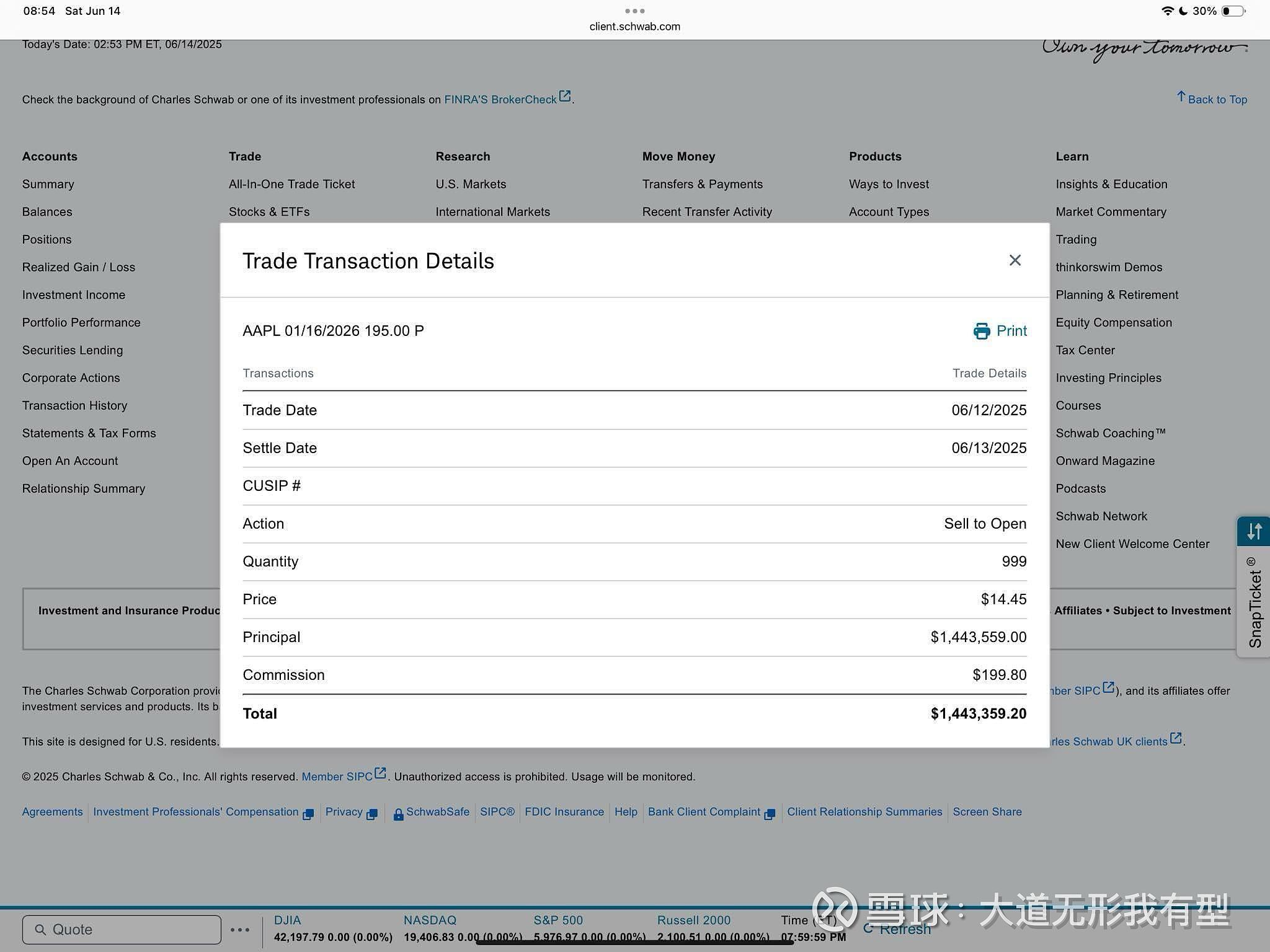

Duan Yongping once again exposed his operation. According to the investment screenshots he shared, he sold Apple's put options (puts), with a total amount of over 1.44 million US dollars. It is worth noting that in the first quarter of this year, the portfolio managed by Duan Yongping sold apples in large quantities.

1. Transaction analysis

原 资 产 (Underlying): AAPL (Apple Inc. Stock)

Option Type: Put (Put option)

Expiry date: 16 January 2026

Exercise price: USD 195.00

Operation TypeSell to Open ( Sell to open a position)

Quantity: 999 shares (each sheet represents 100 Apple shares, equal to 99,900 shares)

Premium price:$14.45

Total revenue (Principal):$1,443,559.00

Handling fee (Commission):$199.80

Actual net income (Total):$1,443,359.20

2. What is the essence of this investment?

Duan Yongping passedSell a Put option (Put), expressed a view to the market:

"I am willing to buy Apple stock at $195 per share on January 16, 2026."

If the stock price is below $195 at that time, he will perform the contract and buy; But he has now received $14.45 per share in premium, equal to195-14.45 = $180.55Buy at the "implied cost price".

3. Profit and loss analysis

Maximum benefit

If expiry date AAPL ≥ $195, the option will not be executed, and Duan Yongping retains all premium rights.

Total revenue= premium × Quantity × 100 = $14.45 × 999 × 100 =$1,443,559

Net income after deducting commission ≈$1,443,359

Maximum loss (theoretically)

If Apple's stock price returns to zero, you need to buy each Apple at 195, and the loss is:

Single share loss: $195-$14.45 = $180.55

Total loss: $180.55 × 999 × 100 =$18,043,445

So:This strategy is limited gains, but the potential losses are large.

Break-even point

Breakeven = Strike Price-premium = 195-14.45 = $180.55

As long as AAPL is above $180.55 at expiration, he can make a profit.

4. The magic of selling put options

This is a typical "Cash Secured Put" strategy, suitable for investors who are bullish on Apple for a long time and are willing to buy at a reasonable price.

Duan Yongping operated through this option:

InBullish on Apple but wait for lower prices to buyUnder the premise of actively earning premium;

If the stock price pulls back, just buy it at the price you want;

If the stock price is strong and does not fall, thenSteady collection of $1.44 million in revenue。

This reflects the triple wisdom of value investors who are "willing to buy, will wait, and can earn".

Comments