On June 5th, during market hours, Donald Trump and Elon Musk engaged in a heated argument across social media platforms, with their bickering continuing until the U.S. stock market closed.

The way the two argued resembled a childish spat, almost like grade-school banter. However, upon reviewing the content of their exchange, it became clear that their political ideologies are fundamentally incompatible. This public clash left no room for ambiguity, fully exposing their differences. As a result, Tesla's stock plummeted by 14.26%.

Both onlookers and institutional investors have tried to mediate, as such uncertainty has a significant market impact. Although the broader market was relatively stable, with the S&P 500 closing down only 0.53%, risk indicators in growth stocks were evident. For example, PLTR fell 7.7%, and the popular AI stock CRWV dropped 17.2%, reflecting heightened market risk awareness.

After the market closed, the White House arranged for Trump and Musk to have a call on Friday, June 6th. However, before the market opened, Trump unexpectedly backed out, stating he had no interest in speaking with the "irrational" Musk. He even announced plans to sell the red Tesla he purchased earlier this year. Following this statement, Tesla, which had been gaining in pre-market trading, began to decline.

Overall, seasoned Tesla investors know Musk is someone who will always act on his convictions, including his political ideology. Trump, on the other hand, is a prideful individual. Musk’s decision to bring up the controversial "Loli Island" issue during their argument was a major misstep.

The rift between the two is unlikely to be resolved, and their relationship likely won’t return to what it once was. While they might superficially reconcile in the coming days, Musk’s personality suggests he will continue to challenge policies he disagrees with. Trump understands this, which means Tesla will no longer enjoy any presidential favoritism and will instead be treated strictly on a business basis.

Options Data

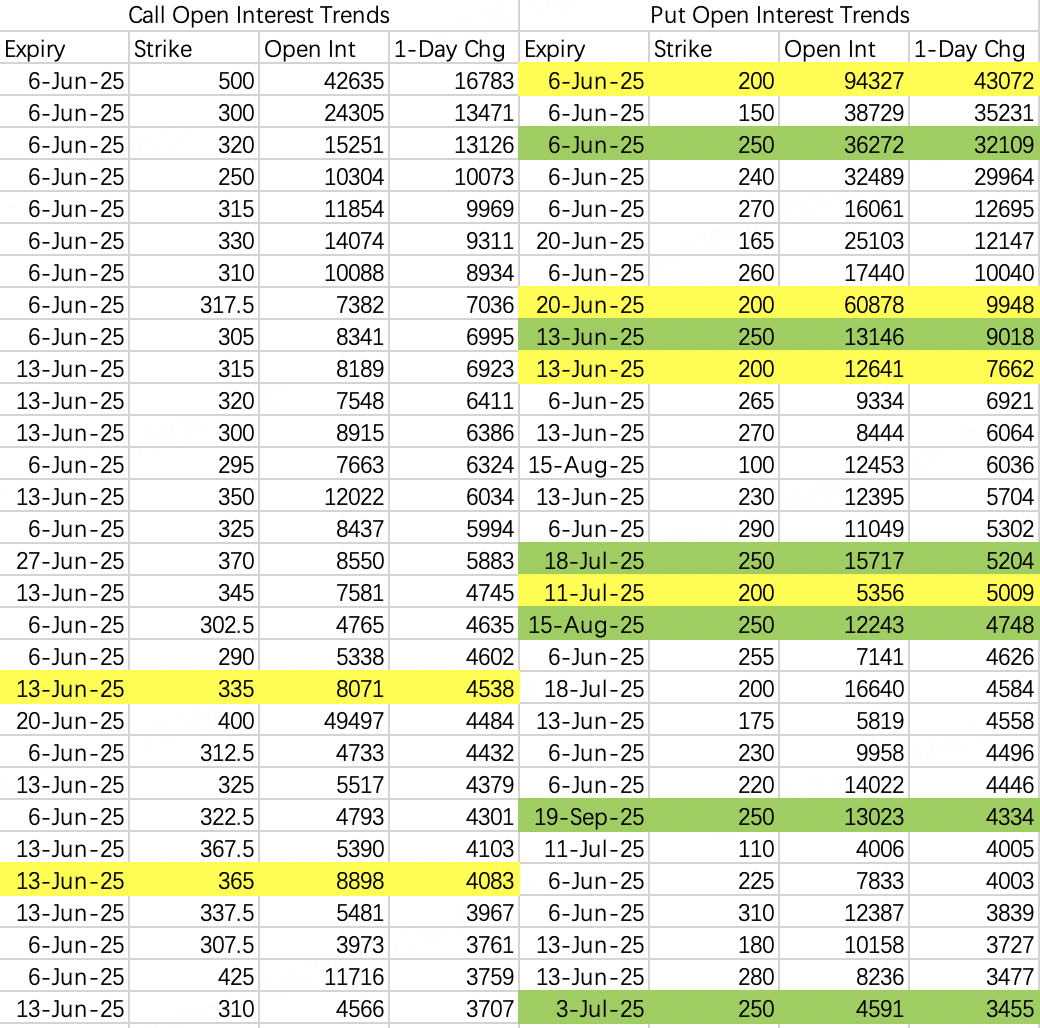

Thursday’s options trading did not clearly reflect long-term valuation strategies, focusing instead on short-term battles over the next two weeks. Tesla has struggled to reflect any consistent valuation logic this year, with bullish and bearish exposures diverging widely. However, expectations for Tesla post-Musk’s return are generally better than before.

Bullish Data: The reference value of bullish data is limited, as Tesla’s fundamentals continue to deteriorate. Before Trump and Musk’s argument, Tesla released new delivery figures, which showed further declines. Goldman Sachs subsequently lowered its delivery forecasts for 2025, 2026, and 2027 from 1.7M/1.95M/2.2M units to 1.575M/1.865M/2.15M units. The short-term price ceiling is seen at $330.

Bearish Data: The $200 put and $250 put strike prices saw the highest open interest. However, $200 put positions are mostly concentrated in the next two weeks, while $250 put activity is more interesting.

Among the many short-term strategies, I noticed mid-term bearish positions being closed or rolled over. Some mid-term short strategies that closed on Thursday did not continue with bearish positions but instead opted for sell puts.

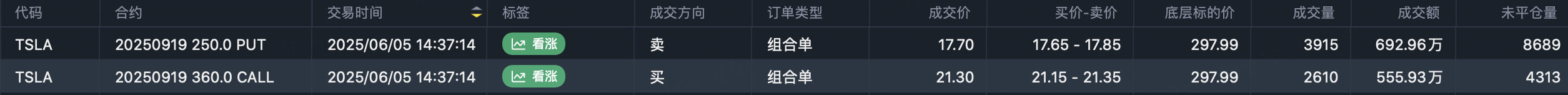

For example:

Sell 360 Call: $TSLA 20250919 360.0 CALL$

Buy 280 Put: $TSLA 20250919 280.0 PUT$

After closing positions on the $280 put and $360 call on Thursday, traders rolled over to sell puts:

Sell Put: $TSLA 20250919 250.0 PUT$

Additionally, long-term sell calls at $330 and $360:

were also closed on Thursday, with new $250 puts sold:

Sell Put: $TSLA 20250815 250.0 PUT$

Investors looking to bottom-fish might consider these strategies for reference.

Friday Market Outlook

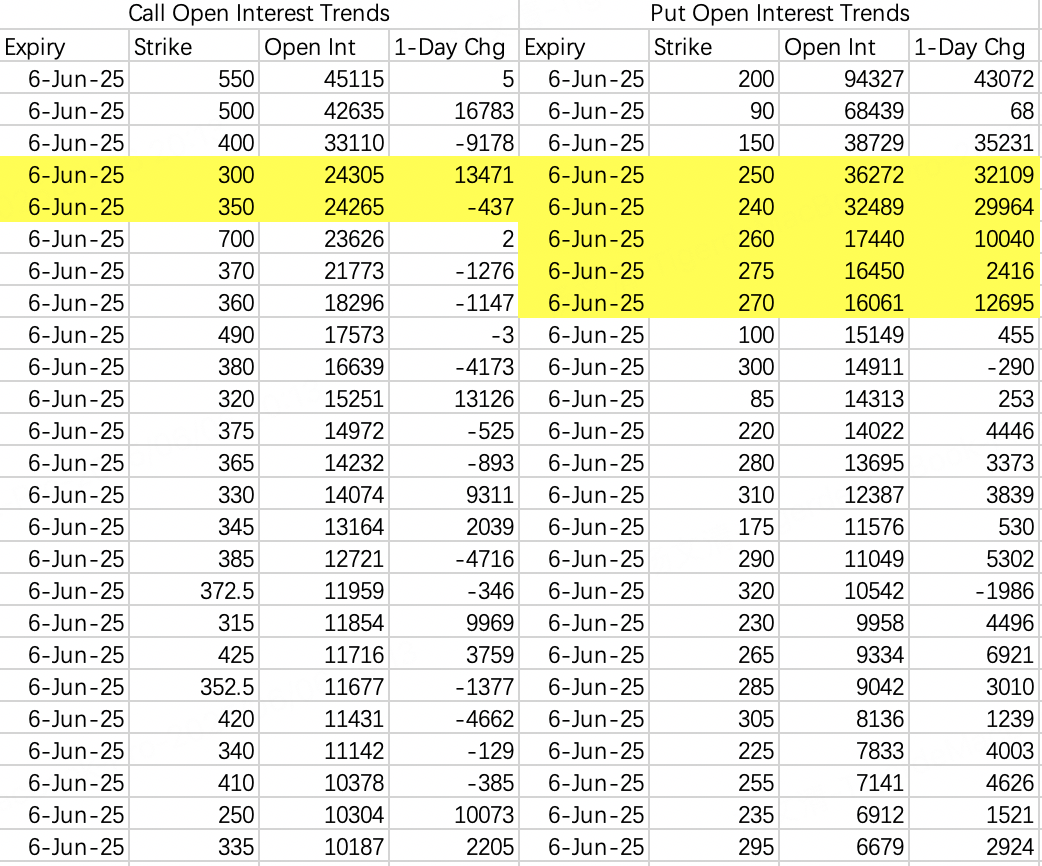

Options activity on Thursday showed significant open interest, with an average trading volume of 100,000 contracts and 10,000 new contracts opened. This means if Friday’s trading volume is below 100,000 contracts, the possibility of a short squeeze can be largely ruled out.

If there are no unexpected events, such as another shocking statement from Trump or Musk, Tesla’s stock is likely to trade in a range of $270–$300, with a broader range of $250–$330 being possible. Investors may consider these levels for trading strategies.

Comments