In the past few days, Bloomberg published an article titled Mystery Options Buyer Bets Some $3 Billion on US Stock Rally. The Chinese translation reads: A mysterious options buyer bets about $3 billion on a U.S. stock market rally.

The article highlights that Nomura strategists have identified substantial open interest in long-dated call options on several tech stocks over the past month. How long-dated? Specifically, options expiring in June 2027. According to their calculations, the total premium paid for these options amounts to nearly $3 billion.

In their client report, Nomura's cross-asset strategists provided examples of three stocks: Amazon, Salesforce, and ARM Holdings. The options buyer spent $316 million on at-the-money options for Amazon, $159 million for Salesforce, and $878 million for ARM Holdings.

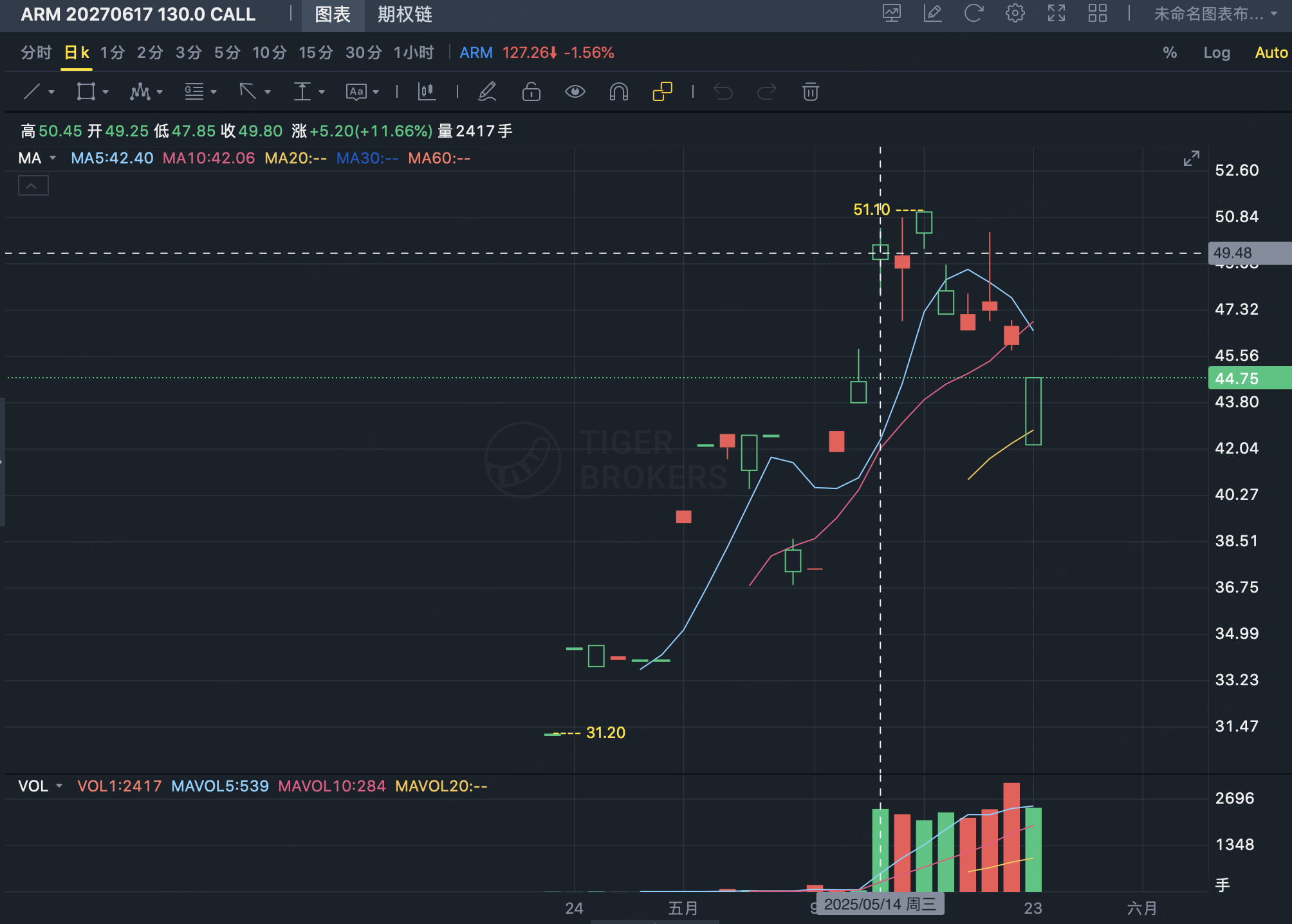

A more specific example is ARM. The article mentions that on Wednesday, May 21, 2,200 contracts of the $ARM 20270617 130.0 CALL$ expiring in June 2027 were traded, with a total premium of $10.4 million.

Revisiting the 2027 Expiry "Oddity"

I previously noted unusual activity surrounding 2027 expirations earlier this month. Let's take this opportunity to revisit and analyze whether June 2027 call options truly reflect insider preference. We'll specifically focus on the names mentioned in Bloomberg's article: Amazon, Salesforce, and ARM Holdings, with data as of Wednesday, May 21.

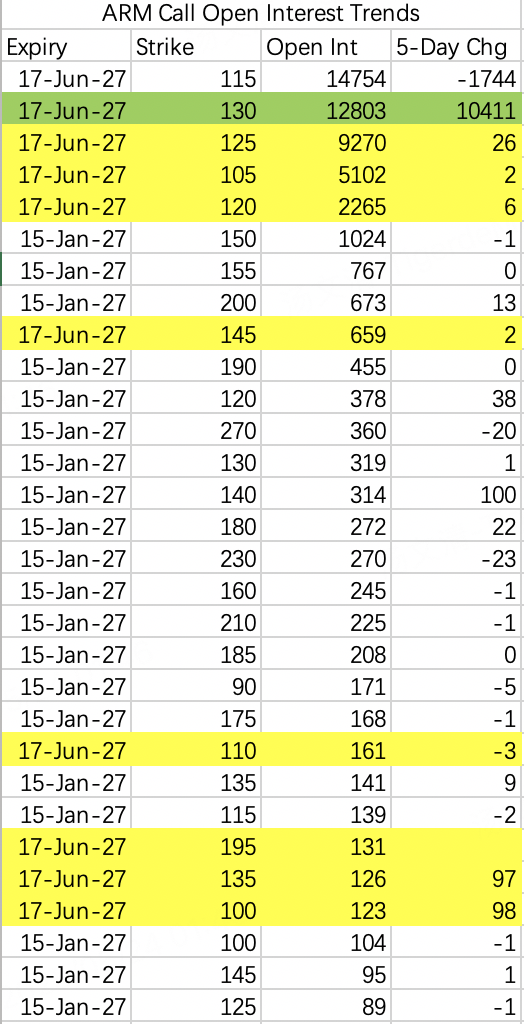

$ARM Holdings(ARM)$

Sorting the data for June 2027 expirations by open interest, several strikes stand out besides the highlighted $ARM 20270617 130.0 CALL$ :

All four options saw significant open interest build-up within the past month. However, the $ARM 20270617 130.0 CALL$ is distinct, with consistent buying activity starting from May 14. It has seen multiple days of continuous opening trades.

May 14 is three days after the U.S.-China weekend trade talks concluded, during which the market absorbed the tariff-related positive news.

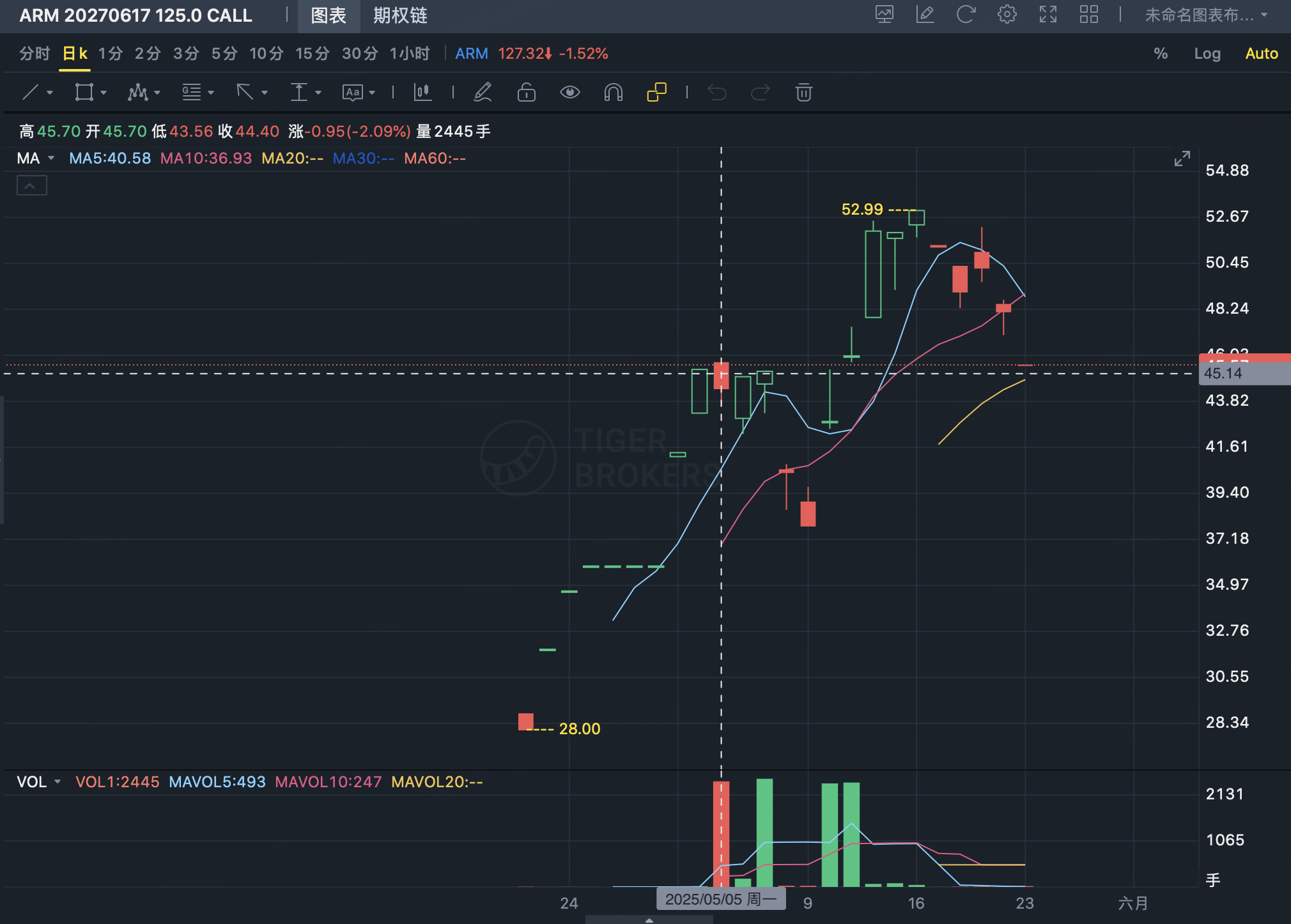

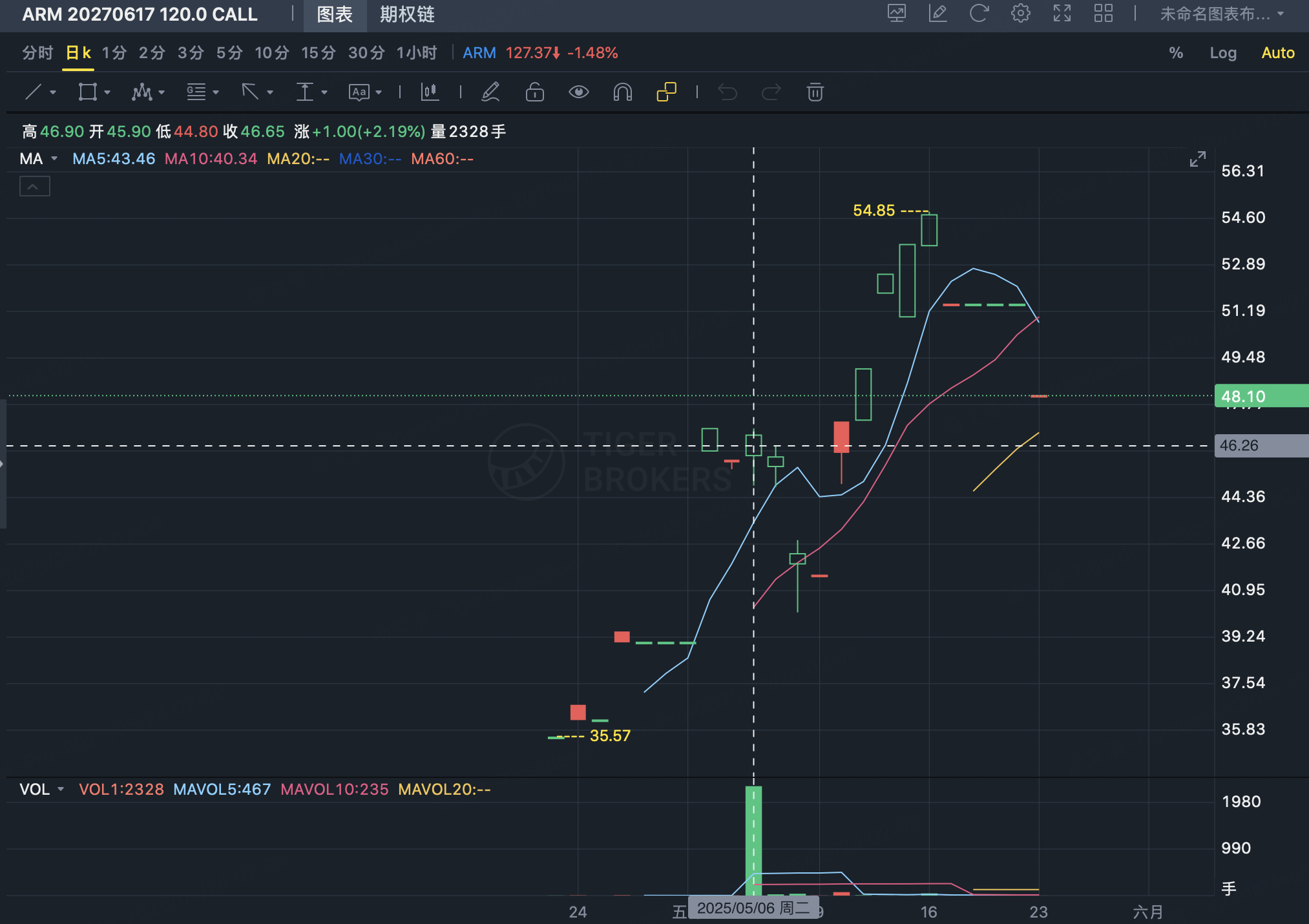

In contrast, the $ARM 20270617 125.0 CALL$ , $ARM 20270617 105.0 CALL$ , and $ARM 20270617 120.0 CALL$ saw earlier trades. While the timeframe between April 20 and May 20 is relatively short, the difference in opening dates (e.g., April 20 for some strikes versus May 20 for others) suggests divergent trading logic. It’s unlikely that the same trader executed all these orders.

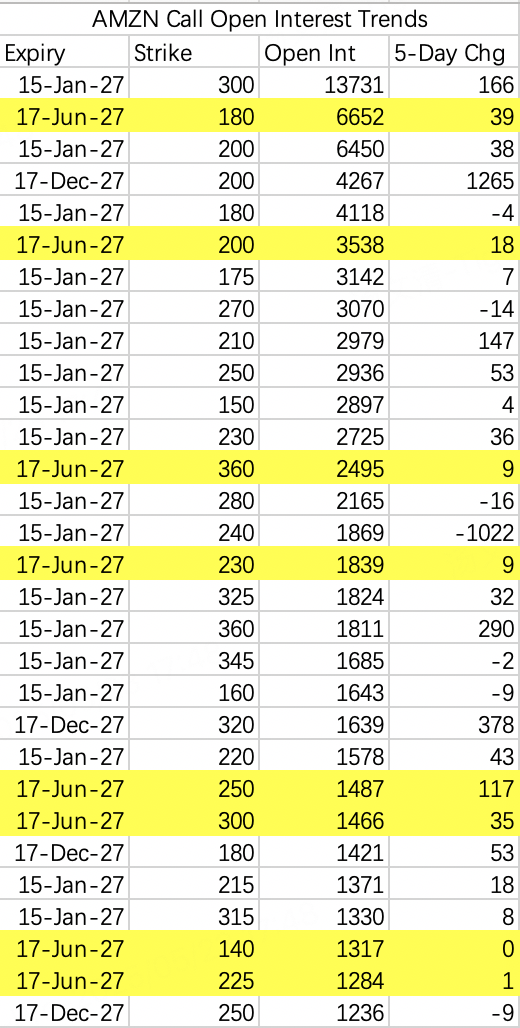

$Amazon.com(AMZN)$

For Amazon’s June 2027 options, open interest analysis reveals notable activity in the following strikes:

The trading style for these strikes leans more toward bottom-fishing, which contrasts with the more aggressive logic seen in $ARM 20270617 130.0 CALL$ .

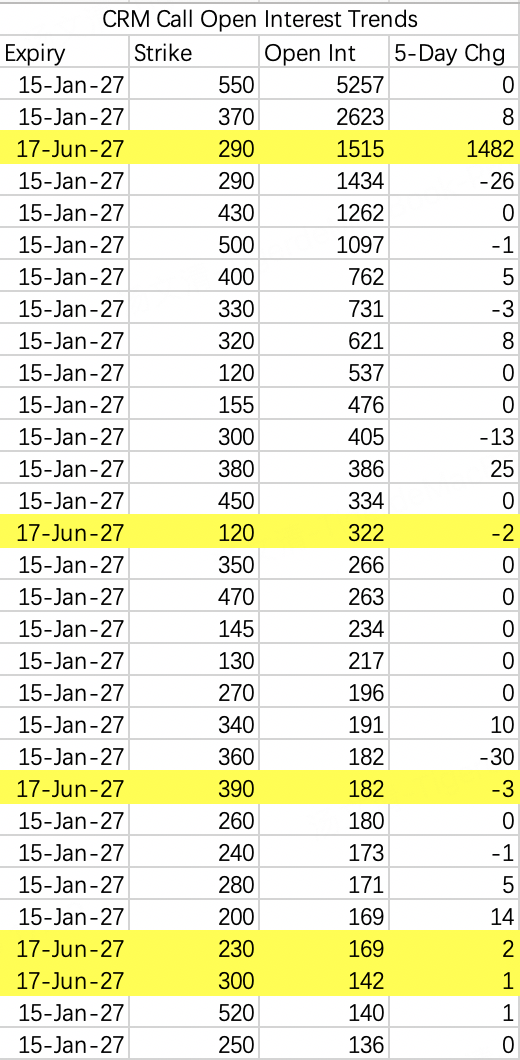

$Salesforce.com(CRM)$

Compared to the other stocks, Salesforce has lower options volume, making it easier to identify unusual activity. The standout strike is:

Given that the $CRM 20270617 290.0 CALL$ and $ARM 20270617 130.0 CALL$ were traded on similar dates (May 15 and May 14, respectively), it’s plausible that these trades were executed by the same entity.

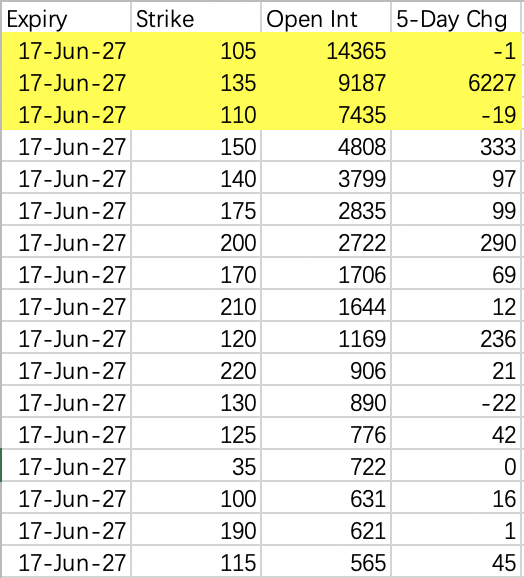

$NVIDIA(NVDA)$

As a popular trading instrument, NVIDIA’s June 2027 options have abundant open interest. The key strikes include:

Of particular interest is the $NVDA 20270617 110.0 CALL$ , which was bought on April 29 and 30 before being sold on May 12 and 13. This trade perfectly captured gains from a policy-related rally.

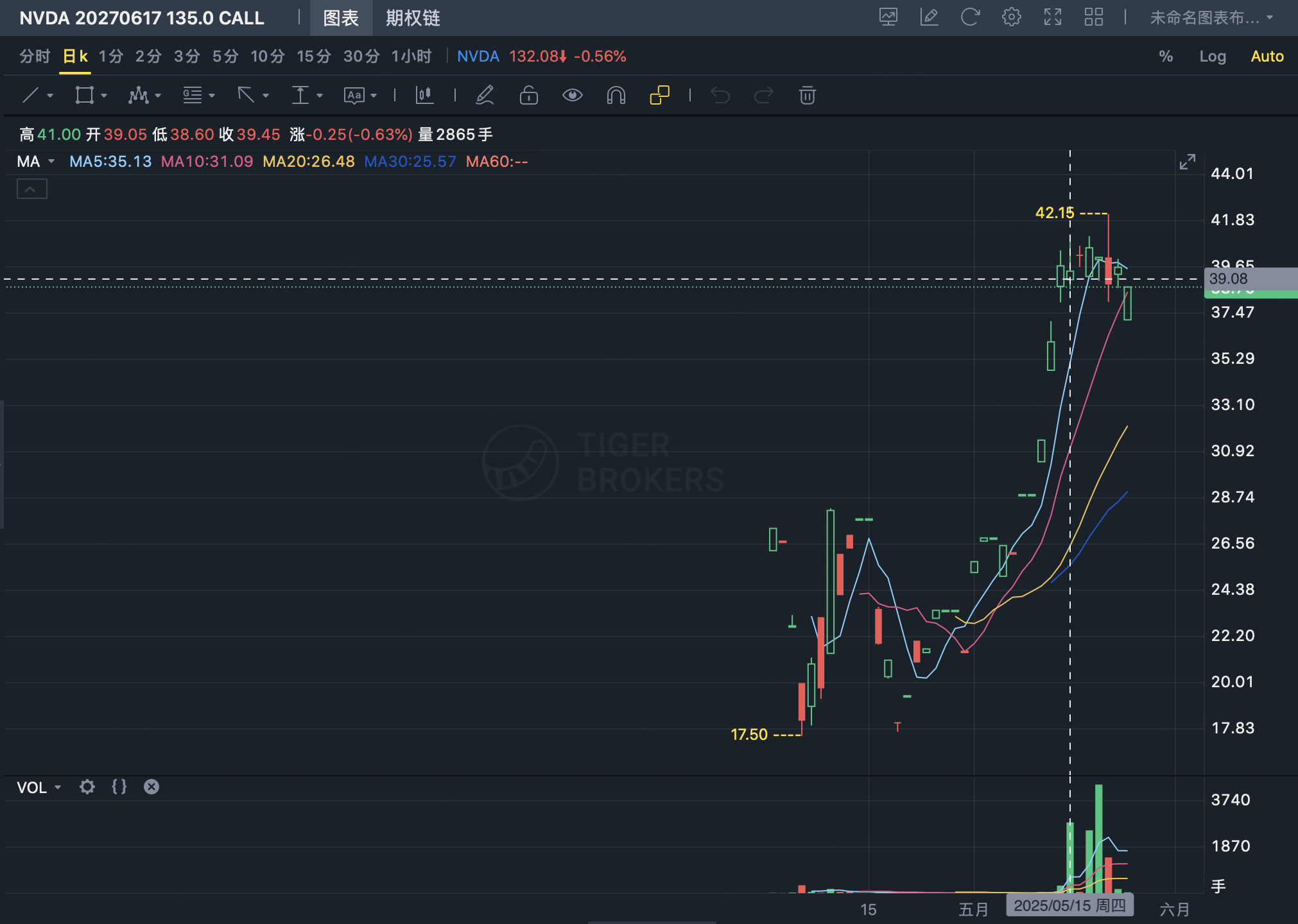

The $NVDA 20270617 135.0 CALL$ shares similarities with the $CRM 20270617 290.0 CALL$ and the $ARM 20270617 130.0 CALL$ , suggesting these trades could originate from the same source.

Conclusions

Buying long-dated at-the-money call options expiring in 2027 appears to be a bottom-fishing strategy employed by institutions.

The timing of these purchases predates Trump’s policy announcements, indicating they were not random or reactive trades.

Post-May 14 trades exhibit a different style, suggesting they may involve imitators rather than the original trader. The $ARM 20270617 130.0 CALL$ is either an extreme insider bet or a reckless retail gamble.

Going forward, it will be crucial to monitor the open interest and trade activity for June 2027 options, especially for new rolls or large closures.

Comments