In just three months, U.S. stocks have rebounded from the sharp sell-off shock in April to record highs. Now, traders are waiting to see: Can the "report card" of American companies match the optimism that the stock market has priced in?

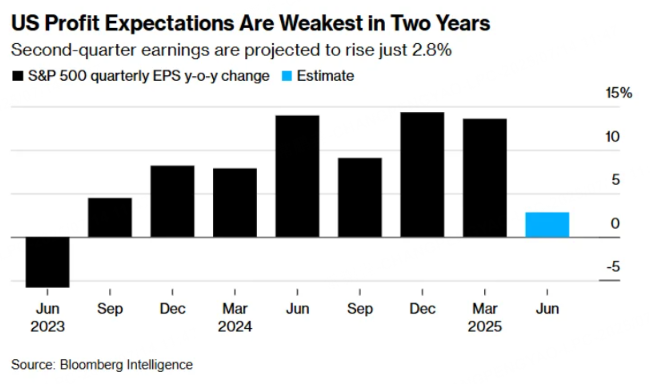

In fact, market expectations are not high:Wall Street is bracing for its weakest earnings season since mid-2023.Bloomberg Intelligence data shows that analysts expect$S&P 500 (. SPX) $The profit of constituent stocks in the second quarter increased by 2.5% year-on-year; Of the 11 sectors, 6 are expected to experience profit decline; At the same time, the full-year growth forecast of the index has dropped from 9.4% in early April to 7.1%.

Lower expectations make it easier for companies to achieve better-than-expected performance.Bloomberg Intelligence strategists Gina Martin Adams and Wendy Soong said that looking at near-term corporate guidance, companies are likely to easily beat these conservative expectations.

"The expectation threshold is very low now," said Kevin Gordon, senior investment strategist at Charles Schwab & amp; Co. "This certainly makes it easier for companies to exceed expectations, but I think the focus will be on gross margins--especially if tariff pressure exists, it should be reflected in gross margins."

Earnings season kicks off this week: On Wednesday, financial giants like JPMorgan Chase (JPM), Citigroup (C), and BlackRock (BLK) will be the first to release earnings; Next week, JB Hunter Transportation Services (JBHT),$Netflix (NFLX) $Heavyweight companies will follow suit.

For the upcoming earnings season, investors can choose the best play style for them.

Single-leg options (buy call or put options)

Principle: Buying a Call option (Call) is equivalent to betting that the stock price will rise, and buying a Put option (Put) is equivalent to betting that the stock price will fall. You only need to pay the premium once, and you will lose this investment at most, and the potential for income is great.

advantage: Simple structure and controllable risks. The investment is small, and the income is not capped (call option) or the stock price returns to zero at most (put option).

shortcoming: It is necessary to judge the correct direction and the fluctuation is large enough, otherwise it is easy to lose all premium due to time attenuation.

Applicable scenarios: When you have a greater confidence in the direction of ups and downs, for example, the expected financial report is particularly good or particularly bad.

Straddle arbitrage (Long Straddle)

Principle: Buy call options and put options with the same strike price and expiration date at the same time, betting on large fluctuations.

advantage: There is no need to predict the direction, just the stock price fluctuates violently to make a profit.

shortcoming: The cost is high, which requires the stock price fluctuation range to be large enough, and the impact of time attenuation is greater.

Applicable scenarios: The earnings report is expected to trigger wild volatility, but it is not sure whether it will be up or down.

Long Strangle Arbitrage

Principle: Buying out-of-the-money calls and puts at the same time, betting on large swings, but at a lower cost than straddles.

advantage: Lower input costs, suitable for limited budgets.

shortcoming: It requires larger stock price fluctuations to make a profit, otherwise it is easy to lose money.

Applicable scenarios: I hope to use less funds to win big fluctuations.

Spread Strategy

Bull Call Spread Bull Call Spread

Principle: Buy a call option with a lower strike price while selling a call option with a higher strike price.

advantage: Reduced costs, controllable risks, suitable for moderate rising prices.

shortcoming: The income is limited and not suitable for the expected explosive rise.

Applicable scenarios: The stock price is expected to rise steadily to a certain price point, but not skyrocketing.

Bear Put Spread Bear Put Spread

Principle: Buy a put option with a higher strike price while selling a put option with a lower strike price.

advantage: Reduce the cost of shorting, and the risks and benefits are limited.

shortcoming: The stock price needs to fall moderately, and the magnitude cannot be too small.

Applicable scenarios: The stock price is expected to fall moderately after the earnings report, but it won't crash.

Butterfly spread Butterfly Spread

Principle: Buy one lower strike price option, sell two middle strike price options, buy one higher strike price option, and bet that the stock price will remain in the range.

advantage: Small investment and small risk. If the stock price expires near the target range, the yield is very high.

shortcoming: The stock price fluctuation is required to be very small and the landing point is accurate, otherwise it will lose money.

Applicable scenarios: Stock price volatility is expected to be limited after the earnings report is announced, and market sentiment is flat.

The earnings season is often the most volatile period, which is suitable for using options to lay out short-term opportunities. However, different strategies are suitable for different expected scenarios: if investors judge a clear direction, they can consider single-leg options; If you just feel that the fluctuation will be large, but you are not sure of the direction, you can use the straddle or wide straddle; If you want to control costs and have clear expectations for the rise and fall of stock prices, you can use the spread combination; If the market is expected to be cold and the stock price fluctuation is small, butterfly spread can be considered.

Each strategy has advantages and limitations. The key lies in flexibly choosing the right tool based on your own judgment and financial situation. Options themselves are not universal amplifiers. Only when used reasonably can you really improve the winning rate and capture your opportunities during the earnings season.

Comments