$iShares 20+ Year Treasury Bond ETF(TLT)$

On Wednesday afternoon, a 20-year U.S. Treasury auction encountered some issues. Weak buyer demand pushed the 30-year Treasury yield above 5%, nearing its highs from Q4 2023.

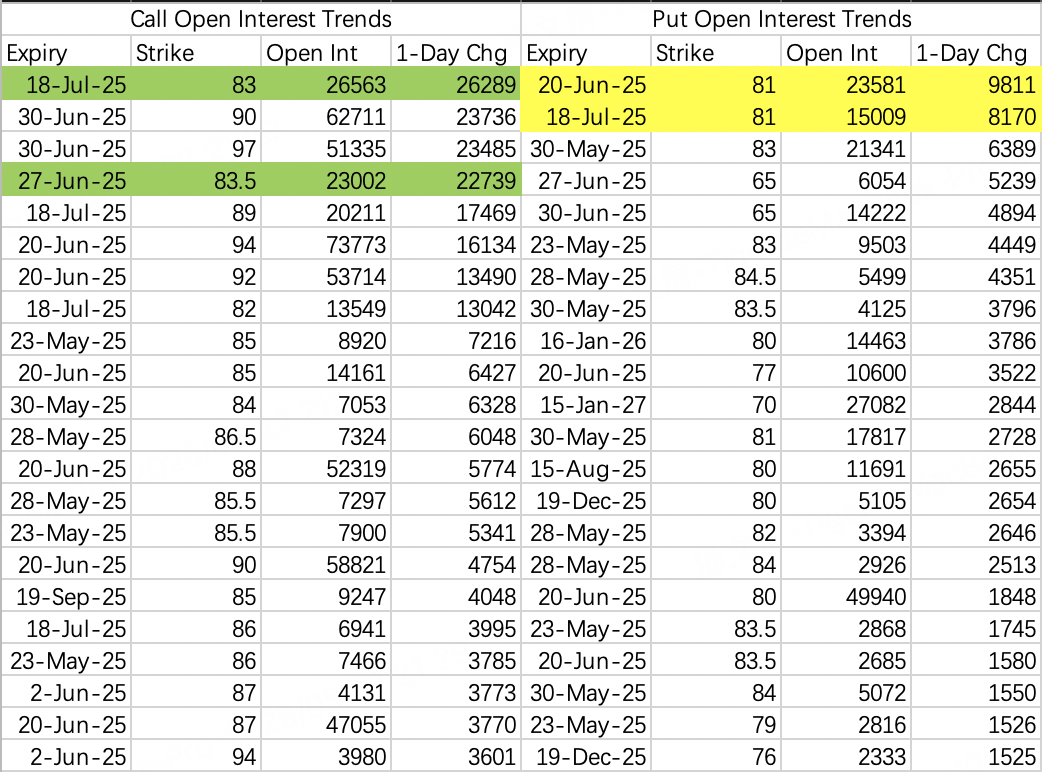

Notably, before the auction, at 10 a.m. EST, with TLT trading around $84.9, a large volume of $TLT 20250627 83.5 CALL$ expiring June 27 was opened. After reviewing the trade details, it was clear that this in-the-money call option was sold.

Without a doubt, this is an insider-driven large order.

Typically, if one expects a price decline, buying puts might seem like the better choice. However, based on TLT's price chart, the stock is already near its bottom. Comparing the premiums for bearish and bullish options, selling calls is more profitable in this scenario. The 83.5 put premium rose from $1.23 at Wednesday’s open to $1.70 at Thursday’s open, while the 83.5 call premium dropped from $2.70 to $1.86 over the same period.

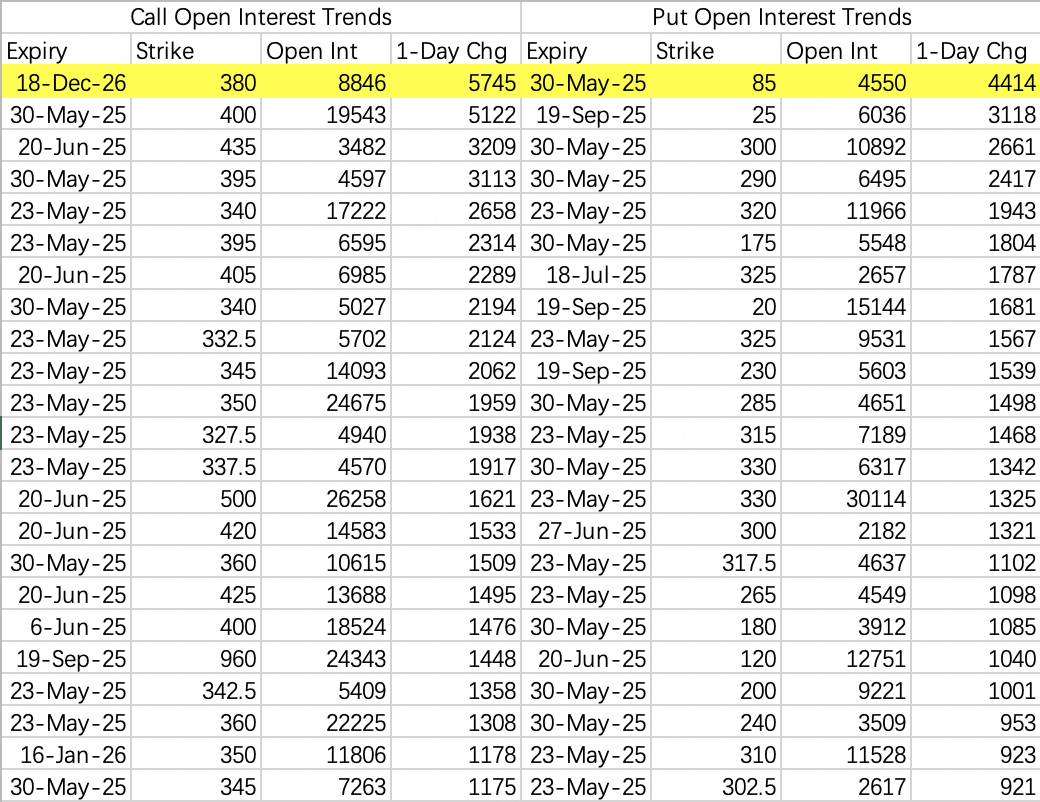

Based on Wednesday’s open interest data, bearish positions were concentrated around the 81 strike, with strategies focused on rolling and hedging bearish exposure, such as selling the 89 call and buying the 81 put.

Bullish open interest was more aggressive. After the price decline, traders opened bullish vertical spreads for July expirations, such as the 89-96 call spread, and bought $TLT 20250718 83 CALL$ . This suggests that the downside for TLT is limited at this point. There’s no need to panic about the broader market being dragged down by Treasuries, at least until NVIDIA’s earnings report.

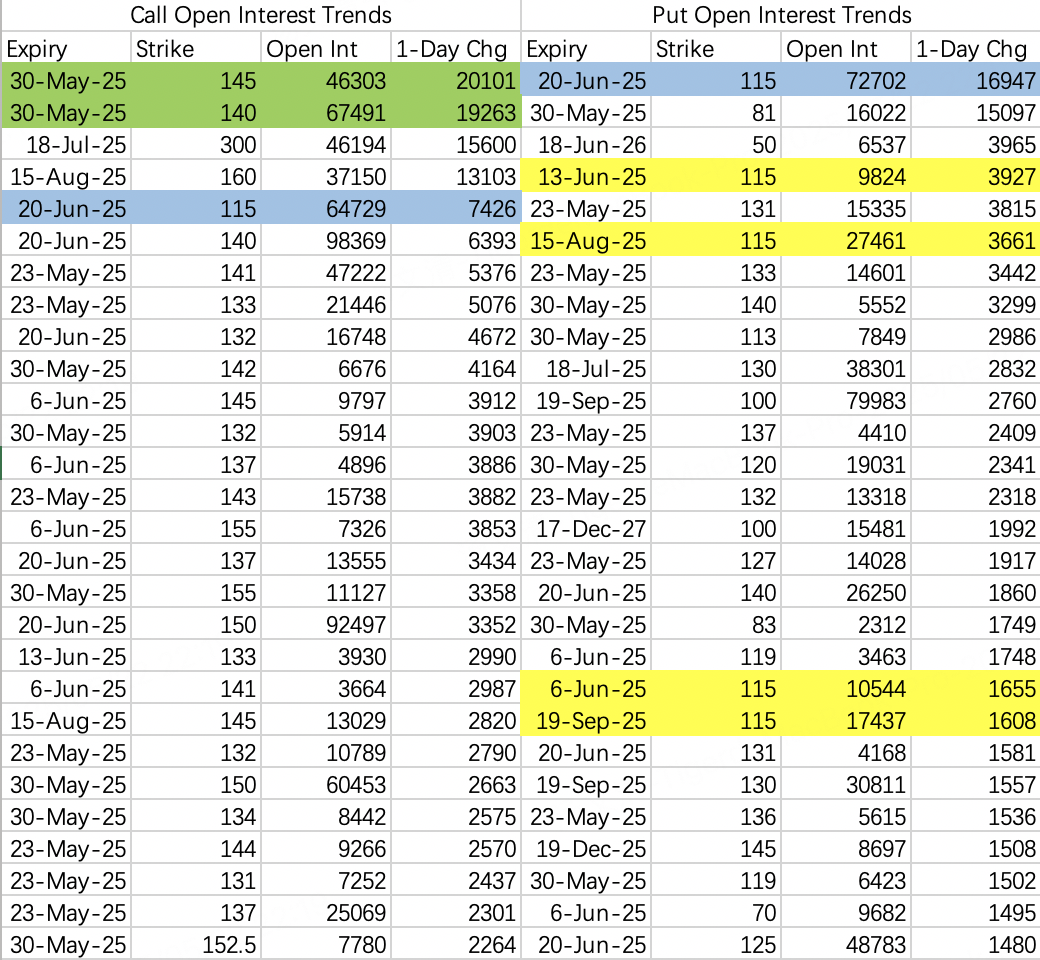

Due to significant downside pressure on the market and frequent unforeseen events, traders have shifted to more conservative strategies, such as selling puts like $NVDA 20250613 115.0 PUT$ . Several 115 put contracts marked in yellow were also sold. This indicates that 115 is likely the expected support level for a post-earnings pullback.

For bullish positions, the largest open interest was in call spread combinations: buying $NVDA 20250530 140.0 CALL$ and selling $NVDA 20250530 145.0 CALL$ . This reflects a slightly lower price target compared to the previous 144-150 spread but still maintains a bullish outlook.

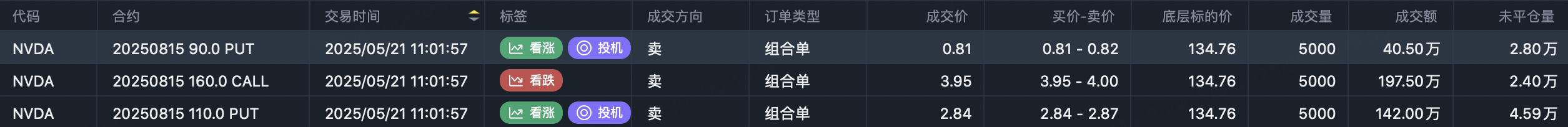

Some traders are avoiding bets on the current uncertainty by opting for strategies less affected by market volatility, such as selling the 160 call, selling the 110 put, and buying the 90 put. Based on the current market sentiment (expecting prices to stay between 115 and 150), NVIDIA should have no major issues navigating its earnings report:

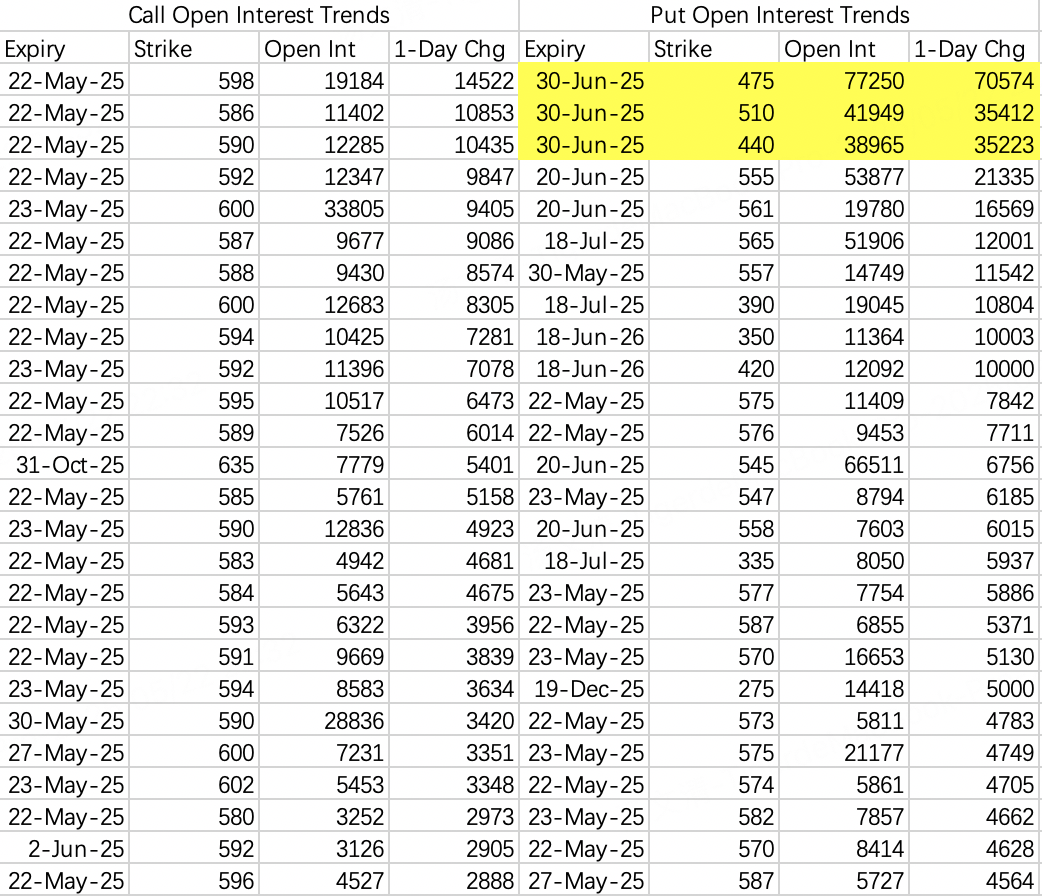

Bullish options activity is primarily intraday or expiring the next day, as long-term uncertainty remains high, resulting in limited long-term bullish positioning. On the contrary, bearish long-term positions are more active, such as a June-expiration butterfly spread with strikes at 440-475-510. This position profits if SPY drops below 510.

Tesla’s valuation only aligns during upward trends. When market headwinds prevail, its trading data becomes less reliable unless there are large institutional orders. However, institutions were cautious on Wednesday, so other traders are even less likely to commit.

Institutional sell call activity at the 365 strike earlier this week remains unproblematic.

The $GOOGL 20251219 185.0 CALL$ saw significant buy-side open interest, indicating a bullish outlook at that strike. In contrast, I chose to sell the $GOOGL 20251219 150.0 PUT$ , which can also serve as a reference for downside expectations.

Comments