In options trading, Rolling is an important risk management and strategy adjustment tool. Simply put, moving positions isClose the current option position while opening a new option position to adjust the expiration date, strike price, or both of the position。

1. What is option position transfer?

Option position movement means that when the original option position has not yet expired, the trader chooses to close the current position, and at the same time opens a new position in the same direction but with a different expiration date or strike price.

For example:

Exchange a contract that is about to expire to the next one;

Or adjust the call option currently held with an exercise price of $100 to $105;

Or change the time and price at the same time.

This operation is usually done as aActively manage positionsStrategies used to adapt to market changes or control risks.

2. Why do you want to move options?

Common reasons for moving positions in options include:

Extended time valueThe current contract is about to expire, but you are still optimistic about the trend of the underlying and want to continue to hold positions in a similar direction.

Locking in profitsThe current position has a considerable floating profit, and you hope that part of it will be safe, and at the same time continue to play the follow-up market.

Loss reductionThe current position has suffered a floating loss, and it is expected that the profit and loss structure will be improved by adjusting the exercise price or changing months.

Respond to changes in target trendsFor example, if the underlying price rises more than expected, you may want to increase the exercise price to make the risk lower and the profit more efficient.

Avoid being exercisedWhen the seller's position is close to the real value or even has the real value, it may face the risk of exercise near the expiration. At this time, unnecessary delivery can be avoided by moving the position.

Opportunities or risk management needs arising from changes in volatilityFor example, after the implied volatility rises sharply, moving positions to forward contracts may have higher time value.

3. Common ways to move options positions

Rolling OutThe contract that is about to expire is moved to a future period, and the exercise price will remain unchanged or slightly adjusted. It is usually used to continue to hold the position in the original direction while extending the time.

Rolling Up/Down (adjusted exercise price)If the underlying price changes significantly, you may choose to adjust the strike price upward or downward. For example, if the underlying price rises sharply, the virtual value Call becomes the real value. In order to lock in profits, the exercise price can be moved upward. Or the underlying price falls sharply and the original put option is deeply in the price, or the exercise price can be lowered to harvest part of the profit.

Rolling Out and Up/Down (simultaneously exchange month + exchange price)In some more complex scenarios, such as when the direction continues to change but it also takes longer, you can change months and adjust the strike price at the same time. For example, move a $100 call option that expires next week to a $110 call option one month later.

4. What situations are suitable for considering moving positions?

The following are common applicable scenarios for warehouse movement:

You're betting in the right direction, but the contract is about to expire: You can consider extending the holding time to allow profits to continue to enlarge.

You bet in the right direction, but you have reached near the key strike price: At this time, moving positions can prevent exercise while retaining potential income.

You bet in the wrong direction but don't want to stop loss and leave the market: You can consider moving the position to a more favorable structure, such as changing to a more forward position, lowering/increasing the exercise price, to alleviate the loss.

The out-of-the-money option you originally wrote becomes close to real-money or has become real-money: Consider moving positions in advance to avoid being exercised or physical delivery problems.

You just want to cash in earlier but you still want to stay involved: For example, if you close the current Call and then sell the Call with a higher exercise price, you will not only harvest part of the profit, but also continue to participate in the rise.

5. Issues that should be paid attention to when moving warehouses

Don't move positions in order to "delay decision-making"If your trading logic has failed (such as a complete trend reversal), you should not move your position at this time, but stop your loss.

Handling fees and slippage costsEvery time a position is moved, additional transaction costs will be incurred. For frequent rolling strategies, the proportion of handling fees must be specially controlled.

Impact of implied volatility on new positionsIf market volatility is high, new forward contracts may be expensive in time value and may not necessarily be cost-effective.

Positions and risk exposures may changeSometimes moving positions will unconsciously expand risks (such as increasing Delta, Gamma, Vega), and it is necessary to reassess the risk of holding positions.

Pay attention to the overall structural symmetry when combining strategiesIf you are doing a combination strategy such as bull market spread and wide straddle, you should consider the corresponding adjustment of both legs at the same time when moving positions to maintain symmetry.

6. Practical examples of warehouse moving

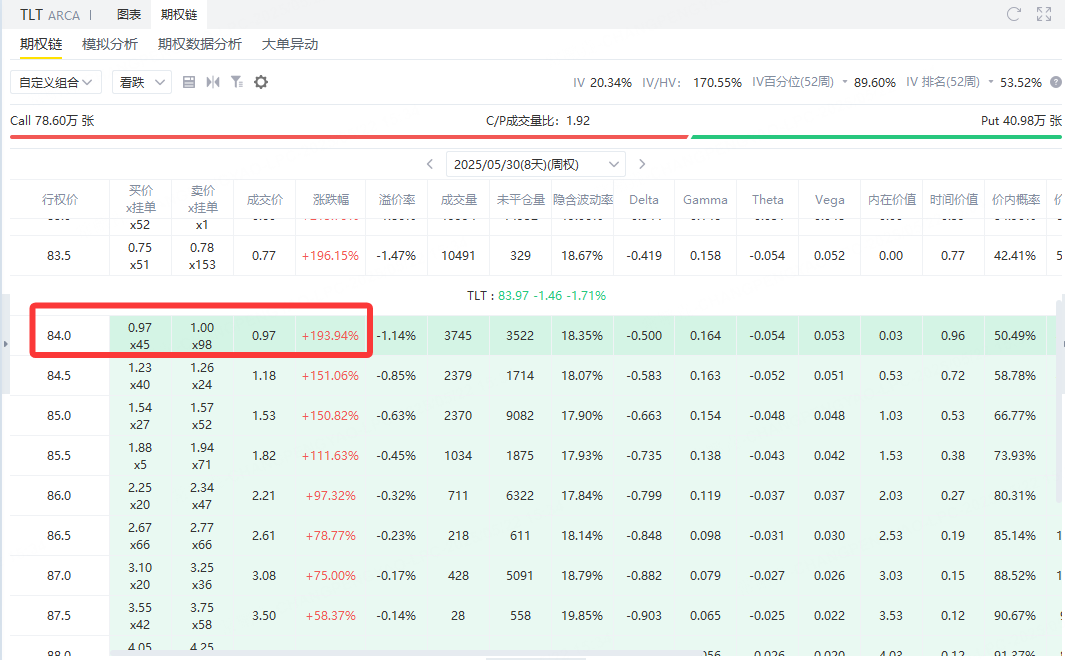

To sell$20 + + Years US Treasury Bond ETF-iShares (TLT) $0530 84 Put, get $54 premium for example. After the market plummeted, the subsequent contract incurred losses. If investors don't deal with it, they will have to passively take over the order. If investors don't want to take over TLT and think that TLT has a chance to rise later.

At this time, you can choose:

Replenishing the Put;

At the same time, I sold another $84 Put that expires in a month and received a $193 premium.

This operation is typicalRolling Option,Cover the original Put and sell the new Put with the same exercise price and further expiration to continue to obtain income while avoiding the exercise risk near expiration.

Comments