June 28 marks Elon Musk's birthday. I remember this time last year, Musk was riding high, and Tesla stock surged 27% during the U.S. Independence Day week. Back then, I jokingly commented that Wall Street was incredibly patriotic.

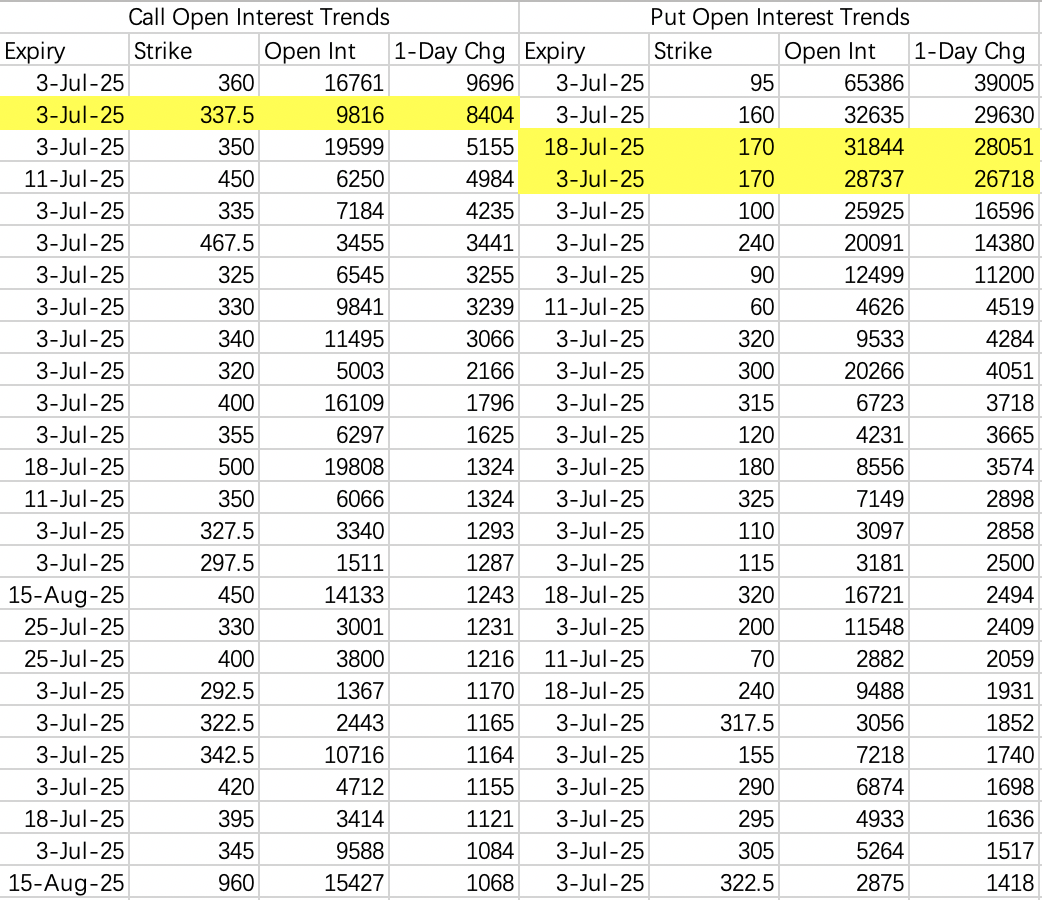

However, one year later, whether Wall Street is patriotic or not, it’s clear that they are no longer in love with Tesla. Bearish positions indicate that shorts are once again betting on Tesla’s stock being halved. For example, there’s a new position of 28,000 contracts for the $TSLA 20250718 170.0 PUT$ , with a total transaction value of approximately $868,000.

Don’t ask—the early July delivery report will surely be another mess.

Institutions are selling calls at 337.5 and hedging at 360. I’ve chosen to sell calls as well: $TSLA 20250703 350.0 CALL$ .

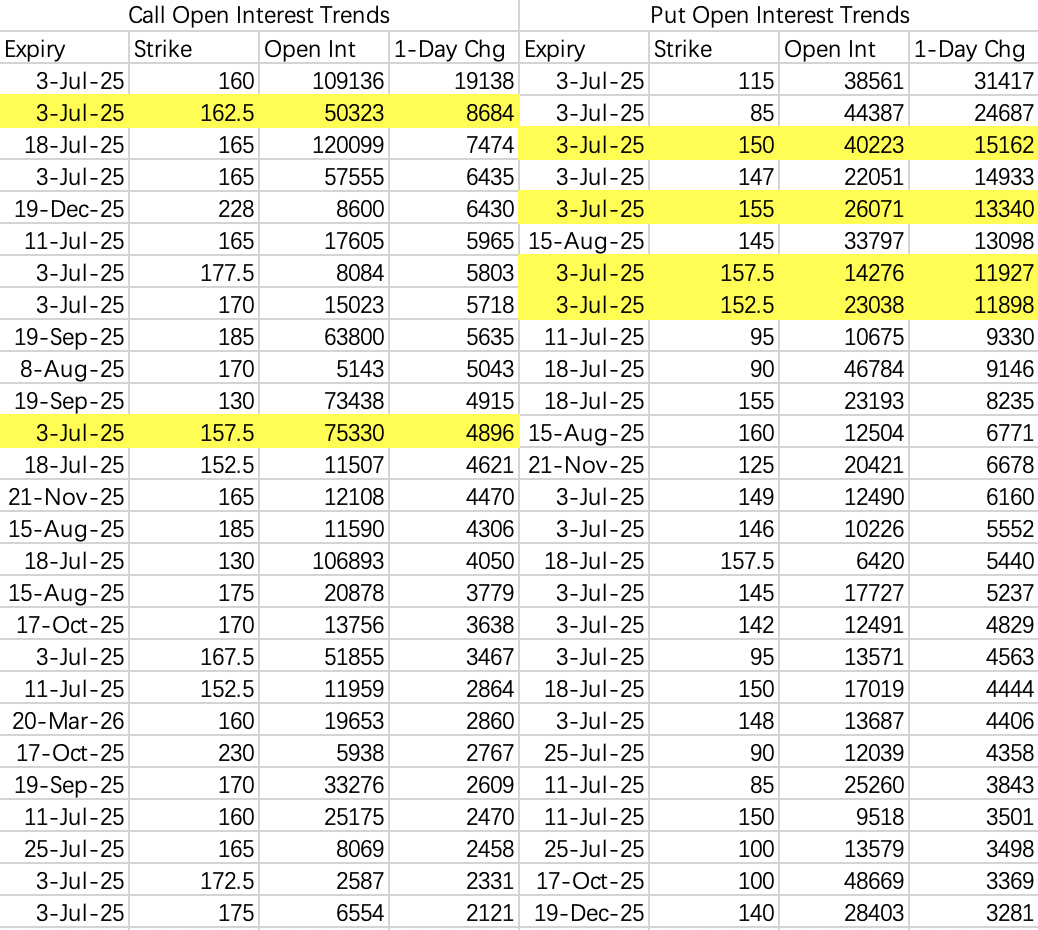

The newly opened bearish put positions are somewhat similar to the bullish call positions opened last Monday. There’s a gradient of positions opened from 157.5 to 150, with over 10,000 contracts at each strike. This indicates that bears are preparing to push the price down to 150.

Given the Independence Day holiday, a pullback to 150 seems a bit extreme, but I think some consolidation or a slight pullback is inevitable.

Institutions are selling calls at 157.5, which is quite aggressive. We’re probably done with short squeezes this week… right?

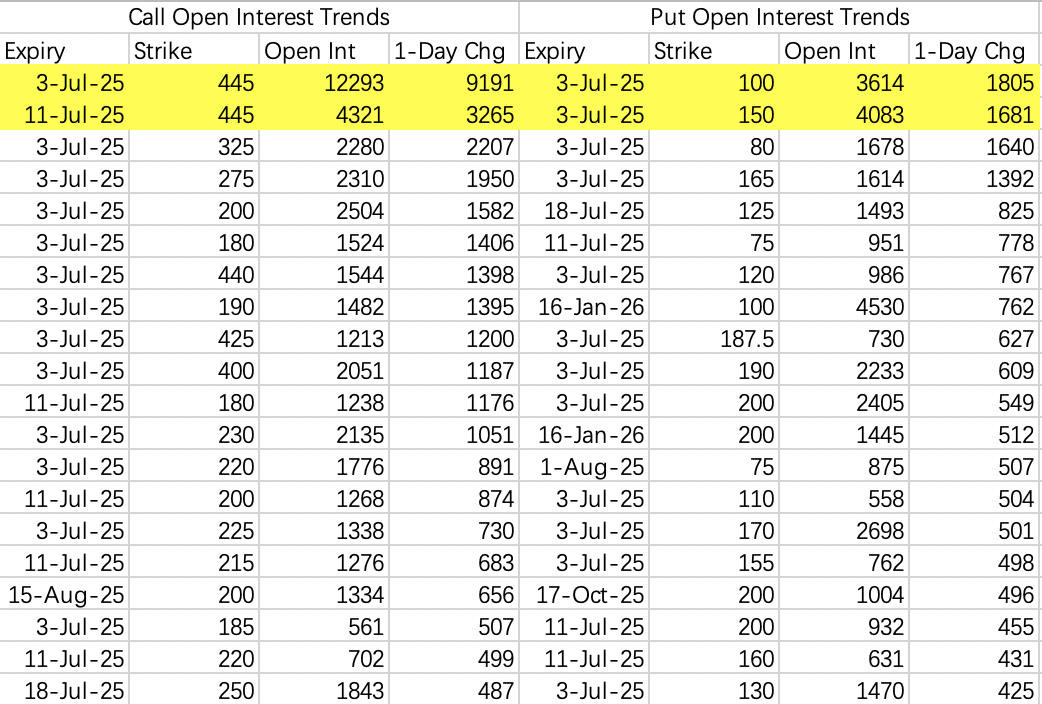

The most frequently opened sell-call strike is 445. Selling the July 11 445 calls offers an annualized return of 10.6%. However, the margin requirements are quite high, which prevents the use of leverage.

On the bearish side, the put positions are mostly initiated by buyers, indicating that bears expect the stock price to be halved. However, most of these are speculative trades.

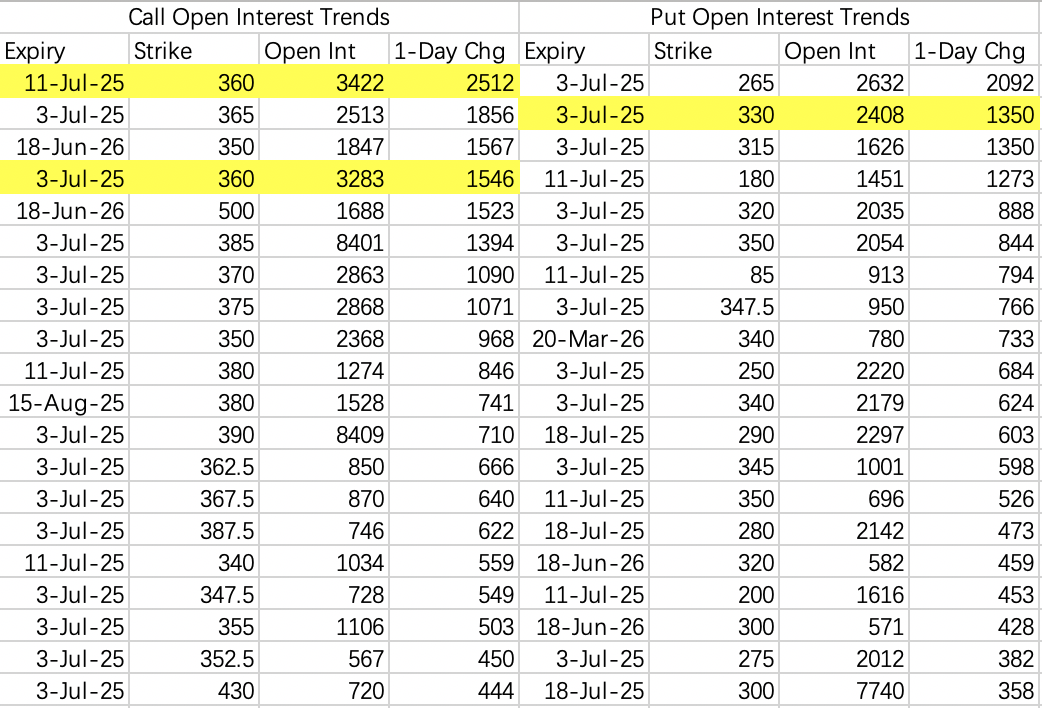

The stock is trading in a narrow range between 330 and 360. For a strangle strategy, I would choose strikes outside the 300–380 range.

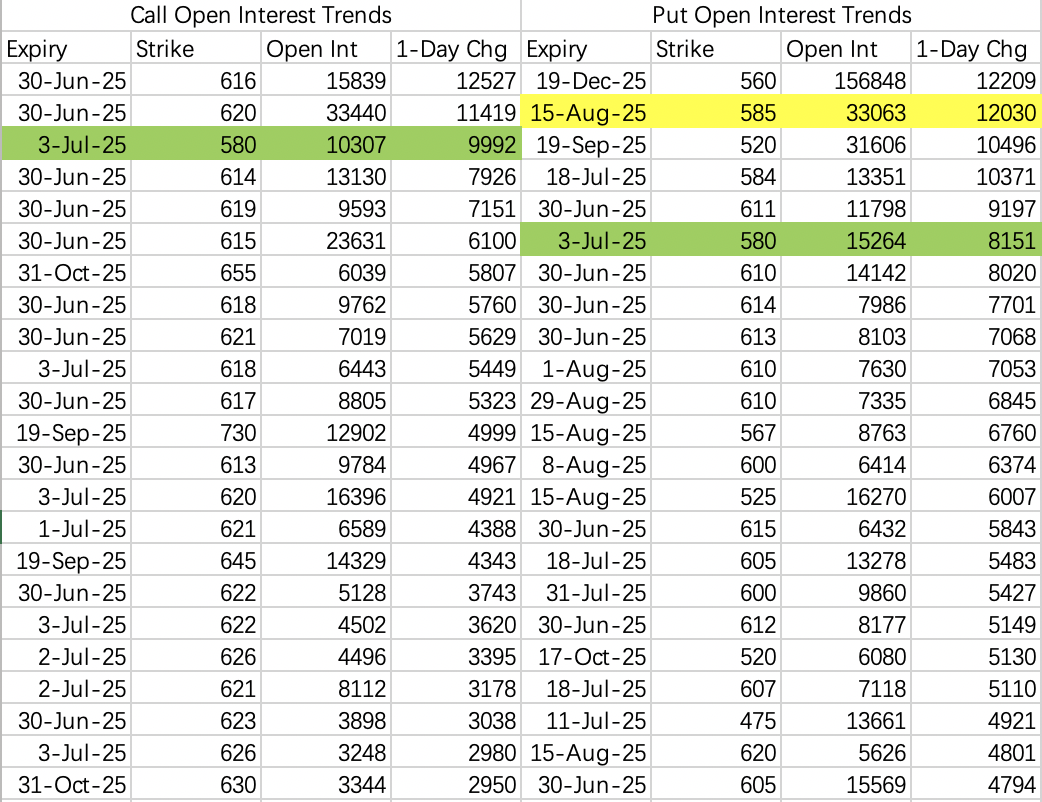

The straddle position opened for this week’s expiration at a strike of 580 is worth noting: $SPY 20250703 580.0 PUT$ and $SPY 20250703 580.0 CALL$ .

Comments