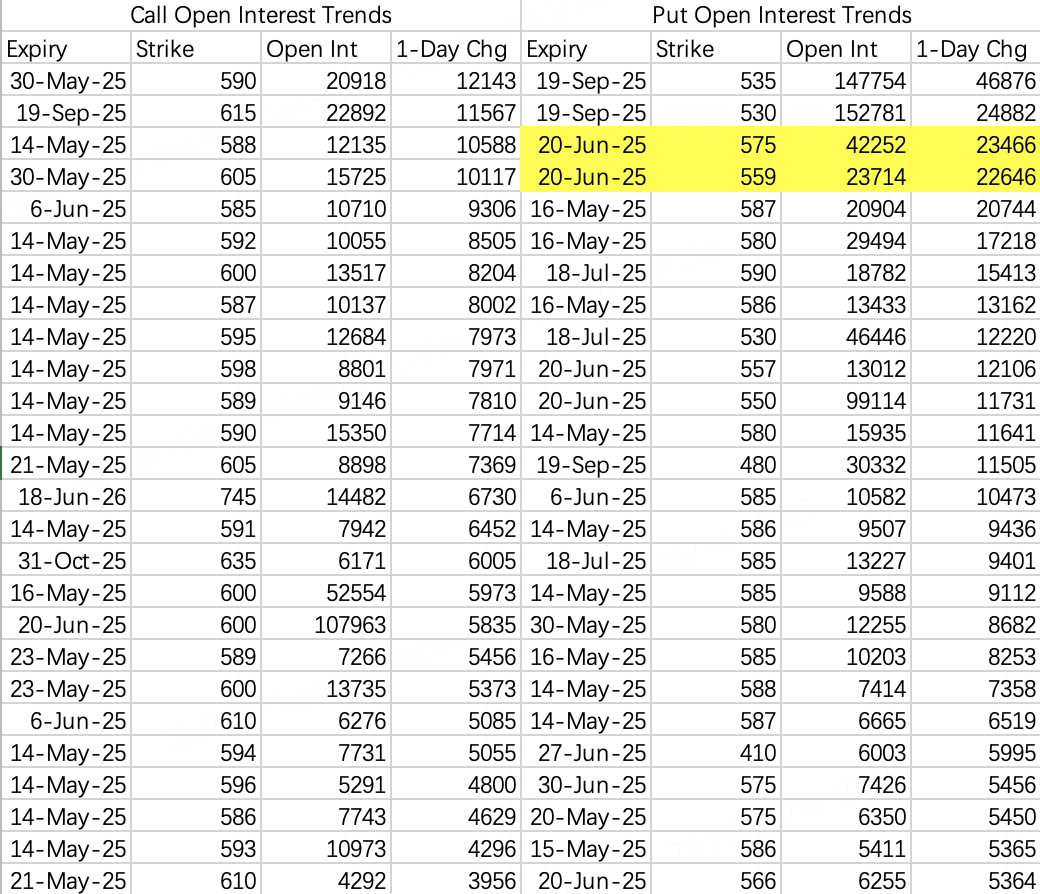

As of now, there’s little sign of a pullback before June 20th.

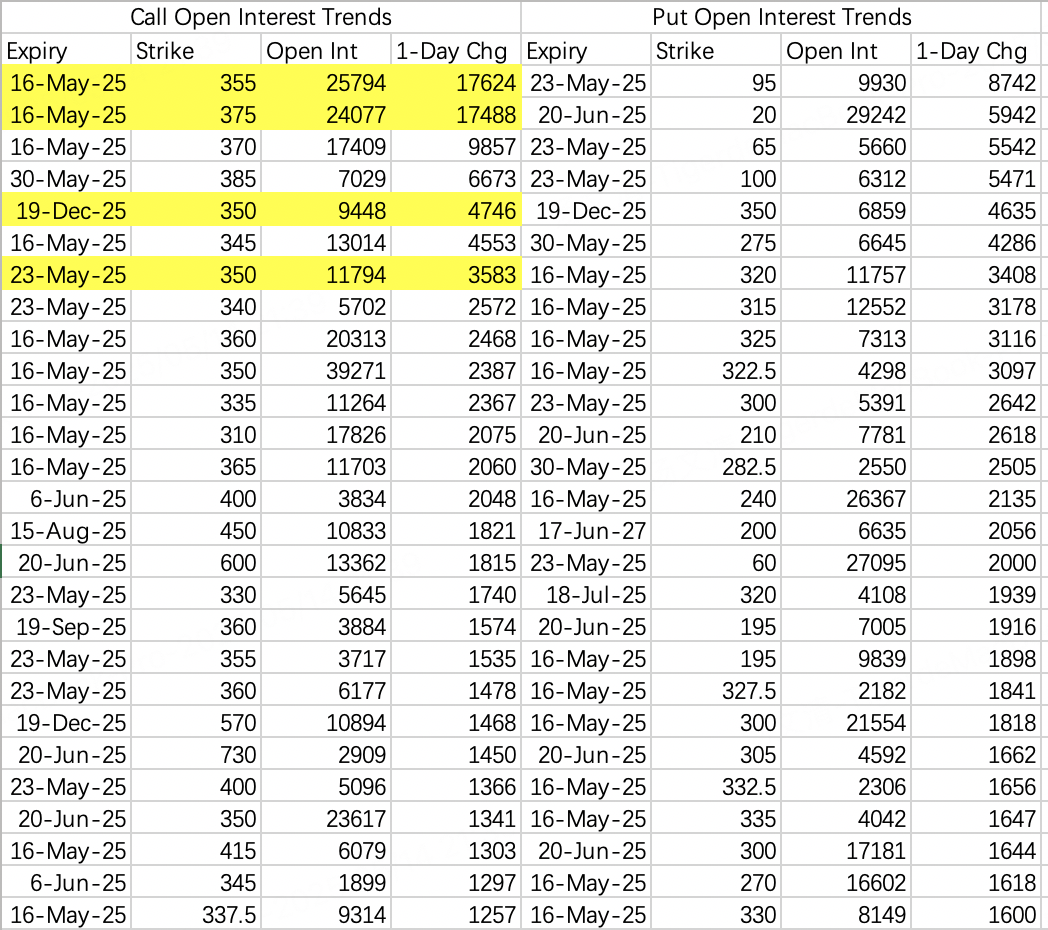

Similar to NVIDIA, institutions rolled their sell call positions. They are now selling the 355 call and buying the 375 call. This makes 355 the latest resistance level for the week.

Comments