The earnings report this time caused a drop far exceeding market expectations, with the price falling below 100—an unexpected event. From a bottom-fishing perspective, 90 is widely recognized as a support level. However, considering the recent overall weak performance of Chinese stocks, it’s better to observe for two more days before executing large trades.

Why was the drop worse than expected? Before this earnings report, the bearish large orders mainly consisted of two types: hedging-based bearish positions and single-leg sell calls. These showed a somewhat negative outlook for the stock price but not a fully bearish stance. Among them, the single-leg sell call involved selling the $PDD 20250718 150.0 CALL$ .

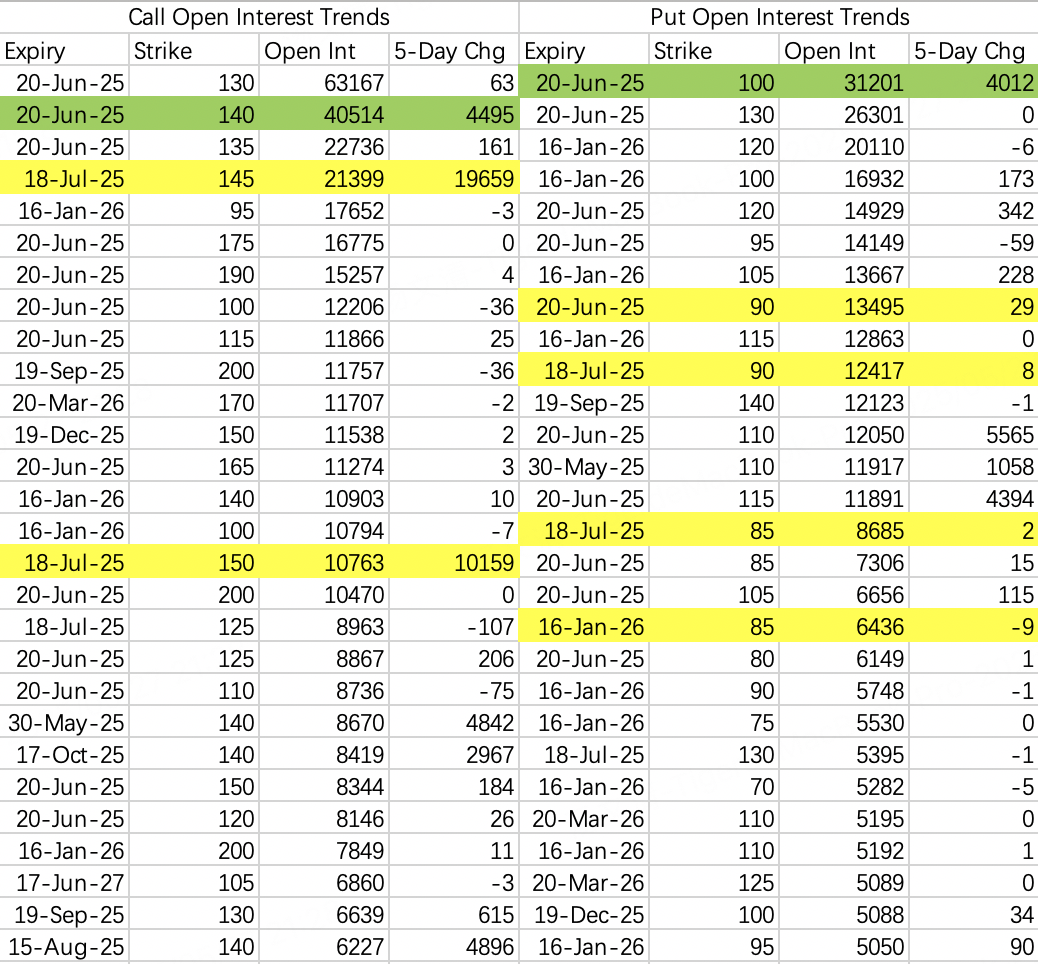

Based on the open interest of put options, the leading bearish force for this earnings report was the 100 put $PDD 20250620 100.0 PUT$ . The large order strategy involved a May 13th transaction of selling the 140 call and buying the 100 put: sell $PDD 20250620 140.0 CALL$ , buy $PDD 20250620 100.0 PUT$ .

This is a fully hedged bearish strategy, meaning institutions weren’t confident about a significant drop. It was more of a “hit or miss” approach, but it ended up capturing this unexpected plunge.

If you’re slightly bullish on the stock right now, you could consider selling long-term deep out-of-the-money put options, such as $PDD 20260116 70.0 PUT$ .

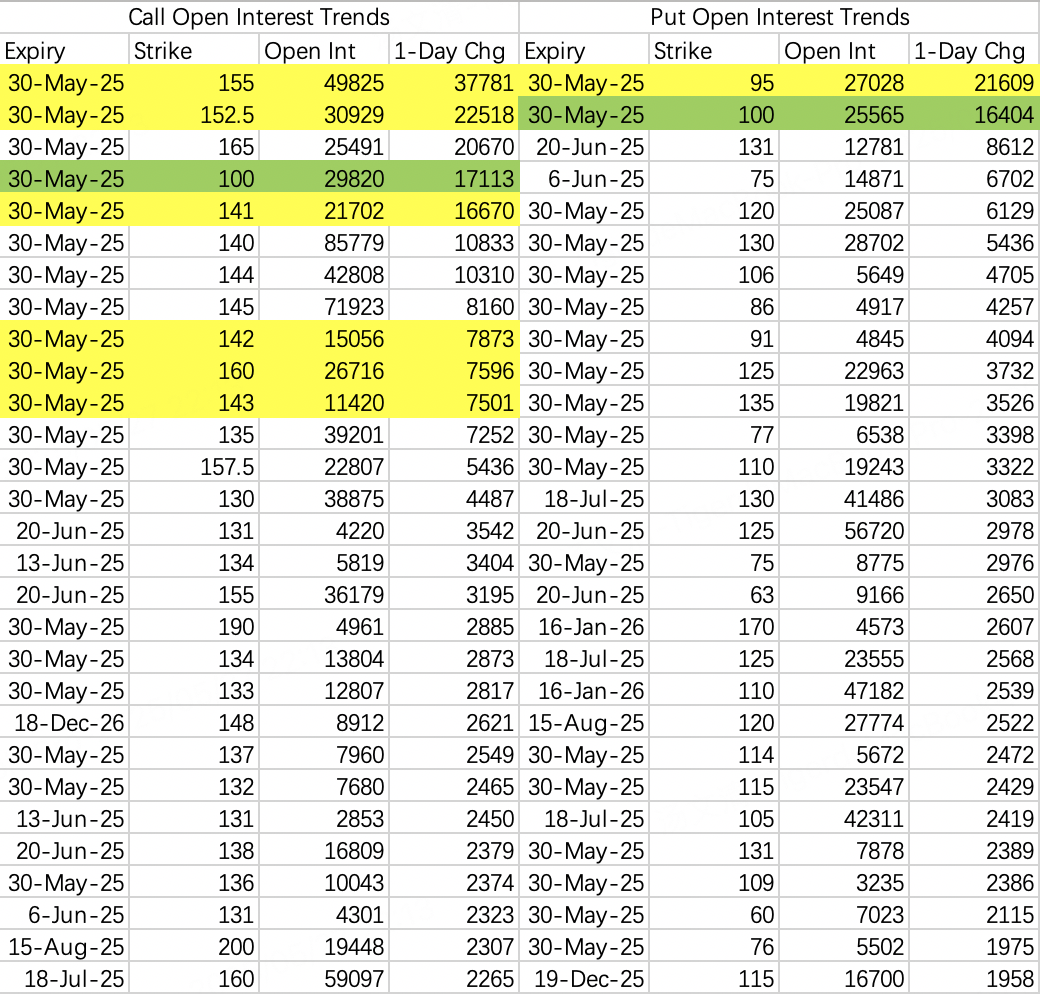

NVIDIA’s earnings report this week has no surprises—expectations are decent, with the stock price below 145. If the stock price suddenly surges on May 28th, referring to the May 21st trend, a bullish strategy should consider reducing positions in advance.

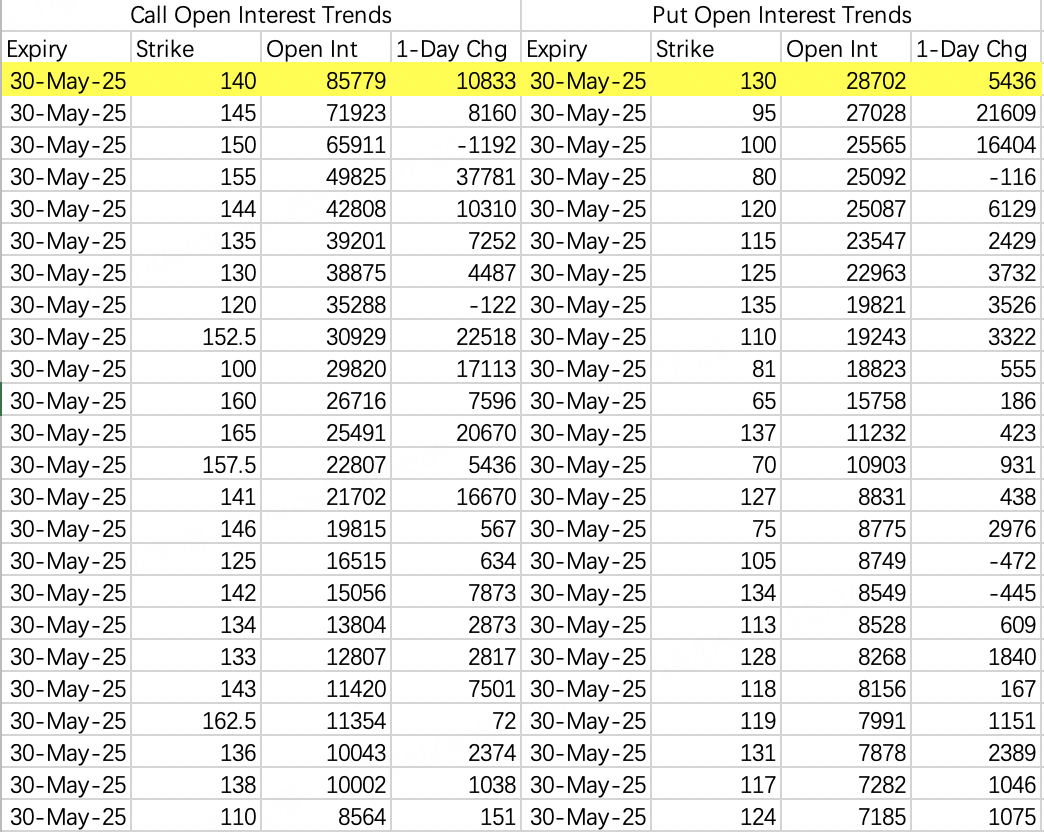

Last Friday, institutions rolled their spread strategies to the 140–160 range, i.e., sell call 140–143 and buy call 152.5–160 for hedging purposes.

Some strategies don’t require closing positions before the earnings report, such as the dual-selling strategy mentioned last week: sell $NVDA 20250815 160.0 CALL$ and sell $NVDA 20250815 110.0 PUT$ . I believe selling put options below 130 should be considered relatively safe.

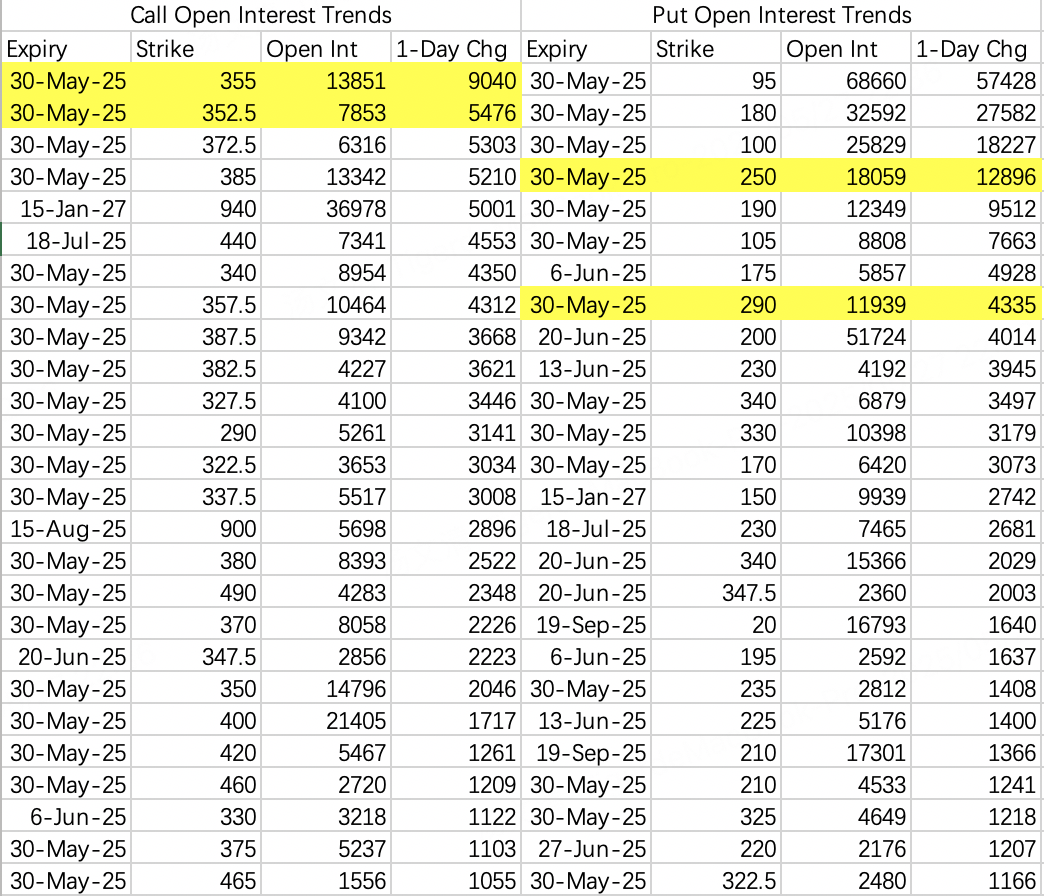

This week, institutions are selling calls in the 352.5–355 range.

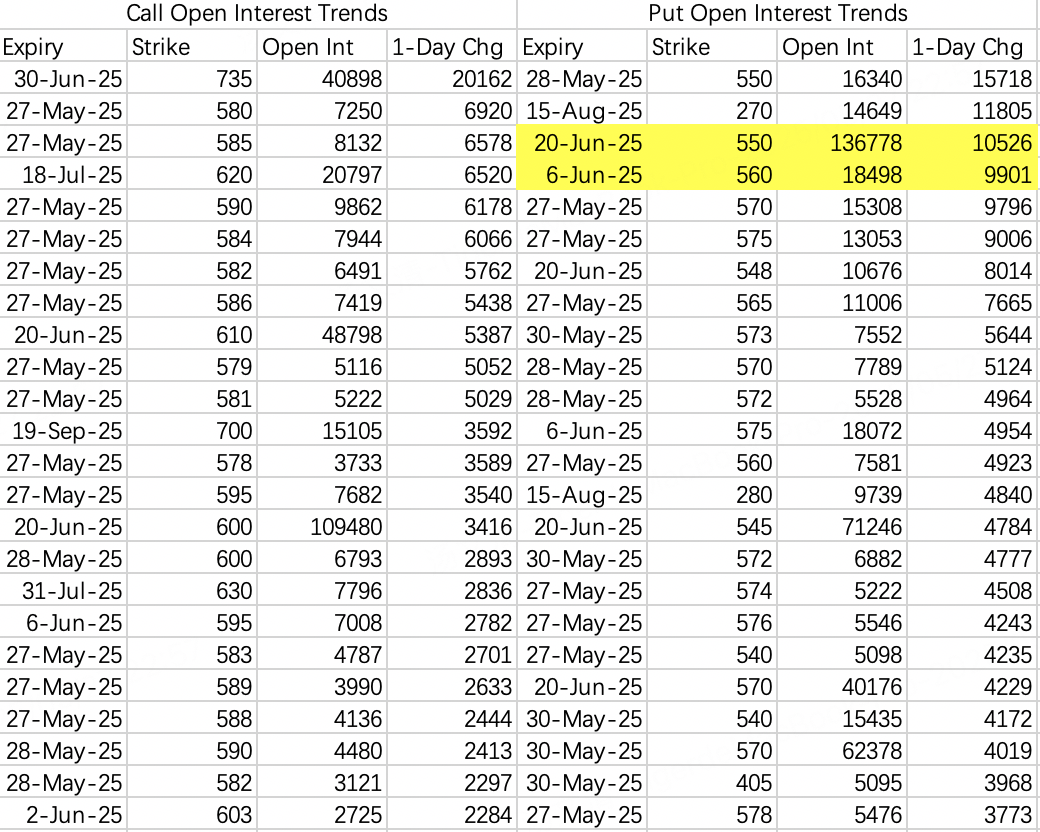

There are some signs of a pullback this week, but the weekly close should still remain above 570.

Comments