On May 19, during the opening of the Taipei International Computer Expo, NVIDIA CEO Jensen Huang delivered a keynote speech. The speech did not reveal any major surprises: it mainly reiterated the company’s focus on AI communication infrastructure (e.g., NVLink Fusion) and long-term projects (e.g., robotics and Omniverse). Although the U.S. Department of Commerce's restrictions may have short-term impacts, the bearish factors are clear, and the company is expected to accelerate growth again in the second half of the year.

As for next week’s earnings report, the bearish factors are also clear. Morgan Stanley analysts noted that they expect investors to anticipate a slight beat in Q2 earnings, with guidance remaining flat or slightly increasing (which may fall short of the typical $2 billion sequential quarterly growth guidance).

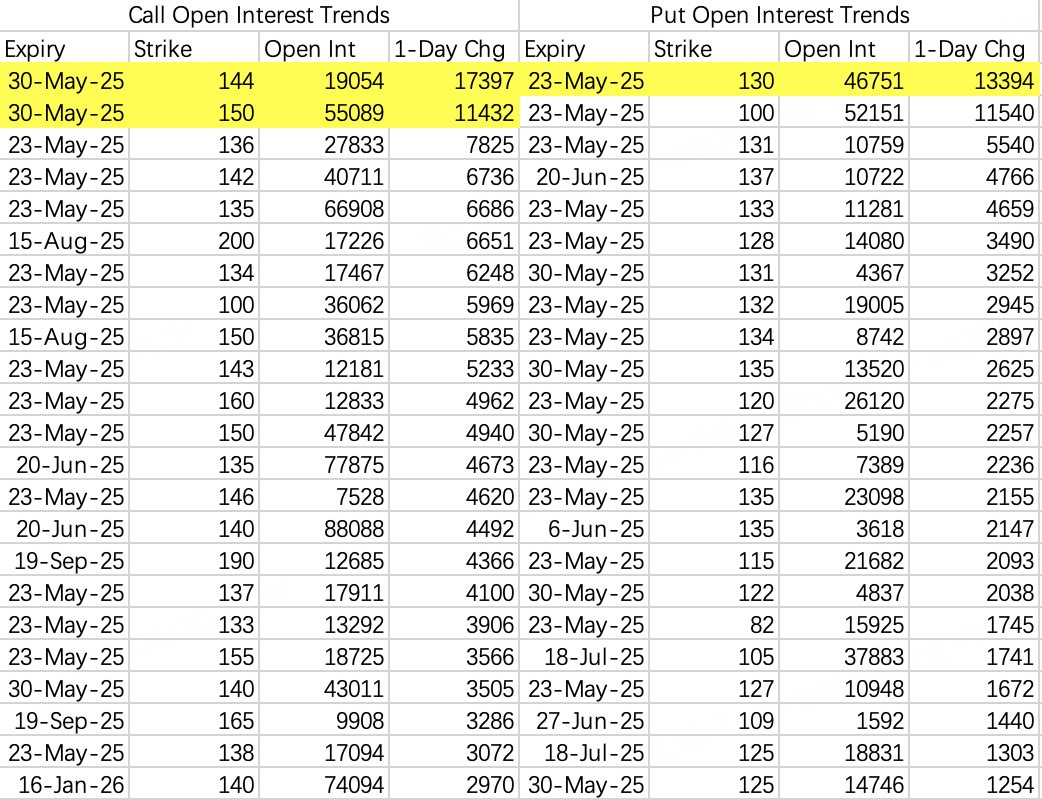

Based on the current feedback, some institutions have begun positioning strategies for next week’s earnings report. Options data for May 20 shows notable open interest growth in the $NVDA 20250530 144.0 CALL$ expiring May 30 (144 call) and the $NVDA 20250530 150.0 CALL$ (150 call), with an increase of 17,000 contracts and 11,000 contracts, respectively.

Upon further investigation, this appears to be a bullish vertical spread strategy — buying the $NVDA 20250530 144.0 CALL$ and selling the $NVDA 20250530 150.0 CALL$ . Based on the strike prices, it can be inferred that their expected price range is between 144 and 150.

Some may wonder why this strategy cannot be found on the Tiger PC options screener. This is because the screener is biased toward filtering large orders, and the trader of this strategy managed their orders by splitting the large order into smaller trades of around 200 contracts each. The trading volume clearly differs from options typically dominated by retail investors, as the distribution is remarkably uniform.

The transaction amount can be roughly estimated from the 144 call’s open interest, subtracting the premium from the 150 call, resulting in a net cost of around $2 million. Compared to the usual $400,000 speculative bets during earnings season, this reflects a much more serious attitude. Combined with the effort to avoid large-order monitoring, this institutional bet seems highly credible.

However, if the stock opens lower on Tuesday, it could be an opportunity to sell puts. A strike price of 130 could be chosen, as it aligns with the highest open interest for put options, indicating the expected downside.

The 125 put contracts opened on Friday have already been largely closed out on Monday, suggesting that this level of pullback is unlikely for the rest of the week.

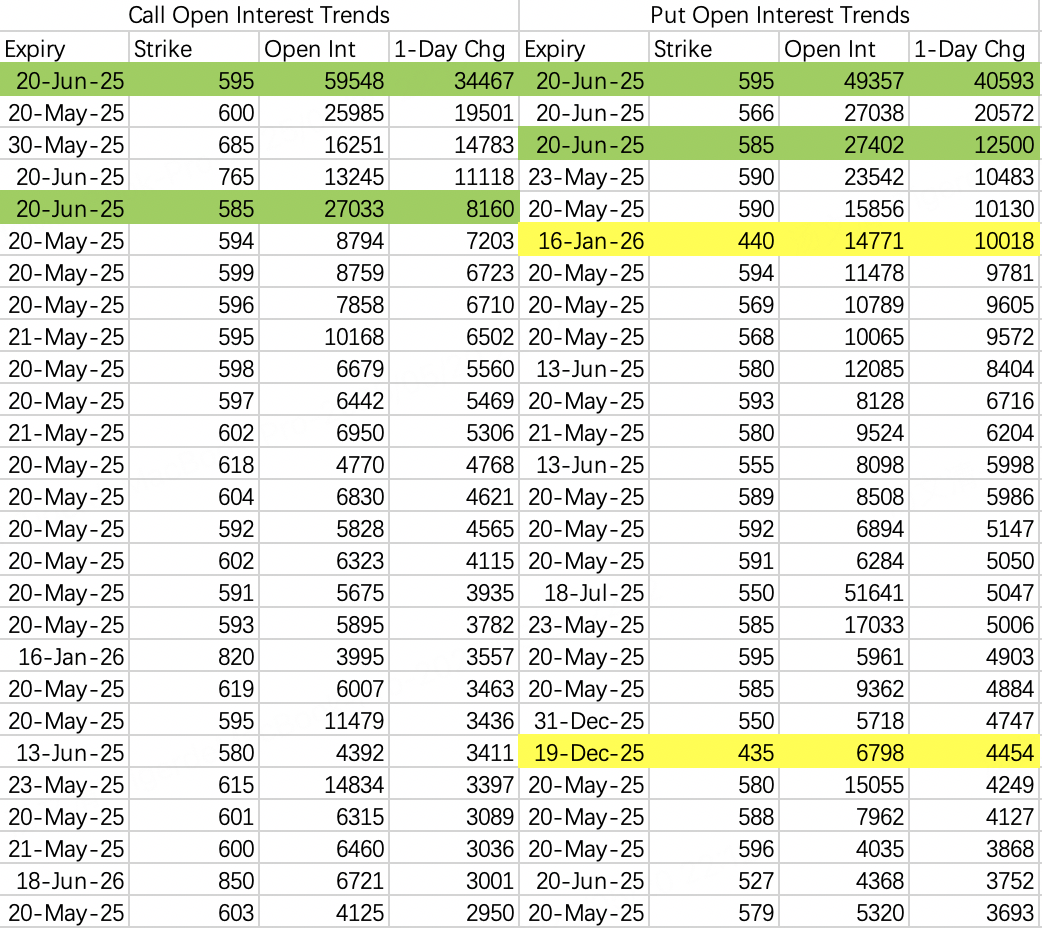

Two single-leg, long-term, deep out-of-the-money put options are worth noting: $SPY 20260116 440.0 PUT$ and $SPY 20251219 435.0 PUT$ . Both involve single-leg purchases.

The strike prices are not particularly significant; the selection of deep out-of-the-money options mainly reflects a bet on increased volatility. Overall, there is a downside expectation for the broader market.

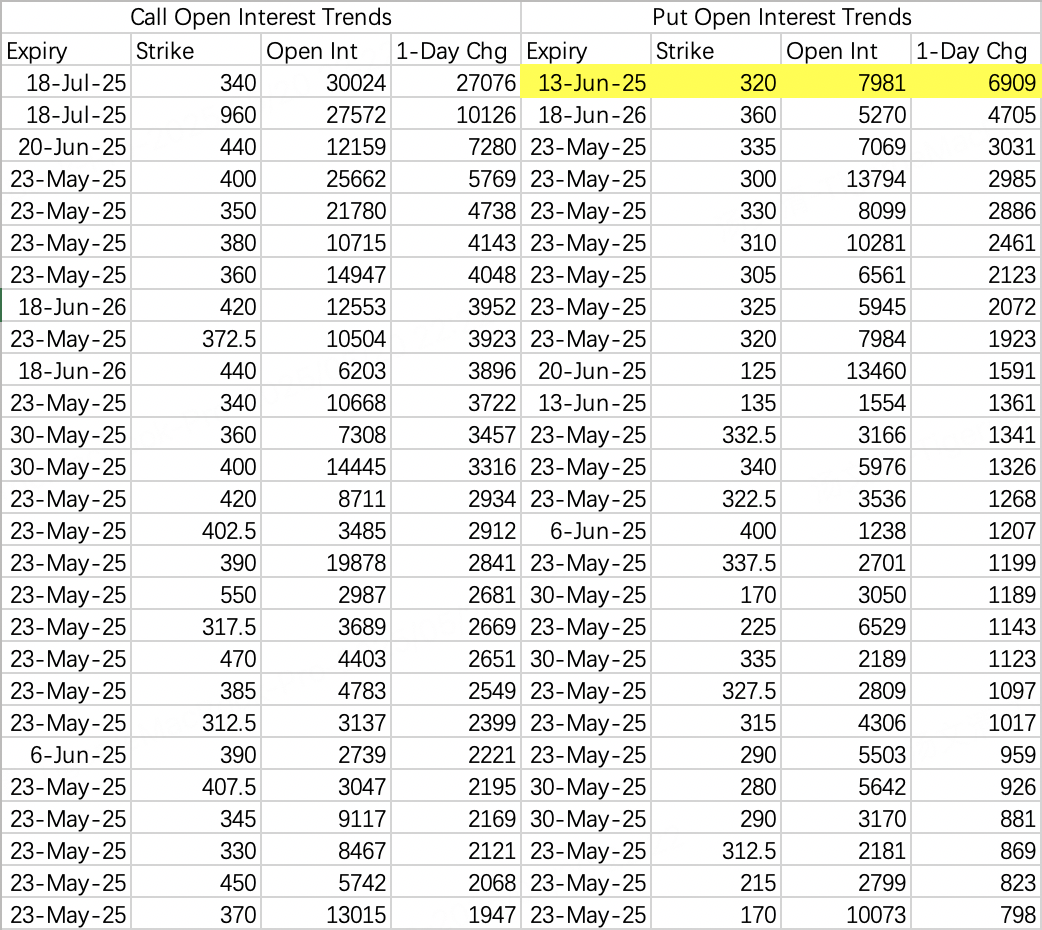

An unusual large sell-put order has been observed, involving the sale of $TSLA 20250613 320.0 PUT$ expiring on June 13. This can be used as a reference for recent sell-put strike prices.

Comments