This week’s trading range: 125–140.

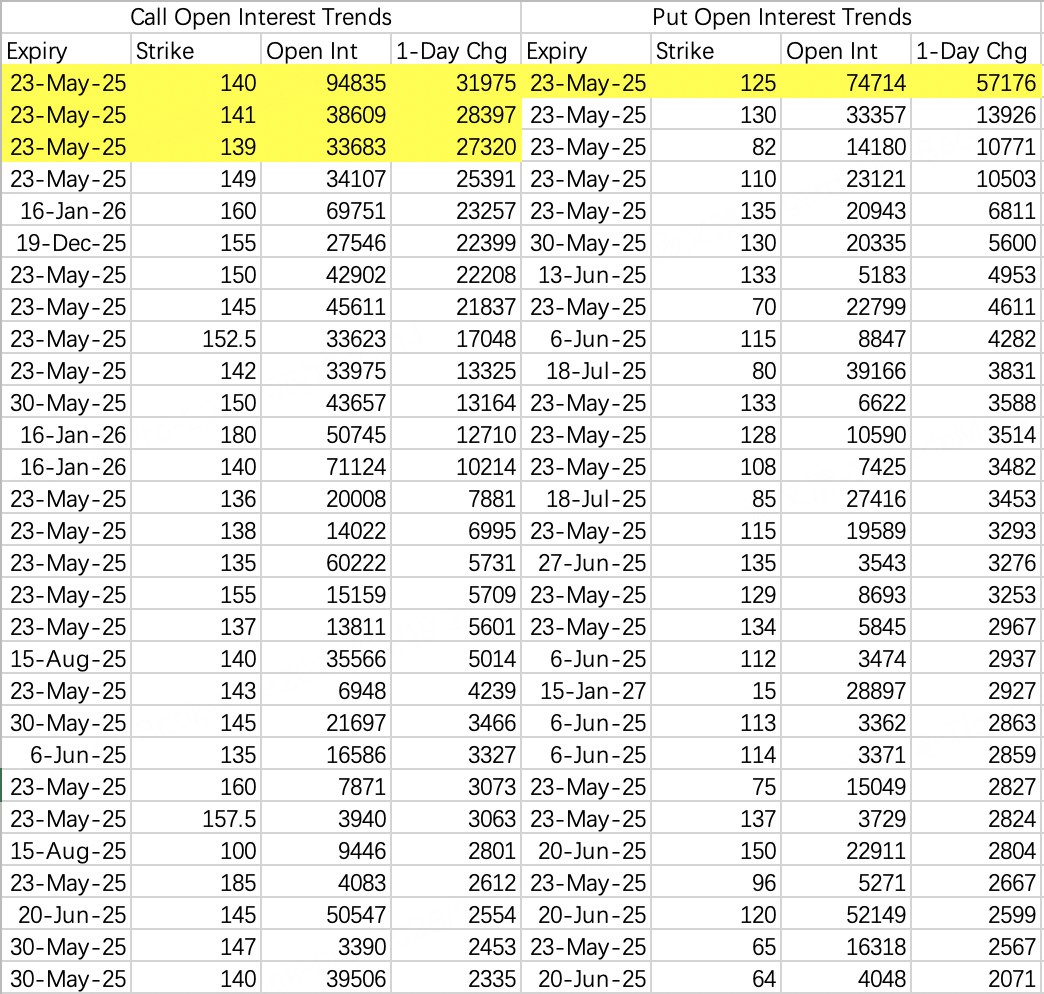

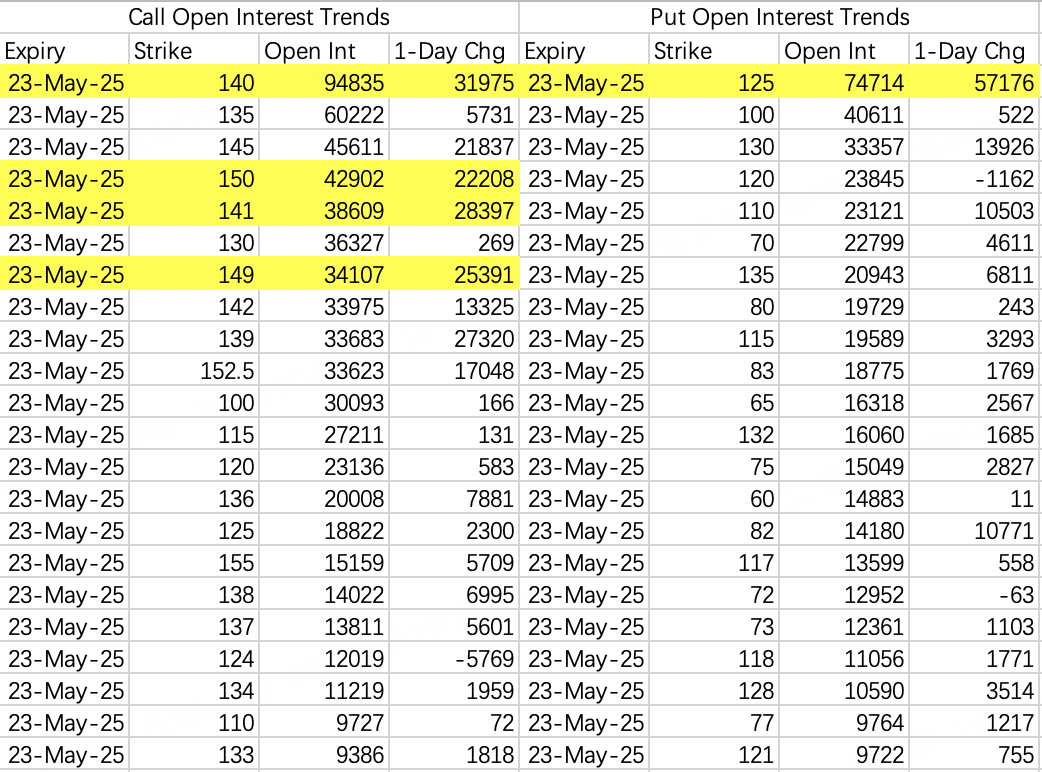

The upper limit of the range is based on institutional spread arbitrage strategies. Although institutions failed twice last week to roll their positions successfully, they continued rolling on Friday. For their arbitrage strategy, the sell call strike remained in the 139–141 range, while the buy call strikes were set at 145, 149, 150, and 152.5.

This positioning makes sense. Unless there’s a major bullish catalyst—such as Trump promoting NVIDIA again—it will be difficult for the stock to break above 140, even if it reaches that level. The resistance above 140 remains strong.

On the bearish side, the 125 put $NVDA 20250523 125.0 PUT$ expiring this week saw 57,000 new contracts opened, with a mix of buying and selling activity. This strike can only be considered as the lower limit of the pullback range.

For this week’s open interest:

The call option with the largest open interest is at the 140 strike ($NVDA 20250523 140.0 CALL$ ).

The put option with the largest open interest is at the 125 strike ($NVDA 20250523 125.0 PUT$ ).

With the current price at 135, a straddle or strangle strategy (selling both calls and puts) could be appropriate.

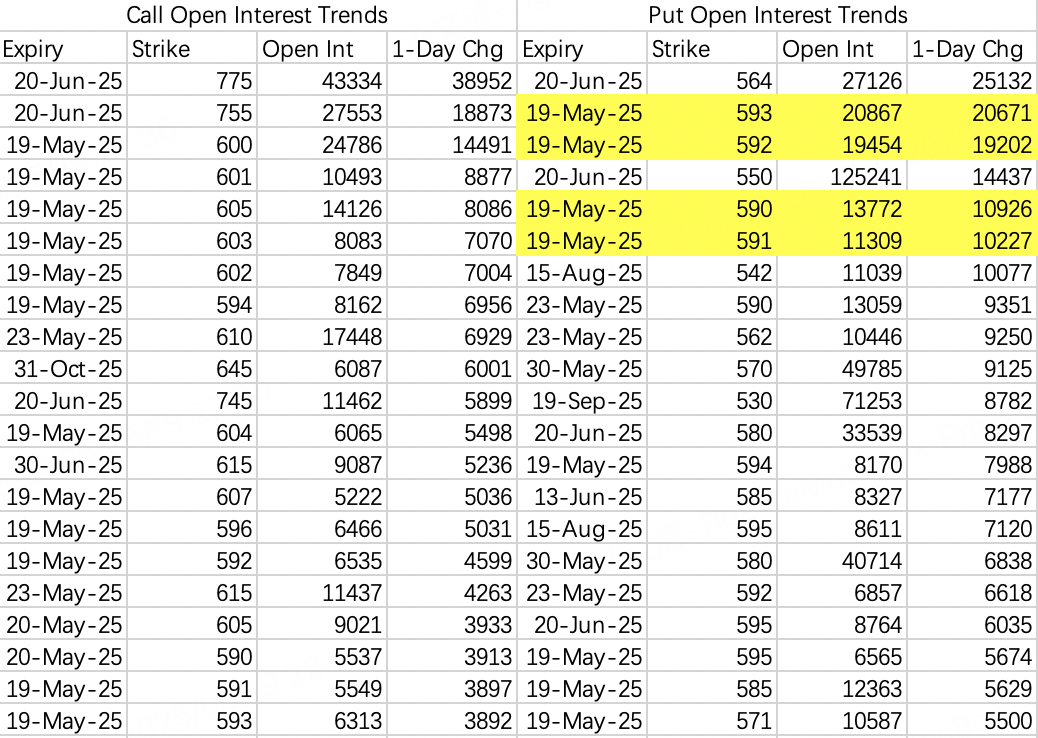

Moody’s downgrade had a significant impact on the market. However, large bearish bets were already placed last Friday, indicating the market is likely to follow this sentiment.

Monday’s bearish outlook suggests SPY could drop to the 591–592 range.

While the broader market is expected to pull back and fill its gaps before the June triple witching day, the timing for this correction doesn’t appear to be this week.

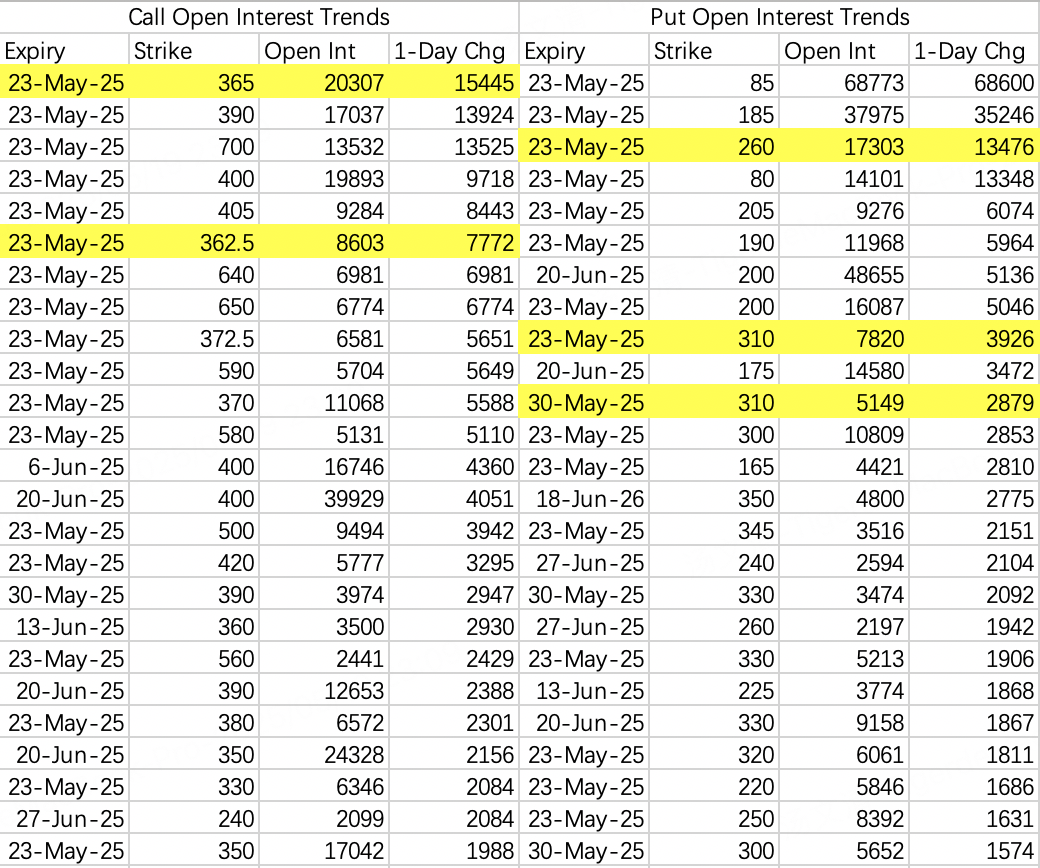

Institutions’ arbitrage strategy for Tesla this week involves selling the 365 call $TSLA 20250523 365.0 CALL$ to collect margin and hedging with the 405 call $TSLA 20250523 405.0 CALL$ . This suggests that Tesla’s stock price is unlikely to exceed 365 this week, which is also consistent with the broader market’s expected movement.

When Tesla’s upward momentum weakens, bearish option activity becomes aggressive. There has been an explosion in open interest for deep out-of-the-money puts, with a target price of 260. However, a more realistic pullback would likely be around 310.

Comments