$NVIDIA(NVDA)$

Next week’s target: 140.

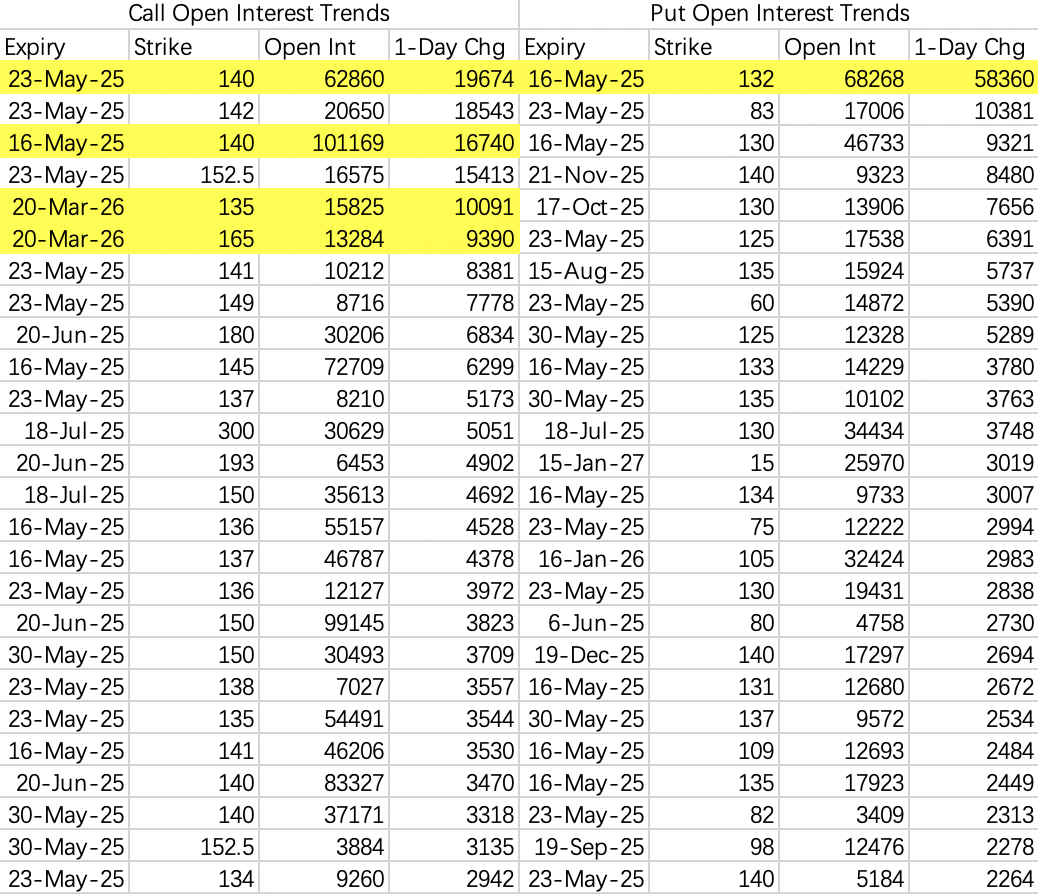

On Thursday, May 15th, $NVDA 20250516 132.0 PUT$ saw 58,000 contracts opened, with most of the activity leaning toward buying. The total transaction value was over $1.7 million, indicating that traders are expecting a pullback to 132 by Friday.

From the transaction details, the 132 put was bought at NVIDIA’s intraday high. Combined with the transaction size, this suggests that the trader has high confidence in a pullback.

However, since everyone is now anticipating a pullback to enter bullish positions, the market rarely aligns with such expectations. I think there’s a higher probability of the stock closing flat.

Even if the stock doesn’t pull back, selling puts could still be a viable strategy, as the stock price is likely to remain above 130 before earnings.

Currently, the highest price target for NVIDIA comes from Morgan Stanley analysts at $160, while the average target is $150.

The lowest target, $120, comes from HSBC analysts, who believe that although AI demand is strong, supply chain uncertainties in the second half of the year could weigh on NVIDIA’s outlook. Additionally, they expect Q1 and Q2 revenue to have difficulty exceeding expectations. However, I believe these factors won’t prevent bullish sentiment from being priced in before the earnings report.

Therefore, selling outside the 130–150 range should be relatively safe. (I mistakenly mentioned selling calls at 140 yesterday. While it’s okay this week, it could become risky next week.)

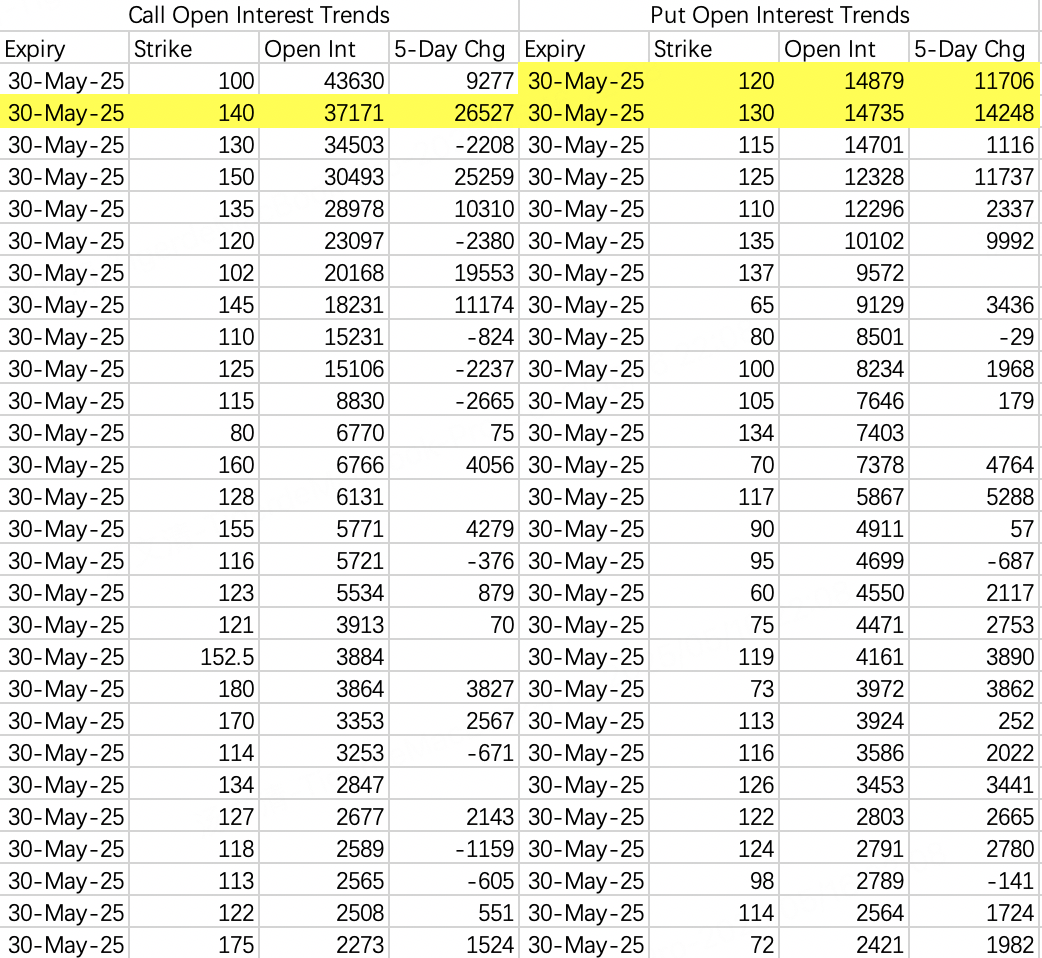

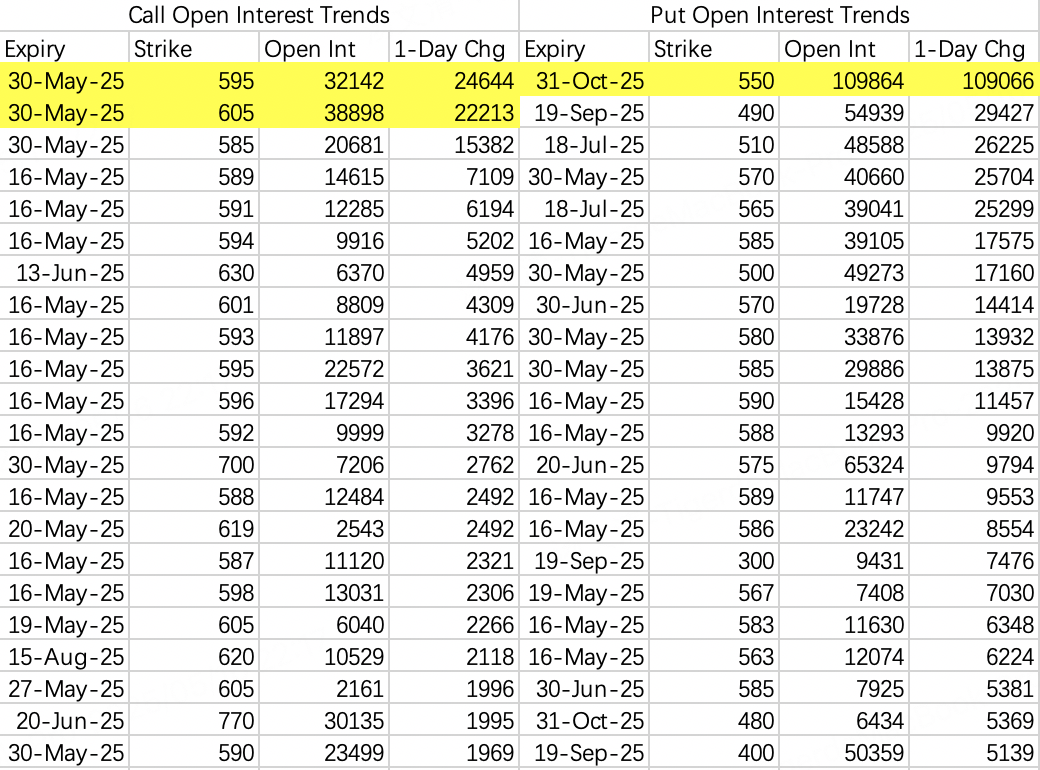

$SPDR S&P 500 ETF Trust(SPY)$

SPY’s option activity remains consistent, with the trend continuing to climb slowly toward the 600 target. In the short term, there are no apparent bearish catalysts. A significant number of bearish positions are being opened for longer-dated expirations, with reasonable downside targets at 570–580.

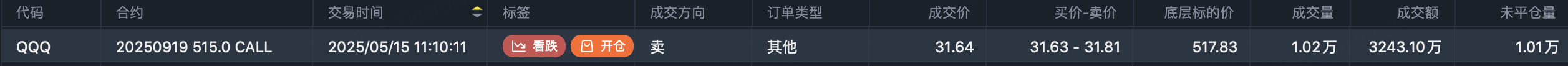

Regarding the market’s top, there are two noteworthy large covered call orders on $QQQ$:

$QQQ 20250919 515.0 CALL$ : 10,200 contracts traded.

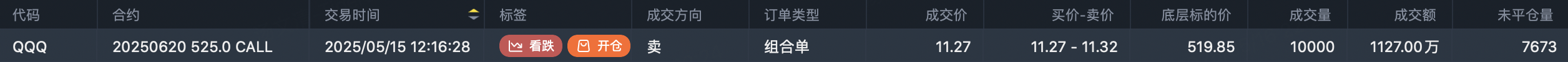

$QQQ 20250620 525.0 CALL$ : 10,000 contracts traded.

Both transactions were in the tens of millions of dollars.

This type of at-the-money covered call strategy reminds me of a similar approach I’ve seen before.

On March 18th, Duan Yongping bought 100,000 shares of NVIDIA at $116.78 per share and simultaneously sold 1,000 contracts of $NVDA 20260320 120.0 CALL$ expiring on March 20, 2026.

Shortly after, NVIDIA’s stock price began a sharp decline.

I don’t think NVIDIA’s stock will experience a significant pullback before its earnings report, but there’s limited room for upside. For those holding shares, rather than buying puts for protection, consider referencing this strategy.

Take $QQQ 20250919 515.0 CALL$ as an example. If the option’s price is $31, and QQQ ends above 515 at expiration, it’s equivalent to selling your shares at $515 + $31 = $546. If QQQ ends below $494, the shares offset the $31 loss, so there’s no significant downside risk.

$iShares China Large-Cap ETF(FXI)$

On Thursday, there was significant activity in $FXI 20250815 34.0 PUT$ , with 46,000 contracts opened. The overall transaction direction leaned toward selling, with a total transaction value exceeding $5 million.

This indicates that some traders are taking a sell-put position, expecting FXI to stay above 34 before August. This corresponds to Alibaba trading at approximately $120.

Comments