The bullish trend is very strong, but bearish crash bets are starting again. Next week, it will either rise normally or experience a flash crash.

Institutions are selling calls at 170 and hedging at 177.5. Bullish options are seeing a large number of new positions for the following weeks, presenting an optimistic landscape, though I can't say for sure.

Bearish options are being opened for puts expiring on the 18th at strike prices of 140 and 141. Additionally, there's significant open interest for the halving level at 95, but this doesn't correspond to bearish positions on $SPY$.

I lean toward normal trading next week, and my position is sell call 170 + sell put 160. If NVIDIA’s stock price breaks 168, I'll consider rolling the position. While there might be a short squeeze, it's best not to sell puts alone at this stage.

Some might ask: "If there's a risk of halving, why not exit completely to avoid it?" Here's the thing — the timing of the pullback is uncertain. The worst-case scenario is being out of the market and watching the stock price surge, leading to emotional imbalance and chasing the highs with a full position. If you hold the stock, continue with a half position for covered calls. If you don't hold the stock, selling a small number of puts to follow the rally can balance your mindset. Additionally, if a pullback happens, it won't be as painful to manage.

No particularly extreme bearish orders. Compared to late June, it currently resembles a normal bull market downturn. The bearish expectation remains below 610, but hedging with sell puts has dropped to 565.

There is a notable bearish opening: a large far-out-of-the-money sell call with $5 million in premium income: $SPY 20251121 670.0 CALL$ , opening 7,522 contracts with a delta of 0.24. I think this is worth keeping an eye on.

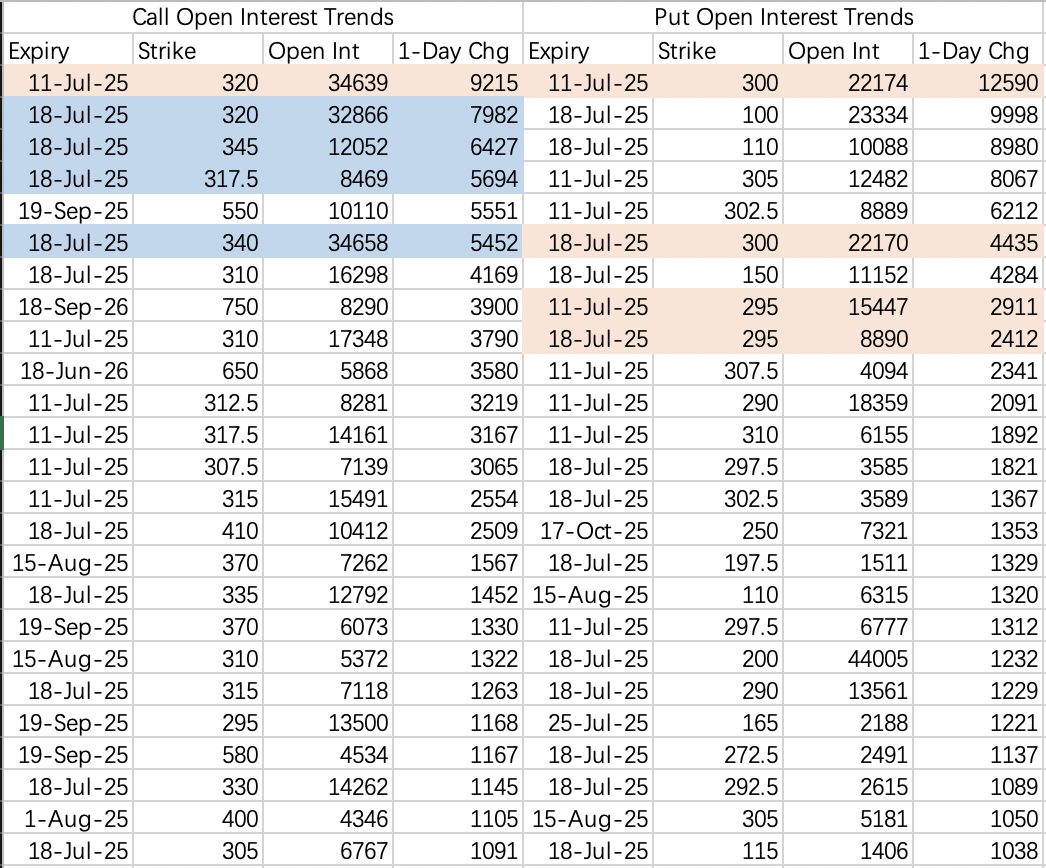

Very quiet. Institutions continue selling next-week-expiring 320 calls: $TSLA 20250718 320.0 CALL$ . Notably, bearish expectations have also decreased, with the volatility range narrowing to 290–320.

$iShares Bitcoin Trust ETF(IBIT)$

The bullish target for Bitcoin ETF is 70, or at least above 68. There is a large bullish spread position buying 68 calls and selling 73 calls:

$IBIT 20250815 68.0 CALL$ and $IBIT 20250815 73.0 CALL$ .

The bearish expectation is at 62.

For $COIN$ next week, institutions are selling calls at 402.5 and hedging at 437.5. If you want to sell calls, you can choose strikes above 420.

A large sell put at 87: $HOOD 20250718 87.0 PUT$ , and a buy call at 102: $HOOD 20250718 102.0 CALL$ .

I choose to sell puts at: $HOOD 20250718 95.0 PUT$ .

$Palantir Technologies Inc.(PLTR)$

Institutions are selling calls at 146. Bearish expectations are at 140, but there is a large far-term bearish position: $PLTR 20260618 100.0 PUT$ . You can handle this similarly to NVIDIA.

Trades:

Previously popular small-cap stocks, $CRWV$ and $CRCL$, are starting to pull back. Generally, this is also a signal of an upcoming broader market pullback. $CRWV$ has a $1 million bearish order for next week, specifically the July 18th 120 put: $CRWV 20250718 120.0 PUT$ .

Option volume for $CRCL$ is relatively low, but the initial pullback expectation seems to be around 180.

Today, I sold puts: $HOOD 20250718 95.0 PUT$ .

Comments