$NVIDIA(NVDA)$

The post-earnings pullback didn’t wait a single day—it started immediately. The target for this pullback is $120, which corresponds to the May 9th negotiation gap. However, it’s uncertain whether the pullback to $120 or $130 will occur during the week of June 6th.

Overall, it seems reasonable to expect a return to pre-negotiation levels. After all, Trump’s sudden reversal today, accusing China of breaching the agreement, essentially nullifies the progress of the past two weeks.

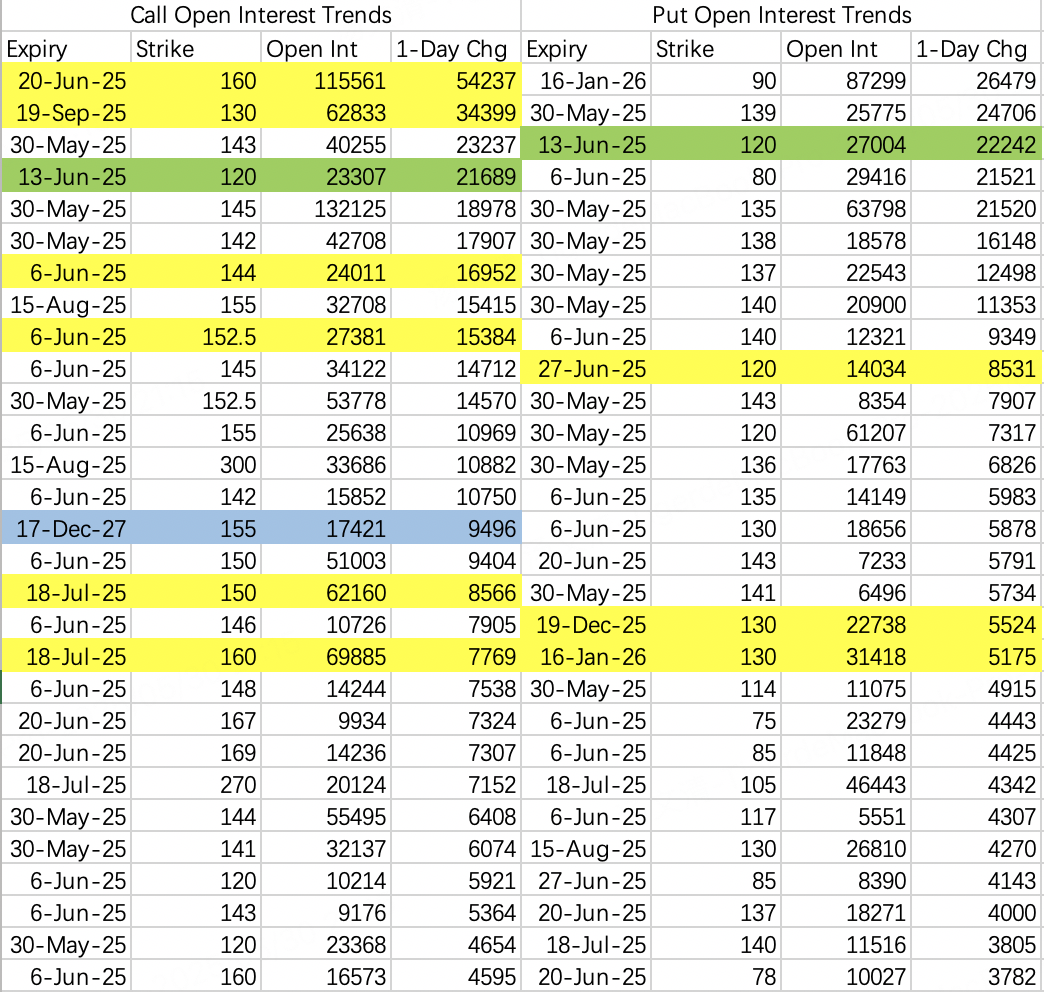

Some notable large orders:

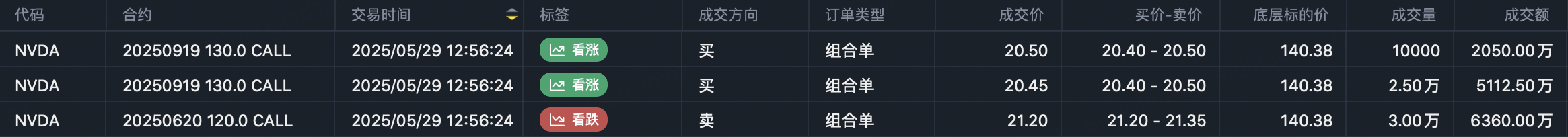

"200 Million Guy" rolls his position:

Closed the June 20th $120 call and rolled into the September 19th $130 call:Sell to close $NVDA 20250620 120.0 CALL$ , buy $NVDA 20250919 130.0 CALL$ .

As analyzed yesterday, raising the strike price to $130 reflects optimism about the earnings data. However, the trading volume was only 35,000 contracts, far below the previous 100,000-contract position, indicating a lack of confidence in the broader macro environment.

After the May 12th announcement of the U.S.-China meeting results, "200 Million Guy" closed two-thirds of his position. It’s possible he’ll add to his position once the negative news fully plays out.

Selling the June 20th $160 call:

Sell $NVDA 20250620 160.0 CALL$ .

Volume: 44,000 contracts.

It’s clear the stock won’t rally to $160 before triple witching day.

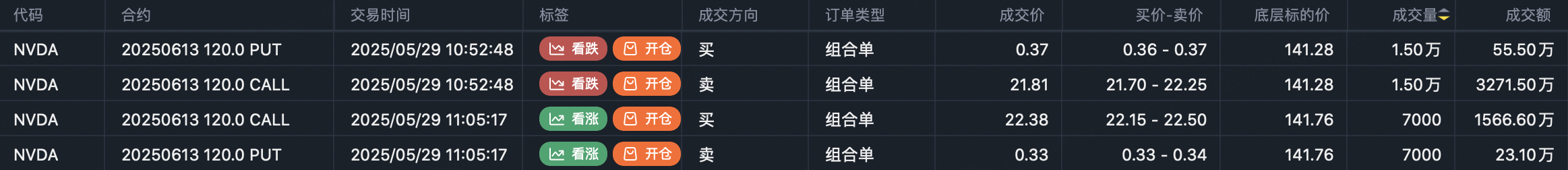

Opening $120 call and put positions for June 13th expiration:

Open $NVDA 20250613 120.0 CALL$ , open $NVDA 20250613 120.0 PUT$ .

This combination strategy doesn’t indicate a clear direction. However, it’s not particularly important—double-sided openings generally signal expectations of significant volatility, with the price likely converging toward the strike price. This suggests the pullback will complete within the next two weeks.

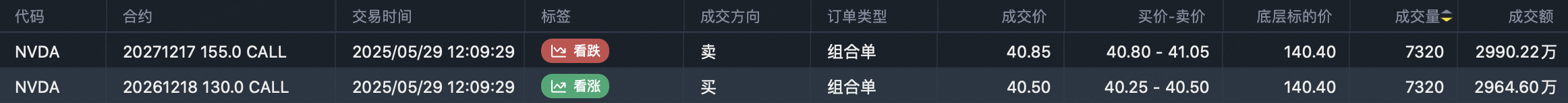

Rolling a long call position:

Close $NVDA 20261218 130.0 CALL$ , buy $NVDA 20271217 155.0 CALL$ .

This is another large long call roll, similar to the "200 Million Guy’s" trade. However, half the position was already reduced the day before the earnings report, as shown in the chart (not included here). This half-roll reflects the same concerns about macro uncertainties.

$VanEck Semiconductor ETF(SMH)$

A large bearish position was opened:

Open $SMH 20250606 225.0 PUT$ , with a volume of 50,000 contracts.

This reflects a clear expectation of a pullback. Calculating the equivalent NVIDIA price, it aligns with roughly $120. However, since the option expiration is very close, it suggests a sharp decline over one to two days. Next Monday or Tuesday could present an opportunity to sell puts.

$SPDR S&P 500 ETF Trust(SPY)$

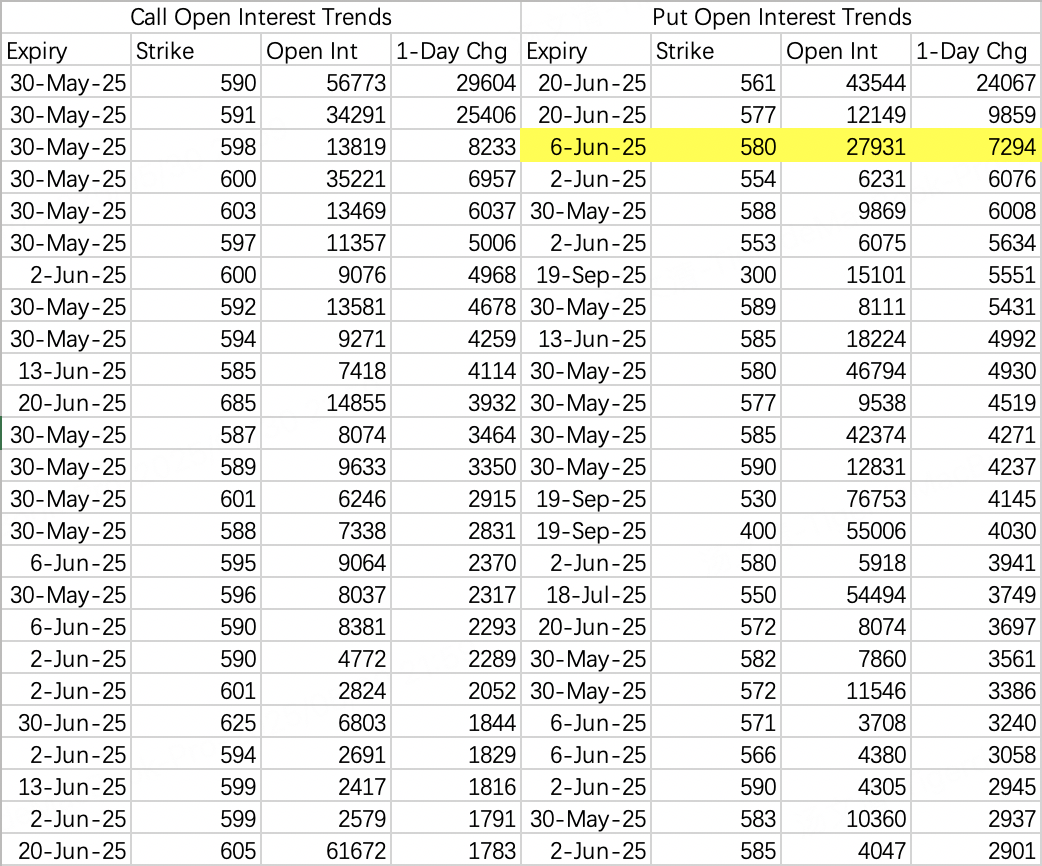

The broader market is expected to pull back to $580 next week. For holders of the underlying stock, consider a collar strategy for hedging:

Sell calls and buy puts.

Comments