Unbelievable! Where’s the pullback everyone expected before the tariff negotiations?

On Monday, unusual activity was observed in Microsoft’s options market. Someone opened a position by buying 18,000 contracts of the $520 call $MSFT 20260116 520.0 CALL$ , with an estimated transaction value of roughly $38 million.

This is an extremely bullish order, carrying two implications. First, it reflects strong confidence in Microsoft’s upside. Second, it suggests the investor does not foresee a significant correction in the broader market anytime soon. If you’re hesitant about going long on Microsoft, you might consider other bullish trades, especially in AI-related stocks.

AMD’s sudden surge during Monday’s session caught many off guard. There wasn’t a unified narrative explaining the rally, though some analysts mentioned Amazon becoming a client. Given the immense size of the AI chip market, it’s reasonable to expect AMD to benefit from the growth driven by AI applications.

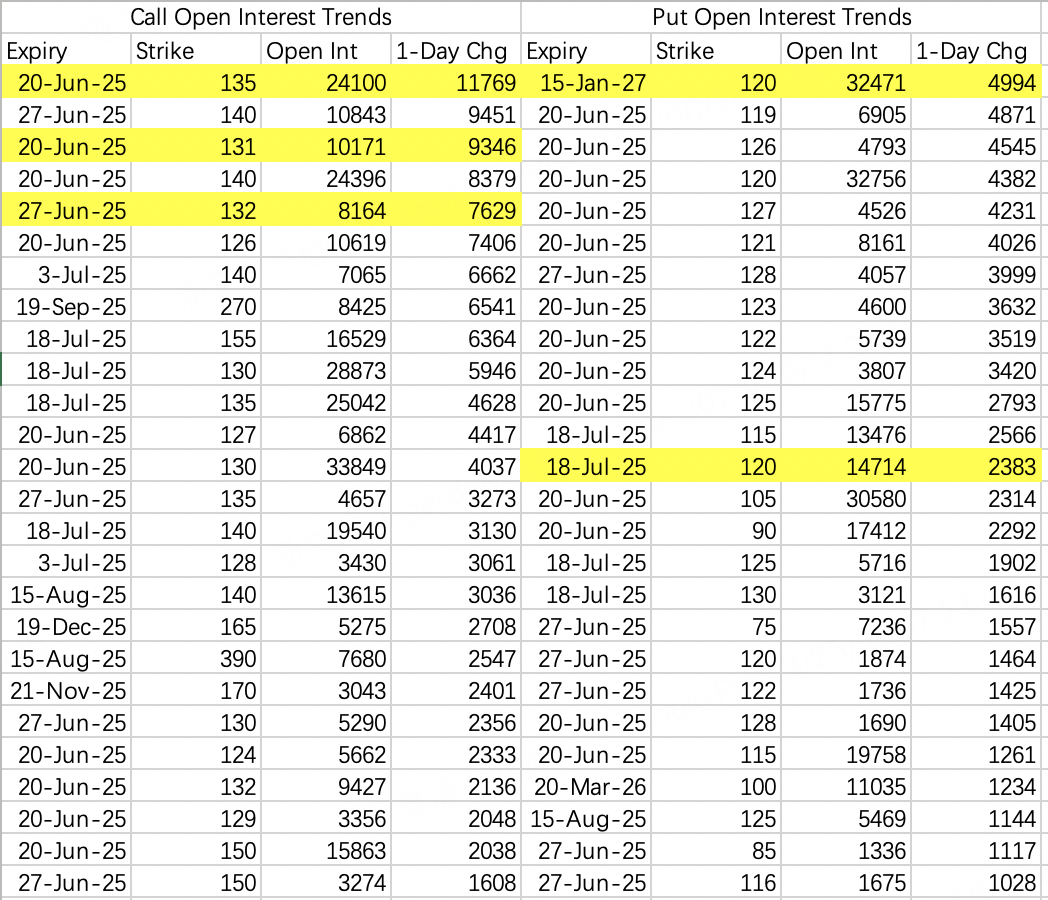

Institutional sell calls were heavily short-squeezed, with further squeezing likely. At the market open, institutions rolled their positions, selling the $126 call and shorting the $132 call expiring next week. Additionally, notable activity was observed in call options at the $140 strike across various expiration dates, signaling an upward adjustment in AMD’s bullish price targets.

On the bearish side, the $120 put has become the preferred target for shorts, implying a potential pullback to pre-rally levels from Monday.

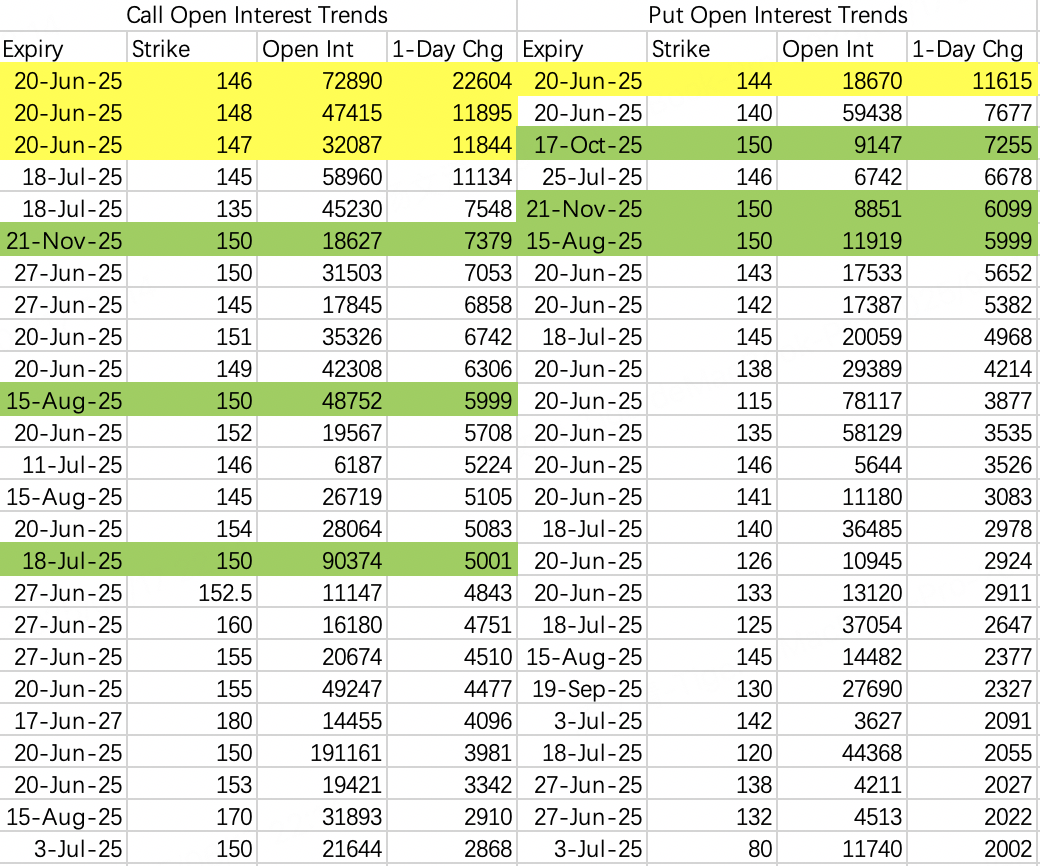

NVIDIA’s trading range is likely to close between $140 and $145 by Friday. As seen on the chart, both bullish and bearish open interest appears to be clustering like auction bids.

What stands out is the heavy trading volume on straddle positions with a strike price of $150. These straddles have expiration dates in July, August, October, and November, indicating that $150 is the next key target level.

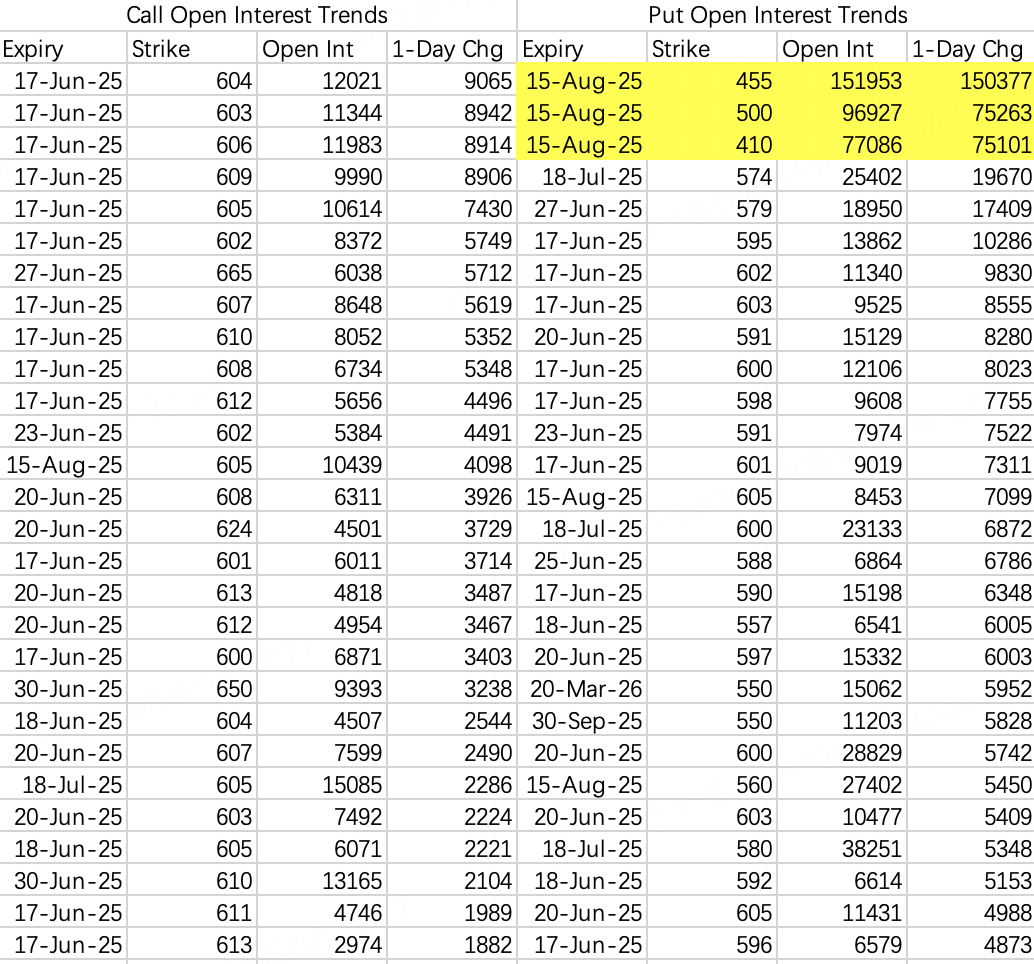

There is no significant long-term bullish sentiment in SPY, suggesting that the current optimism is concentrated solely in the AI sector. The trading range remains relatively stable, between $592 and $609.

Comments