Heading into earnings, NVIDIA's trading range has shifted to 130–150.

Just two days ago, 130 was the upper limit, but now it has become the lower bound after a pullback—this is quite a drastic shift.

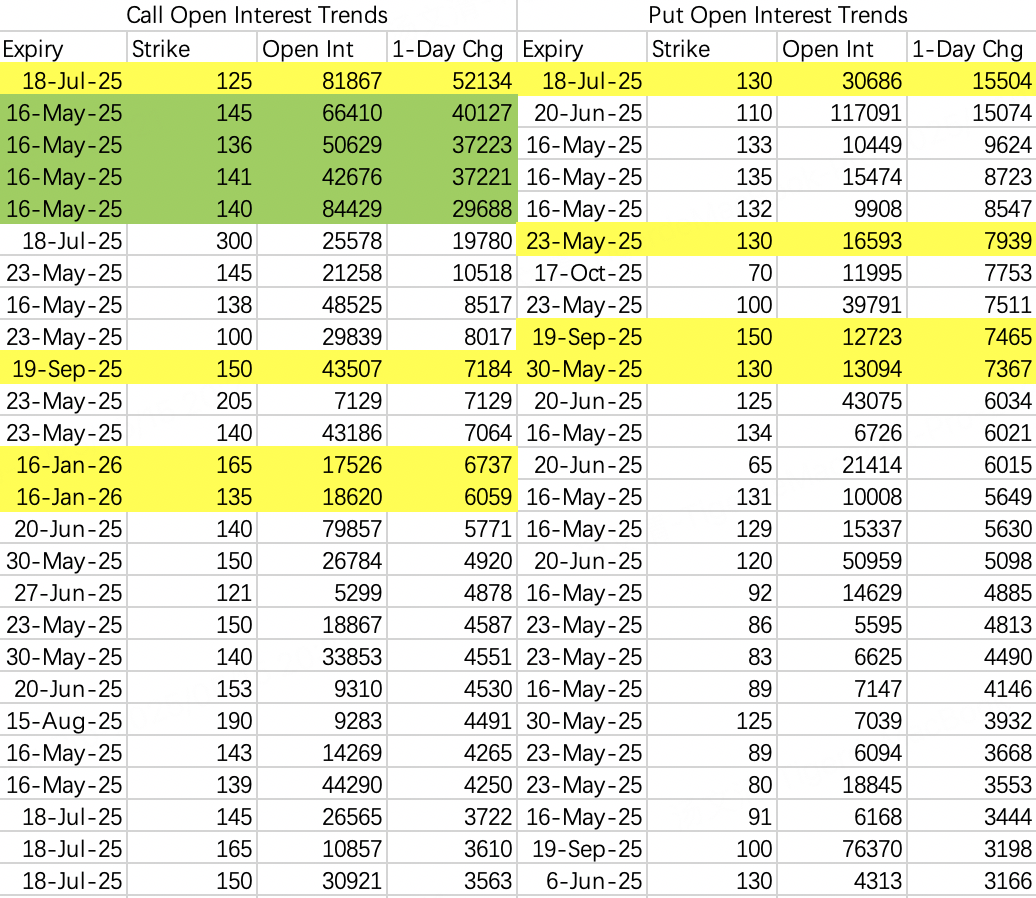

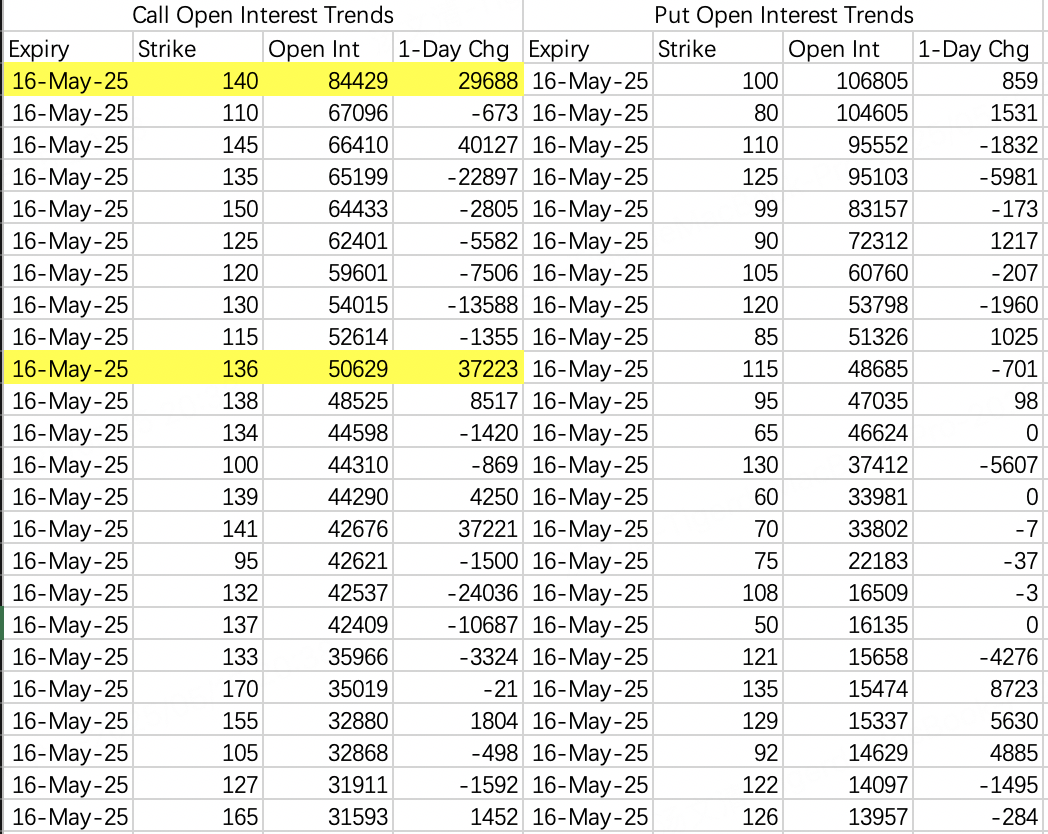

Institutions have rolled their positions twice within a week, closing out spread positions between 130–137 and rolling into 140–145. Theoretically, there shouldn’t be any further short squeezes on Thursday or Friday. If the stock fails to break through 135, there’s a chance it will drop back to 130.

After the roll, the strike price with the highest open interest for this week’s call options is 140. The stock price should stabilize between Thursday and Friday, so selling calls above 140 and selling puts below 130 could be viable strategies.

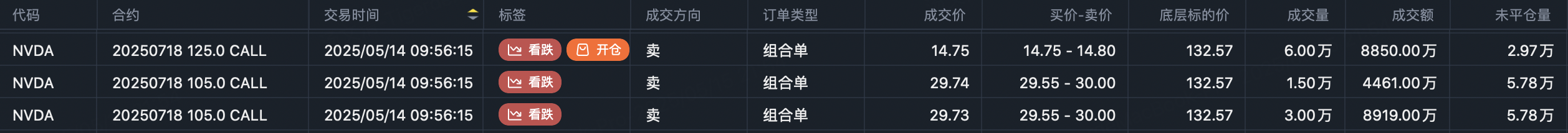

The top new open interest in call options is $NVDA 20250718 125.0 CALL$ , indicating a buy-to-open roll strategy. Positions were rolled from $NVDA 20250718 105.0 CALL$ , with 45,000 contracts rolled into 60,000 contracts for the July 18th 125 call.

Tracing back this strategy, the initial position was opened between April 4th and 10th, buying $NVDA 20250620 85.0 CALL$ at the lowest price, accumulating 39,000 contracts. Then, on May 5th, these were rolled into $NVDA 20250718 105.0 CALL$ . Each roll added more contracts while reducing the transaction volume and cost, using profits from the prior trades to fund the roll.

NVIDIA’s Q1 performance is expected to exceed market expectations. The key question will be its Q2 guidance. However, with Trump personally traveling to the Middle East to secure deals, Q2 expectations have likely already been priced in. At this point, there don’t seem to be any additional bearish factors.

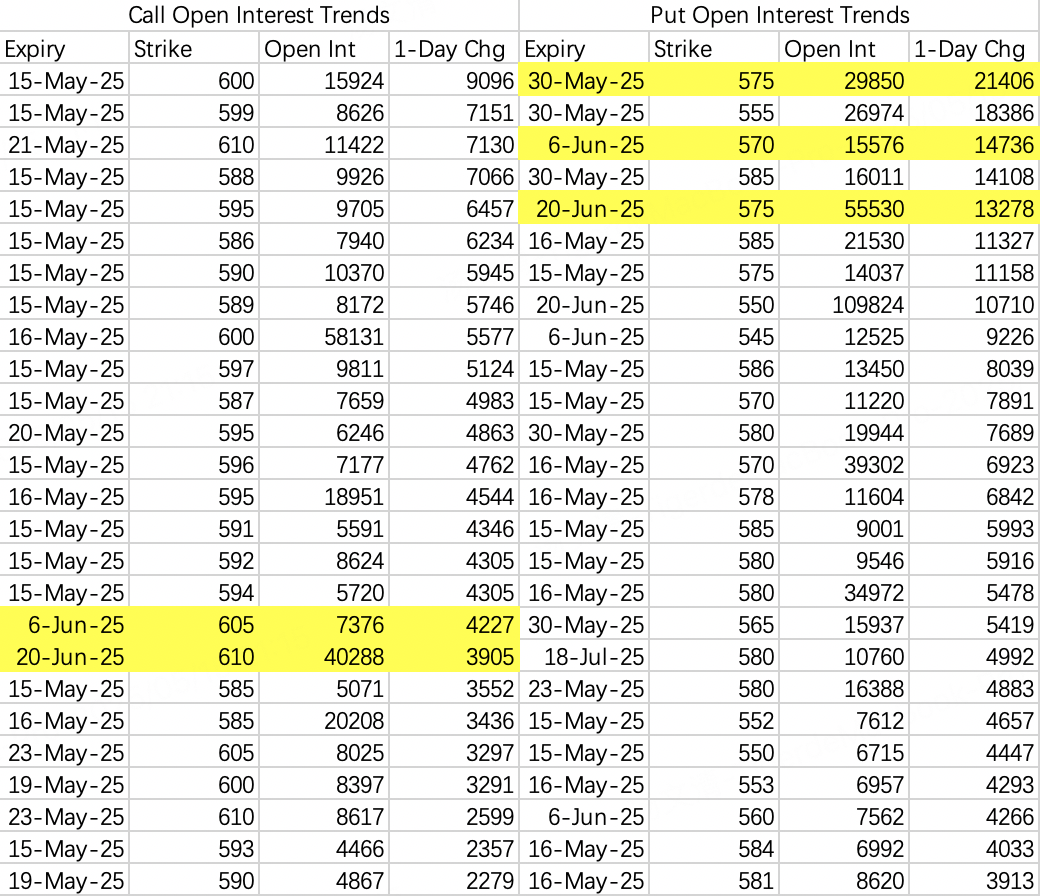

Compared to NVIDIA, SPY’s sentiment is more stable, with a trading range of 575–600.

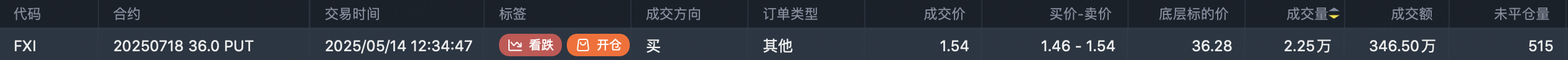

$China Large-Cap ETF - iShares (FXI)$

A large bearish order was opened for $FXI 20250718 36.0 PUT$ , with 25,000 contracts. Be cautious of a potential pullback in Chinese stocks in June.

Comments