I suspect Trump’s premarket statement on Friday about imposing tariffs on Europe might be an attempt to buy NVIDIA at a lower price ahead of its earnings. Otherwise, why would he show support for his good buddy Musk’s earnings but turn bearish when it’s NVIDIA’s turn?

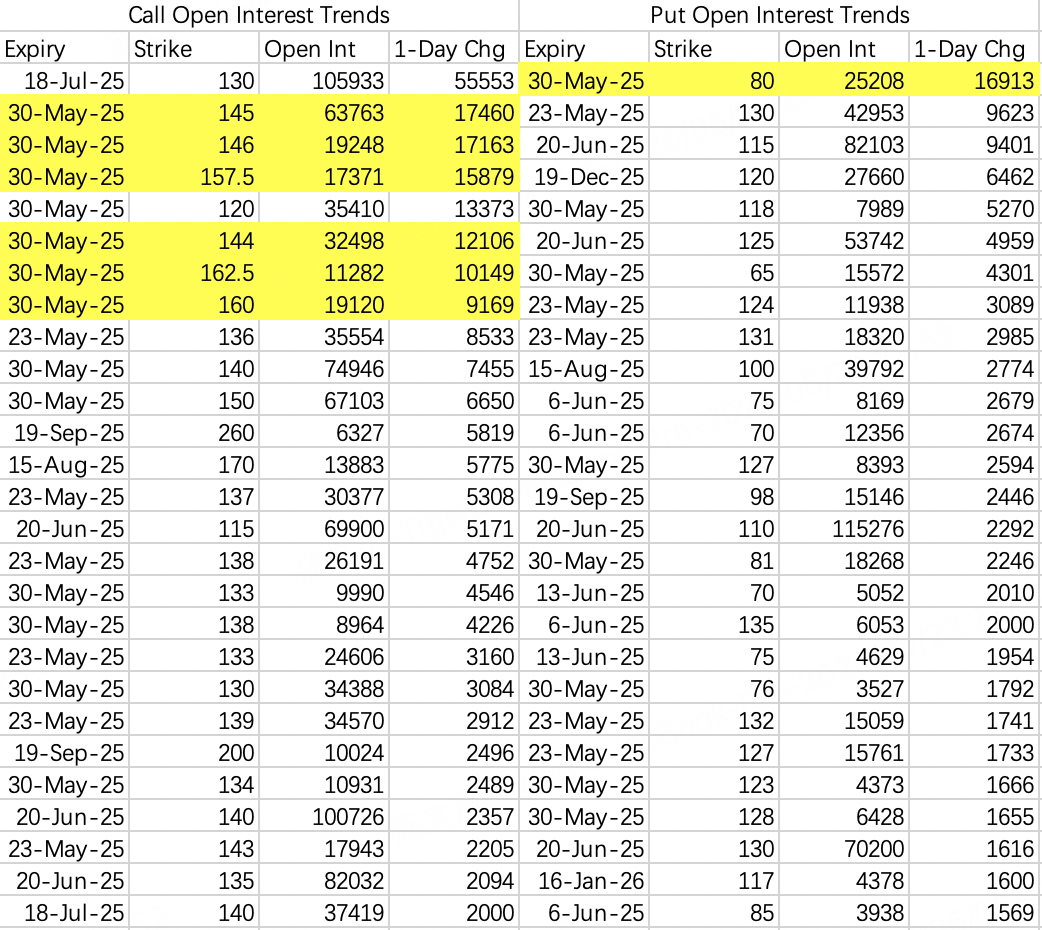

On Thursday, options arbitrage institutions rolled their positions, and judging by the results, next week’s stock price may not be low. They raised the strike prices for their sell call positions to the 144–146 range while hedging with buy calls in the 157.5–162.5 range.

From an analysis perspective, NVIDIA’s stock price next week could potentially hit 140, whether it’s before or after the earnings report. Post-earnings, the stock is expected to trade between 130 and 144.

If this were last year, this situation would likely justify going all-in. However, Trump’s statement comes at a particularly bad time, as the broader market already faces correction pressure. So, while NVIDIA remains bullish for next week, it carries some risk, and position sizes need to be adjusted accordingly.

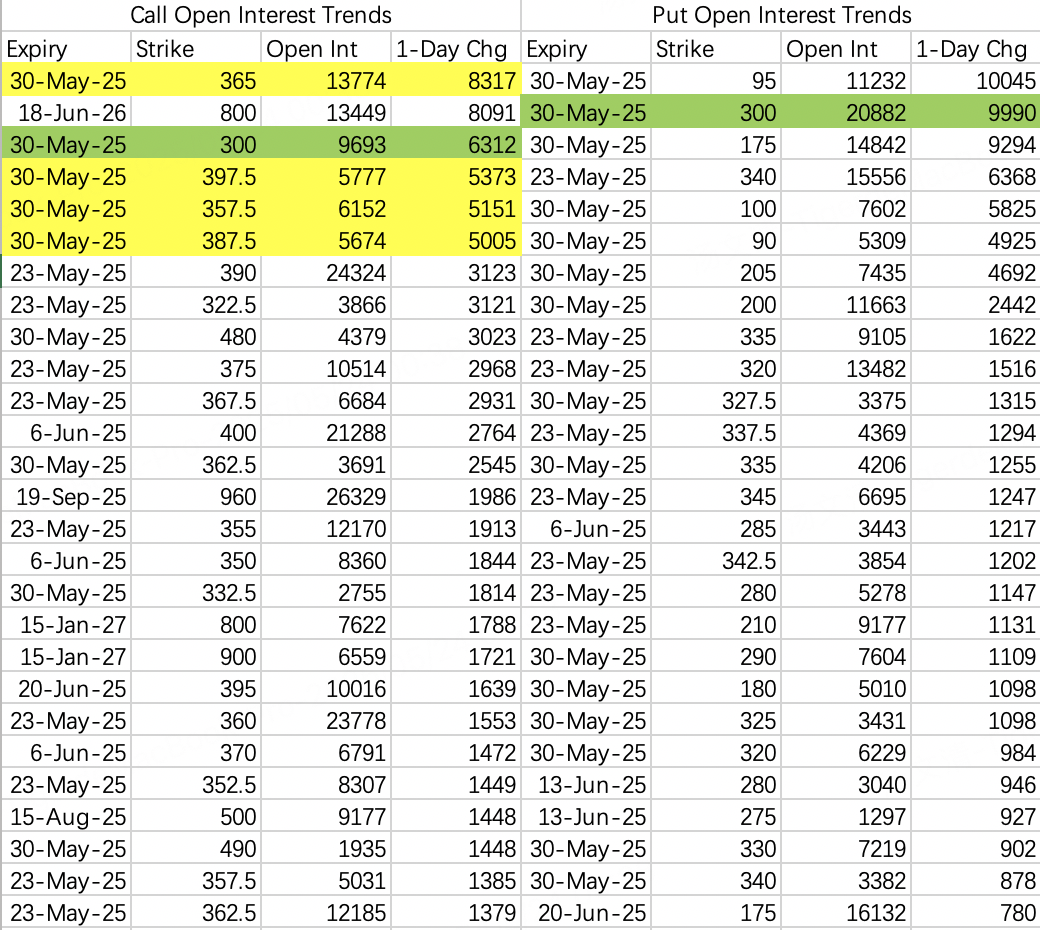

Institutions rolled their long call positions, closing the $NVDA 20250718 110.0 CALL$ expiring on July 18 and rolling into the $NVDA 20250718 130.0 CALL$ with the same expiration date. Although the strike price was raised, this move doesn’t necessarily reflect increased bullishness but rather follows standard roll logic: locking in partial profits while reducing exposure. After the roll, the trading volume remained unchanged, but the transaction amount decreased.

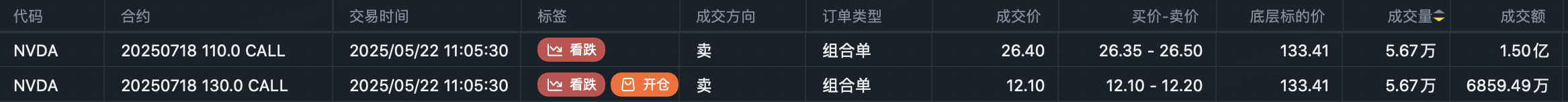

Far-dated bearish open interest remains active, while far-dated bullish open interest is sparse. This reflects the market’s lack of optimism about long-term upside, with a preference for positioning against a decline. Current data suggests the S&P 500 could pull back to 550 by the end of June.

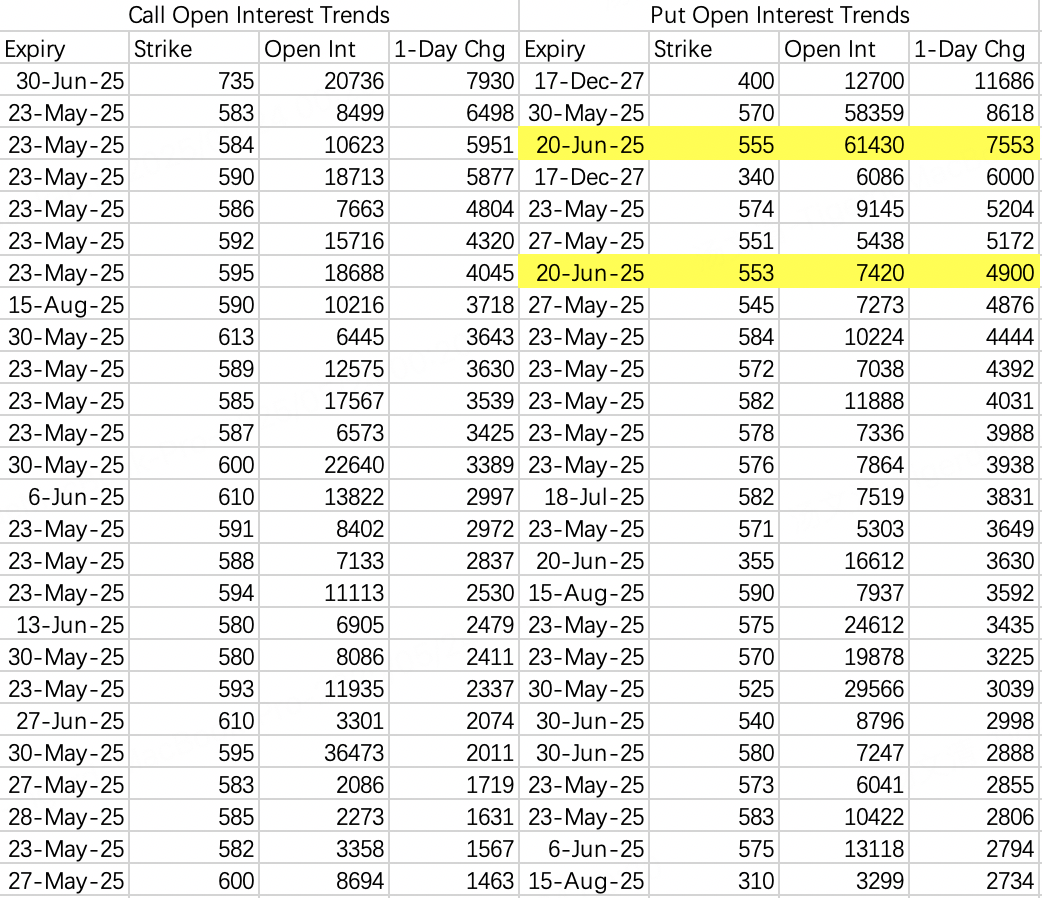

Options arbitrage institutions rolled their positions as well, and next week’s outlook remains weak. Sell call positions are concentrated in the 357.5–365 range, with hedges in the 387.5–395 range, slightly lower than this week’s upper limit.

Interestingly, someone executed a reverse collar strategy by buying the $TSLA 20250530 300.0 CALL$ and selling the $TSLA 20250530 300.0 PUT$ while holding shares. Although the rationale behind this strategy is unclear, their trade caused the 300 put to become the top open interest put option expiring on May 30.

Comments