This week remains a good opportunity to sell calls on price rallies.

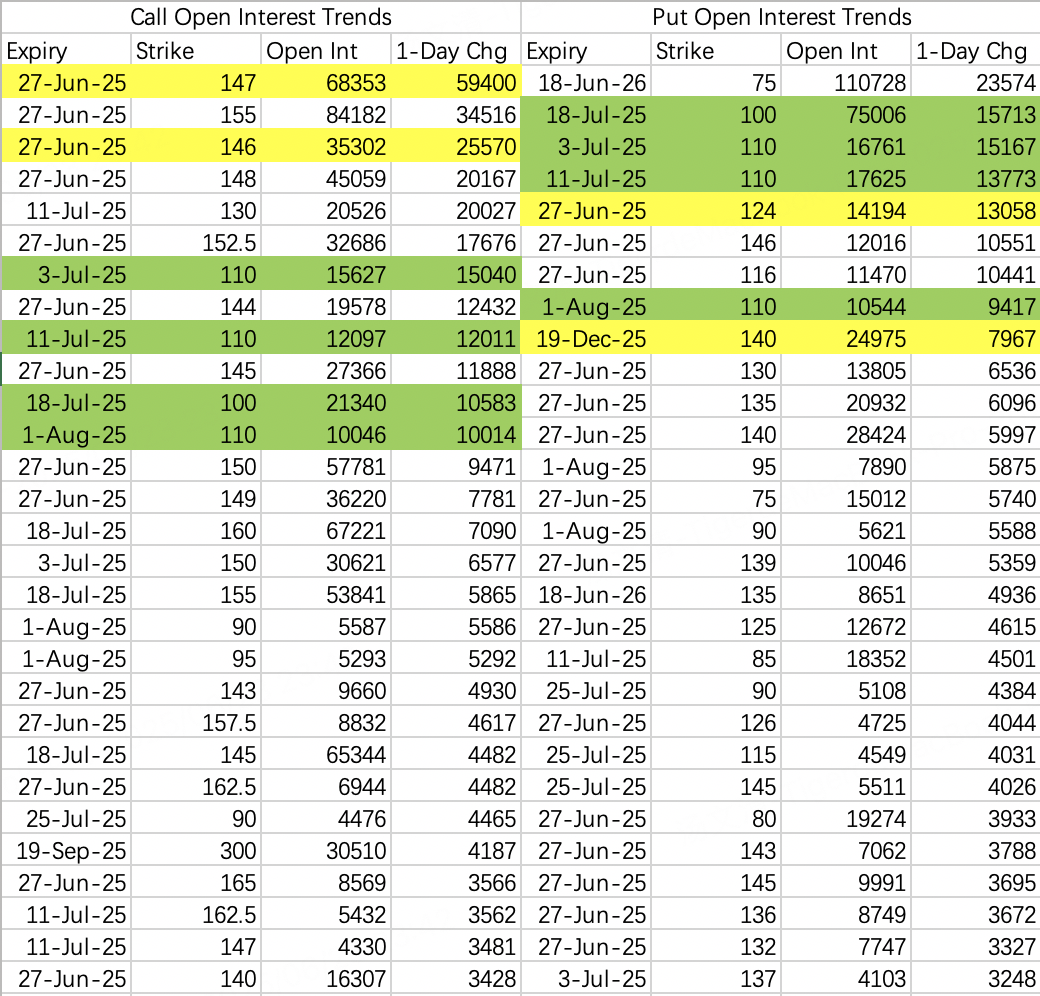

Institutional arbitrage strategies suggest selling calls with strike prices at 146 and 147, which generally indicate a bearish outlook. For covered call positions, these two strike prices are a good choice. For non-holding positions, consider strike prices at 152.5 and 155, with expiration dates either this week or next week.

As for the pullback range, there is no consensus between bears and bulls. There are at least three perspectives: a flat range around 140, a moderate pullback to 124, and a deep drop. All in all, under such circumstances, it’s difficult for the stock to rise, making it suitable for selling calls.

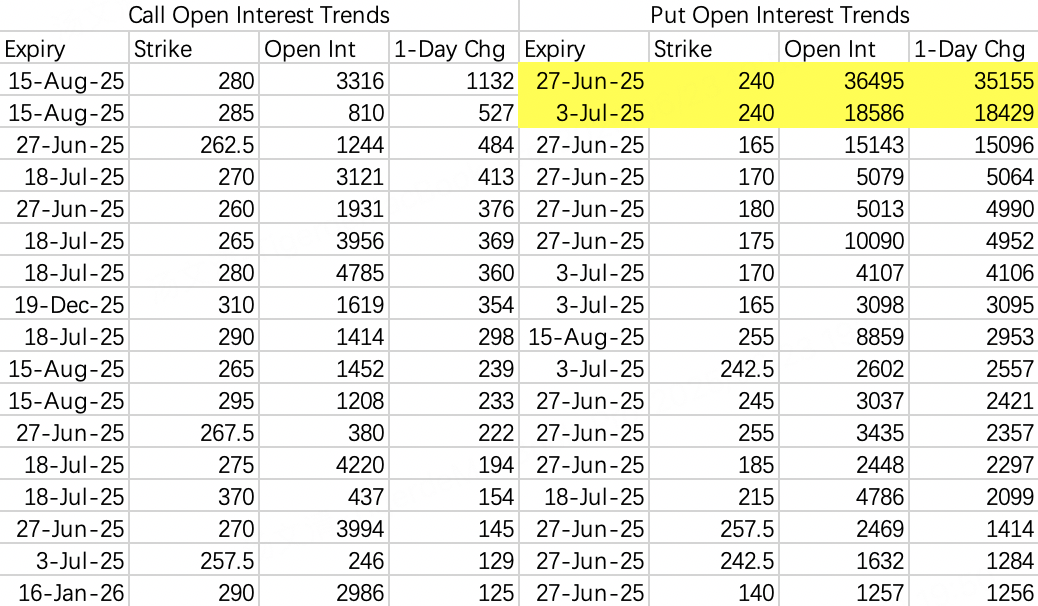

$VanEck Semiconductor ETF(SMH)$

A large bearish options trade worth approximately $4 million has been spotted, with the following contracts expiring this week and next week:

$SMH 20250627 240.0 PUT$

$SMH 20250703 240.0 PUT$ .

Currently, SMH is trading at 260, and bears likely expect a pullback to the 200-day moving average.

The accuracy of SMH's large trades is about 50/50, but the expiration dates are worth noting. As concluded last Friday, if bears act, it will likely happen this week.

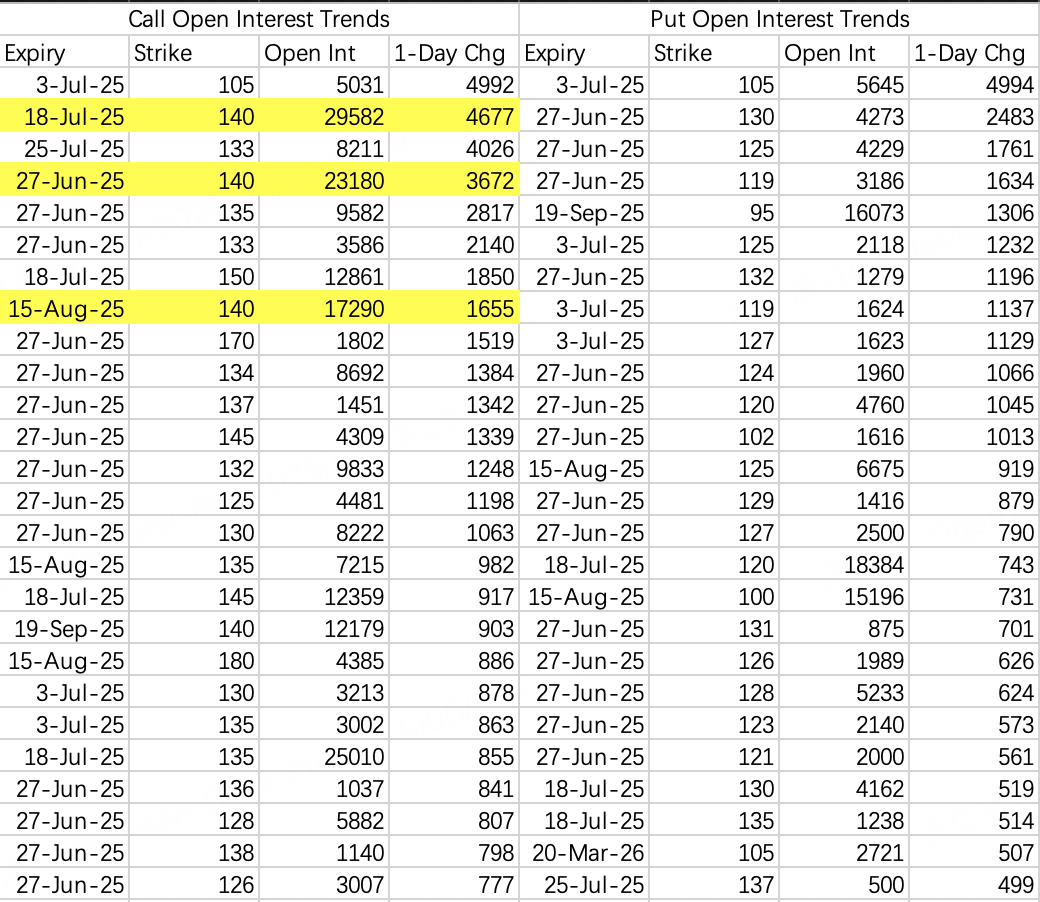

Sell calls at 140 on price rallies, with expirations this week or next week.

Institutional arbitrage strategies suggest selling calls at strike prices of 132 and 134. We can follow the institutional hedging strategy by choosing 140 as the strike price. Additionally, given AMD’s pattern of opening high and closing low daily, it seems feasible to sell calls on price rallies regularly.

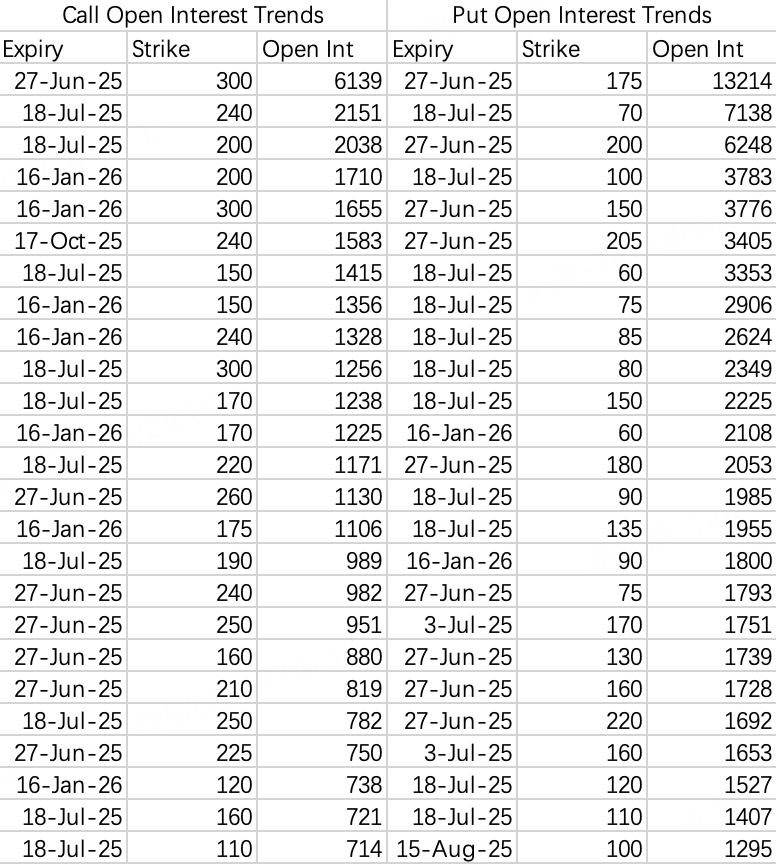

I've always wanted to analyze this but find it challenging to start:

Open interest data is not very meaningful since the upper limit of strike prices increases daily. Today, the strike price reached 445, while the stock’s highest price is 298. Options trading here can only passively respond to demand.

Implied volatility is excessively high. At-the-money options have an implied volatility of 230%, making options prices extremely expensive, with high margin requirements.

Based on the open interest, the highest open interest for calls is on the 300 call expiring this week, with 6,139 contracts. If the price fails to break above 300 in the first few days of this week, shorting may be considered.

Comments