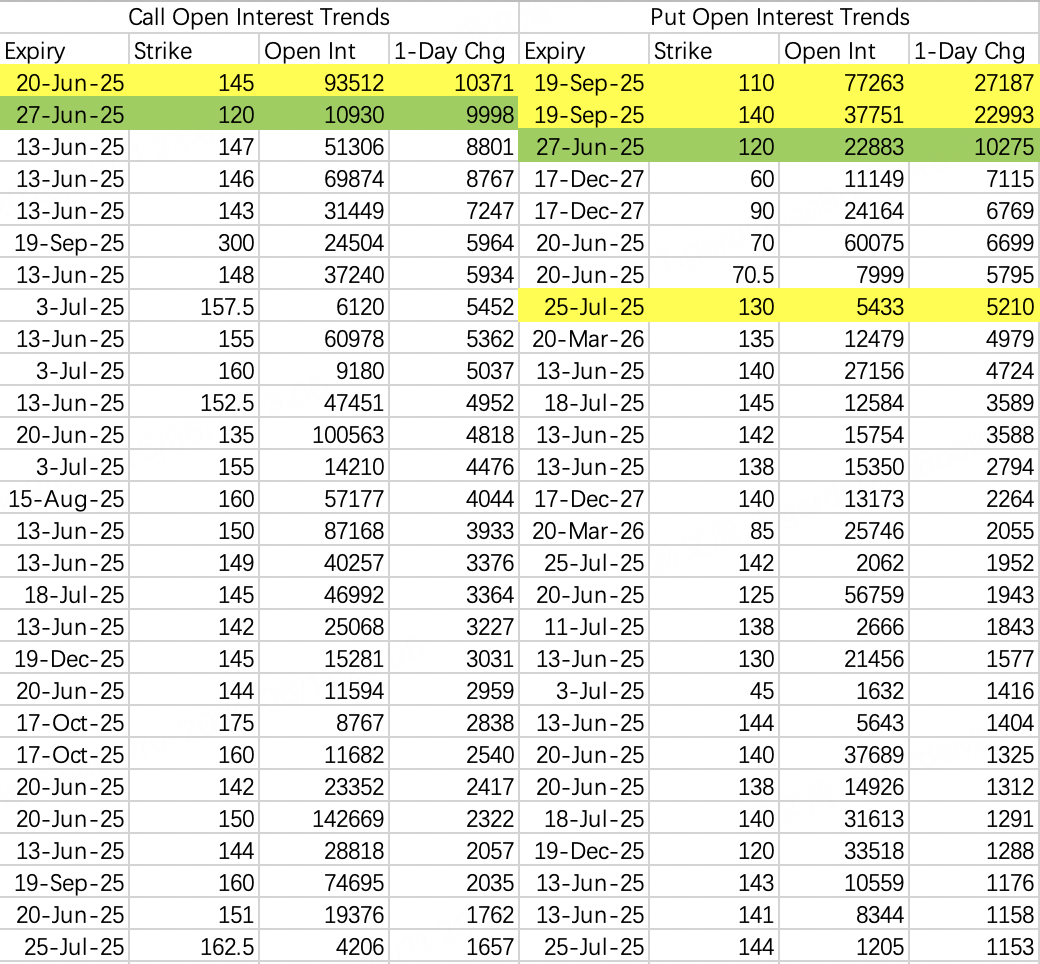

$NVIDIA(NVDA)$

No need to worry about a pullback before triple witching day; the stock price is expected to continue climbing toward 145. A potential pullback may occur after triple witching.

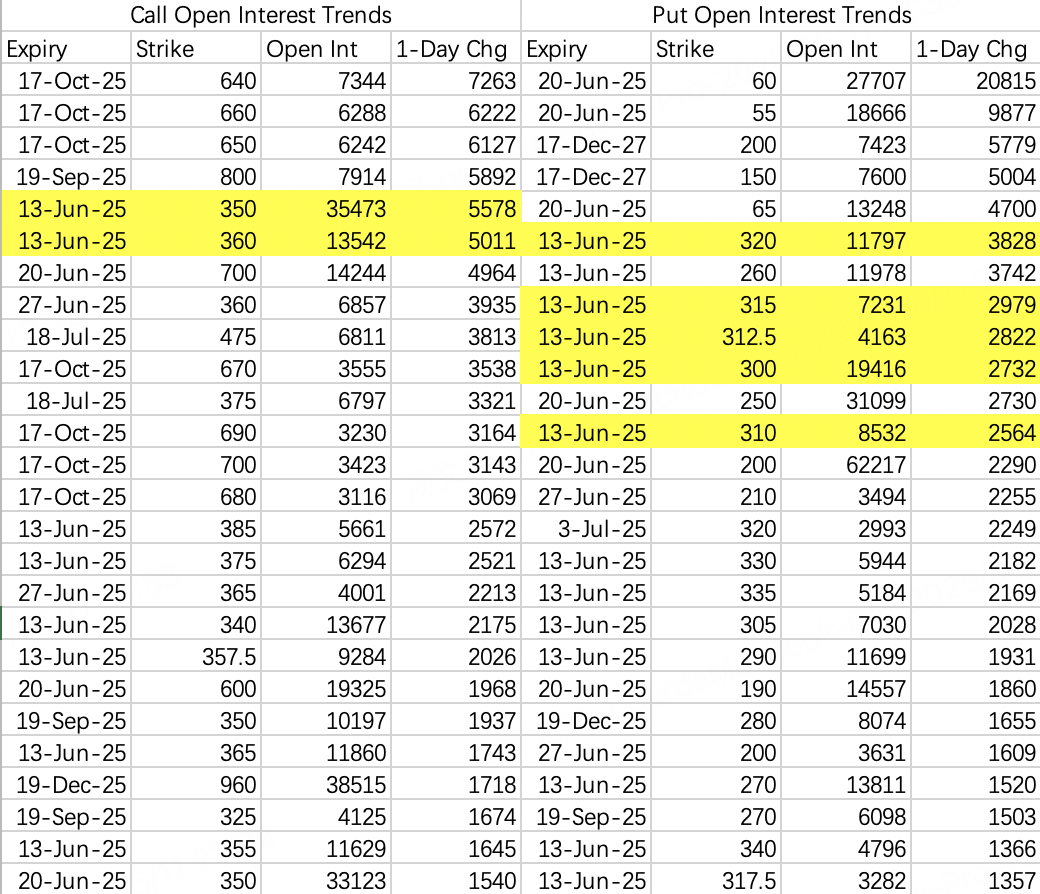

$Tesla Motors(TSLA)$

Two key updates:

The release date for robotaxis has been postponed by 10 days to June 22.

Trump has expressed interest in reconciling with Musk.

The stock price has rebounded to its pre-argument level, but further upside momentum seems limited.

A sell call strategy is appropriate:

For the downside, it’s harder to predict this week. Judging by the open interest in bearish puts, market makers seem to be preparing for a potential pullback to 300.

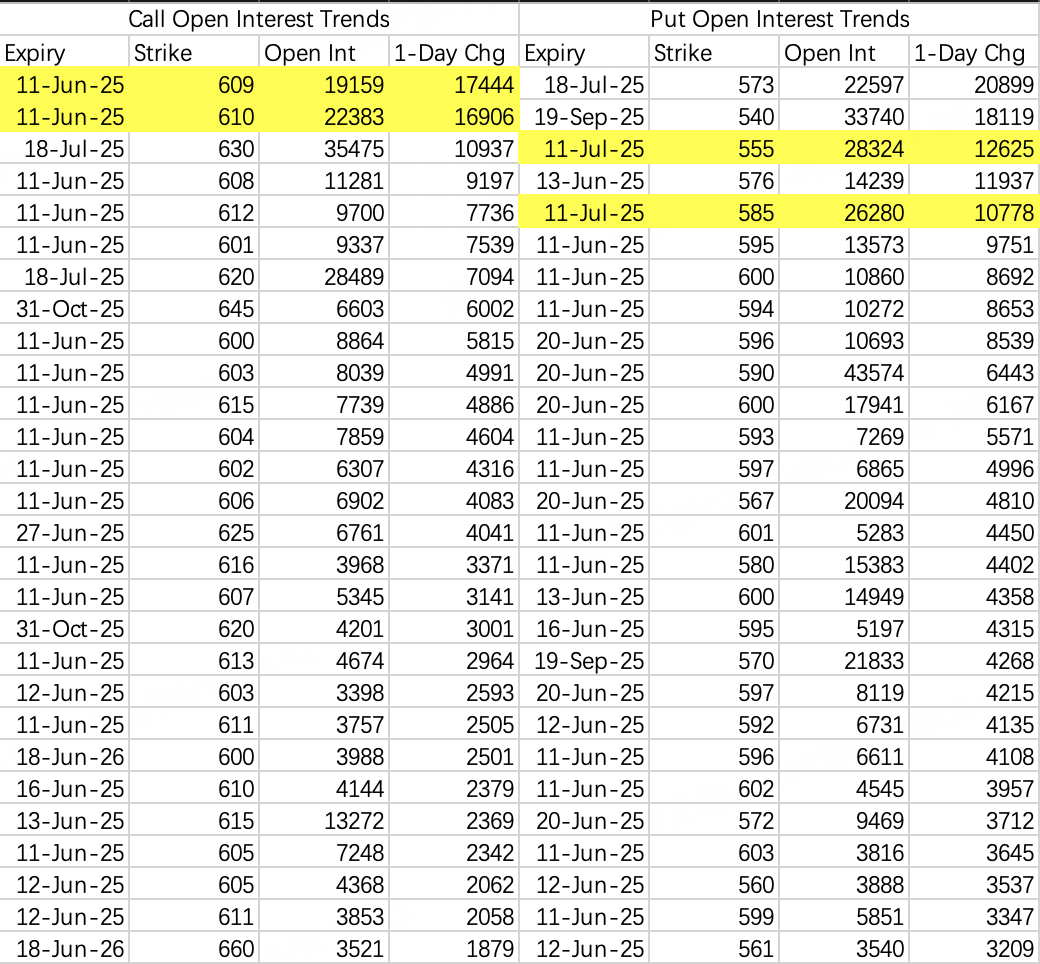

$SPDR S&P 500 ETF Trust(SPY)$

The S&P 500 outlook is slightly stronger than NVIDIA’s. However, bearish puts are being positioned for a post-triple witching pullback, specifically as a hedge against the expiration of the July 9 tariff suspension. The current expectation is a correction to 585.

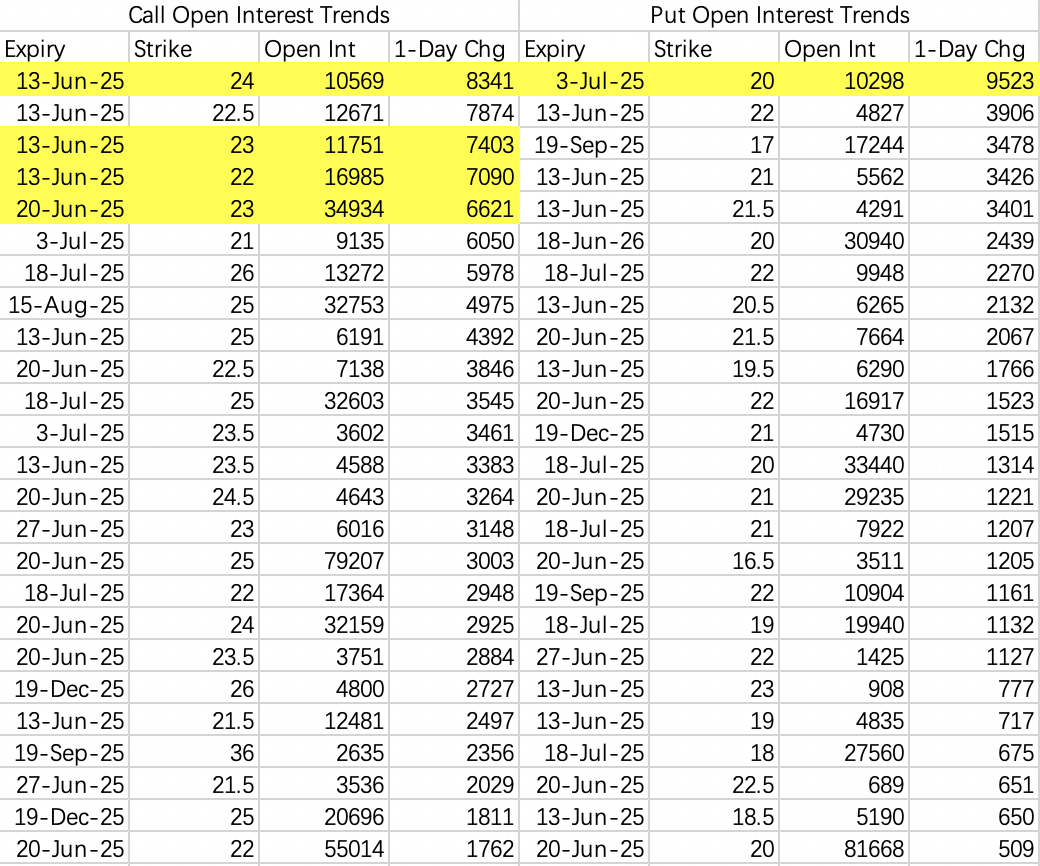

$Intel(INTC)$

The one-day rally ended quickly. Tuesday’s gains were wiped out, and the pullback target is 20. There is no expectation for the price to fall further.

$Palantir Technologies Inc.(PLTR)$

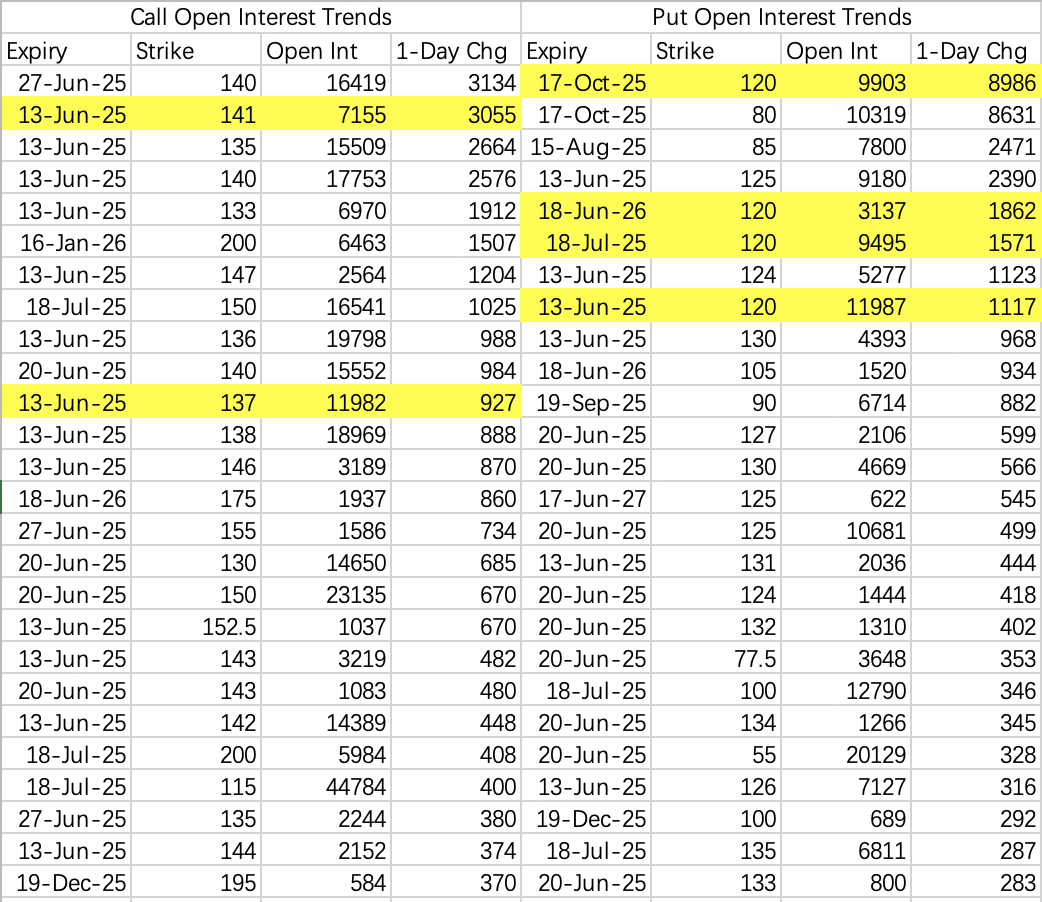

Bullish traders have set up a weekly call butterfly spread:

129-137-141

This means the current price of 137 has already hit their target.

On the bearish side, the pullback target is 120, which is also expected after triple witching.

$Alphabet(GOOG)$ $Alphabet(GOOGL)$

Some traders are betting on both Alphabet's share classes simultaneously by buying long-term call options with a strike price of 190 expiring at the end of the year:

Each position opened with 10,000 contracts, with a total transaction value of approximately $27 million.

Comments