$Intel(INTC)$

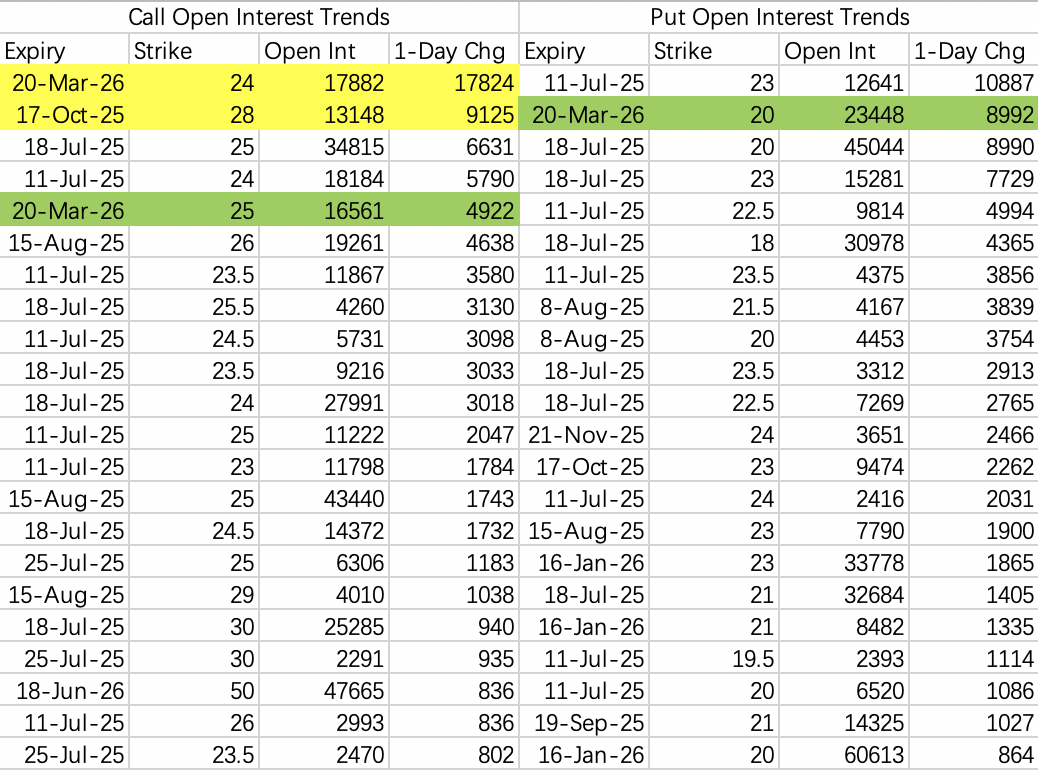

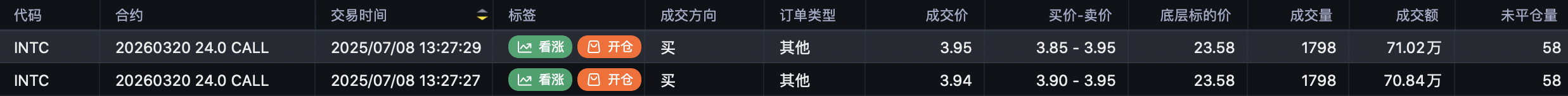

On Tuesday, Intel ($INTC$) inexplicably surged by 7%, and a wealthy trader purchased over $7 million worth of long-dated call options. Specifically:

$INTC 20260320 24.0 CALL$ : 17,800 contracts opened.

This wasn’t the only bullish bet. There were also:

$INTC 20251017 28.0 CALL$ : 9,125 contracts opened.

A long-dated straddle: $INTC 20260320 20.0 PUT$ + $INTC 20260320 25.0 CALL$ .

Based on the open interest, Intel's outlook seems positive. The bullish target is 25, with an extreme pullback to 20 and a general pullback expectation of 23.

The timing of the $INTC 20260320 24.0 CALL$ opening wasn’t ideal, being around 1:30 PM, which seems like a chase after the rally. Of course, it’s possible the trader made this decision after gathering intelligence over lunch.

Given Intel’s earlier announcement that its AI business reboot plan has been delayed to 2027, it’s hard to imagine any other positive news driving such activity. Ahead of the earnings season, selling puts could be a reasonable strategy: sell $INTC 20250725 22.0 PUT$ .

$NVIDIA(NVDA)$

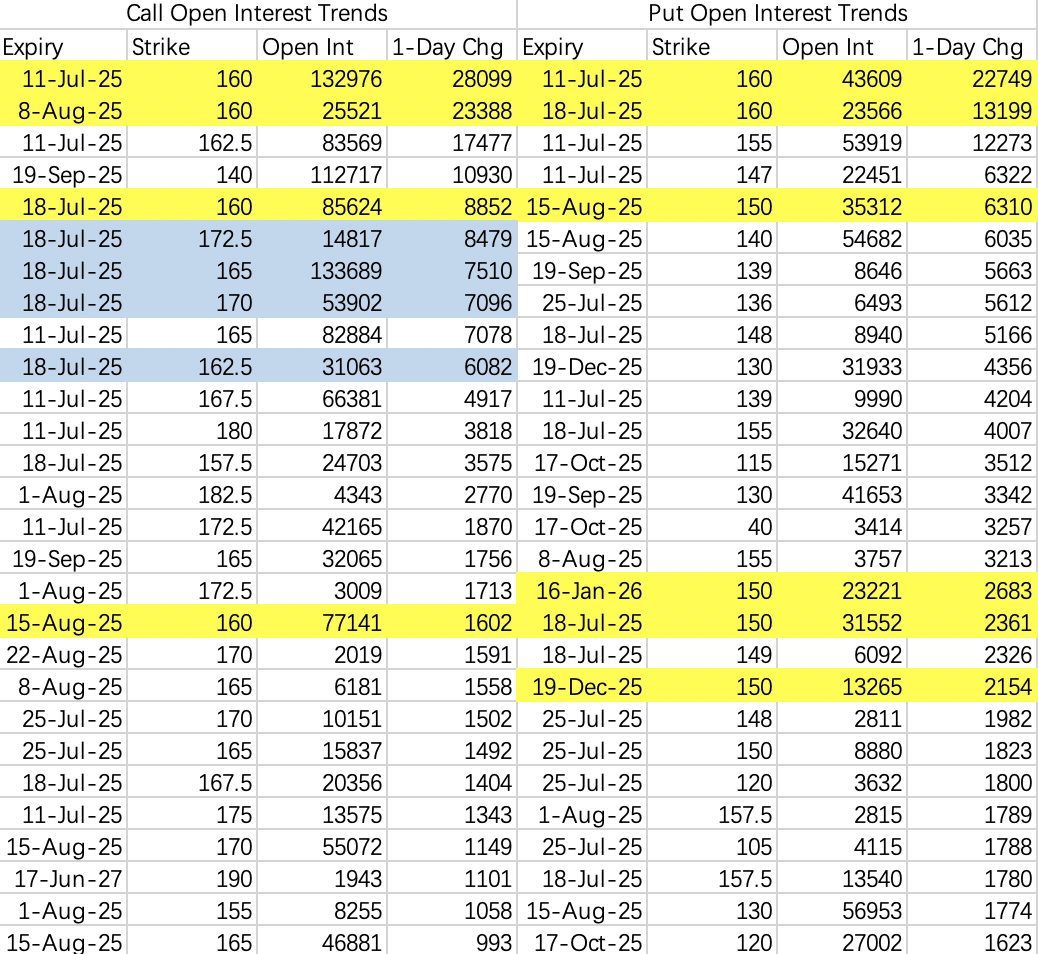

There’s intense competition at the 160 level.

On the bullish side:

Someone purchased 23,300 contracts of $NVDA 20250808 160.0 CALL$ , expiring August 8, with a transaction value of over $13 million. The apparent target seems to be NVIDIA’s market cap pushing toward $4 trillion.

On the bearish side:

13,000 contracts of $NVDA 20250718 160.0 PUT$ were purchased, expiring July 18, with a transaction value of about $4.4 million.

Analyzing just the bullish call options, next week’s open interest shows strikes between 162.5 and 172.5, most of which are market-driven rather than institutional sell-call orders. This suggests a higher probability of further upside, with the stock potentially reaching 170 next week.

Bearish puts seem aimed at pulling the price back to 160, but the bearish activity lacks the systematic planning seen in bullish setups.

For long-dated positions:

Reduced position in $NVDA 20270617 135.0 CALL$ .

Increased position in $NVDA 20270617 190.0 CALL$ .

Similarly, semiconductor peer ARM has reduced its long call position: $ARM 20270617 125.0 CALL$ , with no additional positions added.

The heavy weight of the August 8 $NVDA 20250808 160.0 CALL$ suggests significant influence, so I’ve rolled my earlier sell call to $NVDA 20250718 170.0 CALL$ . I’ll closely monitor when the August 8 position begins to unwind.

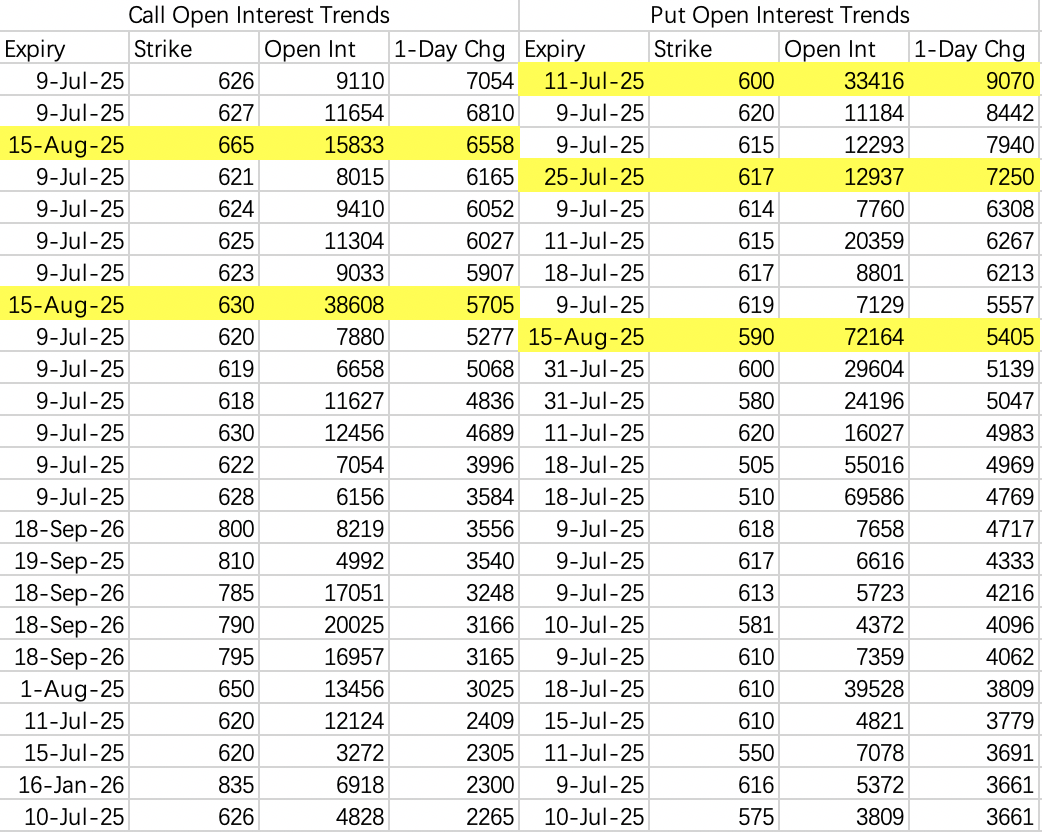

$SPDR S&P 500 ETF Trust(SPY)$

There’s a notable bearish bet expiring this week:

$SPY 20250714 600.0 PUT$ : 9,070 contracts opened.

The high-level consolidation and pullback trends are quite similar. Some traders seem to repeatedly bet on near-term downside by opening weekly puts until they either win or lose. For this type of setup, it’s best to buy a small “lottery ticket” rather than commit significant funds — similar to Tesla.

On the call side, others are betting that the current squeeze will continue, with the SPY potentially rallying to 630 or higher.

$Tesla Motors(TSLA)$

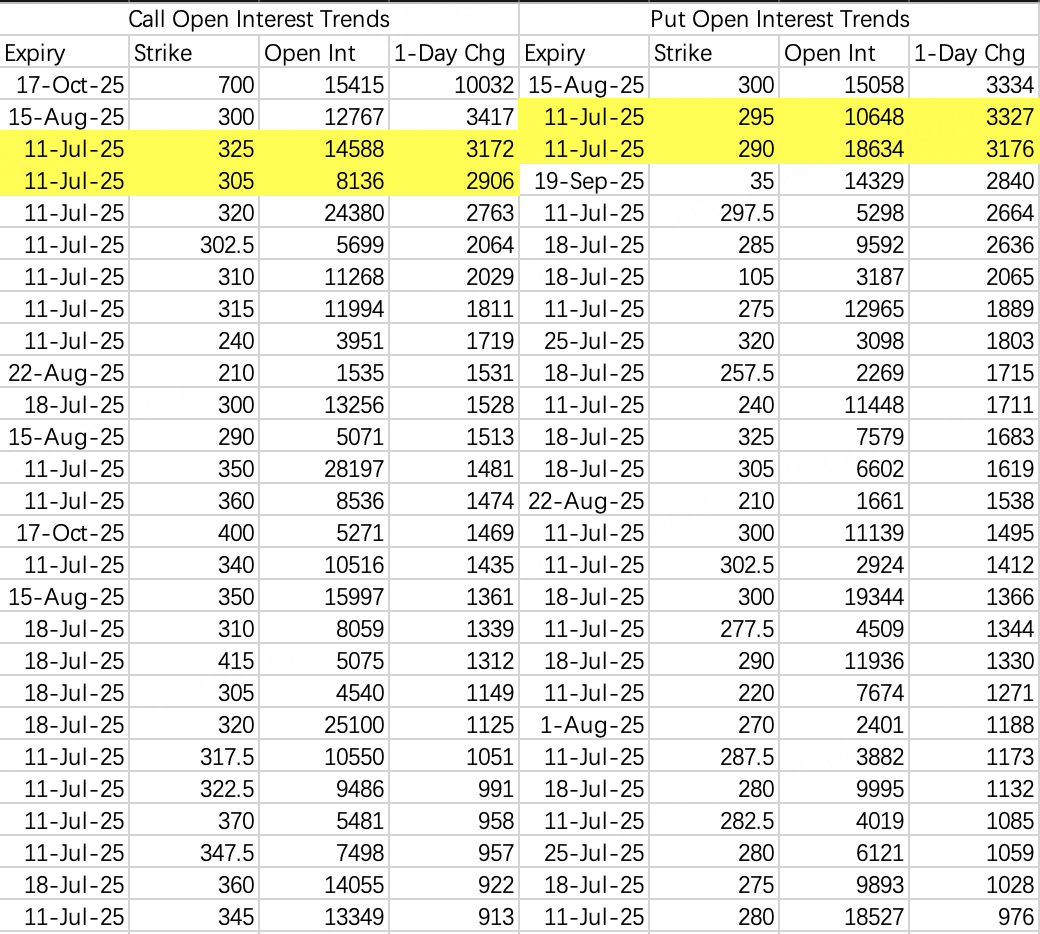

The good news is that Tesla is unlikely to see significant moves this week — it will likely trade within the 290–325 range.

There’s no need to close earlier “lottery ticket” trades, as any losses have already been offset by sell-call positions.

Tesla is better suited for selling options during periods of high volatility. When the stock is range-bound, it’s better to stay on the sidelines.

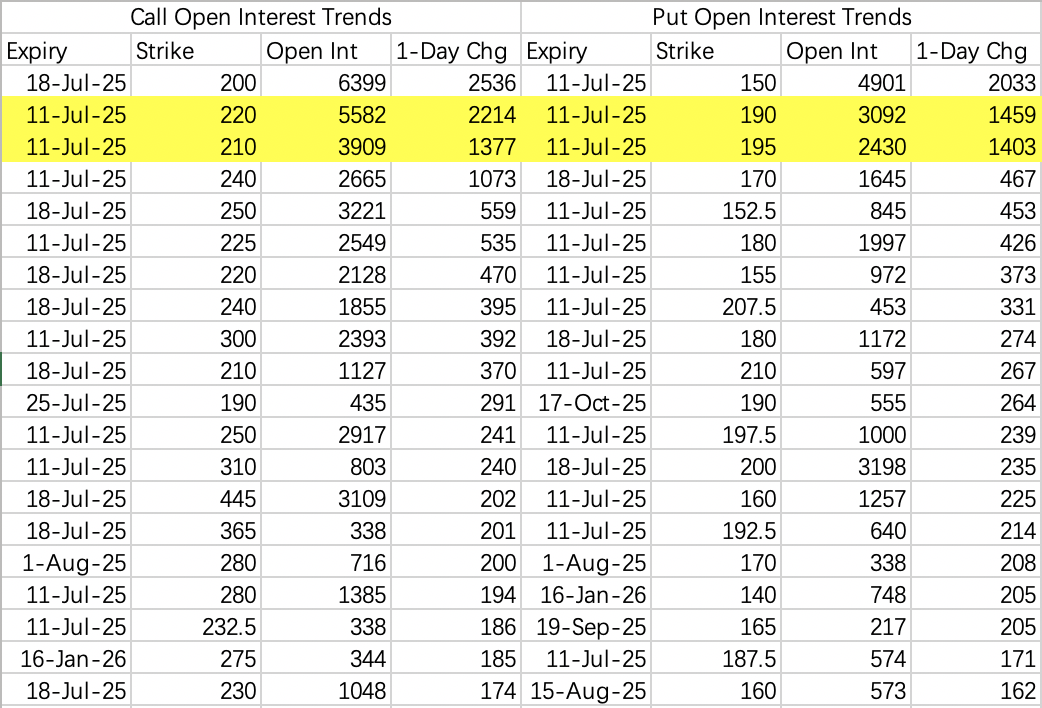

$Circle Internet Corp.(CRCL)$

The market appears to favor trading within the 190–220 range while considering an extreme pullback to 150. Implied volatility also leans toward the 190–220 range.

$Tiger Brokers(TIGR)$

Tiger surged, and the same trader who previously sold calls has returned, selling the same option again:

Today’s Trading Summary

I rolled my NVIDIA sell call to $NVDA 20250718 170.0 CALL$ and didn’t make any other significant trades. Nothing else stood out for action today.

Comments