The volatility is quite muted, with even options trading volume and open interest declining. Let’s briefly discuss NVIDIA's options expiring on the June triple witching day.

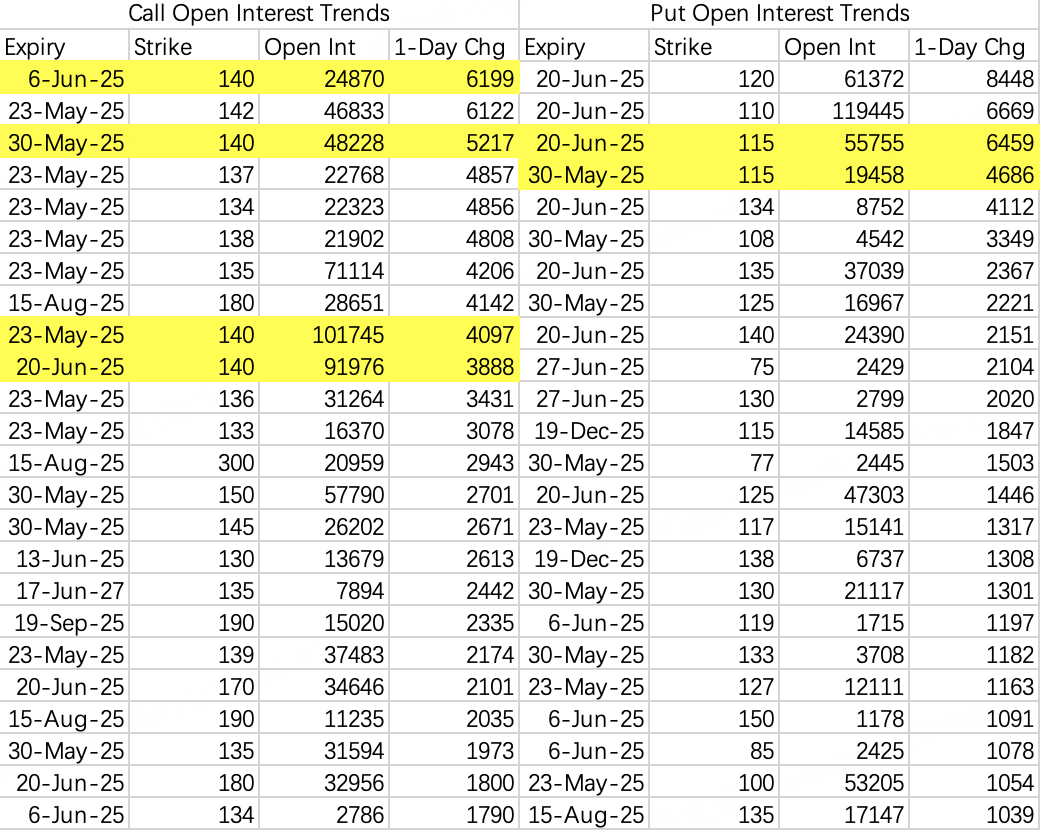

On Tuesday, there was an increase in bullish open interest around the 140 strike, such as the $NVDA 20250606 140.0 CALL$ . These positions include both bullish and bearish bets, but the specific direction is less important. The key focus is on the overall open interest activity.

On the bearish side, there’s a growing presence of deep out-of-the-money put options with a delta absolute value of less than 0.2, such as the $NVDA 20250530 115.0 PUT$ . The reasoning behind this type of positioning can vary, so it’s worth noting and observing for now.

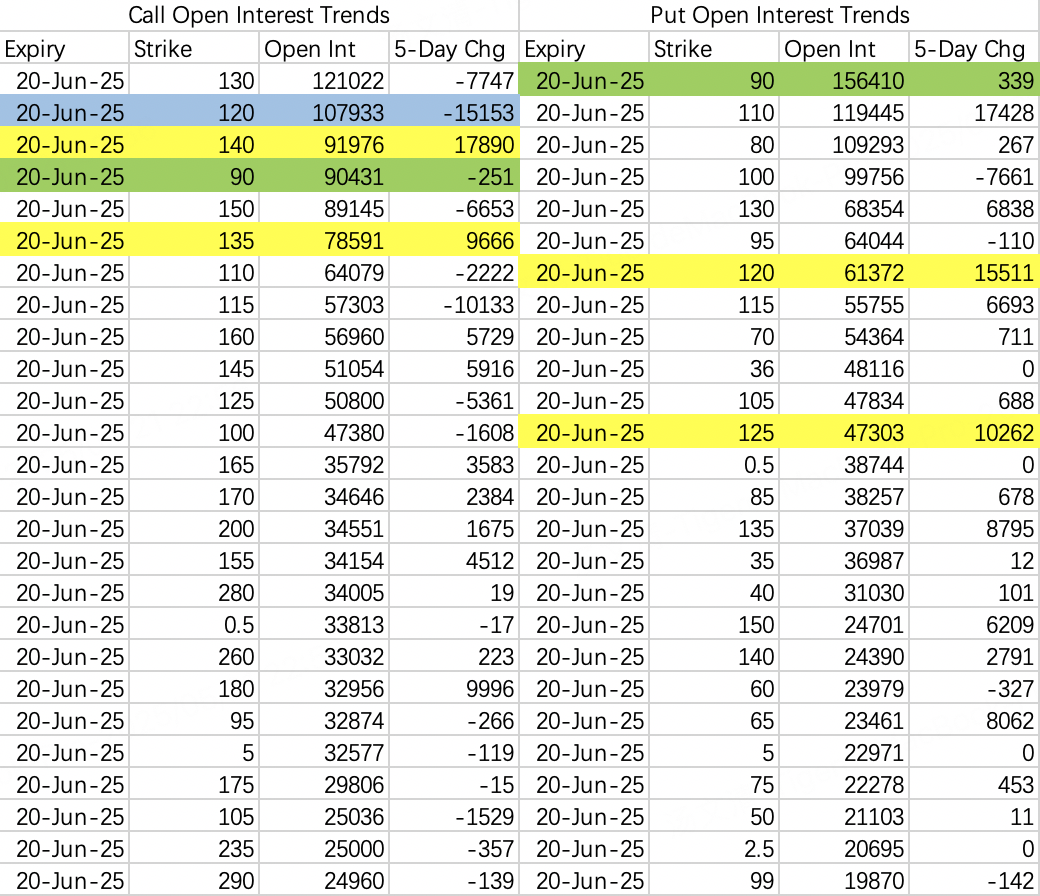

June 20 marks the second triple witching day of the year, and the open interest on NVIDIA options is massive. A preliminary analysis suggests NVIDIA’s stock price may pull back to around 120 before the triple witching expiration. Thus, unless the earnings report delivers a significant upside surprise, it may be more appropriate to sell calls rather than chase the stock higher.

The 120 call, marked in blue, was opened by the "200-million-dollar trader" on March 5—$NVDA 20250620 120.0 CALL$ —with a staggering 100,000 contracts. Historically, this trader tends to roll their positions ahead of earnings, but this time, they chose to reduce their position. Open interest data shows that on May 12, the $NVDA 20250620 120.0 CALL$ saw a reduction of 48,900 contracts.

The half that was closed on May 12 was certainly at a loss. With a cost basis of $12 and a closing price of $9, why would they close at a loss? On that day, the U.S.-China tariff meeting concluded, leading to a market rebound. I believe the institution was concerned about a "sell the news" scenario, with the stock price pulling back after the positive macro catalyst was fully priced in. Therefore, this reduction in position was not specifically tied to earnings performance but rather due to the high level of macroeconomic uncertainty.

Comments