The stock market remains in a somewhat awkward position, waiting for either a pullback or fresh bullish catalysts. During such times, whether bullish or bearish, strategy design tends to focus on minimizing directional mistakes as well as reducing the cost of waiting for a clear trend to emerge.

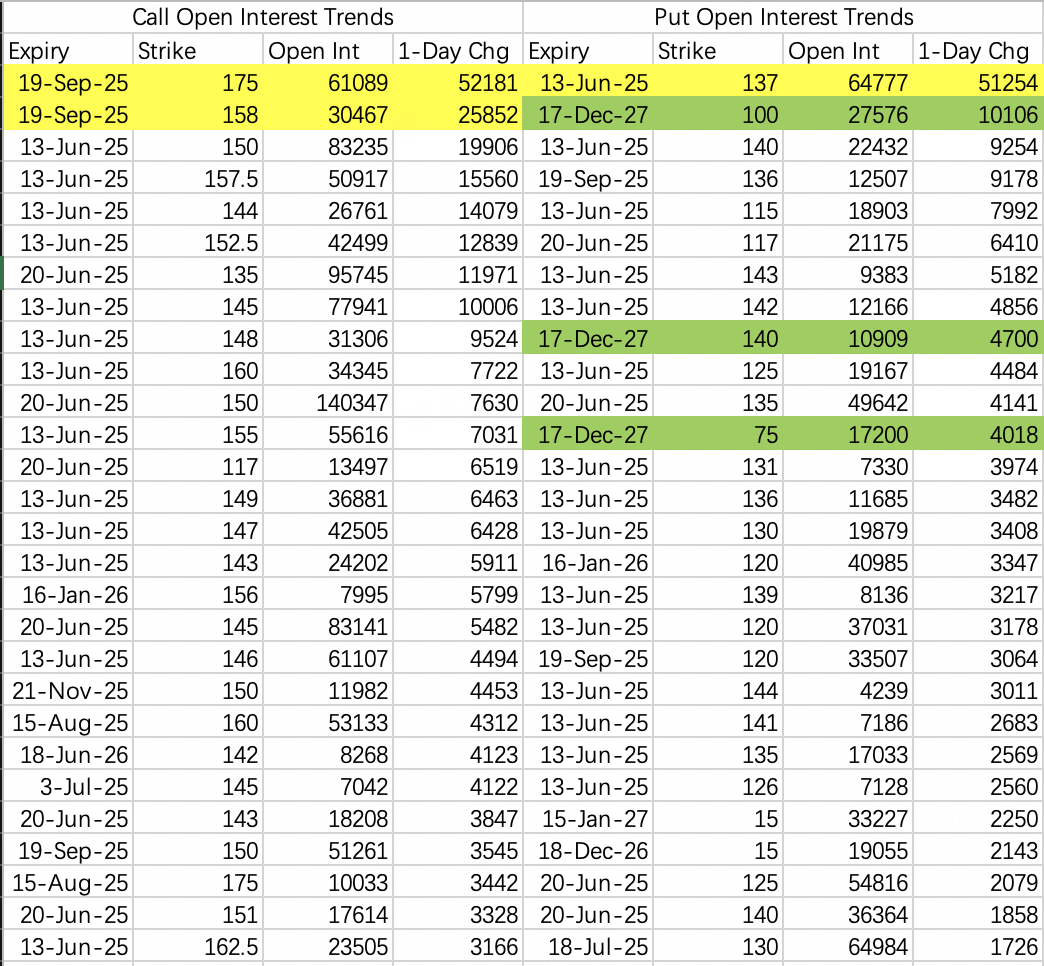

This explains speculative bullish trades such as buying the $158 call and selling double the $175 calls:

This approach allows traders to bet on upside without spending money upfront, as the double sale of $175 calls offsets the cost of the $158 call. The assumption is that NVIDIA's stock price is unlikely to surpass $175 before September, making this a low-cost speculative strategy.

When this type of setup appears, it usually indicates that the market is in a lackluster state, with a low probability of significant short-term upside.

Meanwhile, bears are taking a long-term approach by implementing bearish butterfly spreads:

Buy $140 put, sell $100 put x2, buy $75 put:

The advantage of a butterfly spread is that it starts generating profits within a specific range while limiting losses outside of that range. If traders have a good sense of the stock's price range, this strategy is more cost-effective compared to outright bearish positions.

For this week's price action, significant short-term pressure comes from the 137 put expiring this week:

$NVDA 20250613 137.0 PUT$ , with 51,000 contracts opened on Monday.

This indicates a likely pullback over the next couple of days.

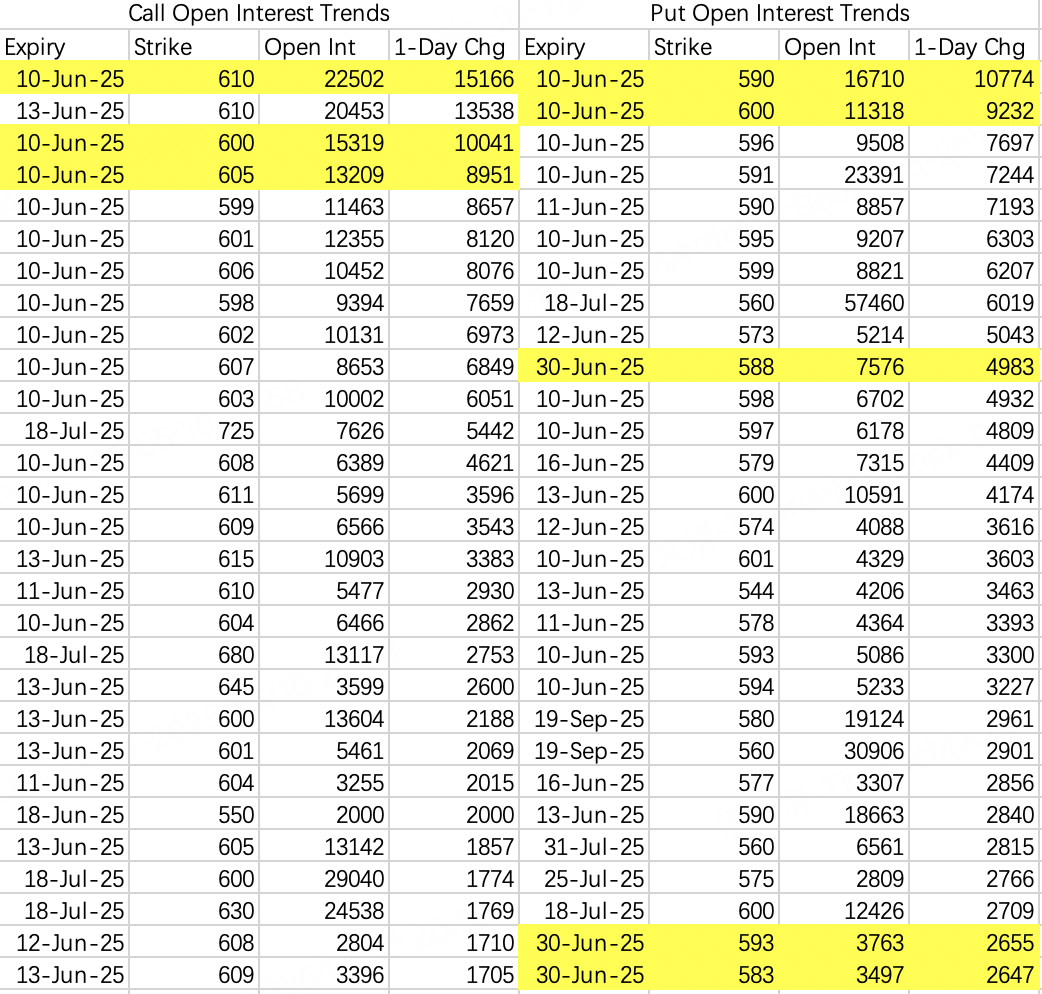

On Monday, a sudden drop in Chinese A-shares triggered many negative speculations about U.S.-China talks. However, SPY options open interest remains optimistic.

For example, there’s a bearish butterfly spread expiring June 30:

$SPY 583-588-593 PUT$.

This trade suggests expectations of a sharp, one-off pullback, possibly as much as 1.5%–2% in a single day.

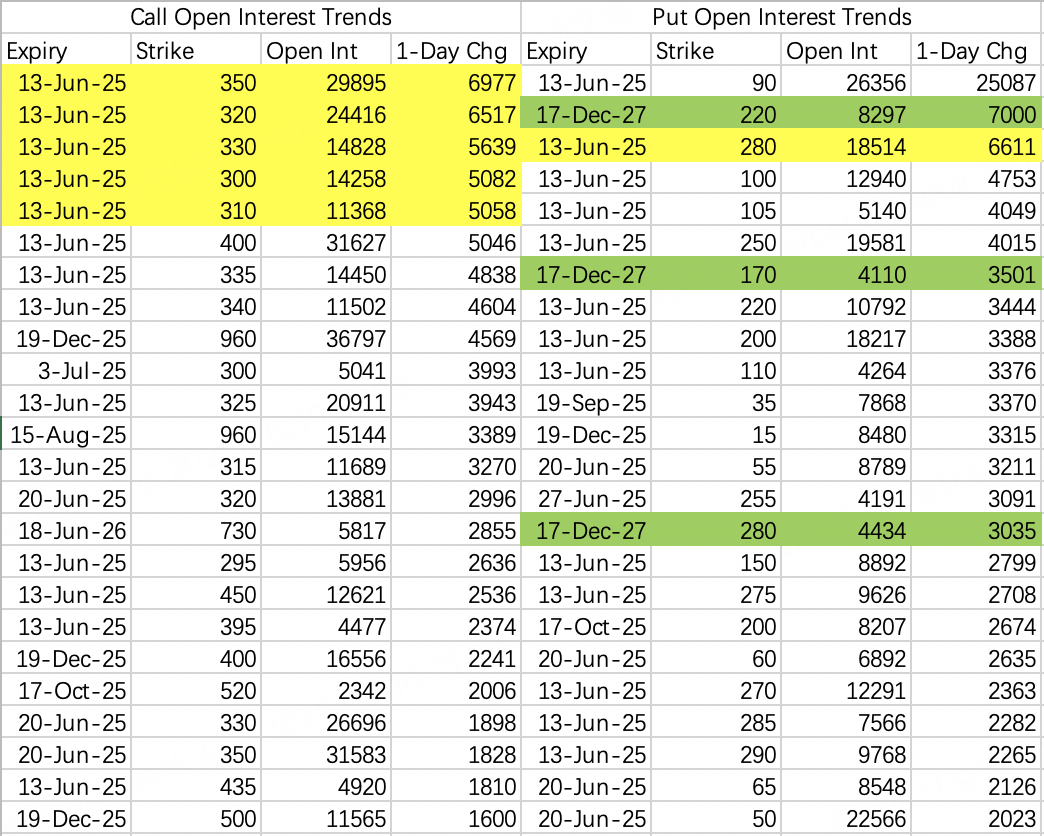

During the final 30 minutes of Monday's session, Trump made a surprising move by signaling a more conciliatory tone. While he stated he hasn’t considered holding talks with Musk yet, he hinted that Musk might want to meet with him. This triggered strong bullish sentiment in the market, with a surge in open interest for 300–350 calls expiring this week.

Institutional sell calls at 325 now appear under significant risk.

On the bearish side, institutions are also setting up long-term bearish butterfly spreads:

Buy $280 put, sell $220 put x2, buy $170 put:

It’s possible that the same institution trading NVIDIA’s bearish butterfly is also behind Tesla’s similar setup.

$T-Rex 2X Long MSTR Daily Target ETF(MSTU)$

While most traders remain cautious about bullish positions, one institution has gone all-in, buying a massive quantity of 9 call options expiring at the end of the year:

$MSTU 20251219 9.0 CALL$ , with 72,660 contracts opened, translating to an estimated transaction size of over $20 million.

Buying calls on a 2x leveraged ETF is essentially a leveraged bet on top of leverage, signaling strong bullish confidence in the blockchain trend. However, there are currently no other significant bullish trades in blockchain-related stocks, so it’s worth monitoring further before jumping to conclusions.

Comments