$SPDR S&P 500 ETF Trust(SPY)$

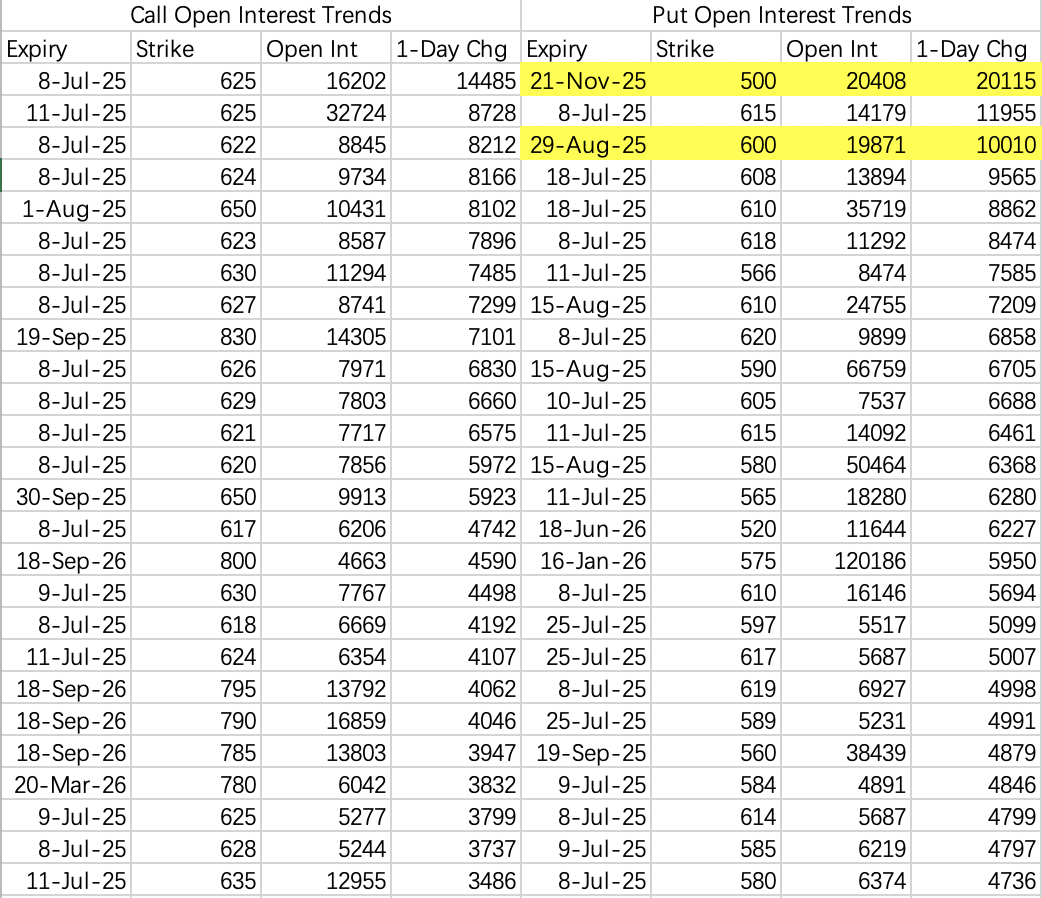

There has been notable activity in long-dated bearish single-leg put options:

$SPY 20251121 500.0 PUT$ : 20,000 contracts opened, with a transaction value of approximately $7.6 million.

$SPY 20250829 600.0 PUT$ : 10,000 contracts opened, with a transaction value of around $7.6 million.

It’s highly likely that the same trader placed these two orders in separate trades — one betting on a long-term volatility surge, and the other on a near-term drop to 600.

$NVIDIA(NVDA)$

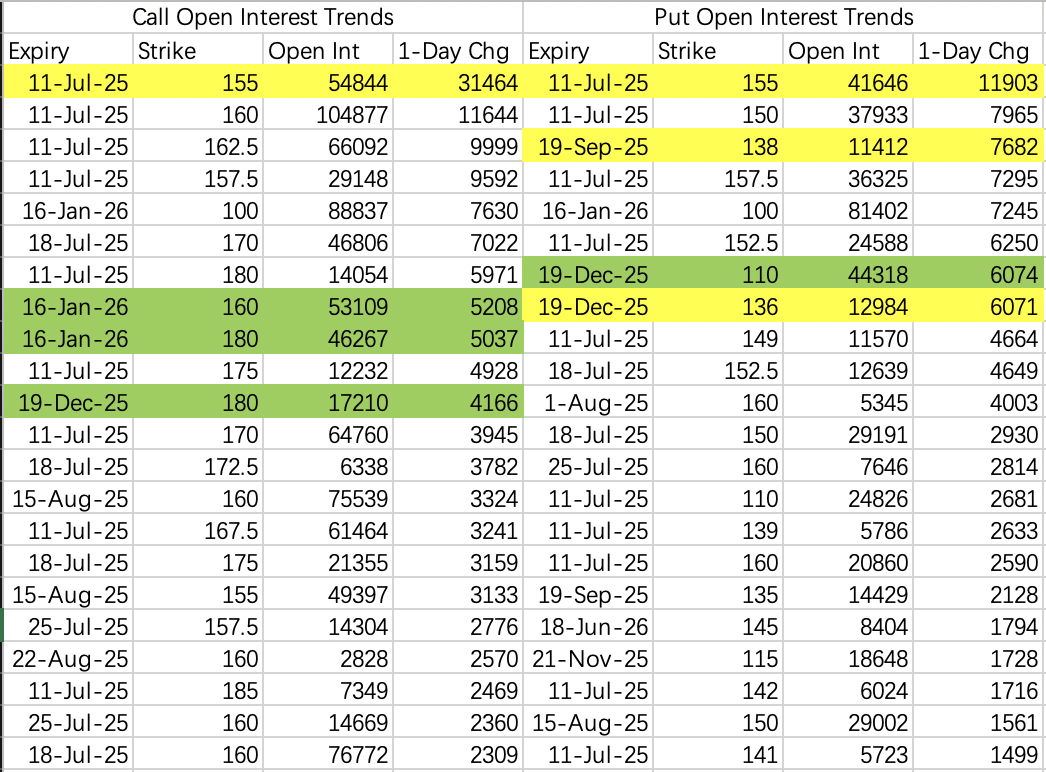

If all goes as expected, NVIDIA will likely continue fluctuating between 150 and 160 this week, with a high probability of closing near 155 on Friday. Based on this, I plan to execute a straddle:

Sell $NVDA 20250711 155.0 CALL$ + Sell $NVDA 20250711 155.0 PUT$ .

On the bearish side, there are single-leg put buyers:

$NVDA 20250919 138.0 PUT$ (expiring in September).

$NVDA 20251219 136.0 PUT$ (expiring in December).

This aligns with the overall pullback expectations.

At this level, a sell call + buy put strategy also looks appealing.

$Tesla Motors(TSLA)$

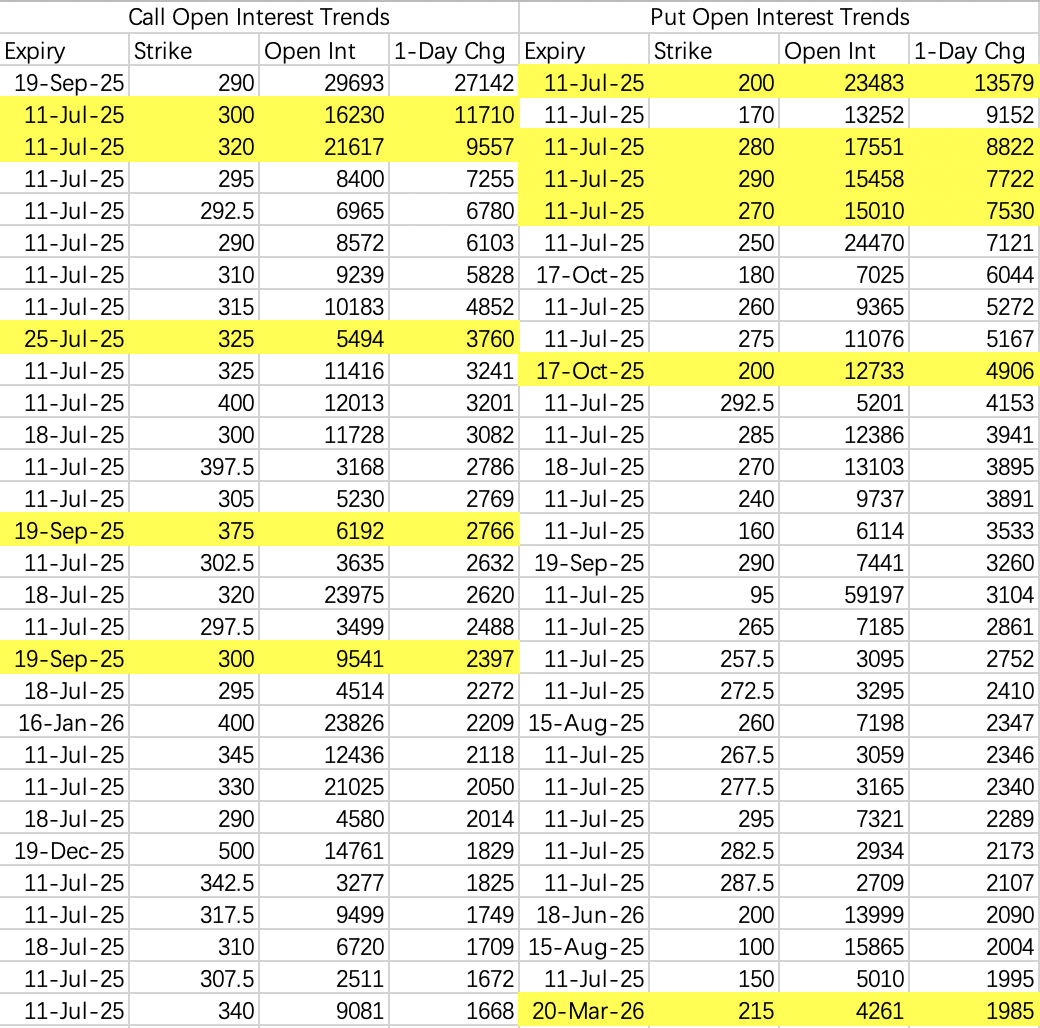

Take advantage of Tesla's rebound by selling calls:

Sell $TSLA 20250711 325.0 CALL$ .

On the bearish side, long-dated puts are concentrated around the 200 level.

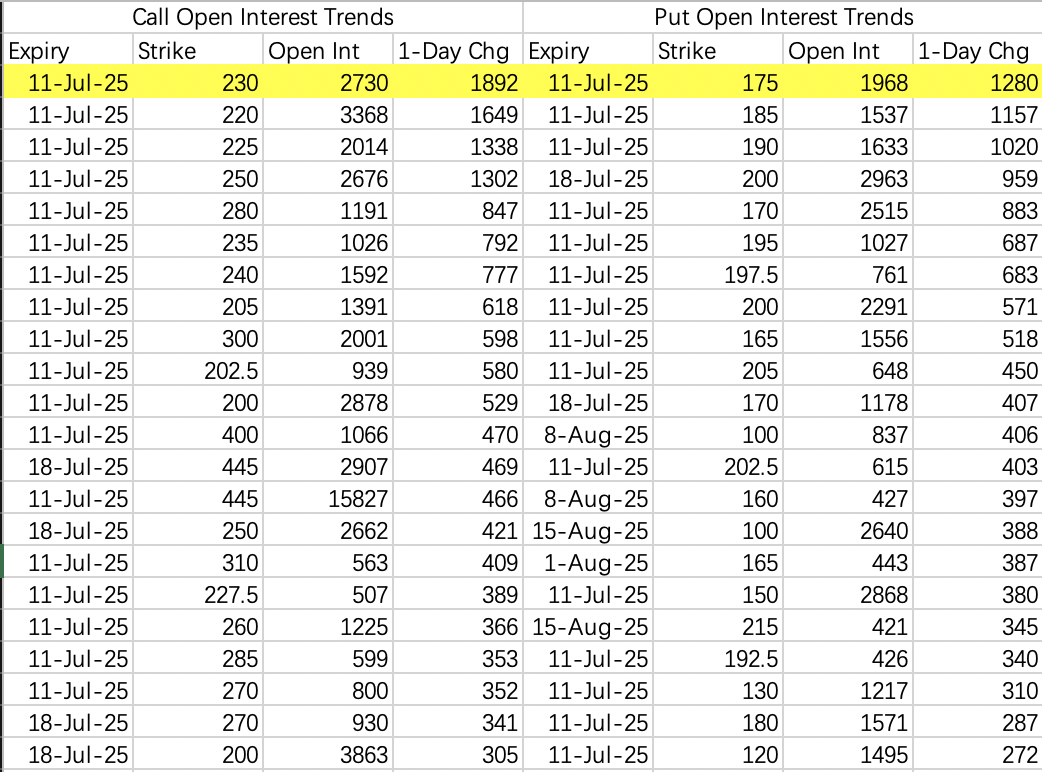

$Circle Internet Corp.(CRCL)$

For a strangle strategy, the 170–240 range is worth considering.

Today’s Trading Plan

Today’s focus is primarily on selling calls:

A 155 straddle for NVIDIA (sell $NVDA 20250711 155.0 CALL$ + sell $NVDA 20250711 155.0 PUT$ ).

Considering the bearish SPY single-leg put orders, I also sold $TQQQ 20250718 86.0 CALL$ .

Comments