The confusing pullback has ended, and it was very brief. On Tuesday, NVIDIA touched a low of 151.49 before quickly rebounding. Overall, it seems like the market will remain stable through the Fourth of July holiday.

A rather cynical theory is that the market, at its current high levels, lacks upward momentum. A small dip could attract shorts, only for a short squeeze to push the market higher on Wednesday.

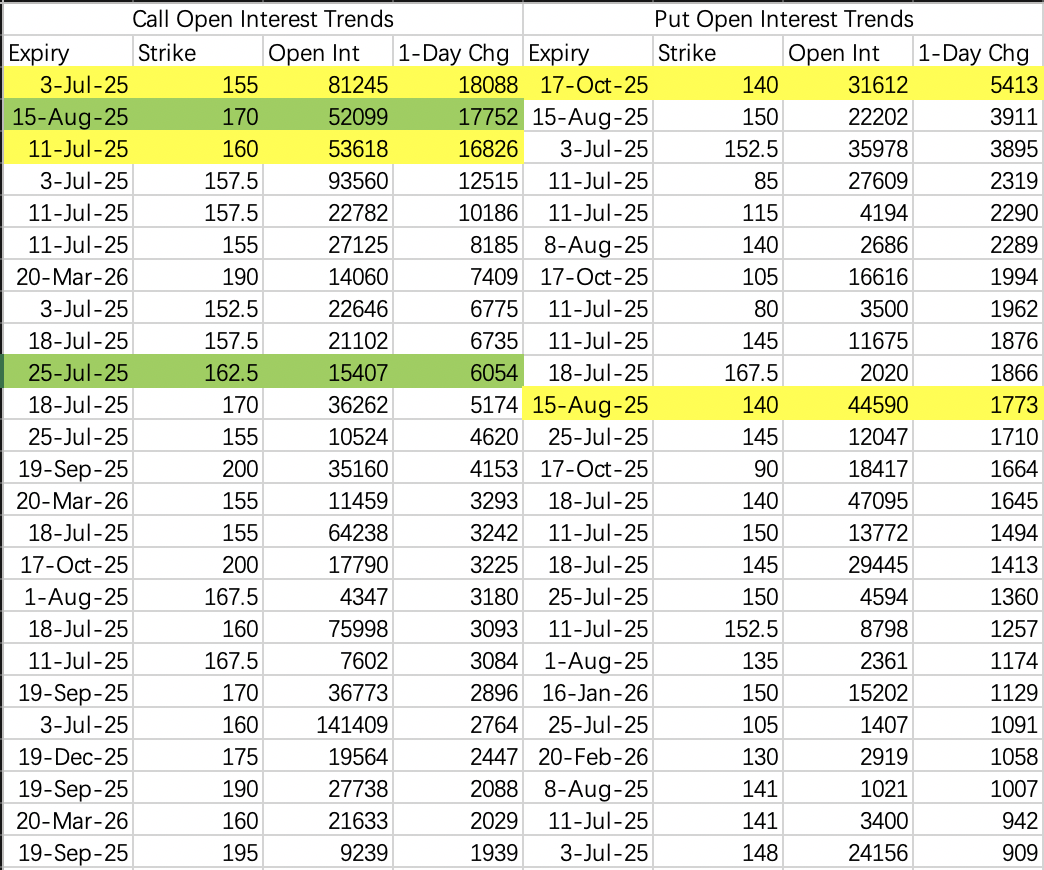

This isn’t entirely speculation—options open interest data shows that new bullish call positions far outpace bearish put positions, with sellers dominating. For example, the $NVDA 20250815 170.0 CALL$ expiring in August saw 17,700 contracts opened, mostly from sellers.

The highest open interest on bearish puts is for the $NVDA 20251017 140.0 PUT$ expiring in October, also dominated by sellers.

Barring surprises, NVIDIA is expected to close this week near 155, while institutions are continuing to sell calls expiring next week at the 160 strike.

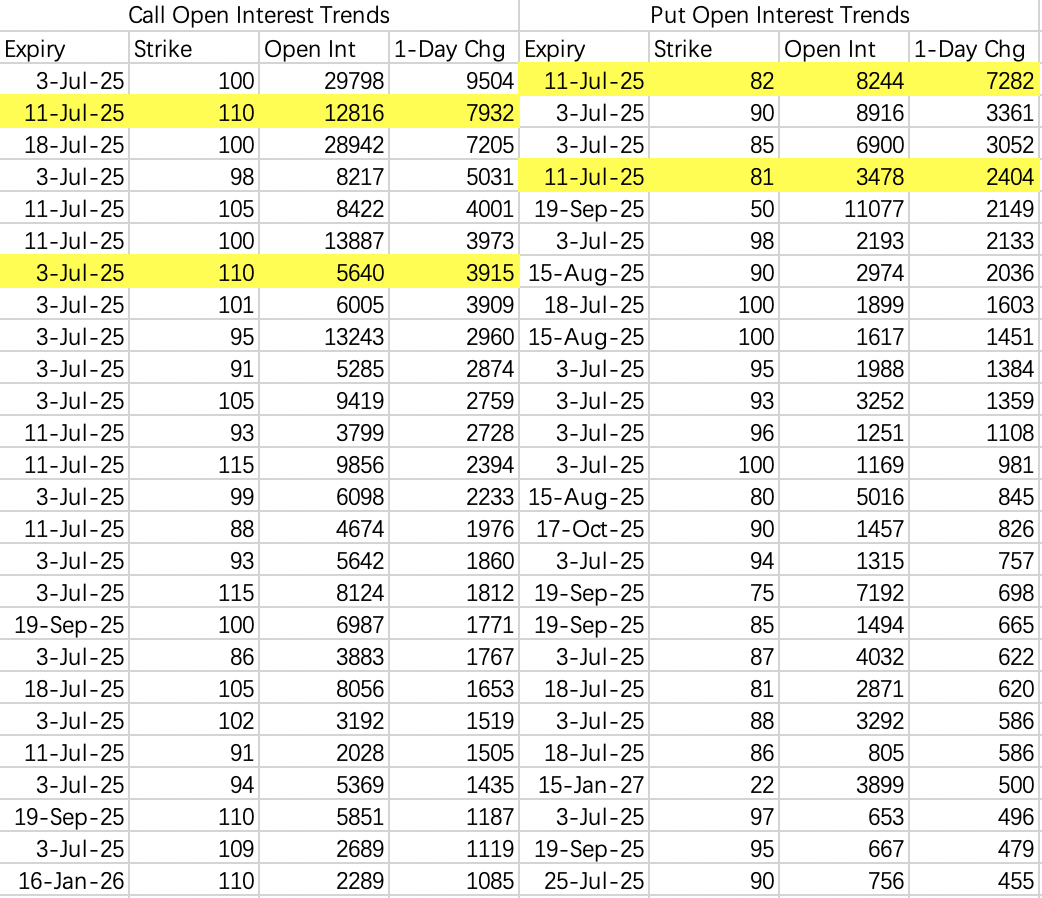

Another interesting note: the far-dated long calls for $ARM Holdings (ARM)$ expiring in 2027 haven’t seen any new positions since last Friday, but there’s also been no selling. This could indicate that traders believe buying above 155 isn’t worthwhile or that they anticipated the recent pullback.

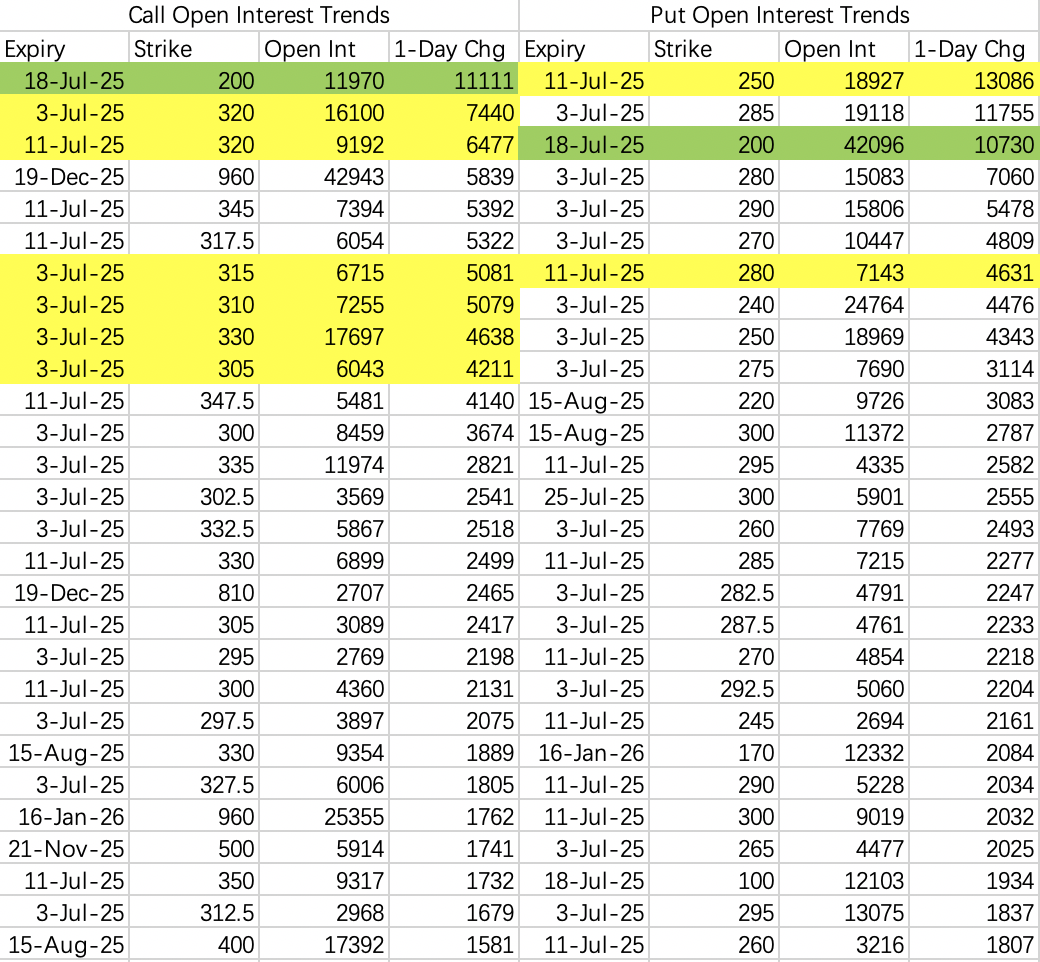

On Tuesday’s dip, institutions chose to sell calls in the 317.5–320 range, which carries some risk of liquidation.

Bearish put positions were surprisingly normal. There’s clear support around 285, while intense buy-sell battles are happening at the 250 put level. It seems the market has become familiar with the pattern of Musk and Trump’s arguments, and traders aren’t making significant risk-hedging moves for this week.

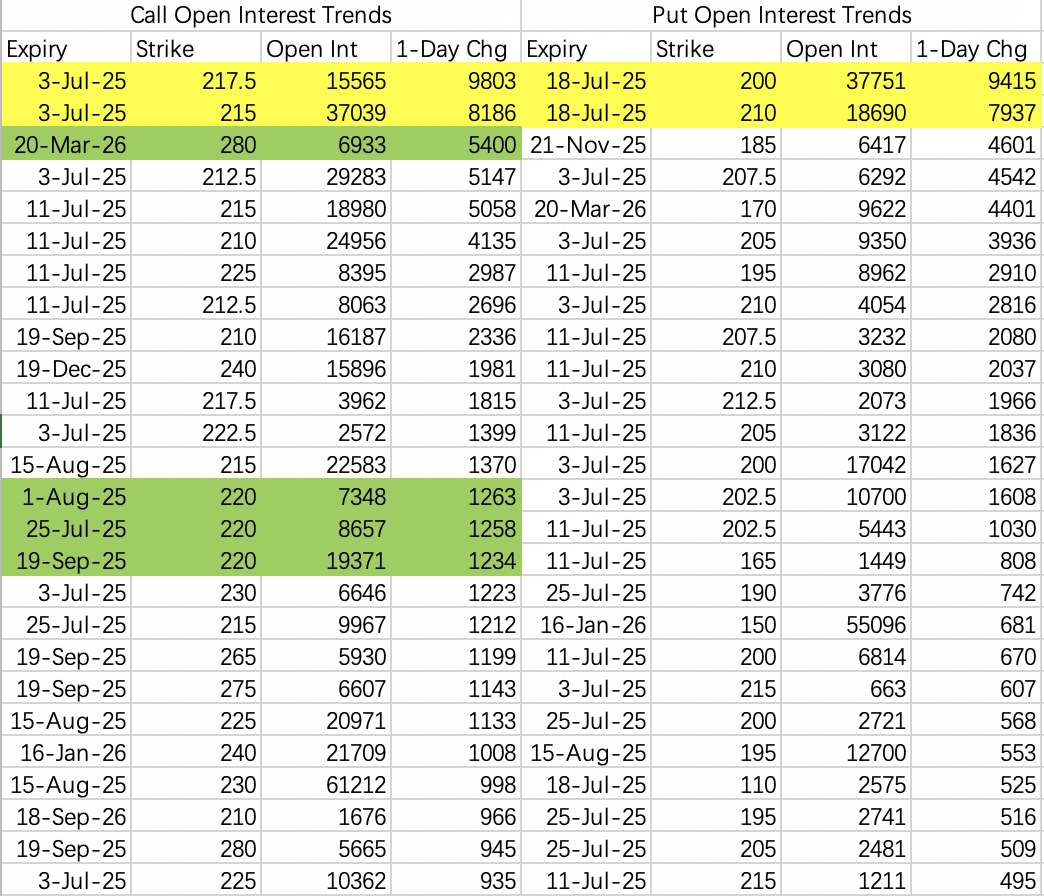

The current rally could push the stock to around 220.

Options trading here is a typical case of chasing the stock price. For bullish calls, the $HOOD 20250815 110.0 CALL$ is dominated by sellers. On the bearish side, a significant put position was opened for the $HOOD 20250711 83.0 PUT$ , expiring on July 11.

Comments