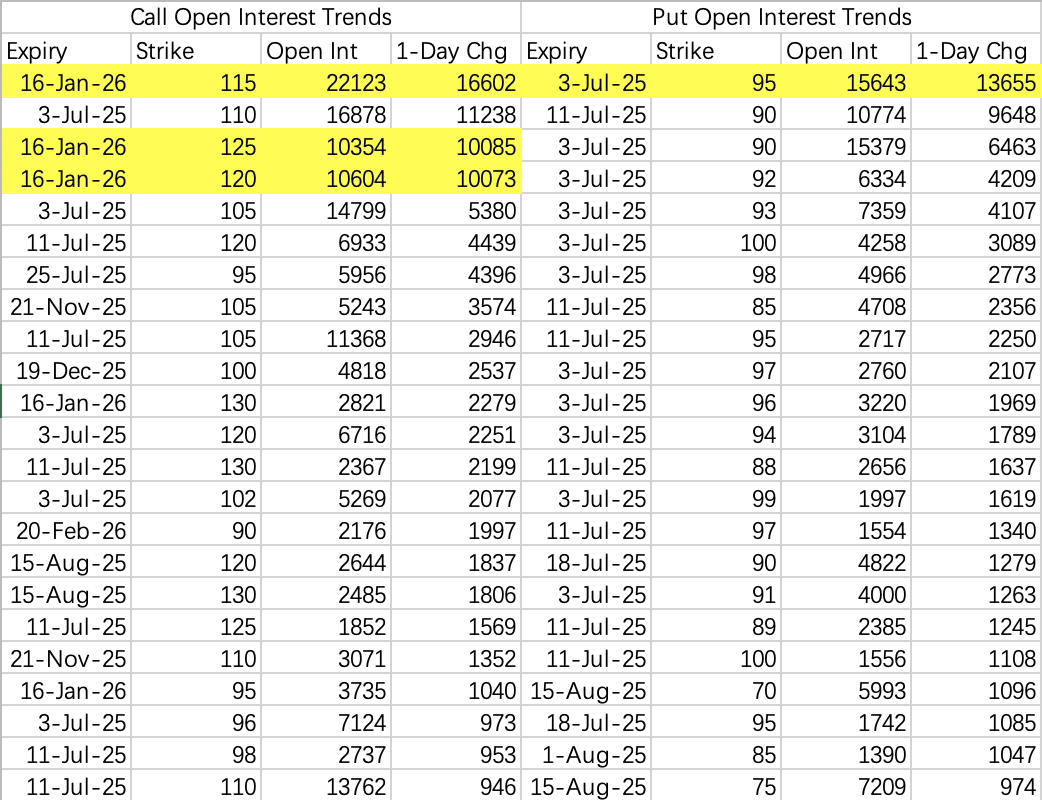

Due to a sudden rally, HOOD’s recent options daily trading volume exceeded 1 million contracts. After a closer look, it appears that institutions may have been involved in bullish positions: 16,600 contracts opened for the 2026 expiry 115 call, over 10,000 contracts for the 120 call, and 12,500 contracts for the 125 call.

Upon further investigation, these bullish option positions were part of a roll trade. The 82 and 85 calls expiring this week ($HOOD 20250703 83.0 CALL$ and $HOOD 20250703 85.0 CALL$ ) were closed and rolled into the 2026 expiry 115, 120, and 125 calls ($HOOD 20260116 115.0 CALL$ , $HOOD 20260116 120.0 CALL$ , and $HOOD 20260116 125.0 CALL$ ).

Were the 83 and 85 calls expiring this week good positions to open?

Based on option charts:

The 83 call ($HOOD 20250703 83.0 CALL$ ) was opened on June 25, three days before the rally.

The 85 call ($HOOD 20250703 85.0 CALL$ ) has great liquidity, so it’s unclear when it was first opened, but it likely dates back to early June.

No doubt, these large positions in the 83 and 85 calls were likely opened with some insider knowledge.

It’s common for insider traders to buy options near expiration dates. After profiting, they’ll quickly close their positions, and if they roll them, they tend to choose options with later expiration dates. In this case, the trader closed half of their position and rolled the other half into January 2026 options.

This suggests the trader believes the stock has entered a consolidation phase, where short-term calls would suffer significant time decay. However, they remain bullish on HOOD’s long-term trend and expect the stock price to reach $130 by the end of the year.

Strategy Suggestions:

Bullish on HOOD: Consider selling puts at 85.

This week’s 95 puts saw 13,600 contracts opened, indicating a bearish outlook above $90.

Holding shares: Consider selling calls at 110 or 120.

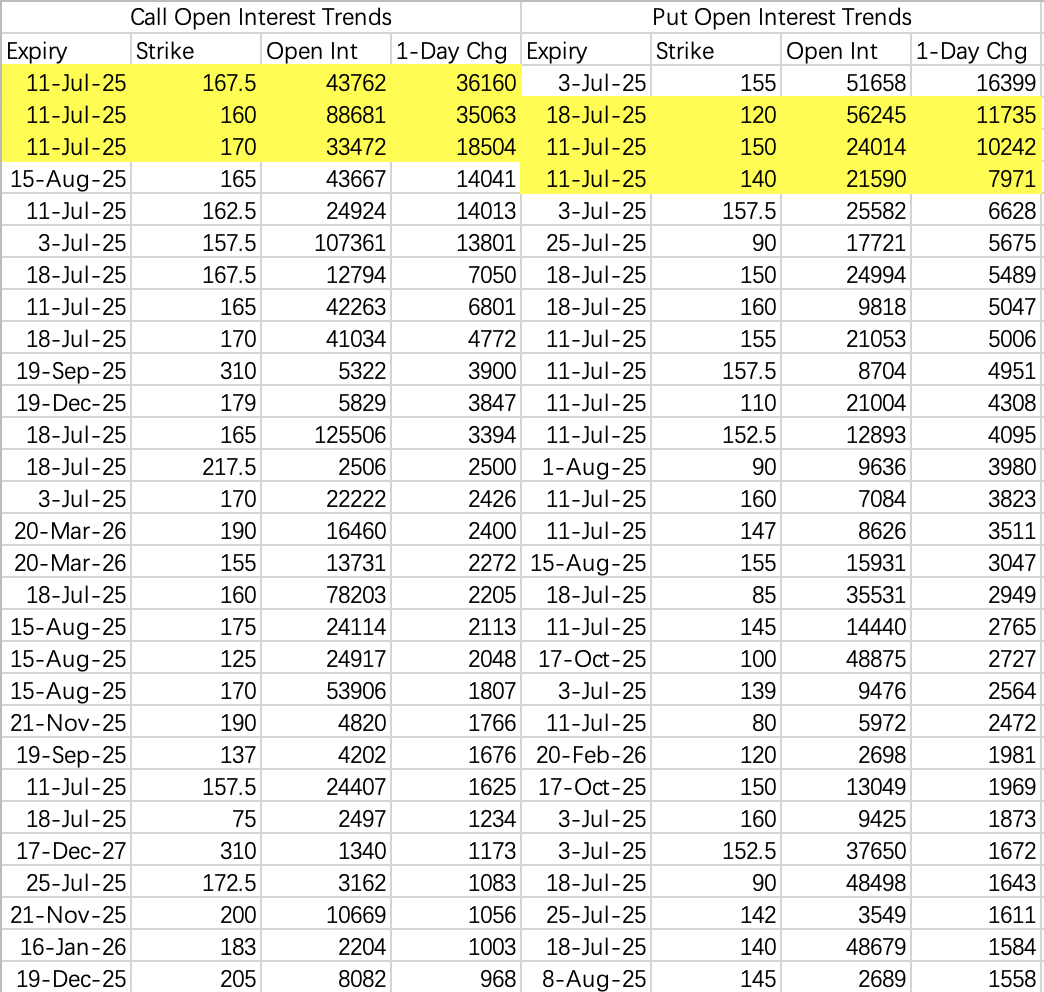

Next week’s expected range: 150–160, though the upper limit remains uncertain.

Bullish positions: Institutions are selling calls at 160 and 162.5, while hedging by buying 167.5 and 170 calls.

Bearish positions:

Most of the activity for the $NVDA 20250711 150.0 PUT$ expiring next week has been from sellers, indicating expectations of an upward trend or consolidation.

On the other hand, most activity for the $NVDA 20250711 140.0 PUT$ expiring next week has been from buyers, suggesting some traders are anticipating a sudden pullback similar to Tuesday’s drop.

Combining SPY Data with NVDA:

The market’s current expectation for a pullback is to return to pre-squeeze levels, which corresponds to around $147 for NVIDIA. I personally favor a sell-put strategy at 150.

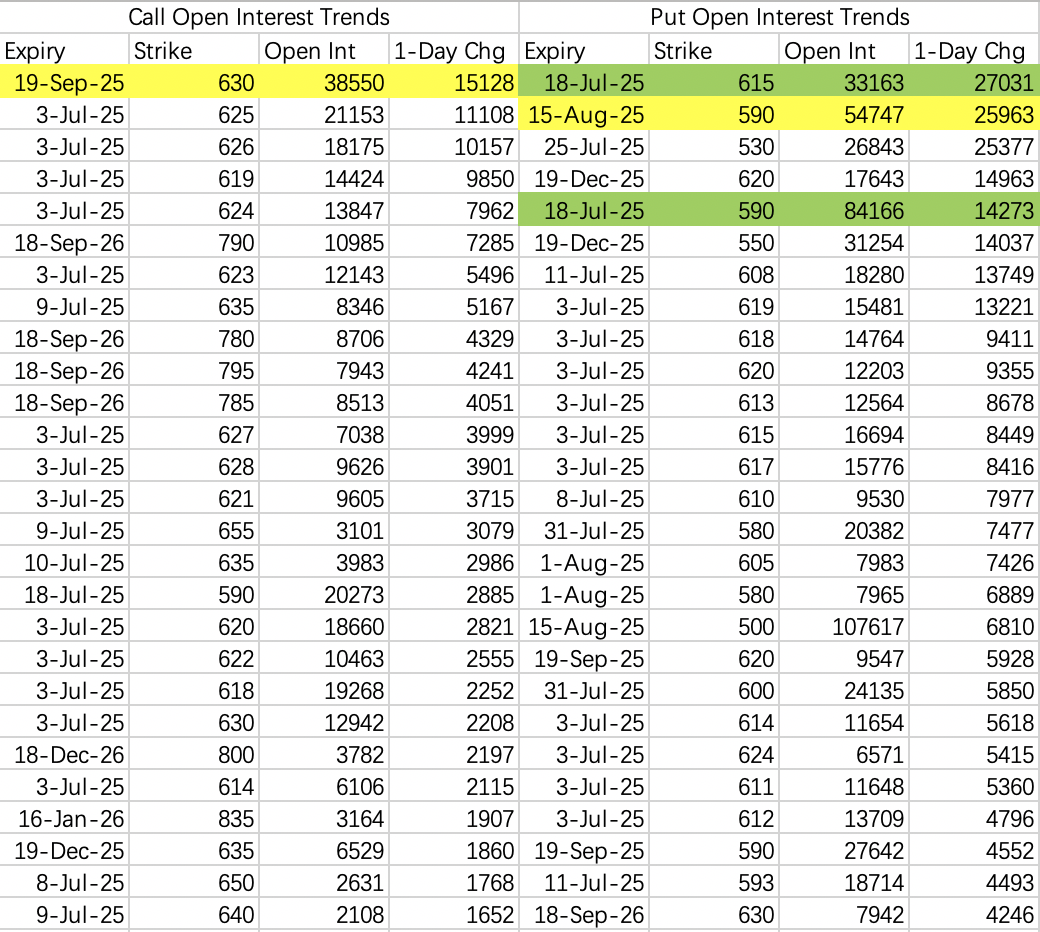

Two significant bearish trades:

A bearish put spread expiring on July 18, using 615 puts and 590 puts, indicating a target range of 590–615.

Institutional hedging via a roll trade: closing August 585 puts and rolling into August 590 puts.

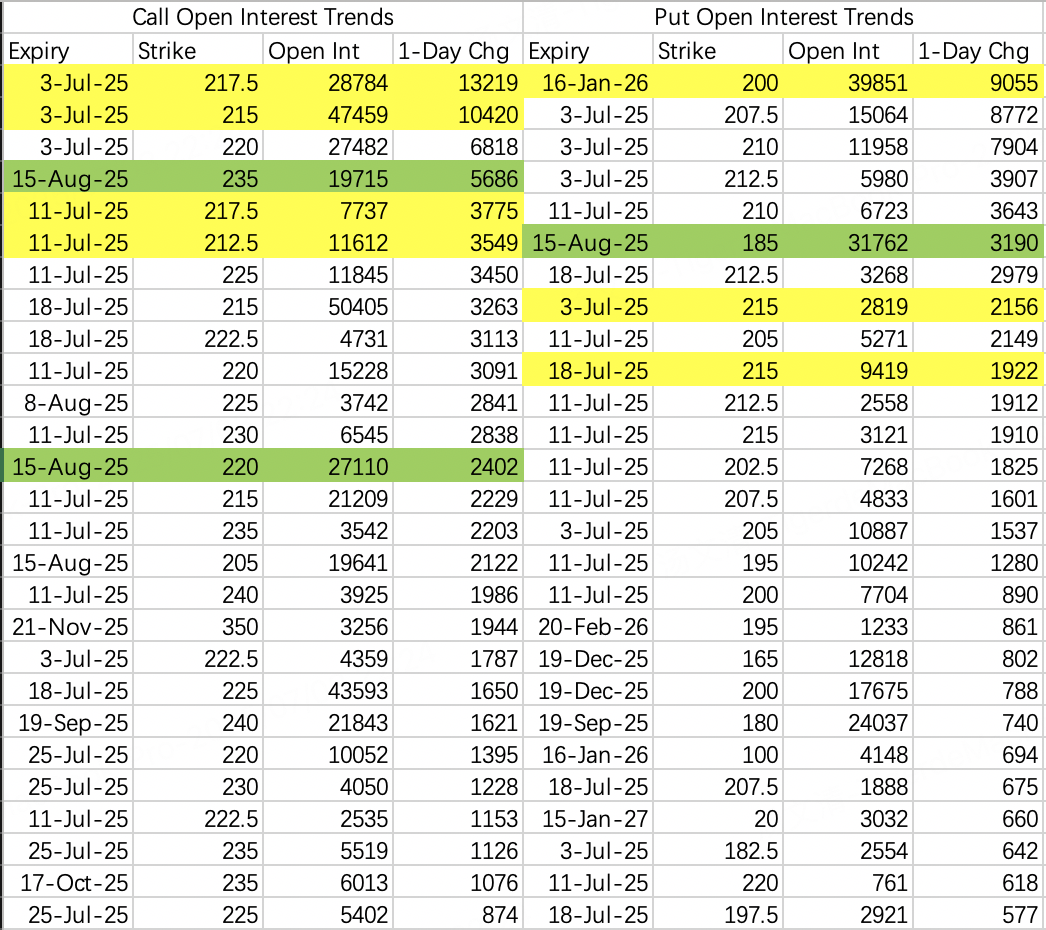

Unusually, bearish positions were opened with deep in-the-money strikes. This could suggest strong confidence in a price level around 215.

For bullish positions, large trades favored conservative strategies: a combination of selling puts, buying calls, and selling calls:

For simplicity, selling puts alone is also an option, with suitable strikes between 200–210.

My Trade:

Sell call: $HOOD 20250711 110.0 CALL$

Comments