Although this week features several major tech conferences, including NVIDIA's GTC and Apple's Worldwide Developers Conference, options open interest does not suggest strong upward momentum. The surprising and fresh bullish catalysts were already announced over the past two weeks, making it unlikely for significant stock-moving news to emerge this week.

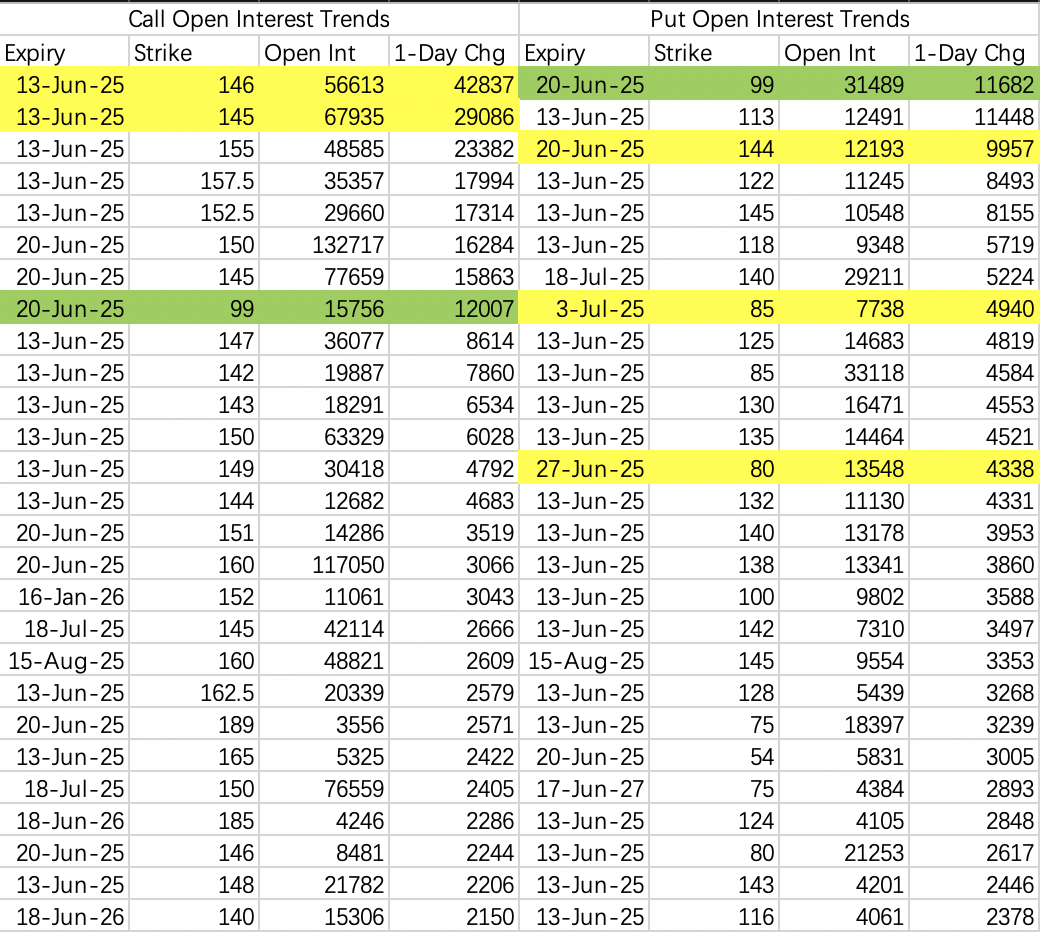

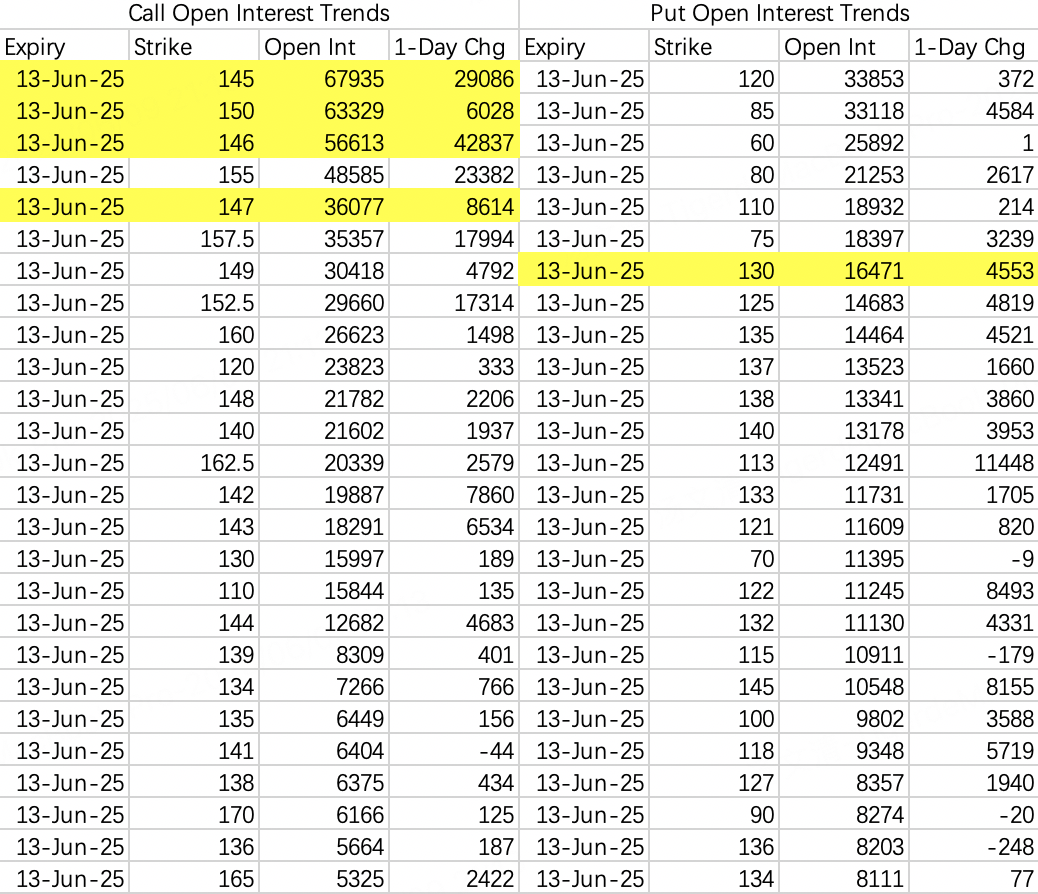

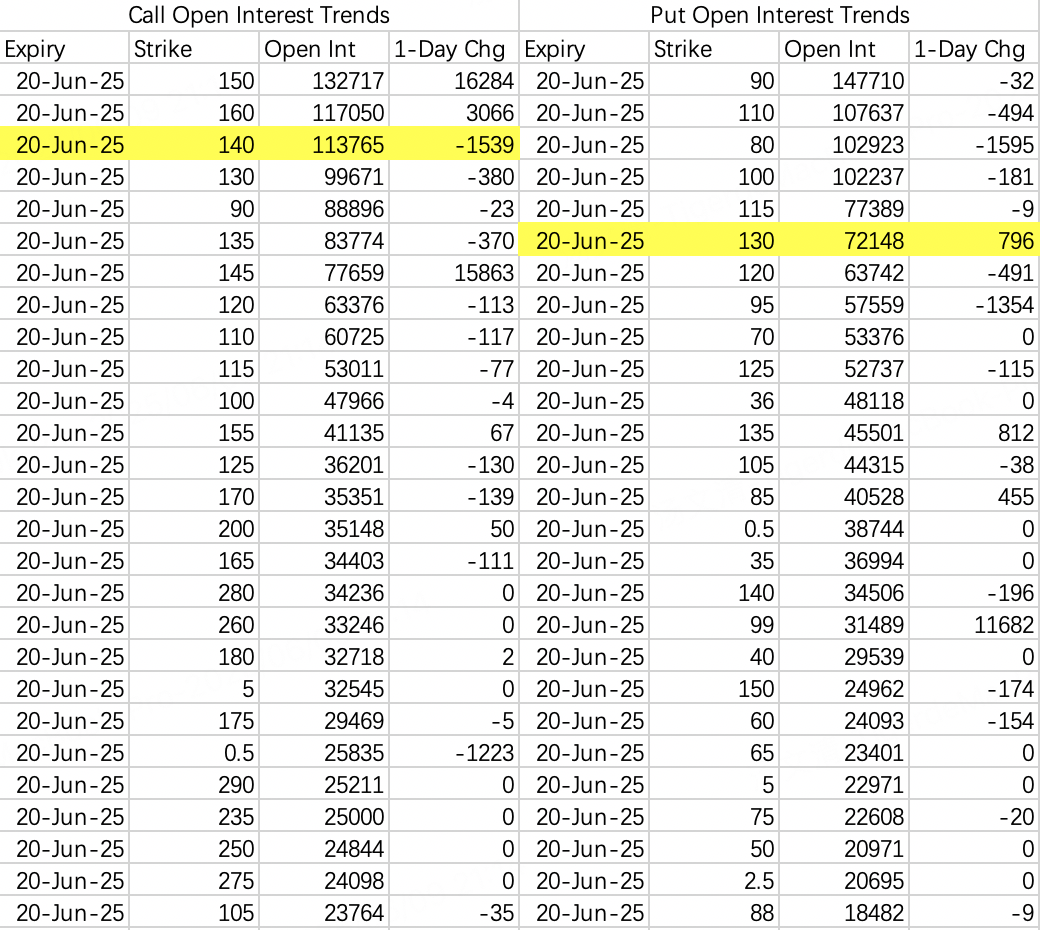

As a result, this week's price action is expected to be similar to last week's. Institutional sell call strike prices are concentrated around 145–146, which could easily trigger a short squeeze and push the stock price to 150. However, I think a breakout above 150 is unlikely this week.

On the downside, there is considerable division among market participants. Some believe NVIDIA's stock price will remain above 140 through mid-June, while others are predicting a sharp pullback to around 120 this week. I lean towards the first scenario, with a higher probability of narrow-range trading between 140 and 145.

The divergence on downside expectations likely stems from uncertainties surrounding U.S.-China talks or the upcoming triple witching day next week. It’s likely the stock price will trade in a tight range until triple witching.

The S&P 500 remains in a cautionary zone, but based on options open interest for several key stocks, the probability of bears making a move before triple witching appears low.

$Palantir Technologies Inc.(PLTR)$

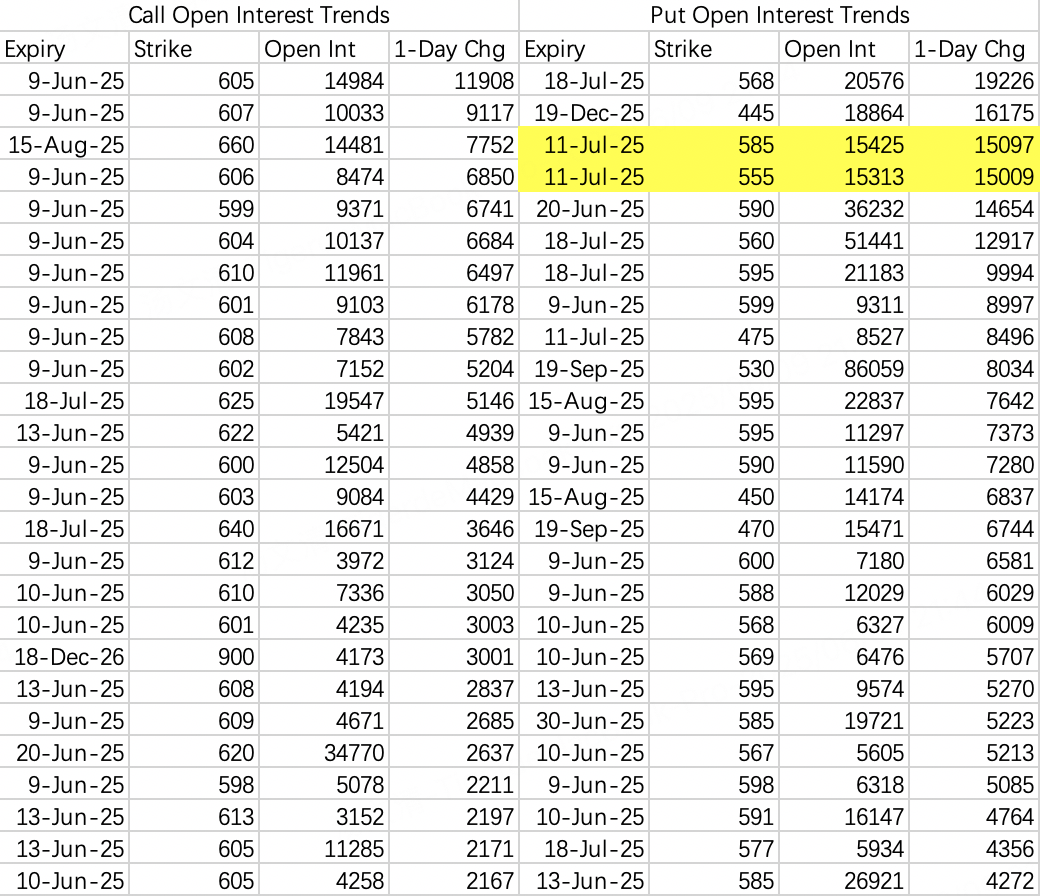

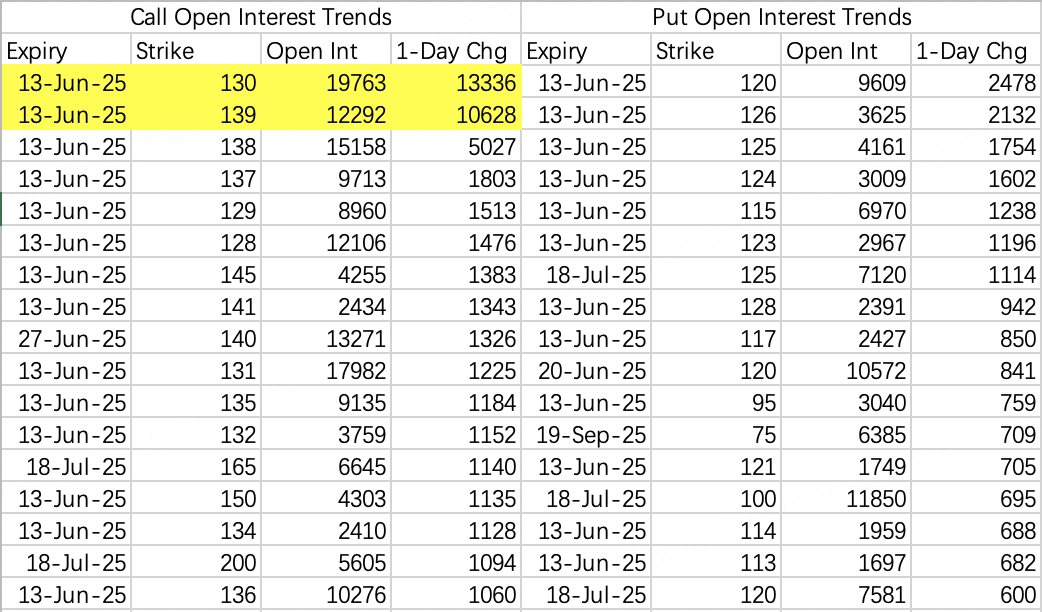

Institutional arbitrage strategies show a sell call strike price at 130:

This indicates the stock is in a topping pattern this week. While this is a risky signal, the data from bearish put options suggests any pullback will be shallow, likely around 120.

It’s crucial to closely monitor PLTR’s open interest patterns, as significant corrections often begin with growth stocks.

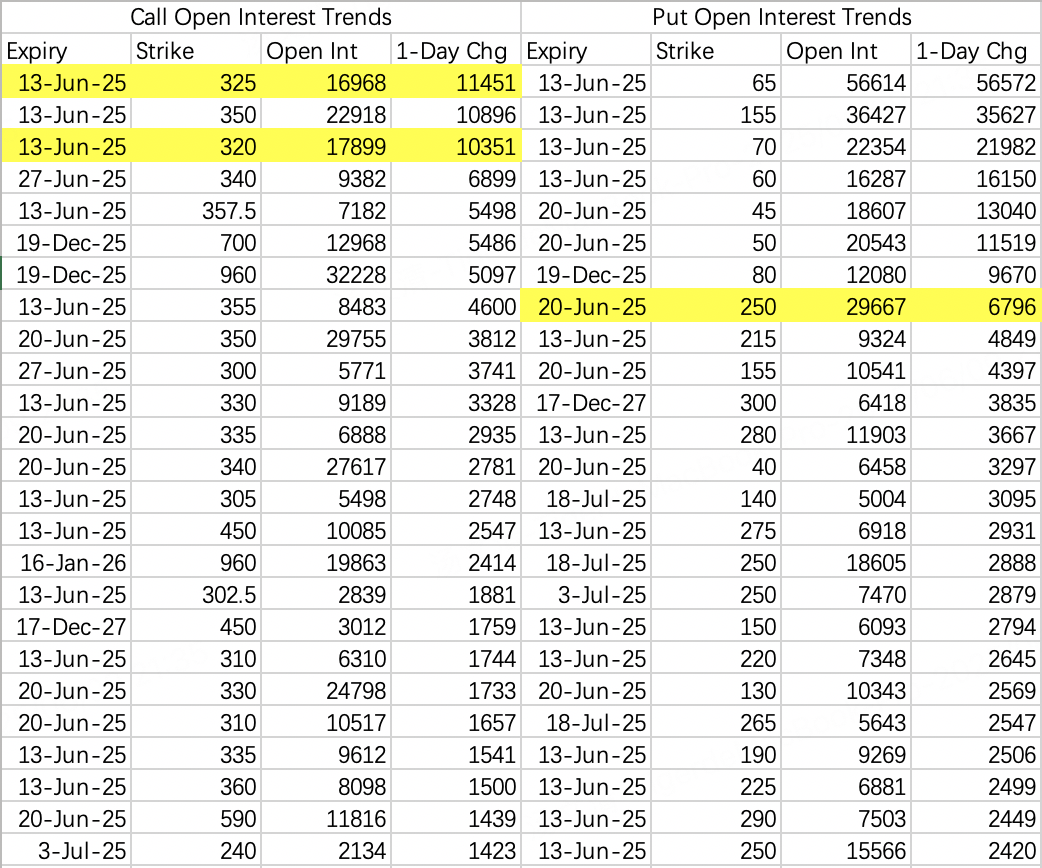

Expected trading range: 250–325. Institutional sell call strike prices are concentrated around 320–325:

If the stock rises, institutions are executing sell calls like $TSLA 20250613 325.0 CALL$ .

If the stock falls, they are executing sell puts like $TSLA 20250613 250.0 PUT$ .

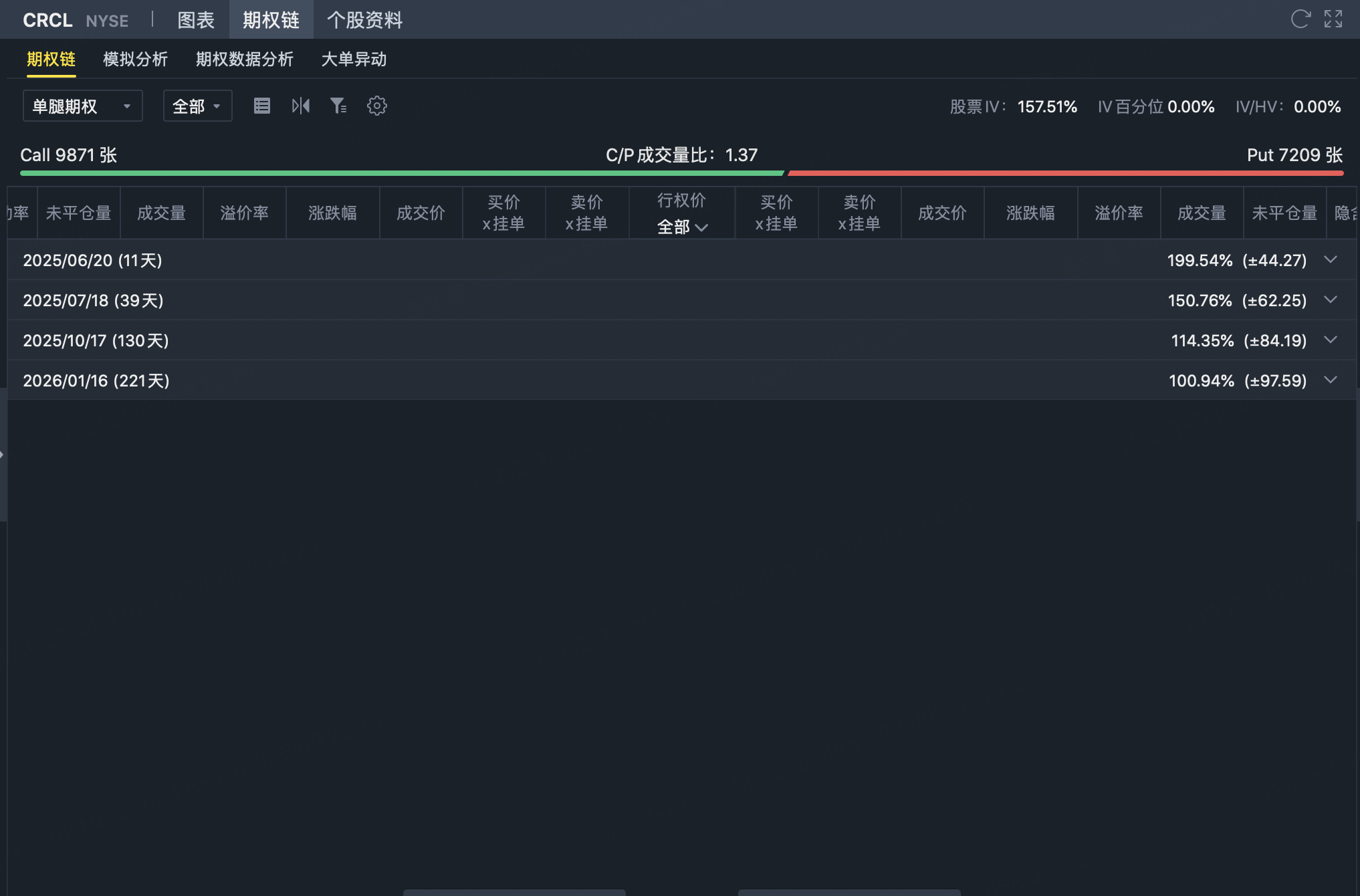

Finally, options for $Circle Internet Corp. (CRCL)$ have been launched.

The expiration dates are limited to monthly options. Early options issuance could reduce volatility in the underlying stock, which is worth keeping an eye on, particularly ahead of triple witching.

Comments