Next week’s triple witching day may finally mark a turning point for this prolonged sideways market... or will it?

After NVIDIA’s earnings report, I had confidence in a pullback. However, as subsequent earnings reports from other chipmakers and cloud service companies were disclosed, along with outlooks from investment conferences, the investment enthusiasm for AI has only intensified.

On Thursday, Oracle reported earnings, and its stock surged by 13%. AI is catalyzing Oracle’s back-office systems into a supercycle because all AI functionalities are only accessible via the cloud. SAP’s earnings report also highlighted this point.

This is significantly bullish for NVIDIA: previously, office software that didn’t require cloud integration didn’t heavily rely on PC hardware environments. However, the standardization of AI cloud services is driving incremental demand for new hardware.

This also explains why Oracle’s capital expenditure forecast exceeded expectations: the company set its FY26 capital expenditure guidance at $25 billion, approximately 25% higher than the market’s consensus estimate of $20 billion, to meet the demand from backlogged orders.

Oracle's capital expenditure increase is different from TSMC’s. For Oracle, this major increase in capital expenditure almost offsets the possibility of generating positive free cash flow, shifting its valuation basis from free cash flow to GAAP operating profits. This essentially signals that Oracle is going “all in” on AI.

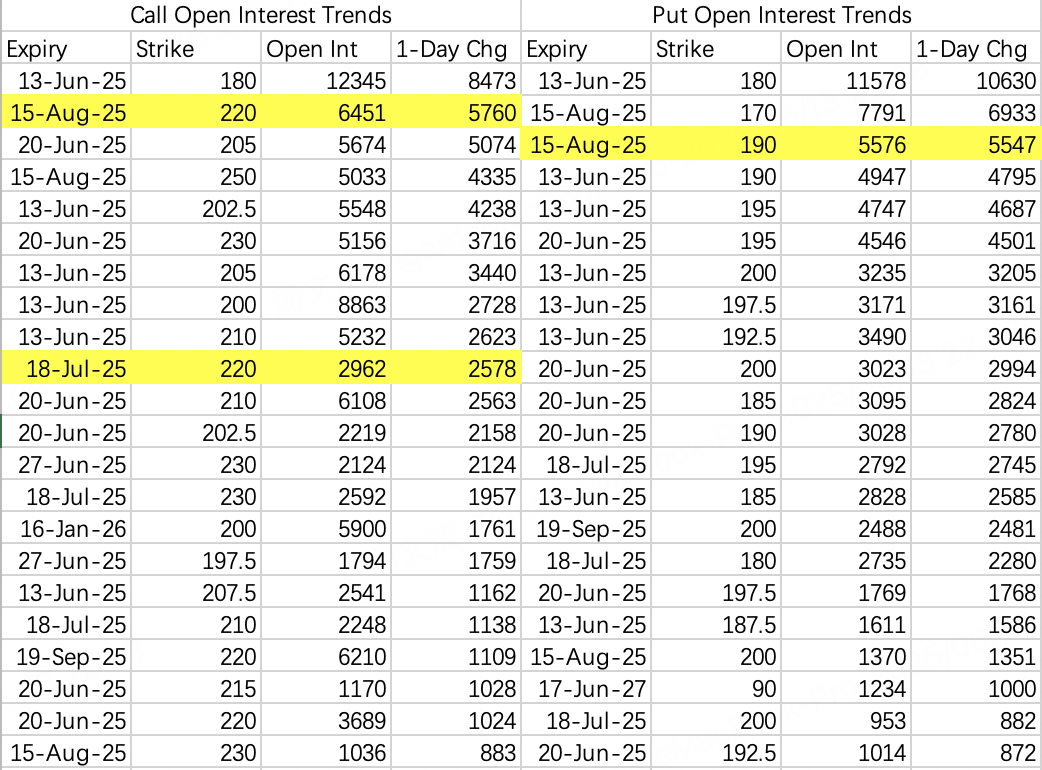

After the earnings report, Oracle’s trading range is projected to be between $190 and $220. At $220, there’s activity on both the buy and sell sides. Therefore, consider selling puts below $210 and selling calls above $210.

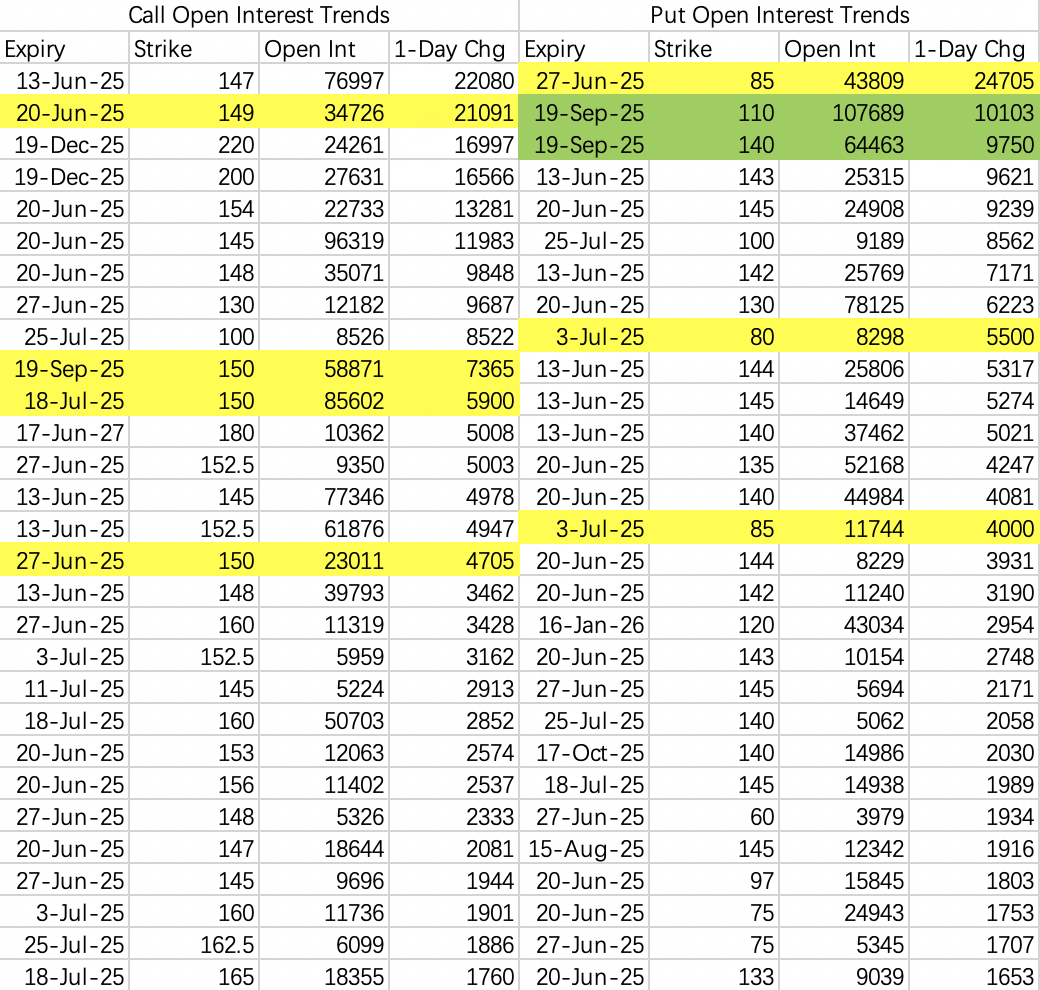

This week, similar to the week of triple witching day, institutions preemptively sold calls on Thursday, including 149 contracts of the $NVDA 20250620 149.0 CALL$ , hedging with 154 calls.

There are two camps when it comes to opening bearish put positions. One assumes a typical pullback to below $140, while the other predicts a drastic drop to $80. Both have their reasons: the $140 pullback is based on AI’s strength, while the $80 prediction bets on macroeconomic risks. For now, it’s recommended to reduce sell-put positions or directly switch to selling calls.

Additionally, it’s worth noting that someone has been continuously opening bearish vertical spread positions for three consecutive days: buying the $NVDA 20250919 140.0 PUT$ and selling the $NVDA 20250919 110.0 PUT$ , with over 10,000 contracts traded daily in large-scale transactions.

Based on the opening statistics from the past two days, a rough estimate of the transaction value for the 140 puts is approximately:

10.4 × 100 × 2.3 + 10 × 100 × 1.7 + 9.96 × 100 × 0.97 ≈ $50 million.

After subtracting the hedging cost of the 110 puts, approximately $10 million, the total investment is around $40 million to short NVIDIA.

As for this strategy, let’s analyze:

Expiration Date: While the expiration is in September, those who have been following closely know that shorts sometimes select expiration dates arbitrarily. There may also be considerations to obscure their shorting intentions, particularly with large-scale short positions. Therefore, this 140-110 put spread is most likely targeting the near-term trend.

Strike Price Selection: The choice of strike prices is very conservative, almost at-the-money for the 140 put. Selling the 110 put indicates that the bears expect limited downside, likely bottoming out at $120 or even $130. Of course, black swan events are not accounted for here.

Given the renewed volatility in the VIX, while the AI trend remains strong, macroeconomic risks could still lead to a stock price correction. It’s advisable to focus more on sell-call strategies and collar strategies to protect long equity positions in the near term.

Comments