$NVIDIA(NVDA)$

The market remains bullish, with NVIDIA's stock price expected to challenge 170. For now, I'll follow the bullish trend and take it one step at a time.

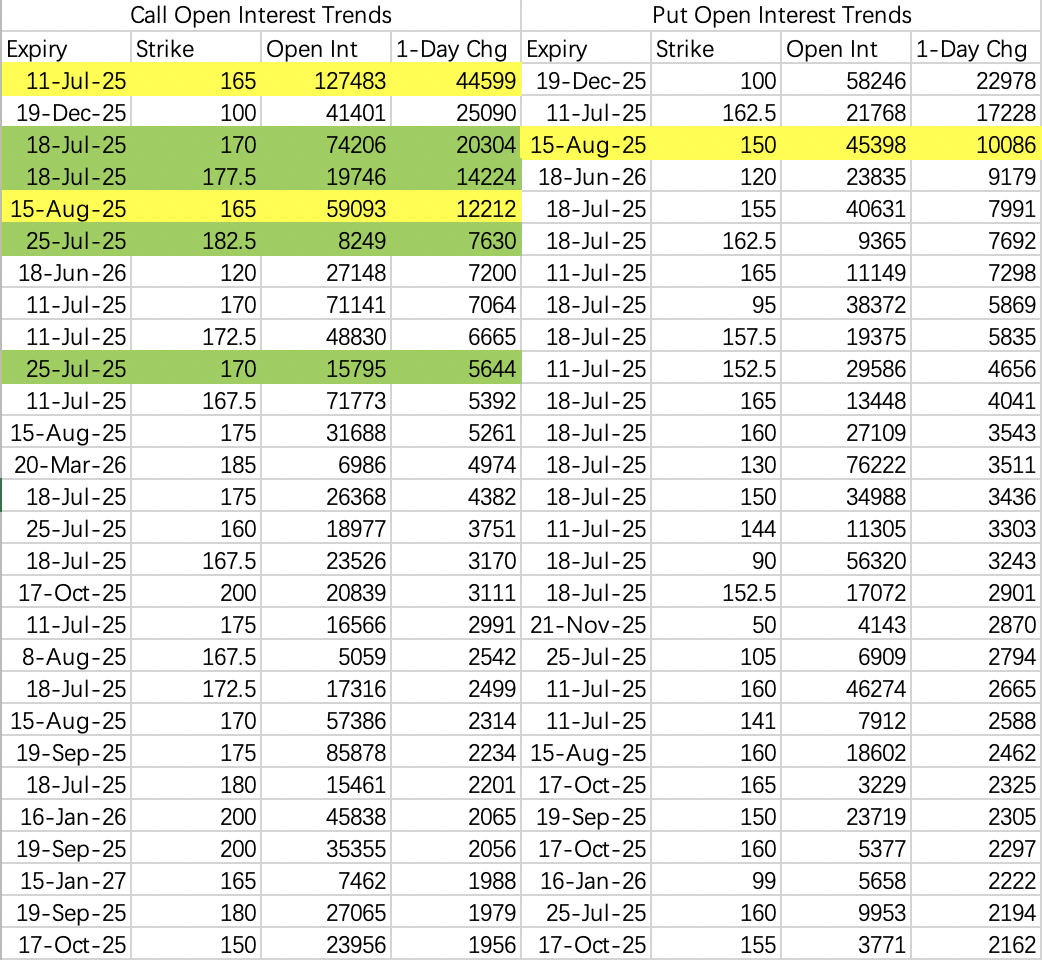

Institutions are rolling their sell calls to next week at the 170 strike, hedging with 177.5.

The $NVDA 20250808 160.0 CALL$ expiring August 8 hasn’t been closed, and the $NVDA 20250715 165.0 CALL$ expiring July 15 is seeing mostly buy-side activity, indicating the current trend could extend into next week.

For now, selling puts is a viable strategy. Selling both this week’s and next week’s puts at the 160 strike is reasonable, but avoid using leverage at all costs.

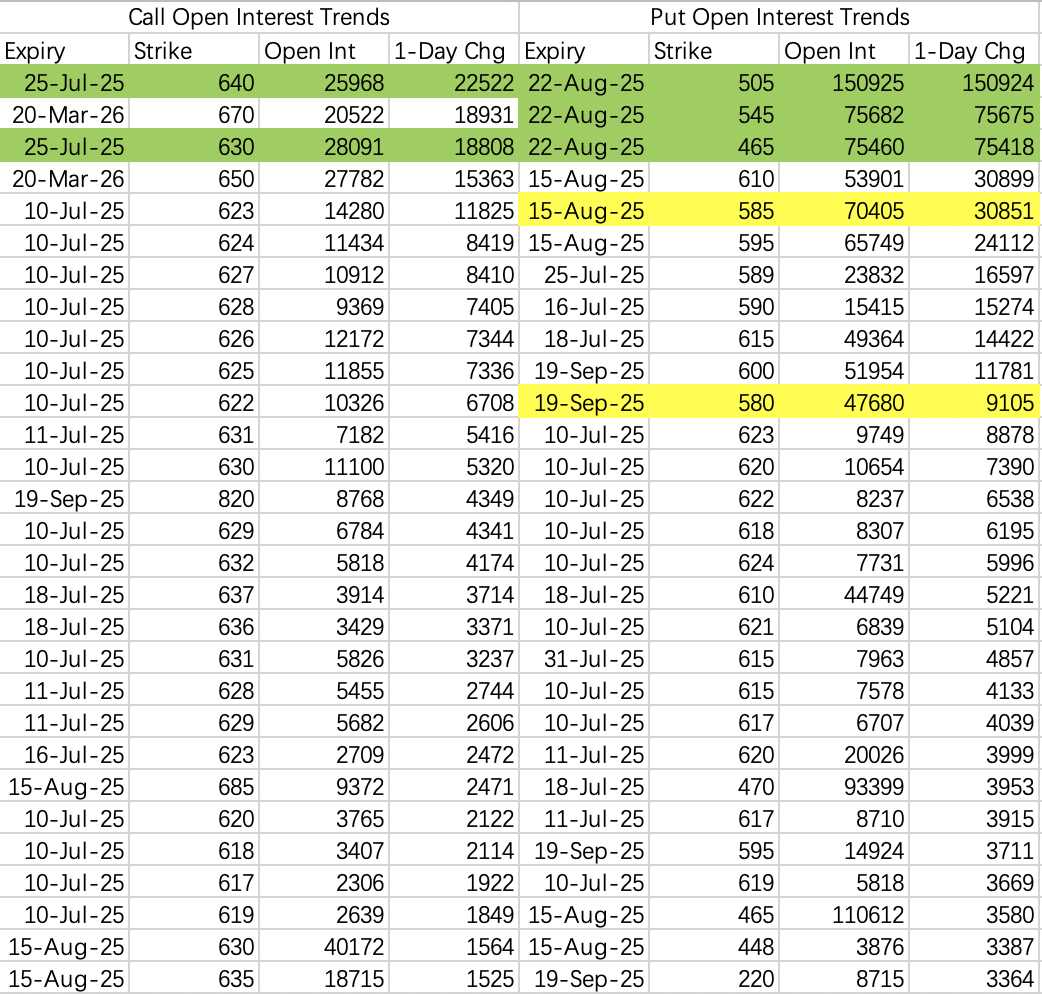

Some may question my decision to sell next week’s $NVDA 20250718 170.0 CALL$ . Based on open interest data, breaking above 165 this week is challenging. As shown in the data, the 165 call has the highest open interest this week at 127,000 contracts, followed by the 160 strike. I plan to close my $NVDA 20250718 170.0 CALL$ next Monday to capture the weekend's time decay.

$Circle Internet Corp.(CRCL)$

CRCL is a great company with attractive options due to its high implied volatility. However, it’s currently lacking a meaningful pullback.

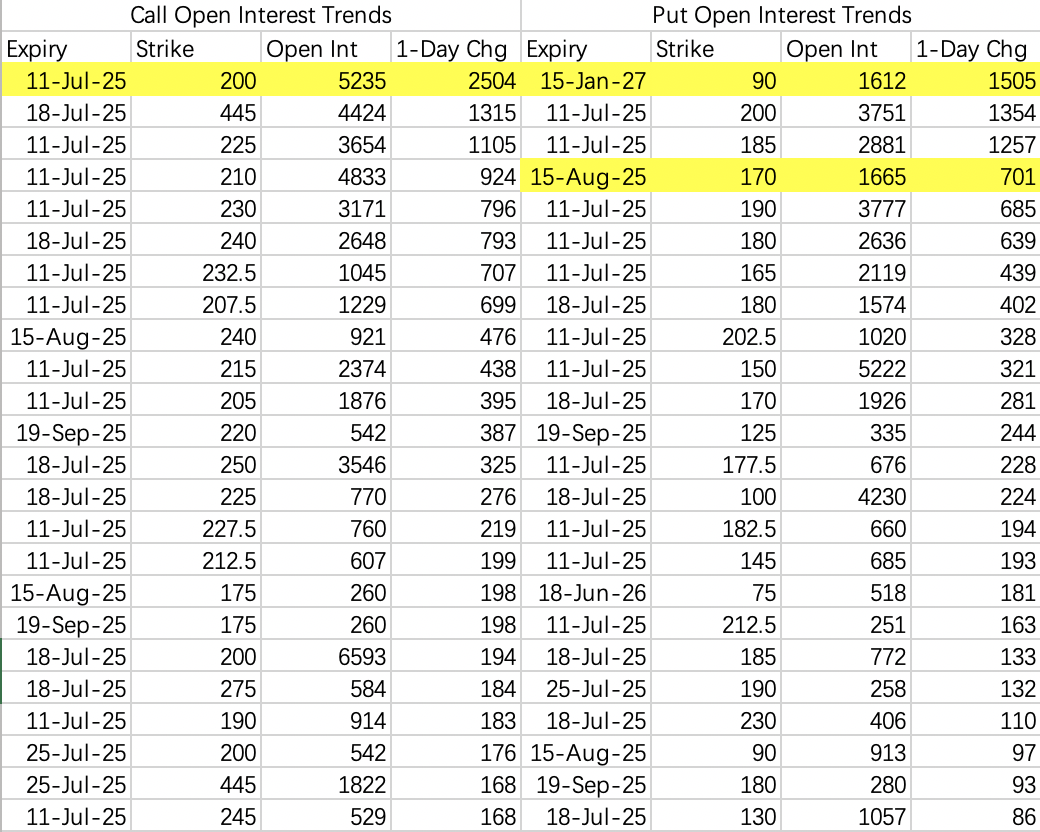

On Wednesday, there was a long-dated bearish position opened:

$CRCL 20270115 90.0 PUT$ expiring January 2027, with a transaction value of approximately $2.69 million.

Excluding extreme bearish scenarios, the short-term support range seems to be 170–180.

Alternatively, selling puts on $COIN could be a better option given its correlated revenue and the recent bullish trend in Bitcoin. Consider: sell $COIN 20250718 335.0 PUT$ .

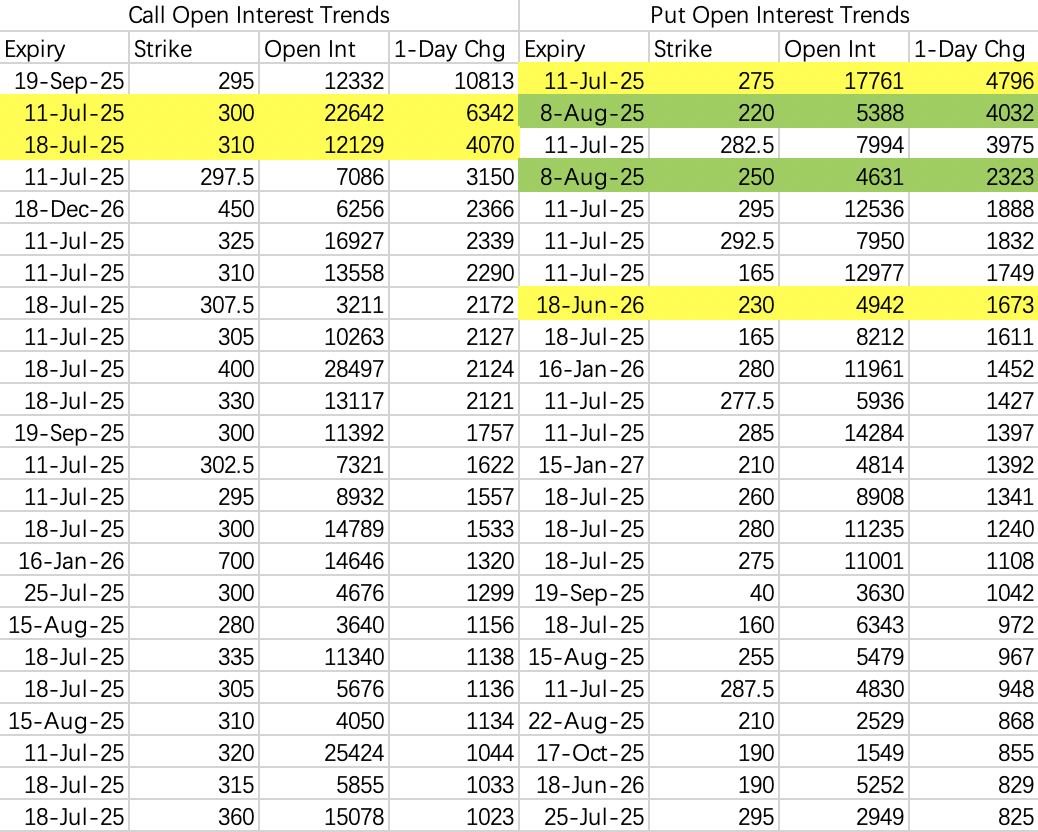

$Tesla Motors(TSLA)$

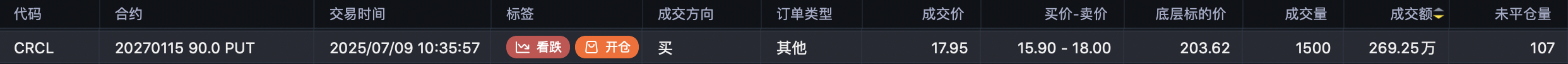

This is a delicate situation. Judging by the bearish positions opened, it feels like Musk and Trump may be moving toward reconciliation. The strike prices for bearish positions have become more reasonable, with some traders even selling puts.

The bearish downside now appears to be around 220. However, it’s hard to say for sure, as the latter half of the week tends to favor sellers. I’ll wait to see if there are any lottery-like bearish positions next week.

For now, continue selling calls at 325. You can even adopt a “T” strategy: close the position if the stock drops, and sell calls again if it rises.

$SPDR S&P 500 ETF Trust(SPY)$

The market seems to be following the bullish trend with blind optimism. My pullback target remains 580, but in the short term, there’s increased bullish momentum, with SPY expected to rise to the 630–640 range over the next two weeks.

Today’s Trades

Sell put $COIN 20250718 335.0 PUT$ .

Sell put $NVDA 20250718 160.0 PUT$ .

Reminder: Avoid using leverage.

Comments