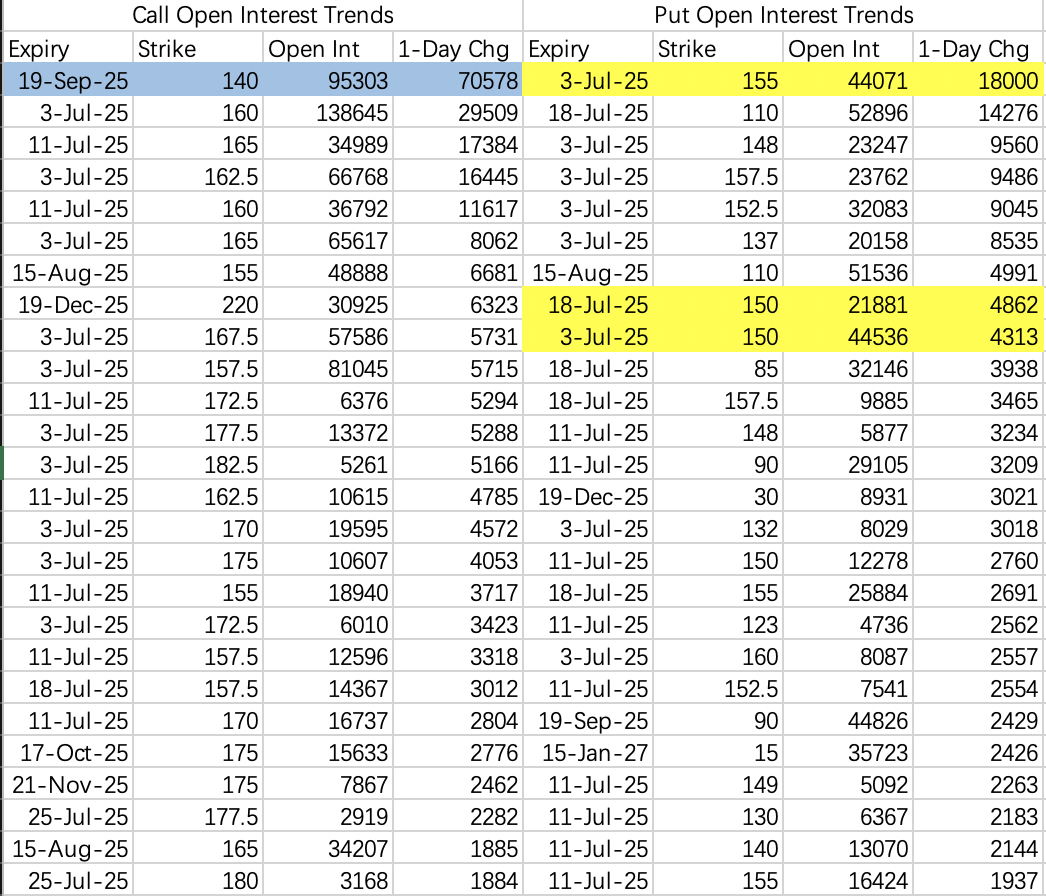

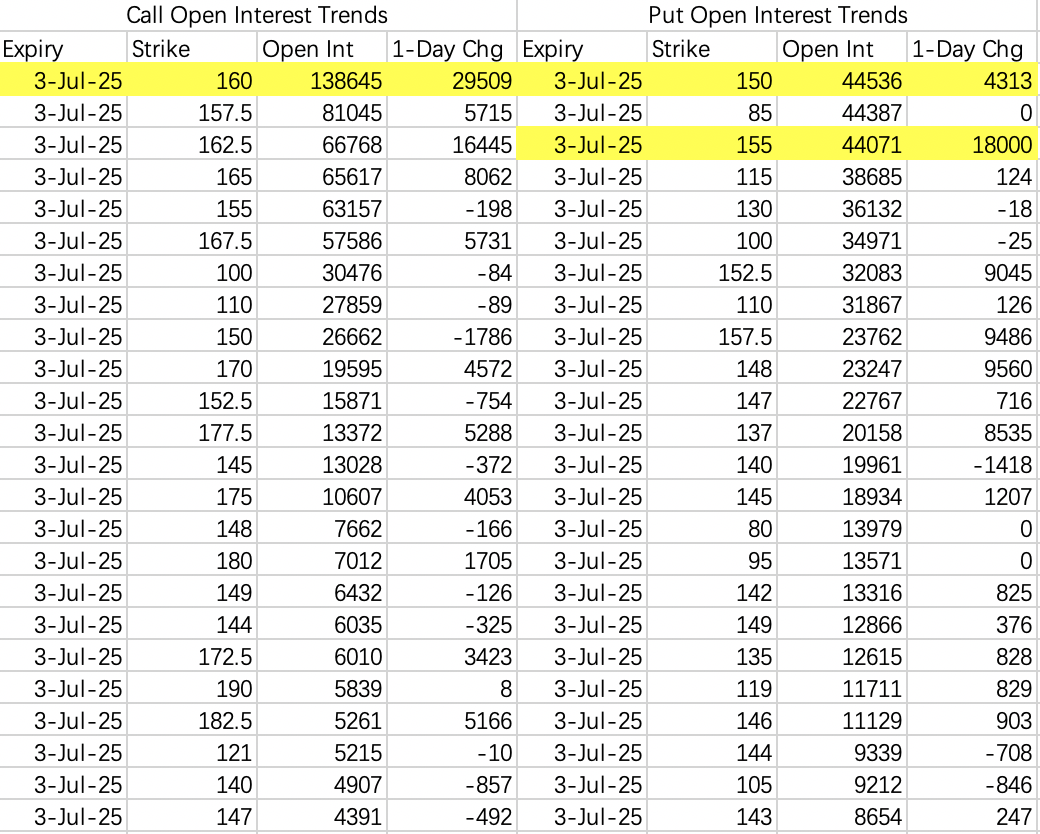

On Monday, 18,000 contracts of the 155 puts expiring this week were opened, clearly a bearish signal. The stock is expected to pull back to below 155 but remain above 150. On the bullish side, sell-call strategies dominate, making it unlikely for the stock to reach 160 this week.

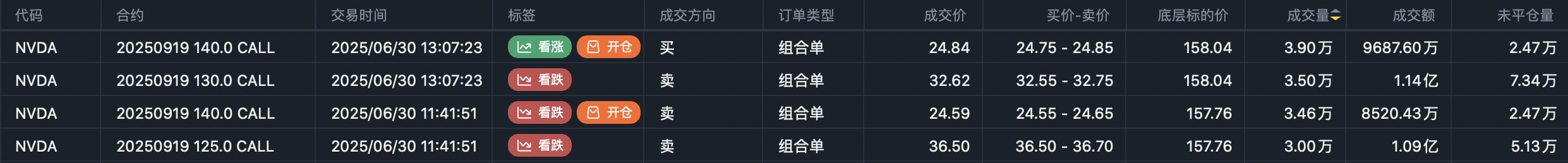

Of particular note is that the “$200 Million Trader” rolled their September 125 and 130 calls into the September 140 calls. Not only was the strike price increased, but the trading volume also picked up, indicating that this trader is optimistic about NVIDIA’s stock performance during earnings season.

The stock is likely to close this week between 150–160, or possibly between 155–160.

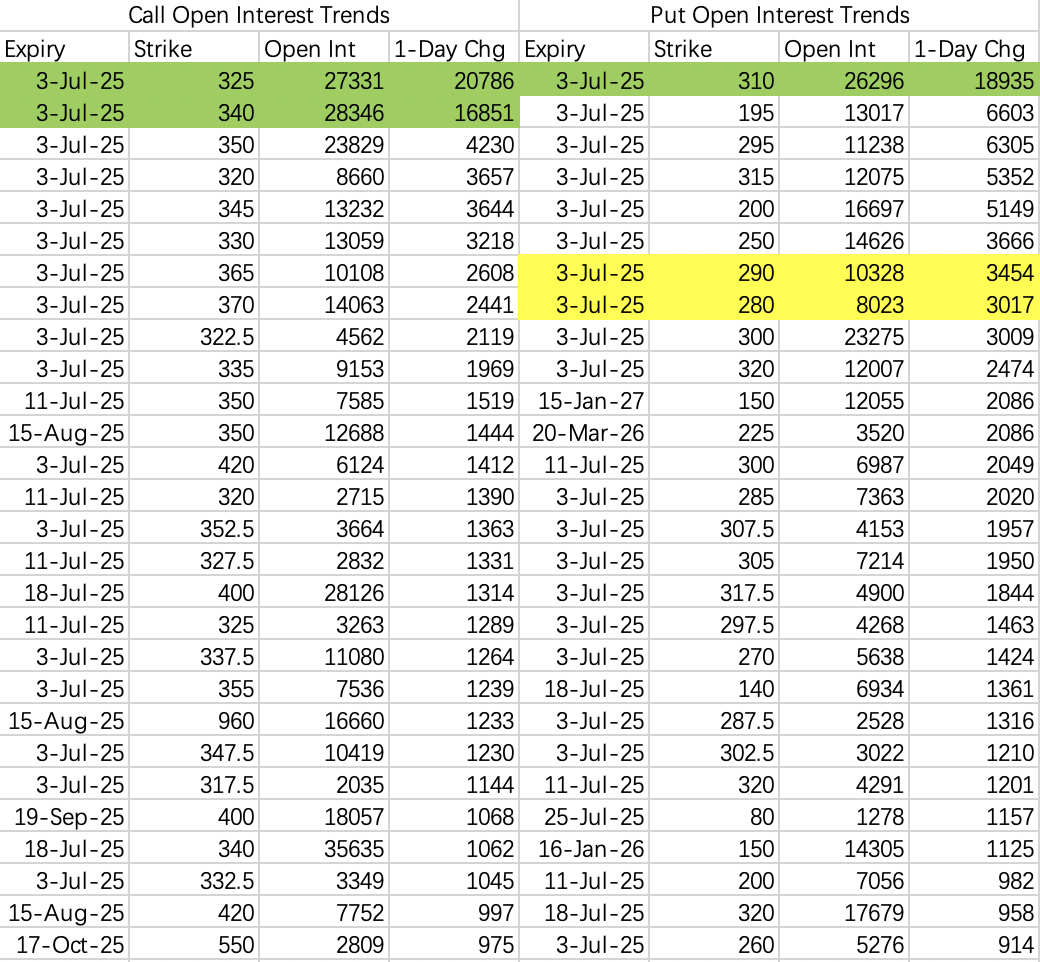

The argument between Elon Musk and Donald Trump is a short-term bearish factor, as reflected in the expiry dates of newly opened bearish put positions.

On Monday, a trader initiated a short-term bearish strategy: buying the 340 call, selling the 325 call, and buying the 310 put, all expiring on July 3. The 310 put strike price isn’t deeply bearish, suggesting that bears believe the impact of this incident on Tesla’s stock price is moderate.

For sell-put strategies, strike prices below 270 can be considered: $TSLA 20250703 270.0 PUT$ and $TSLA 20250703 260.0 PUT$ .

Looking at the 170 puts expiring on July 18: $TSLA 20250718 170.0 PUT$ , they haven’t been closed yet, which suggests there might be additional bearish news. It’s advisable to take profits on short-term trades for now.

Comments