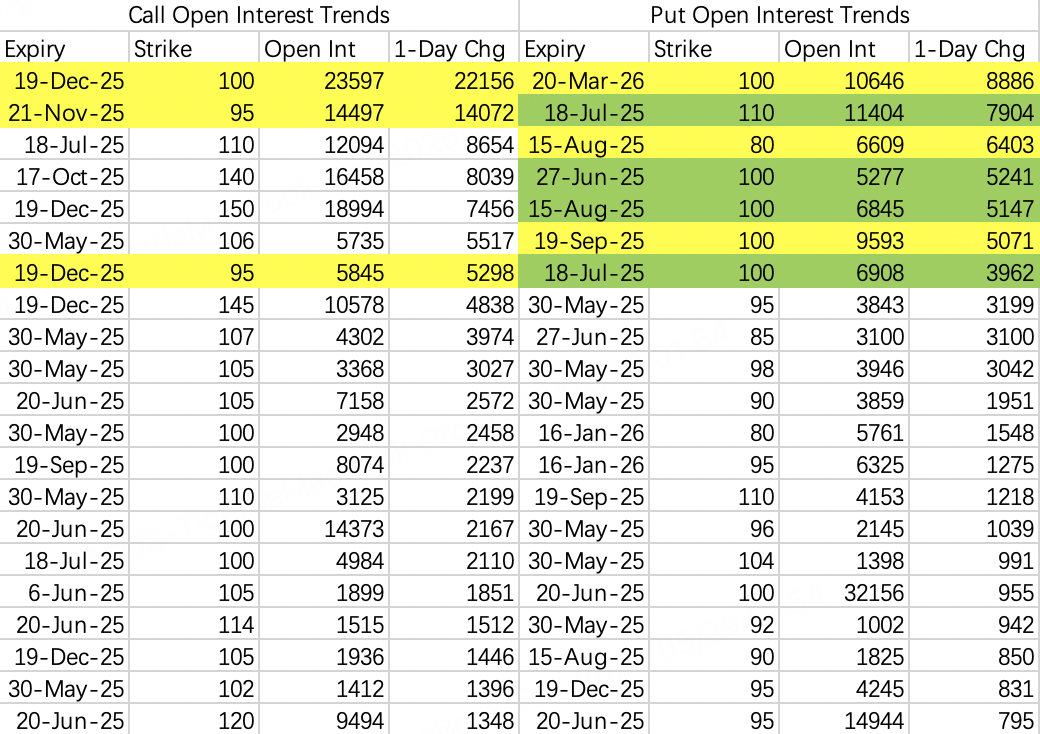

$ARM Holdings(ARM)$

Unlike other large orders expiring in 2027, $ARM 20270617 130.0 CALL$ continues to see daily, consistent opening of 2,000 contracts, with a transaction value exceeding $10 million.

From a fundamentals perspective, growth is moderate. FY26 revenue growth is expected to slow to 18% YoY, down from 24% in FY25. For now, it’s worth continuing to observe.

$PDD Holdings Inc(PDD)$

At the $100 price level, there is considerable divergence in opinions. Bulls are buying long-term at-the-money call options, while bears are buying short-term at-the-money put options. Essentially, the market sentiment is bearish for July and August but bullish for the long term.

Bullish strategy: Consider selling puts with strike prices below 80.

Bearish strategy: Consider at-the-money puts.

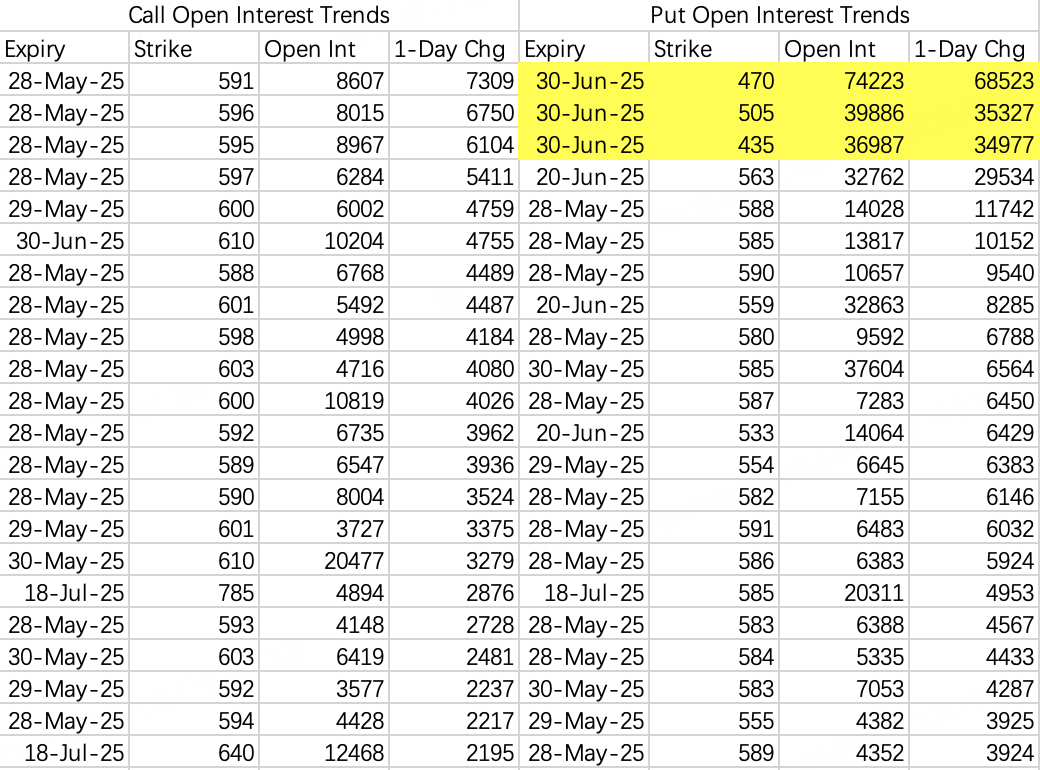

$SPDR S&P 500 ETF Trust(SPY)$

Large orders continue to open bearish butterfly spreads expiring at the end of June, specifically 435-470-505. Be cautious of a potential market pullback in June.

Comments