$NVIDIA(NVDA)$

NVIDIA may become the backbone of the next market pullback.

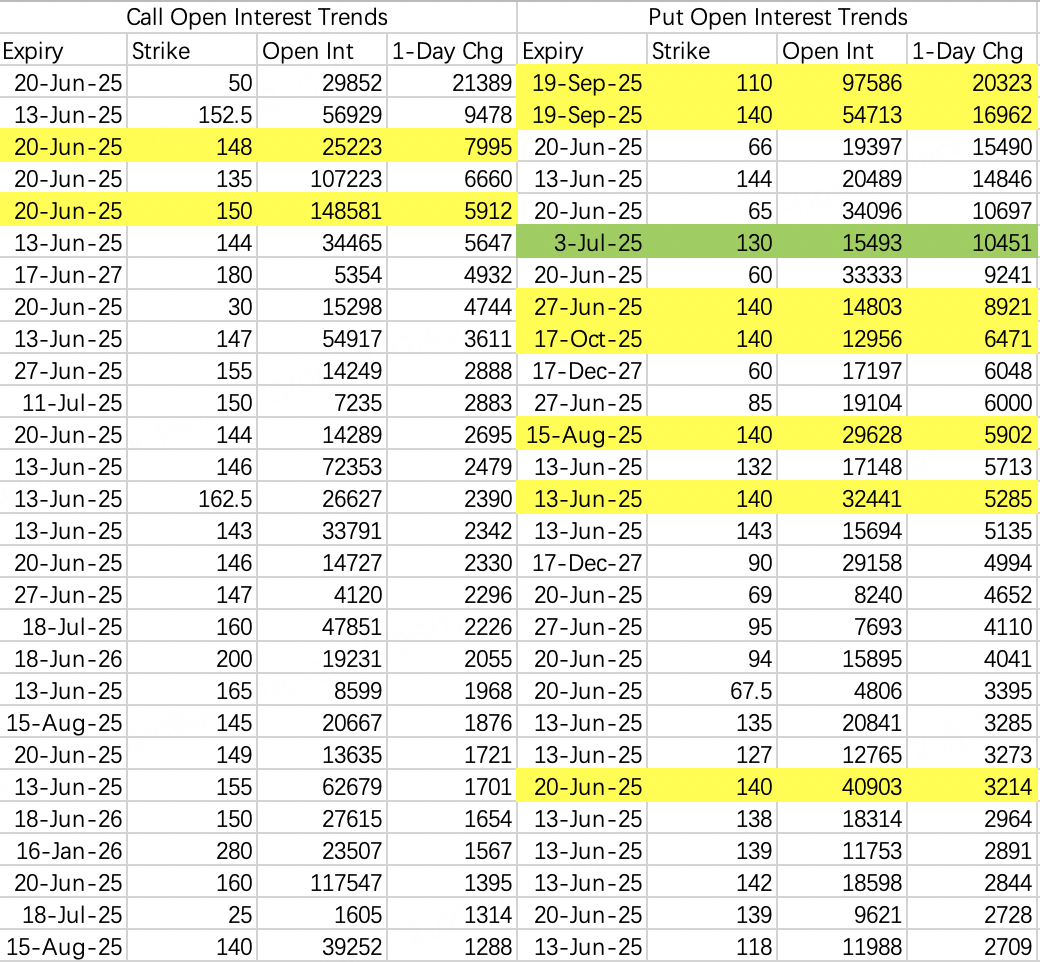

On Wednesday, bearish put open interest was highly focused, with both buyers and sellers targeting 140. This suggests that the pullback target is 140.

Frankly, this conclusion is surprising. Compared to a 130 pullback expectation, a dip to 140 can only be considered a minor fluctuation.

For the 140 puts across different expiration dates, the directional flow varied:

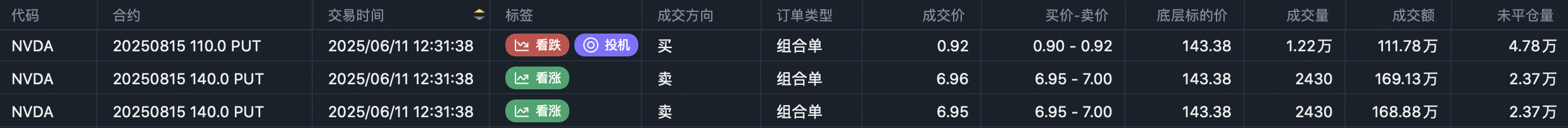

The September-expiry 140 puts were opened as part of a bearish vertical spread:

The June 27th and August 15th 140 puts were mostly sold.

The October-expiry 140 puts were likely sold as part of another bearish vertical spread with the 110 puts:

$NVDA 20251017 140.0 PUT$ paired with $NVDA 20251017 110.0 PUT$ .

On the aggressive bearish side, there was also outright buying of 130 puts expiring July 3rd:

For now, I prefer to observe for another two days. Covered calls at 150 could be a solid strategy, but buying puts to hedge NVIDIA exposure is off the table for now.

$SPDR S&P 500 ETF Trust(SPY)$

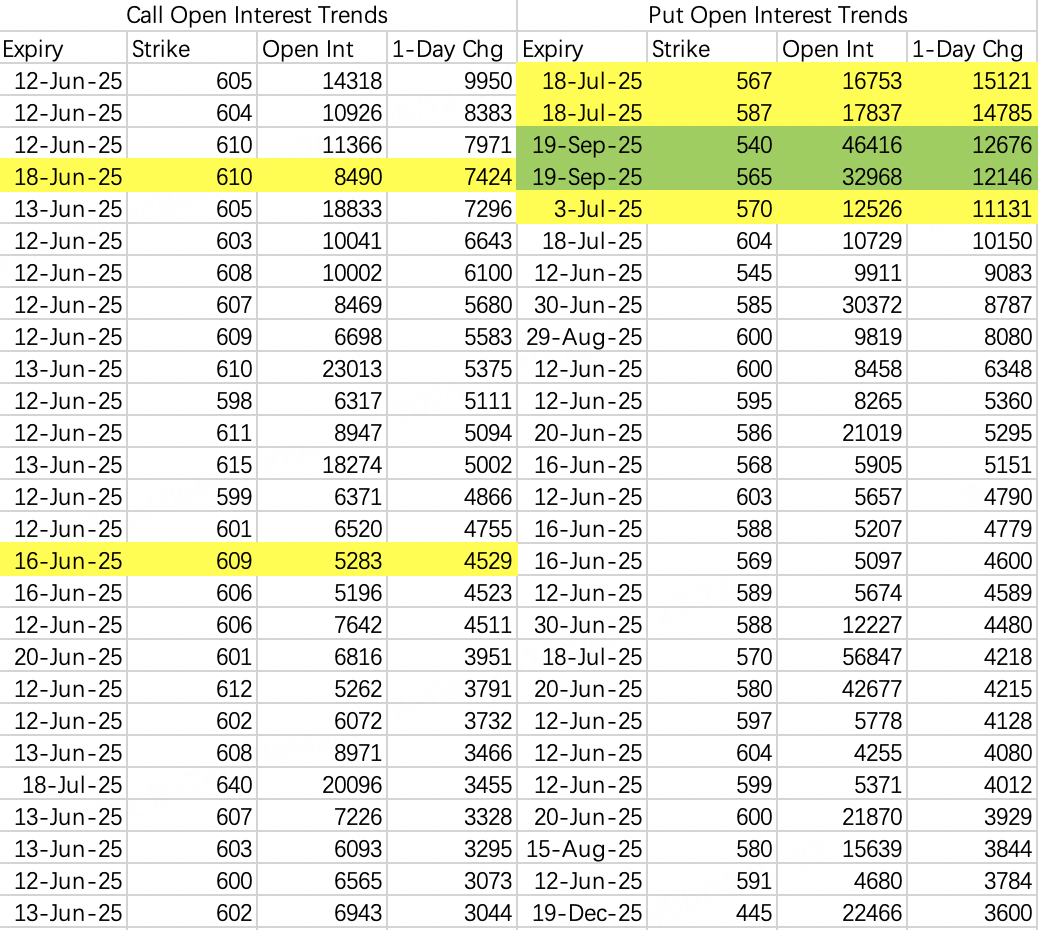

Compared to NVIDIA, the broader market’s pullback expectations remain more pronounced, but there’s still optimism for short-term gains.

To be honest, bullish open interest isn’t particularly reliable, as traders are now making same-day calls and avoiding longer-term planning. The short time horizon makes these trades less actionable as a reference.

Bearish open interest, on the other hand, appears to be in a "waiting for the fish to bite" phase. From initial positioning to an actual pullback, the process typically takes 2–4 weeks. That said, the market has clearer triggers for a near-term correction, so there’s no need for excessive concern.

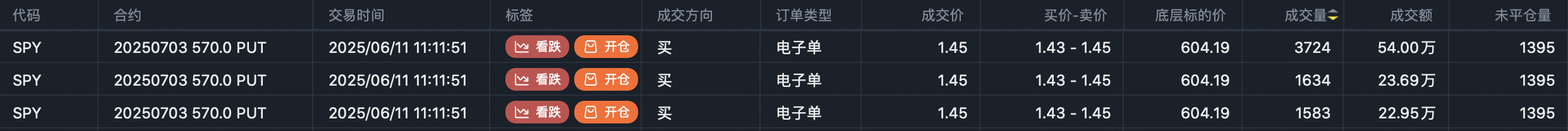

One notable bearish trade is a vertical spread:

Buy $SPY 20250718 587.0 PUT$ , Sell $SPY 20250718 567.0 PUT$

Another sign of aggressive bearish sentiment is the recent single-leg put activity:

This suggests that bears may aim to complete their selling strategies before the July 9th tariff suspension expiration.

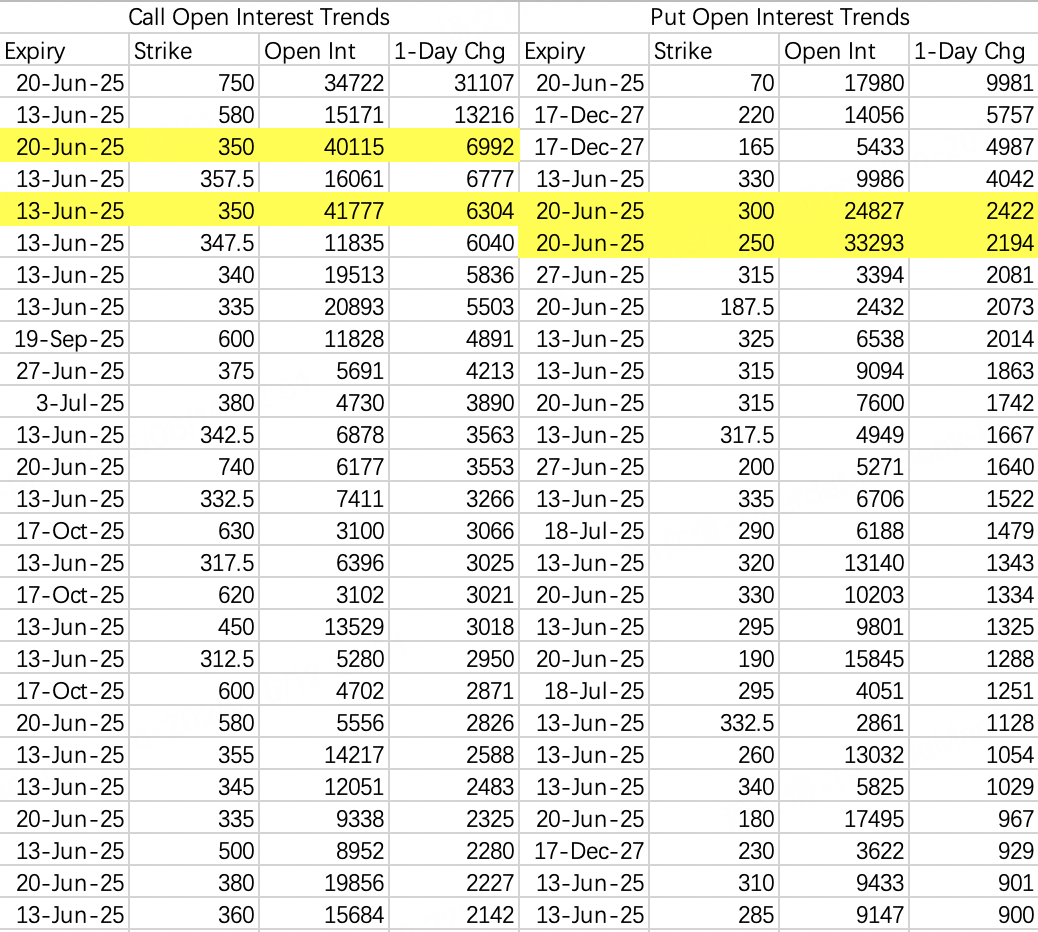

$Tesla Motors(TSLA)$

With monthly options expiring on June 20, there are no major bullish or bearish catalysts expected. Assuming Trump and Musk don’t reignite their feud, Tesla is likely to trade within the 300–350 range.

This makes it suitable for selling a wide strangle:

Sell $TSLA 20250620 300.0 PUT$ , Sell $TSLA 20250620 350.0 CALL$

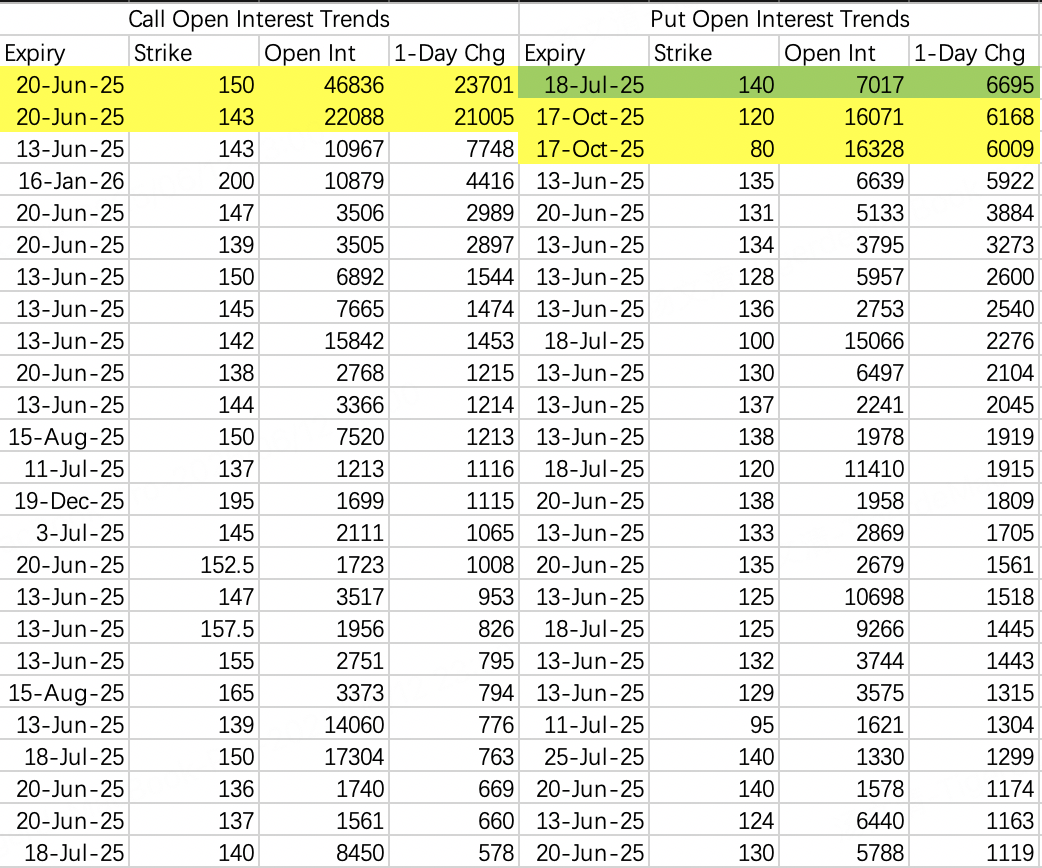

$Palantir Technologies Inc.(PLTR)$

On Wednesday, PLTR briefly broke above 140. Institutions rolled their sell call positions to next week’s 143 calls to hedge against 150 calls.

Bearish put open interest includes standard bearish vertical spreads:

However, there’s also an unusual trade where someone sold the 140 puts expiring July 18th:

This behavior suggests there could be some insider information at play.

Comments