" $Gold - main 2508(GCmain)$ futures rose by about 29% in 2025, while $Silver - main 2507(SImain)$ rose by more than 20%, and the gap between the two is narrowing. Market analysts believe that silver usually sees a rebound after gold prices hit new highs, and in the long run, silver prices are expected to reach $40-50/ounce."

In June 2025, $Silver - main 2507(SImain)$ saw an unprecedented strong rise, and the spot silver price successfully reached $37/ounce, a 13-year high.

Price Breakthrough and Historical Significance: Silver prices successfully broke through the key psychological resistance level of $35/oz last Thursday, marking an important technical breakthrough in many years.

Review the post on April 18, 2025:Precious Metals Lead Gains in 5 Days! Full List of ETFs for Gold, Silver, Copper and etc, many ETFs rises prices:$SilverCrest Metals Inc(SILV)$, $iShares Silver Trust(SLV)$, $Aberdeen Standard Physical Silver Shares ETF(SIVR)$, $ProShares Ultra Silver(AGQ)$, $Global X Silver Miners ETF(SIL)$.

But historical data shows that silver prices are still far below their inflation-adjusted all-time highs, with a peak of $50 in 1980 equivalent to about $180 today.

So from a technical perspective, silver prices have effectively broken through a key resistance range, paving the way for further gains.

How much more can it rise in the future? What are the risk factors? Let's take a look.

1. Supply and demand analysis

1.1 Industrial demand remains strong

According to the latest forecast of the Silver Association, global industrial silver demand is expected to exceed the 700 million ounce mark for the first time in 2025, a year-on-year increase of 3%. Among them, green economic applications continue to be the growth engine, and the solar photovoltaic industry is expected to hit a new record high. The electric vehicle industry is also an important driving factor, and the amount of silver used in each electric vehicle is almost twice that of traditional vehicles.

1.2 Supply has been in deficit for five consecutive years

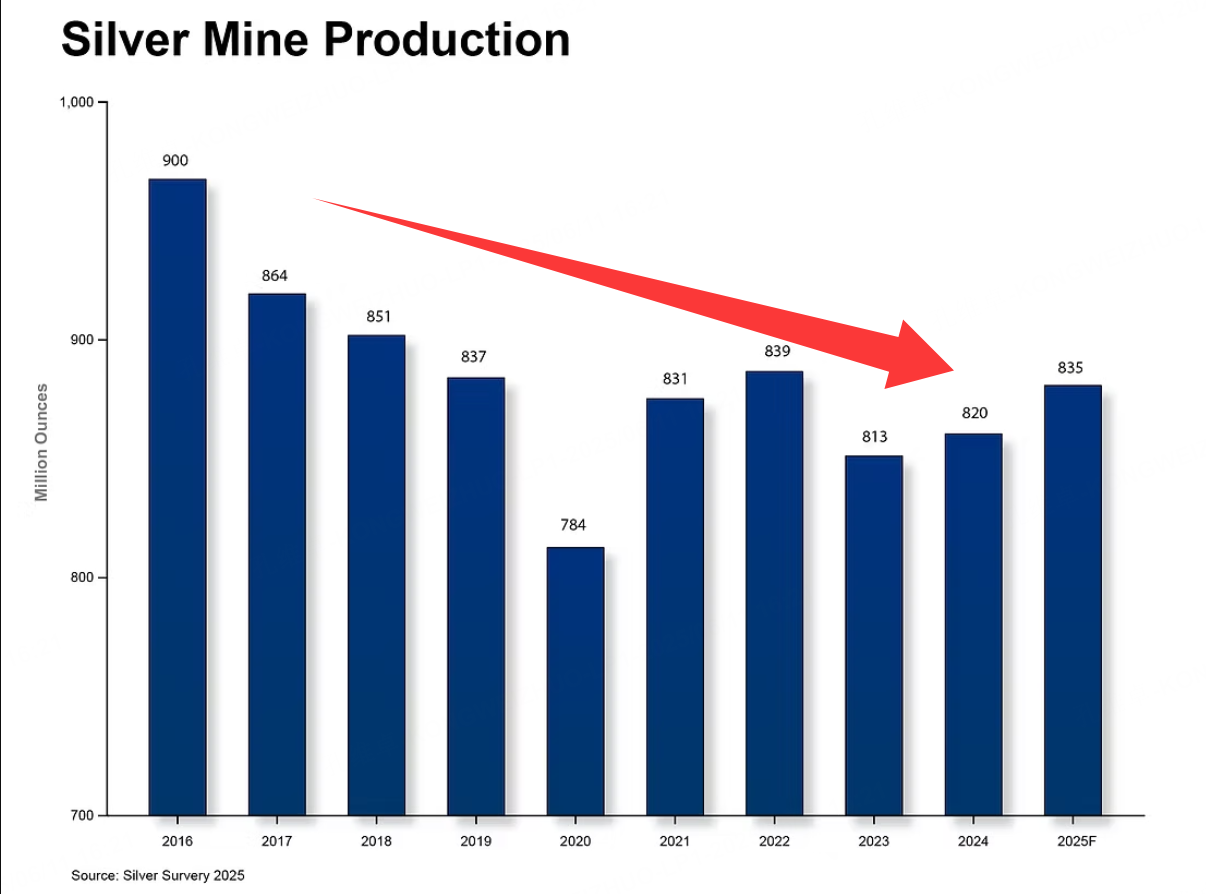

Data from the World Silver Association show that global silver mine production is expected to be 835 million ounces in 2025, a decrease of 7.23% from the 2016 level. In 2025, the global silver market is expected to have a supply gap of 117.7 million ounces, which is the fifth consecutive year of structural deficit.

The long-term decline in mine production is mainly due to factors such as the maturity of major deposits, changes in capital investment cycles, and the extension of the development time of new mines. Although recycled silver production is expected to increase to 195 million ounces, an increase of 24.06%, it still cannot fully make up for the decline in mine production.

2. Analysis of the macroeconomic environment

2.1 Expectations of the Fed’s policy

The current precious metals market has pricing differences on the Fed’s policy outlook.

The federal funds rate is currently maintained in the range of 4.25%-4.50%, and the probability of a rate cut at the FOMC meeting on June 17-18 remains very low. Atlanta Fed President Bostic said that the strong economy provides the central bank with time to observe the impact of tariffs on inflation and growth. This means that high interest rates may continue for a while, but the breakthrough of silver at this time seems to be the market’s rush to anticipate rate cuts. For the overall rise of precious metals, silver’s pursuit of gains seems to still be risky.

2.2 Trend of the $USD Index(USDindex.FOREX)$

The trend of the US dollar index has an important impact on silver prices. Analysts pointed out that if the US dollar index falls below the key support level of 98, it will provide an important impetus for precious metal prices. Historically, a weaker US dollar is usually positively correlated with rising silver prices.

2.3 Impact of inflation data

The upcoming May CPI data will have an important impact on market expectations. If inflation data is in line with or lower than expected, it may increase the possibility of interest rate cuts in the second half of the year, which will be beneficial to precious metals such as silver.

3. The gold-silver ratio data still needs to be repaired

The current gold-silver ratio has dropped from 99.80 on June 1 to 92.04 on June 7, indicating that silver's performance relative to gold has improved. Historically, the gold-silver ratio has fluctuated in the 40-80 range, and the current level is still at a relatively high level, with room for further repair.

Gold will rise by about 29% in 2025, while silver will rise by more than 20%, and the gap between the two is narrowing. Market analysts believe that silver, as the "poor man's gold", usually sees a compensatory rally after gold prices hit new highs.

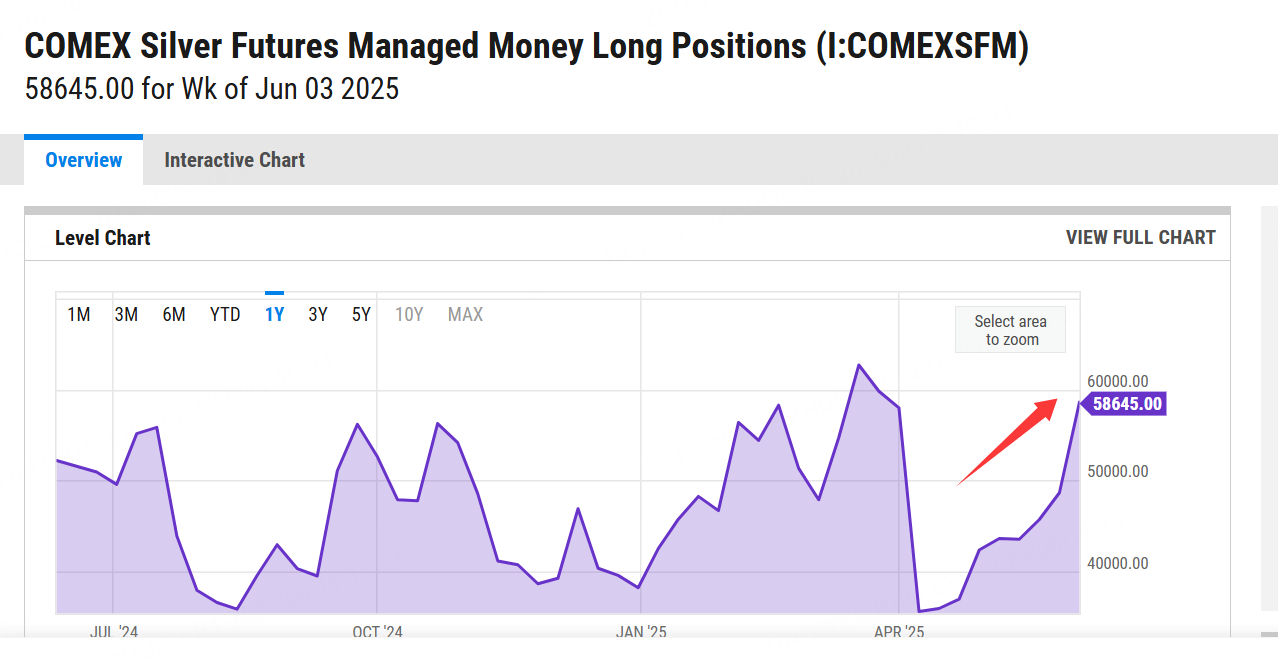

4. COMEX silver futures market position analysis

CFTC position breakdown report shows that the net long position of managed money category increased significantly compared with last week. Fund positions increased long positions significantly and reduced short positions slightly, showing that institutional investors are optimistic about the outlook for silver.

According to the latest CFTC data, as of June 3, the total position of COMEX silver futures was 189,056 lots. The weekly position increased significantly, indicating a significant increase in market participation.

This actually shows that the current crazy rise of silver has not distorted the positive price rhythm of the market. The forward price is still higher than the recent price. The market's future expectations are still positive, which indirectly shows that the surge in silver seems to be not over yet.

5. Risk factors and market outlook

Short-term risk factors: Technical indicators show that silver prices are close to overbought levels and may face profit-taking pressure in the short term. Uncertainty in the Fed's policies, changes in trade policies, and slowing global economic growth may all have an impact on silver prices.

Medium- and long-term prospects: From a fundamental perspective, the imbalance between silver supply and demand is expected to continue, and green energy transformation and Industry 4.0 will continue to drive demand growth. Market analysts predict that in the long run, silver prices are expected to reach $40-50/ounce.

For SG users only, A tool to boost your purchasing power and trading ideas with CashBoost!

Open a CBA today and enjoy access to a trading limit of up to SGD 20,000 with upcoming 0-commission, unlimited trading on SG, HK, and US stocks, as well as ETFs. Find out more here.

Other helpful links:

Comments