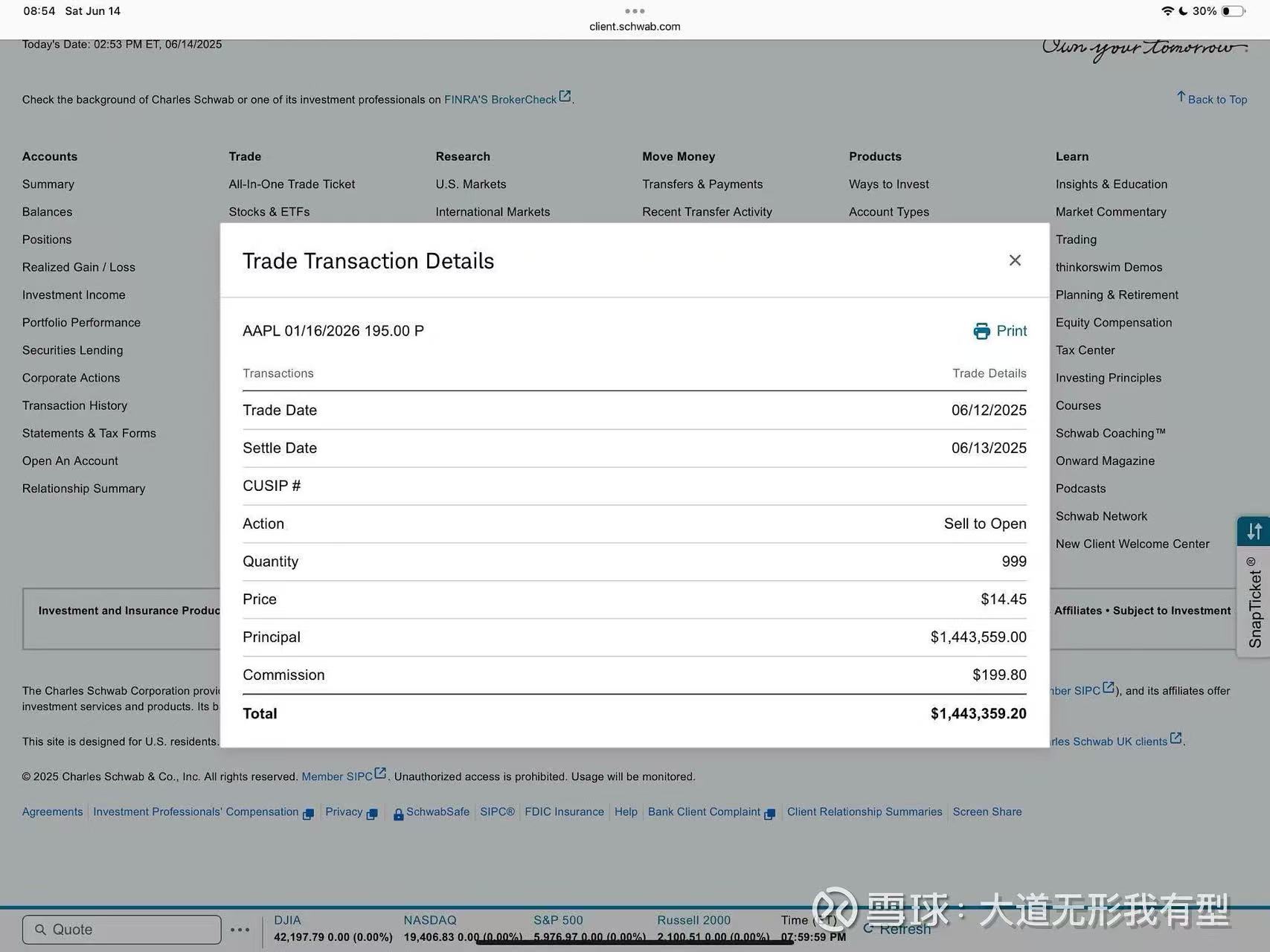

Over the weekend, Duan Yongping, a well-known investor, shared his latest trade after a long hiatus. On Friday, June 13, he sold 999 contracts of the 2026 January 195 put $AAPL 20260116 195.0 PUT$ , earning a premium of approximately $1.44 million.

Duan provided the annualized return for the trade. At $14.45 premium per contract, the annualized return is about 18%.

However, based on records from a large-order scanner, there was also a sell record for the same $AAPL 20260116 195.0 PUT$ on Thursday, June 12, with a similar volume of 999 contracts. It’s likely this was also Duan’s trade. It’s understandable that he didn’t disclose every trade, as he’s under no obligation to share all of them.

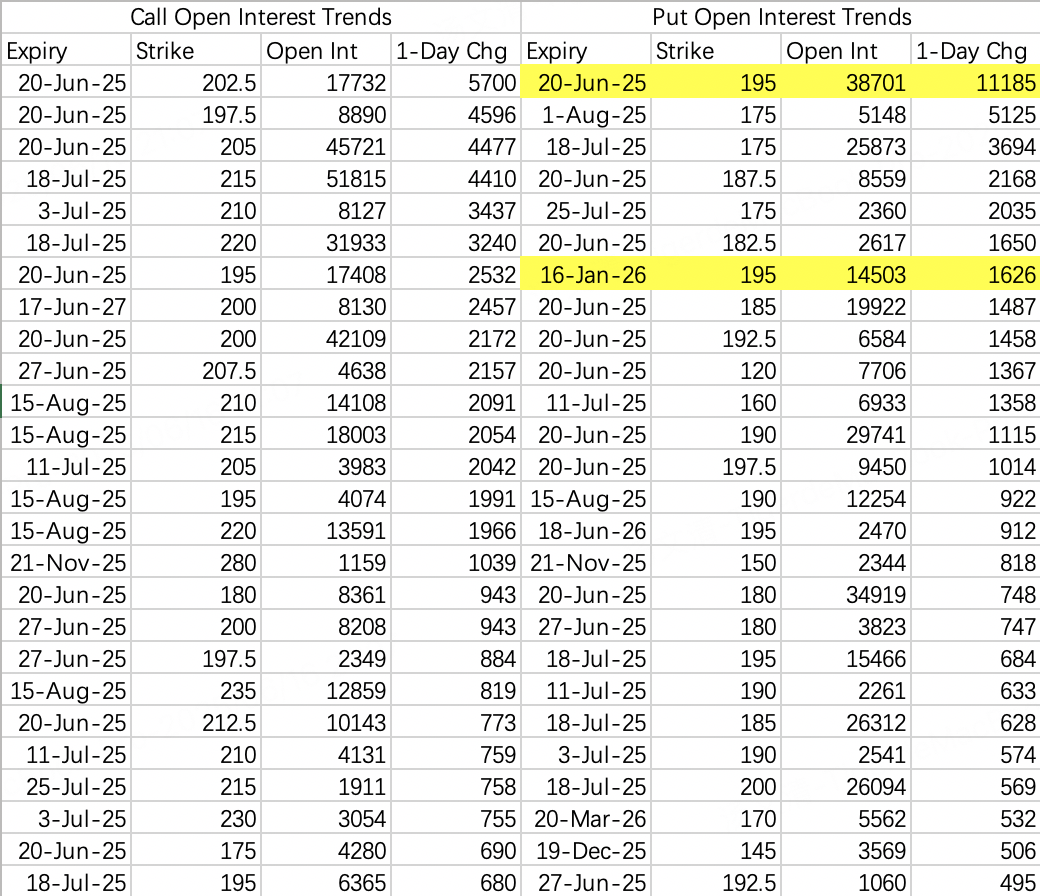

Let’s analyze this strategy. On Friday, Apple closed at $196.45. Selling the 195 put at this strike price is essentially an at-the-money trade. An at-the-money sell put typically indicates a neutral to slightly bullish trend, or it may suggest the trader is highly willing to take ownership of the stock.

Even though the expiration date is six months away, choosing this strike price seems relatively aggressive. After all, Duan didn’t choose an at-the-money strike price when selling puts on NVIDIA.

However, the $195 level for Apple is intriguing. One year ago, in early June 2024, Apple’s stock was also at $195. Going back another year to 2023, Apple’s price was still around $195. Considering Apple’s business growth and valuation, taking ownership at $195 in six months could be seen as a good deal.

Focusing solely on the near-term trend, while other tech stocks have been rebounding toward their previous highs, Apple remains stagnant, trading in the $200 range. This seems inconsistent with broader market trends.

Therefore, despite ongoing macroeconomic risks and potential pullbacks in the coming weeks, selling the 195 put $AAPL 20260116 195.0 PUT$ at this time seems like a reasonable move.

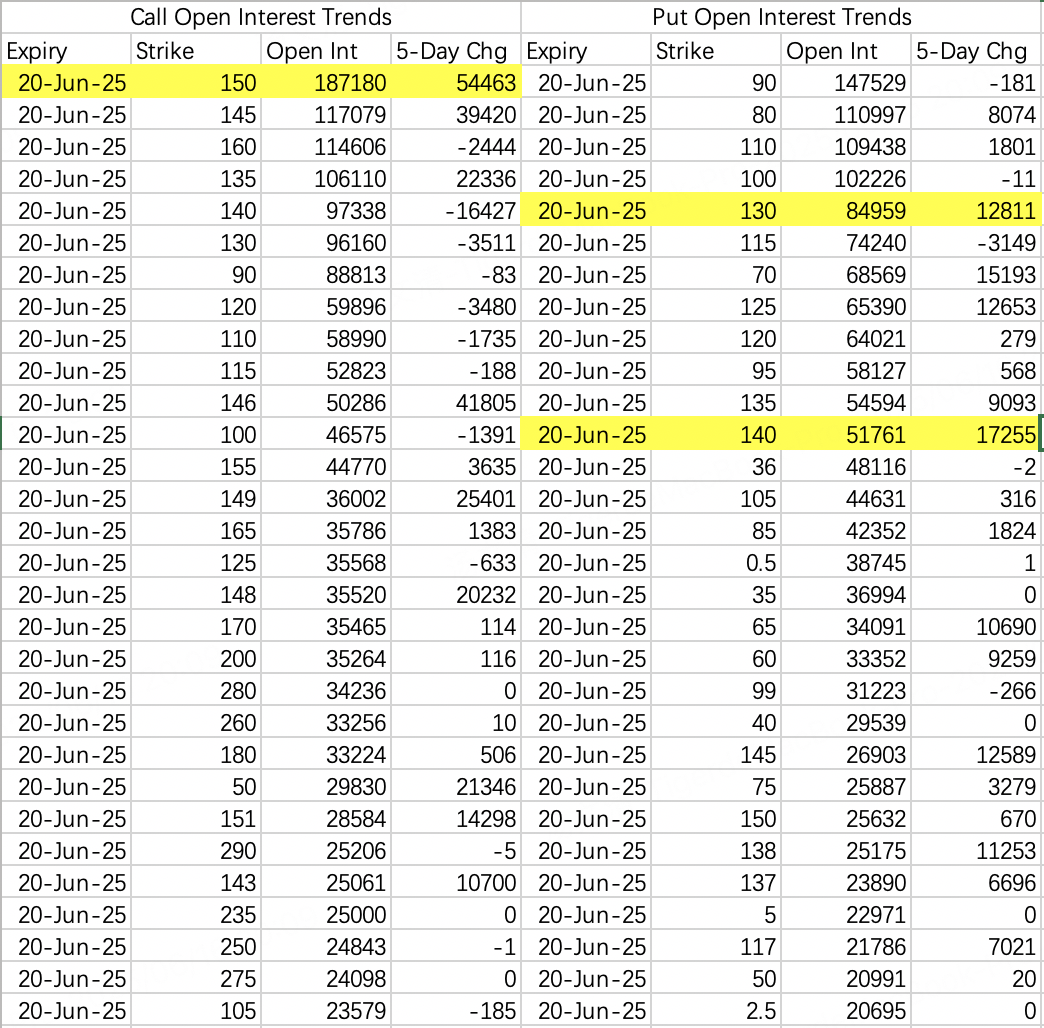

From the options open interest data, the market appears to have hedged against risks for the period after June 20, with a target price of $175.

Monday saw a brief short squeeze. This week includes both triple witching day and geopolitical tensions following Friday’s Iran-Israel conflict, leading to low expectations for market upside this week, with prices expected to remain flat.

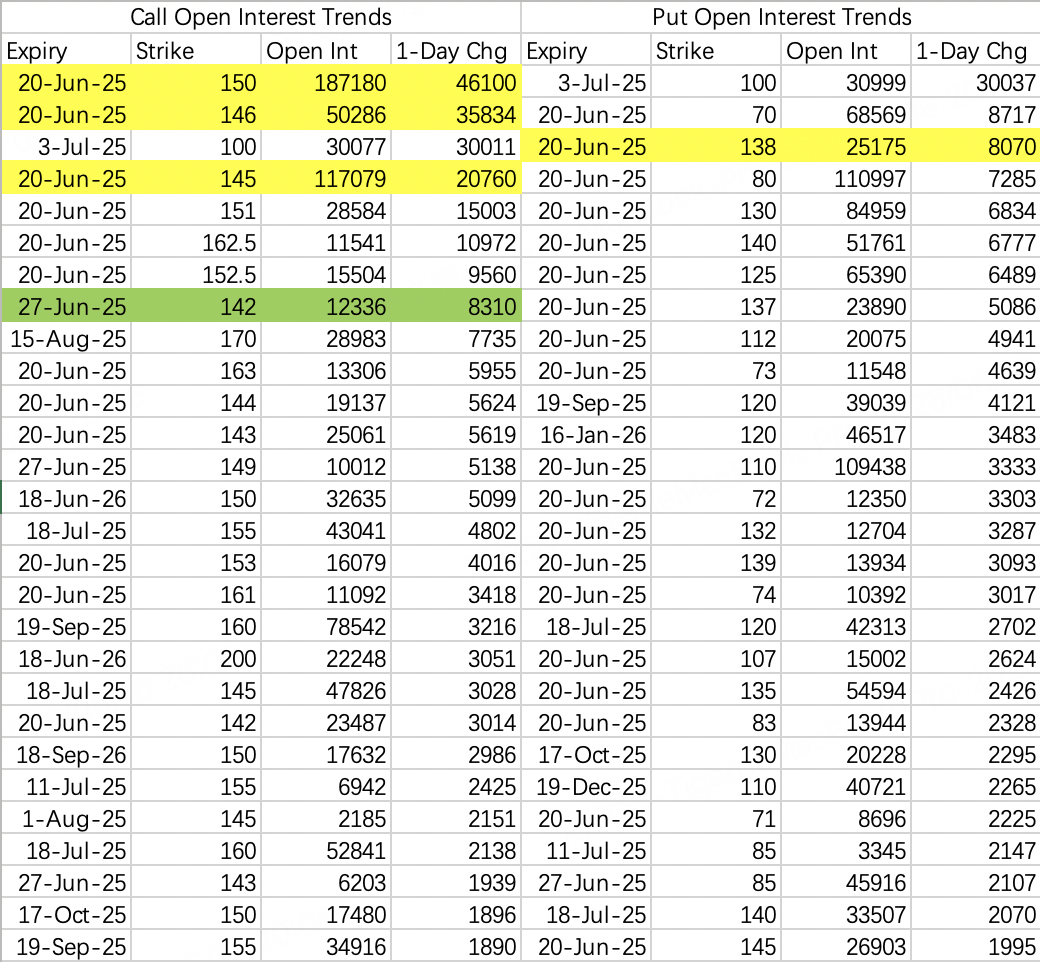

However, on Monday, as market sentiment eased, we saw an immediate short squeeze. AMD and PLTR were notable examples, with AMD experiencing a short squeeze at the open, as institutions had set the strike price for sell calls too low at $126, forcing another adjustment to $132.

NVIDIA may also face a short squeeze in the coming days. Institutional sell call strike prices are currently between $145 and $146. Notably, last Friday, someone purchased the June 27 expiration 142 call $NVDA 20250627 142.0 CALL$ , with a transaction volume exceeding $4 million.

This week’s expected trading range for NVIDIA is $140–$150. If a short squeeze occurs or a breakout above $146 fails, consider selling the $150 call.

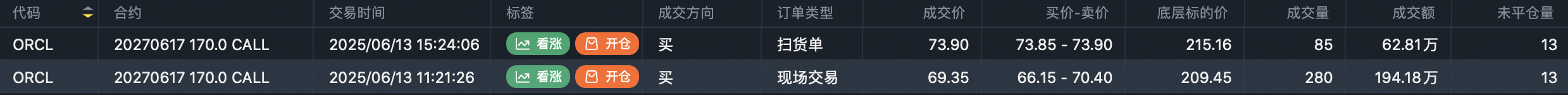

Large orders have been observed for long call options on Oracle. Specifically, the $ORCL 20270617 170.0 CALL$ was purchased, with a total transaction value exceeding $15 million.

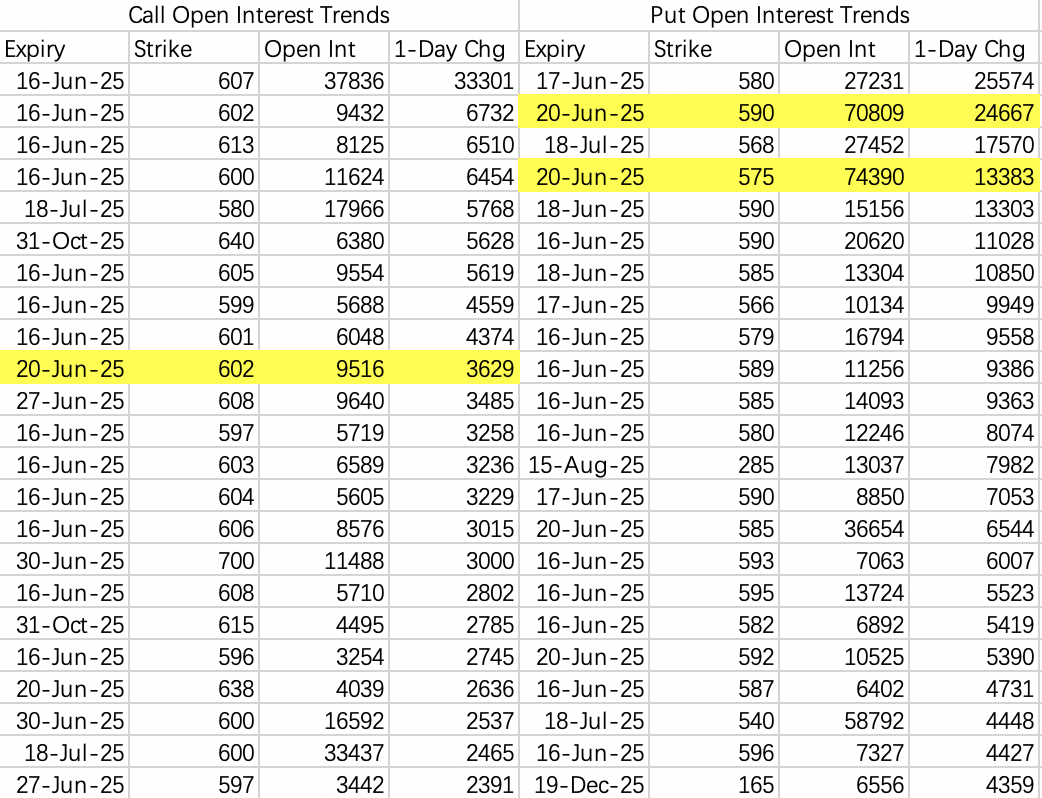

Friday’s closing data indicated an expected trading range of $585.8–$608.2 for this week. However, after Monday’s open, the forecast shifted slightly to $592.6–$609.4.

Based on open interest data, the market has a bearish bias this week, with a target around $590.

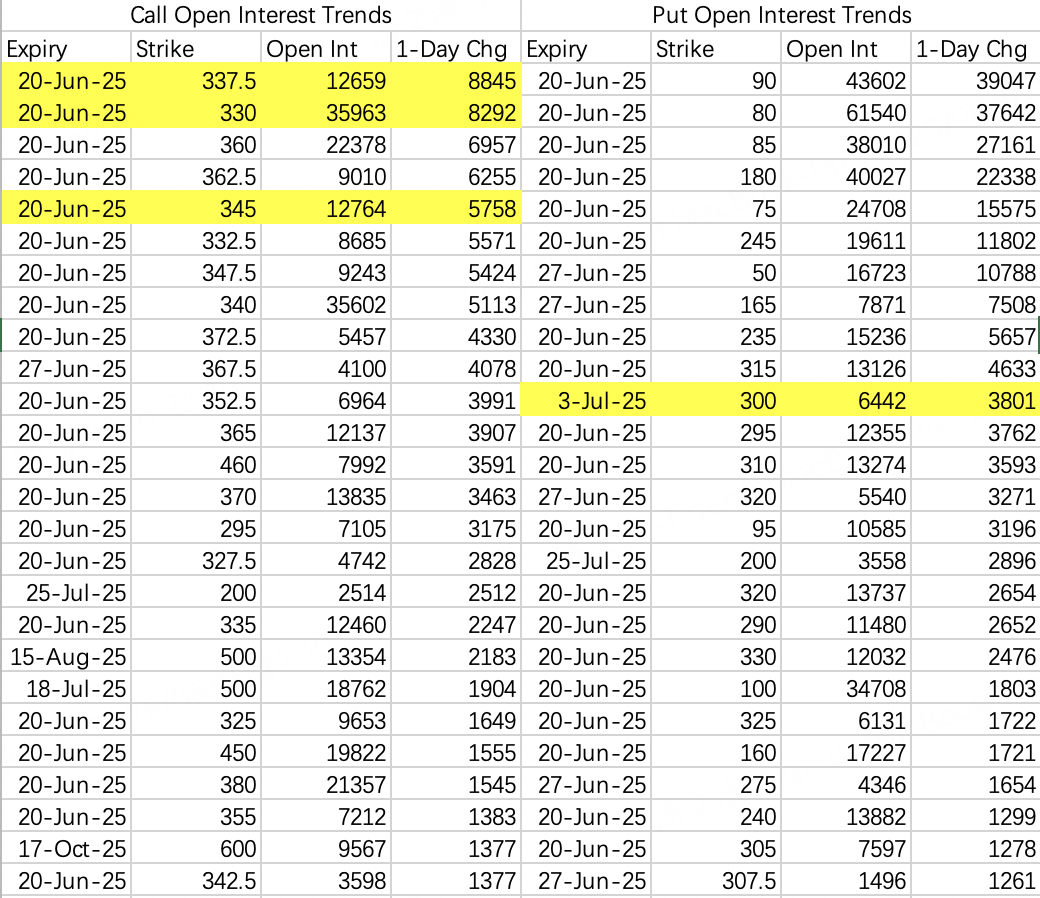

Tesla has yet to experience a short squeeze, which seems unusual. Institutional sell call strike prices this week are at $330, $337.5, and $345, indicating very tight levels.

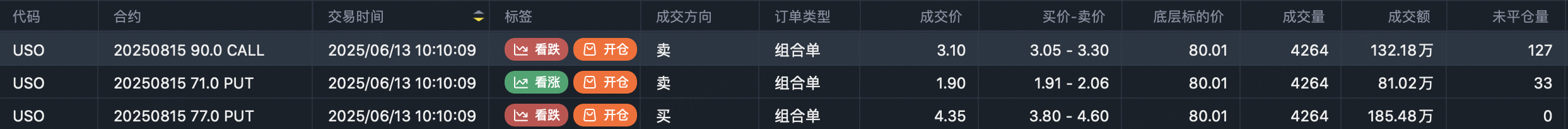

$United States Oil Fund LP(USO)$

A large bearish position on crude oil was established using a zero-cost collar strategy:

Bought $USO 20250815 77.0 PUT$

Comments