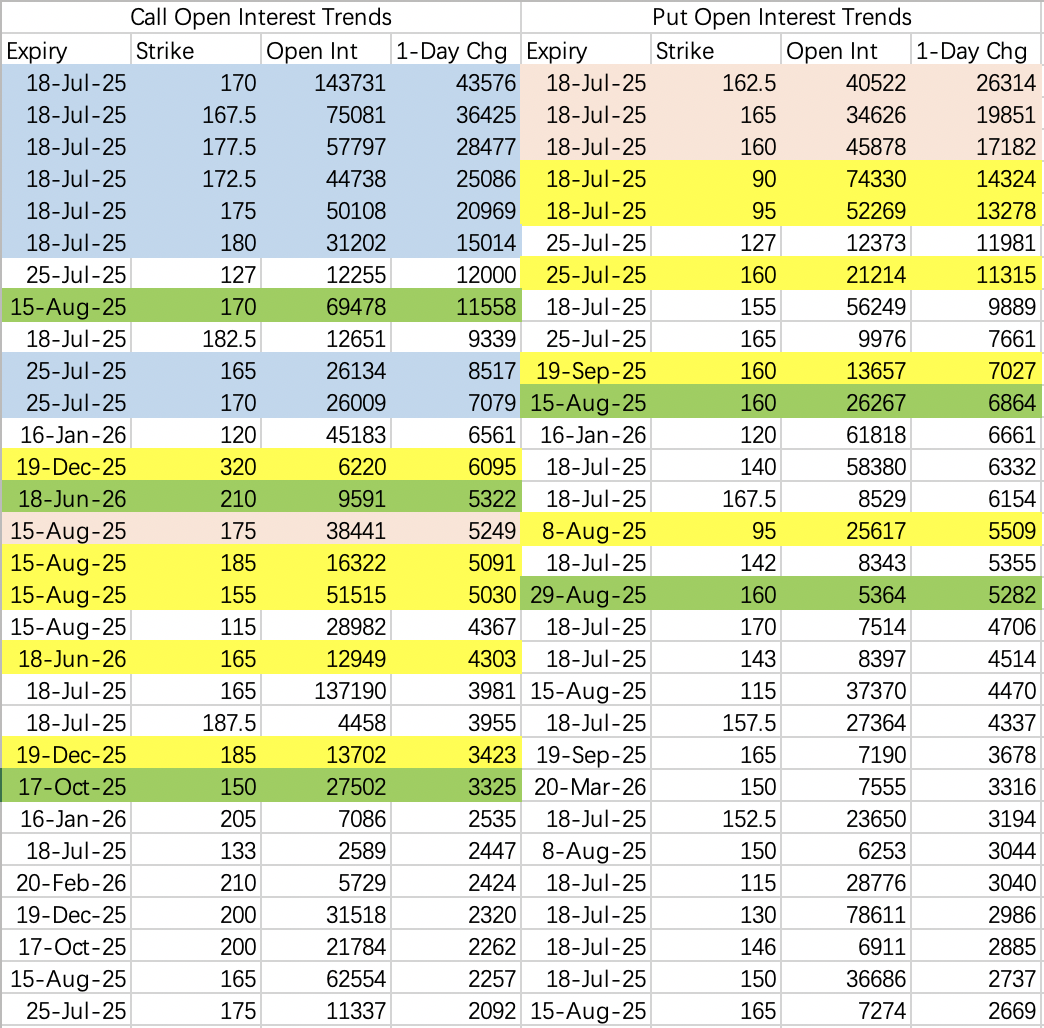

Institutions continued to sell call options at 167.5 and 170 this week. Currently, there are 140,000 open interest contracts for the 170 call, and any strike with more than 100,000 open interest warrants attention.

The largest open interest for puts expiring this week is at 165, 162.5, and 160 strikes. Coupled with additional 160 put positions across other expirations, it’s clear that the bears are hoping for NVIDIA to pull back to 160 this week.

However, the 160 put isn’t strictly bearish. For example, the majority of the 160 puts expiring on August 15th and August 29th are sold positions, signaling that many traders believe NVIDIA will remain above 155 before the earnings report.

On Monday’s open, NVIDIA briefly dipped to 161.7 before quickly rebounding. I don’t think this minor pullback is what the bears were aiming for.

The drop wasn’t significant, which raises the question: why are the bears throwing so much money at this? Are they just making a splash?

Theoretically, buying the 160 put implies a hope for NVIDIA to fall below 160, but for those who’ve followed past trends, you may recall that NVIDIA bears often buy puts at the exact level they want to hammer the price down to.

Considering the significant pullback in ARM while NVIDIA remains resilient, it seems clear that DeepSeek’s anti-hype narrative has failed, leaving NVIDIA firmly back in its position as the dominant AI leader.

From that perspective, being bullish makes sense. However, I lean toward waiting until the end of this week before making any moves.

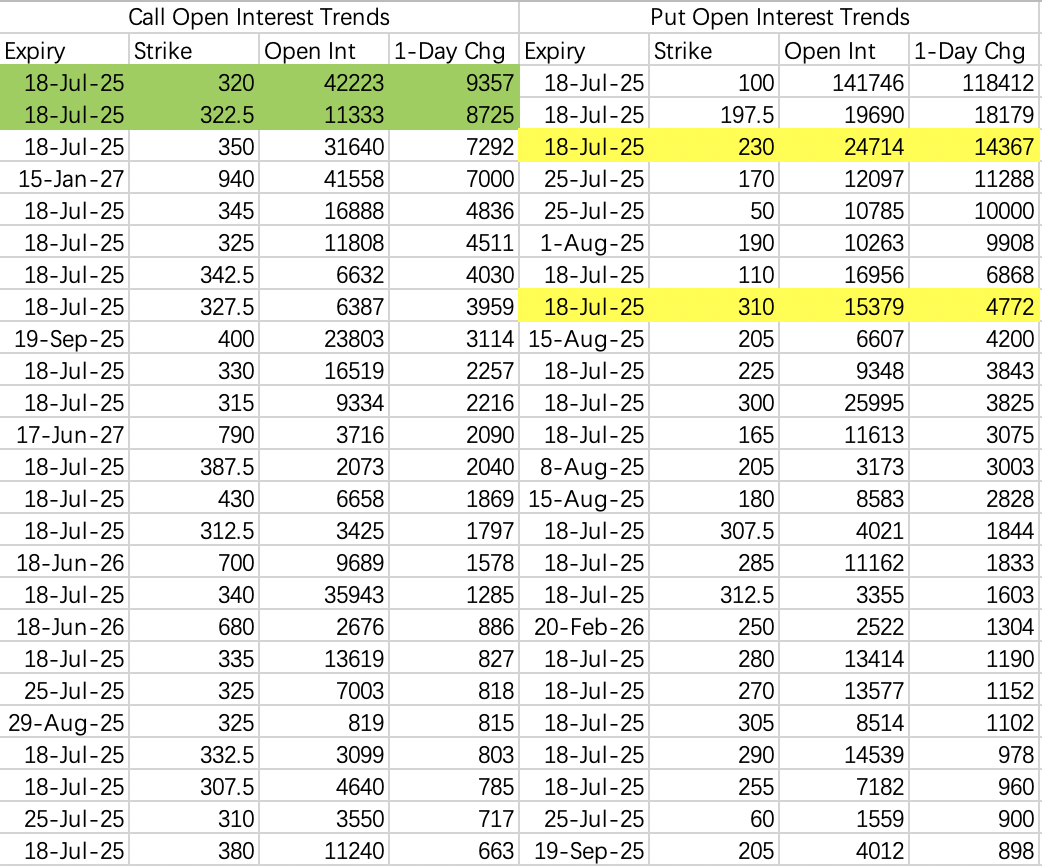

Given the broader market's expected pullback this week, Tesla bears are looking to capitalize. The majority of open interest for $TSLA 20250718 310.0 PUT$ is on the buy side.

For bearish options above the 310 strike, most open interest is buyer-driven. However, strikes below 310 are speculative “lottery ticket” trades.

Institutions are continuing to sell calls at 320 and 322.5 as usual.

Tesla’s current price action shows some bullish potential. It remains to be seen if Elon Musk will leverage this earnings season to squeeze the shorts aggressively.

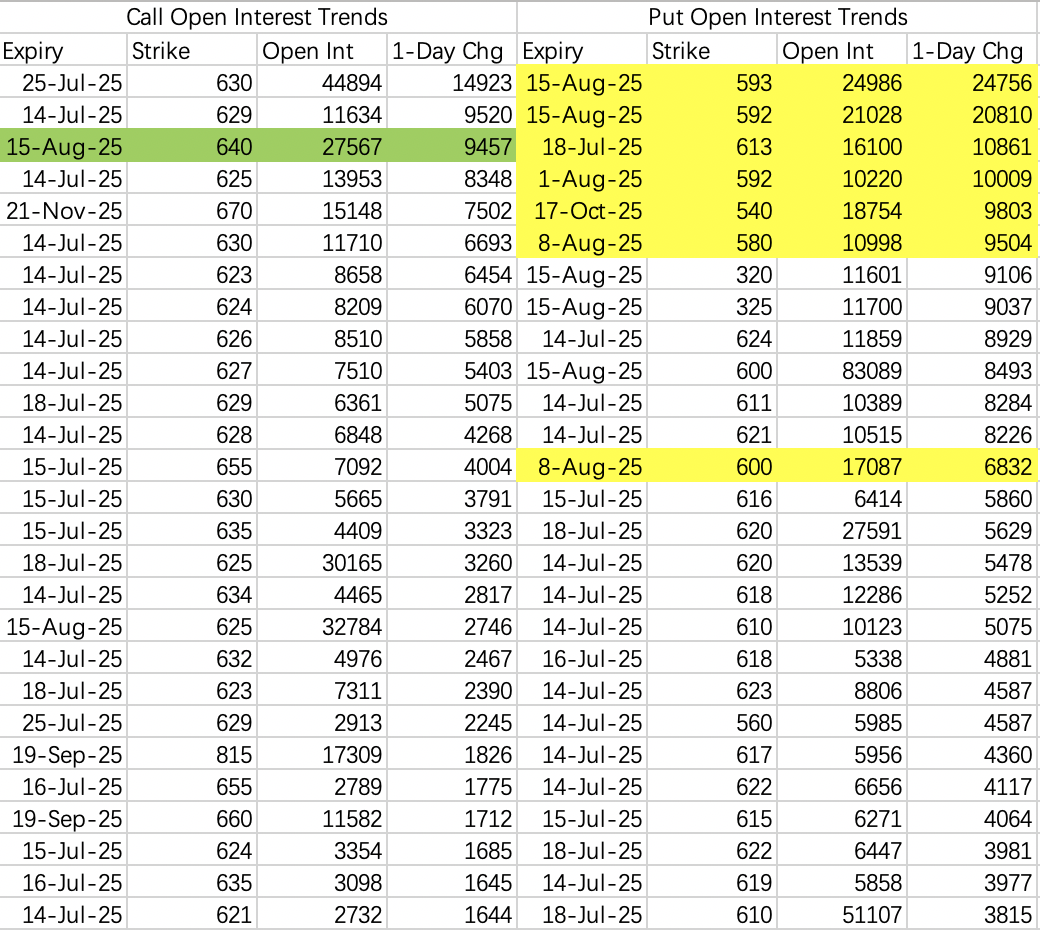

Looking at put open interest, bears have made significant bets this week, including a $1,000,000 wager on the price dropping to 613 ($SPY 20250718 613.0 PUT$ ). Due to time decay, this position is already down 50%. If the market doesn’t drop by Tuesday, this money will evaporate.

A potential trigger for a market pullback this week could come from corrections in heavyweight stocks following their earnings reports.

$iShares Bitcoin Trust ETF(IBIT)$

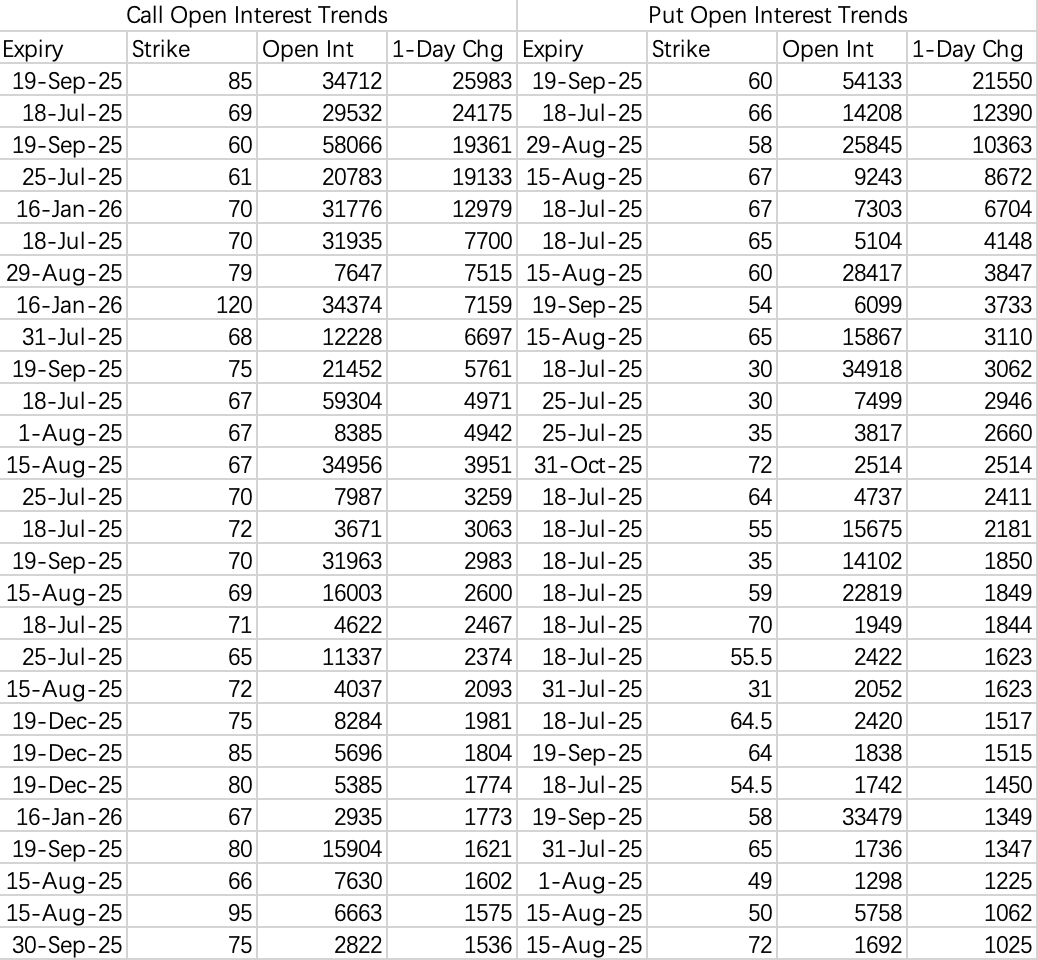

The outlook remains consistent with last week, expecting a move above 70. However, on Friday, a new bullish strategy was initiated with an added leg: selling the 85 call.

For a more conservative bullish strategy, consider selling puts on $COIN$. A conservative strike price could be set at 330.

A bearish vertical spread was opened for this week’s expiration:

Buy 180 put, sell 160 put

$CRCL 20250718 180.0 PUT$ $CRCL 20250718 160.0 PUT$

Today’s Trade

I sold puts on Apple:

$AAPL 20250718 205.0 PUT$ .

Comments