$NVIDIA(NVDA)$

The market may see fluctuations in the range of $S&P 500 Volatility Index (VIX)$ between 20 and 30 in the near term.

I've been calling for a pullback for two weeks, and I’ll continue to do so — NVIDIA is due for a covered call strategy. Judging by the trend, a pullback is inevitable in the near term. Selling calls this week is a safe bet.

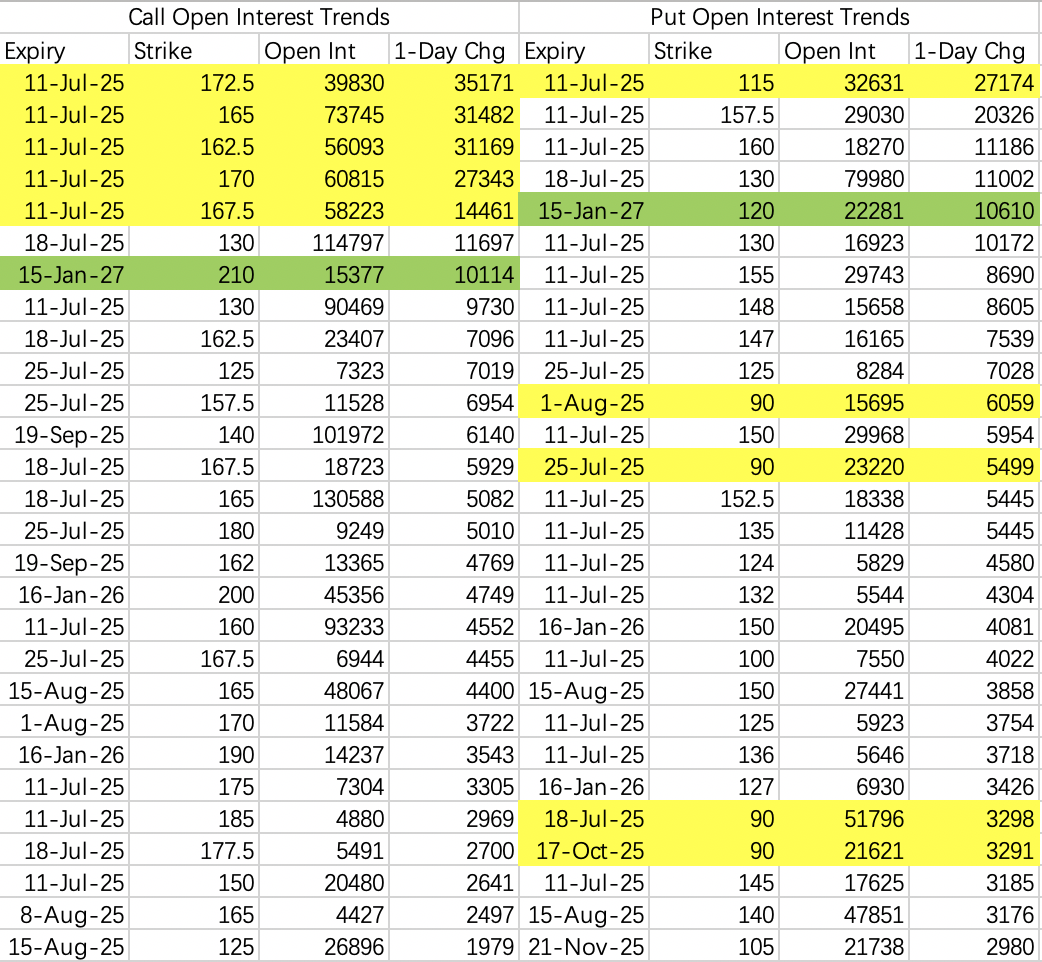

Institutions are selling calls at strike prices of 160, 162.5, and 165, while hedging with 170 and 172.5.

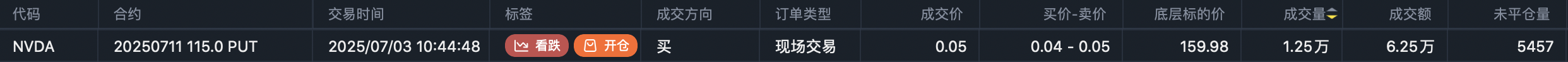

On the put side, there’s something noteworthy: institutions have opened 27,000 contracts of 115 puts $NVDA 20250711 115.0 PUT$ , likely betting on a sudden volatility spike. I expect this pullback to bring the price to around 140, possibly as low as 130.

Be cautious with long positions in the short term. Long-term bulls who previously bottom-fished are halting additional buying and starting to close positions, such as:

This week, I won’t consider selling puts but will sell calls at 165 $NVDA 20250711 165.0 CALL$ .

$Tesla Motors(TSLA)$

Unlike last week’s mild pullback, this week someone’s betting on a larger move.

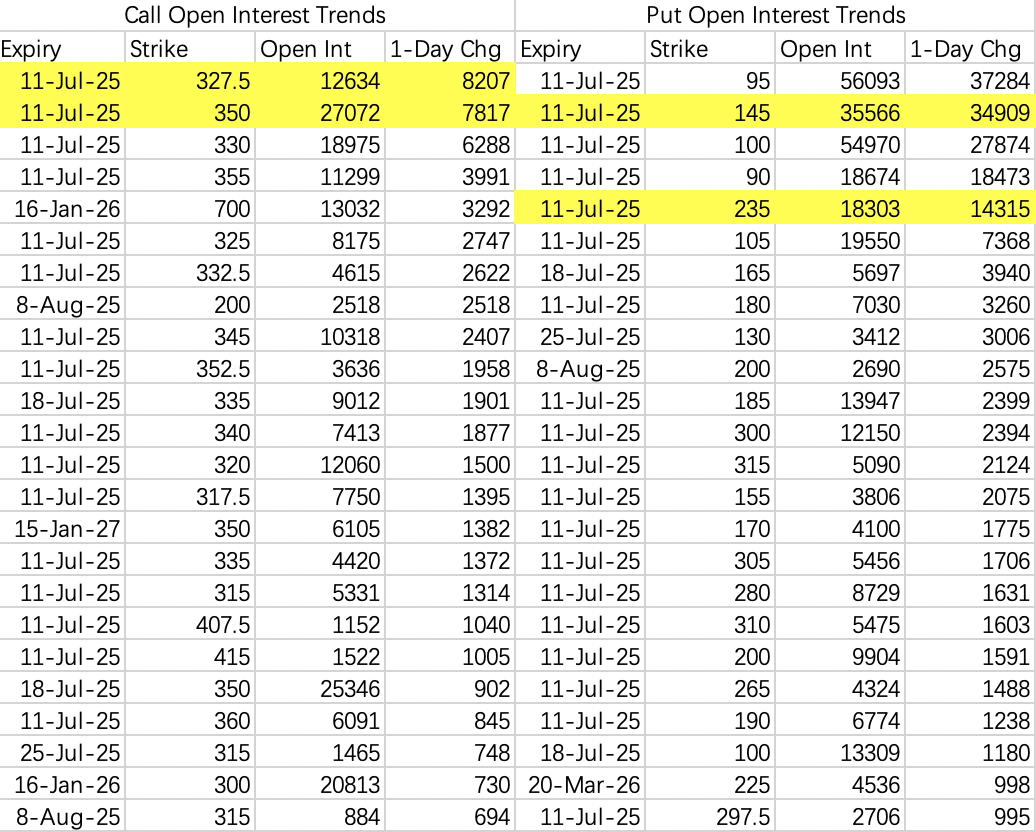

There’s notable activity on bearish options expiring this week:

145 put $TSLA 20250711 145.0 PUT$ (on-exchange trades).

235 put $TSLA 20250711 235.0 PUT$ (bought positions).

The 145 put seems to be a volatility play, while I joined the 235 put for a small position — it’s cheap, so I’m treating it like a lottery ticket.

On the bullish side, institutions are selling calls at 327.5 $TSLA 20250711 327.5 CALL$ .

Tesla’s involvement in political matters has made it a prime target for criticism. This week’s volatility reflects that risk.

$Financial Select Sector SPDR Fund(XLF)$

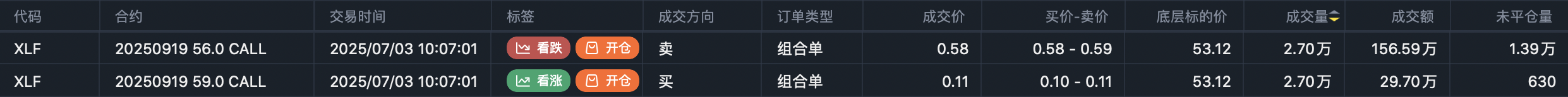

With banks kicking off the earnings season next week, XLF hit a new high. However, large bullish positions are structured as bearish put spreads, suggesting expectations of a pullback post-earnings.

For example:

On the bearish side, there’s a large sell-put order at 51 $XLF 20250718 51.0 PUT$ .

Similarly, BAC has a notable sell call order at 55 $BAC 20250919 55.0 CALL$ .

$Apple(AAPL)$

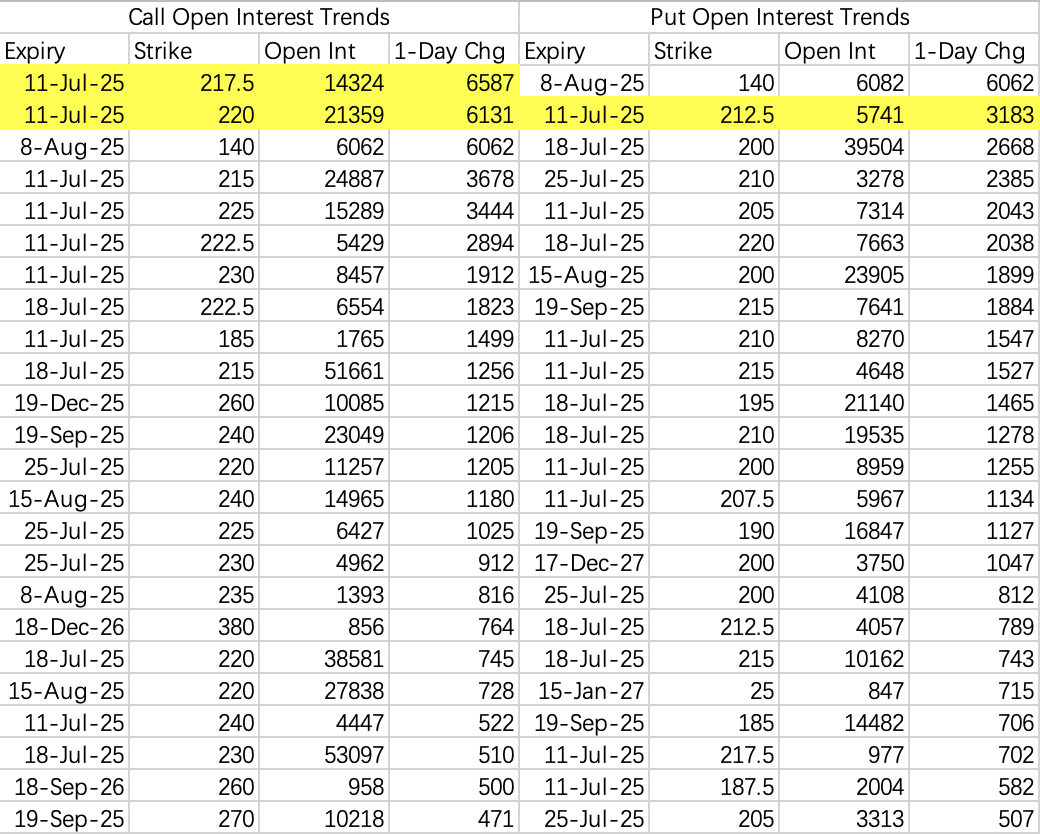

Buyers dominated the open interest in 217.5 call and 220 call options, but these positions are likely to face losses when the market opens this week. Apple will likely continue to oscillate around 210.

Overall, the tug-of-war between bullish and bearish options in the 200–215 range is a good sign. It suggests that, compared to other stocks, Apple will be more resilient to a market pullback. At worst, it could return to 200.

$Robinhood(HOOD)$

There’s a notable bearish spread trade expiring this week:

Buy 87 put $HOOD 20250711 87.0 PUT$

Sell 83 put $HOOD 20250711 83.0 PUT$

Weekly Strategy

No chasing gains this week. On Monday, I’ll start with:

Sell call 165 $NVDA 20250711 165.0 CALL$ .

Buy a “lottery ticket” 235 put $TSLA 20250711 235.0 PUT$ .

I’ll reassess other opportunities tomorrow based on market conditions.

Comments