Tesla's upcoming earnings report is likely to be uneventful. The numbers are weak, with Q2 deliveries down about 14% year-over-year. Even with AI hype, it won’t translate into revenue or profits in the short term.

A safe bearish approach is to sell calls. I sold next week’s 350 strike call:

$TSLA 20250725 350.0 CALL$ .

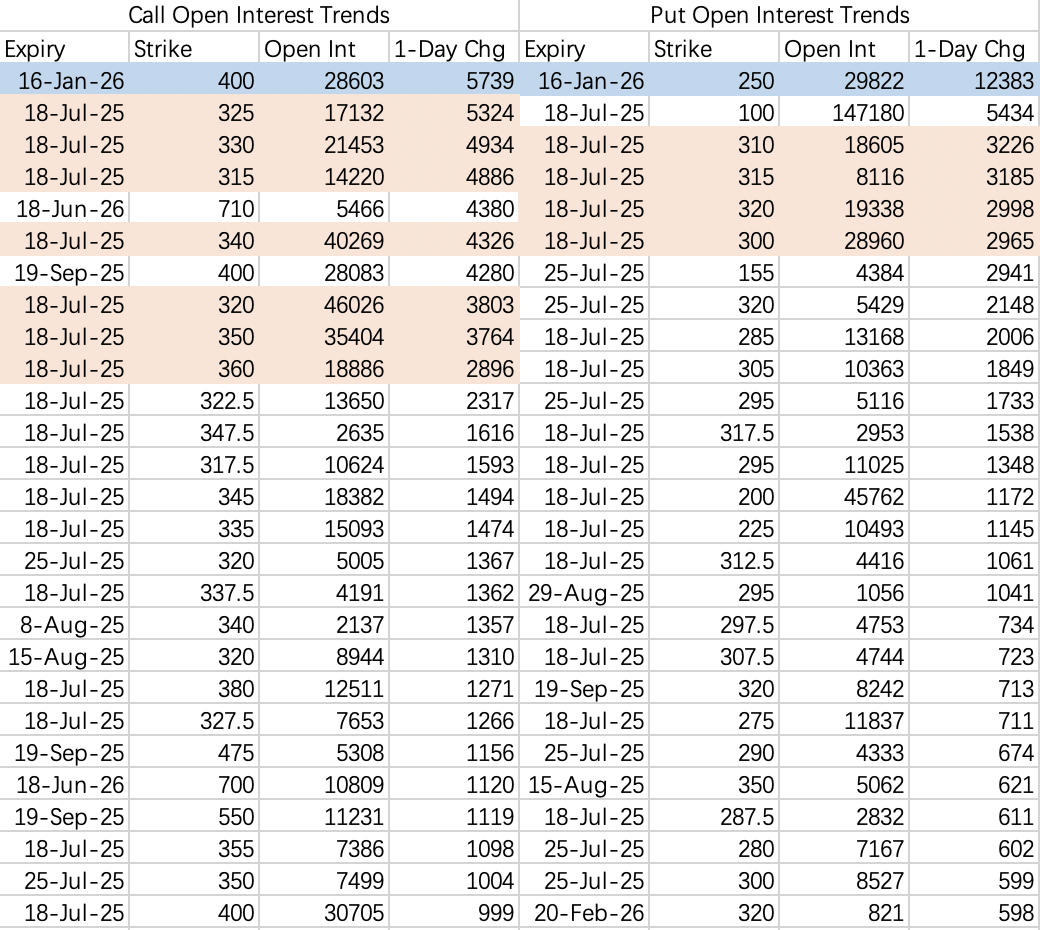

For those looking for a deeper bearish position without spending much, consider this zero-cost bearish strategy employed by a major bear. It avoids IV crush concerns and profits if Tesla’s stock drops below $310:

Buy 1x $TSLA 20260116 400.0 CALL

Sell 1x $TSLA 20260116 300.0 CALL

Buy 2x $TSLA 20260116 250.0 PUT

This bear is very crafty, executing trades in small amounts to avoid detection, but the open interest reveals the strategy.

Based on estimates, the bear likely:

Bought 6,000 contracts of the 400 call.

Sold 6,000 contracts of the 300 call.

Bought 12,000 contracts of the 250 put.

Some might wonder why the open interest for $TSLA 20260116 300.0 CALL is relatively low. This could be due to high at-the-money trading volume, allowing market makers to rely on existing inventory rather than opening new positions. Still, the open interest has increased slightly.

This strategy is effective because if Tesla’s stock drops below $310, it’s almost a cost-free bearish bet. If it falls to $250, the profit could be $5,500 per contract. On the upside, losses are limited; for example, if the stock rises to $350, the loss is about $2,000 per contract.

For those who prefer simplicity, you could just sell the 350 call:

$TSLA 20250725 350.0 CALL$ , earning around $400 with an annualized return of 44%.

The U.S. Commerce Department approved H20 export licenses, but the pre-market reaction—a 5% gain—seems underwhelming. Back in May, NVIDIA recorded a $4.5 billion impairment, with analysts projecting an additional $15 billion impact for the year. Shouldn’t this news drive a 10%+ rally?

The likely explanation is that the prior rally has already priced in the good news. There’s no need to chase the stock higher or panic sell at these levels. Instead, consider adjusting the sell put and sell call zones.

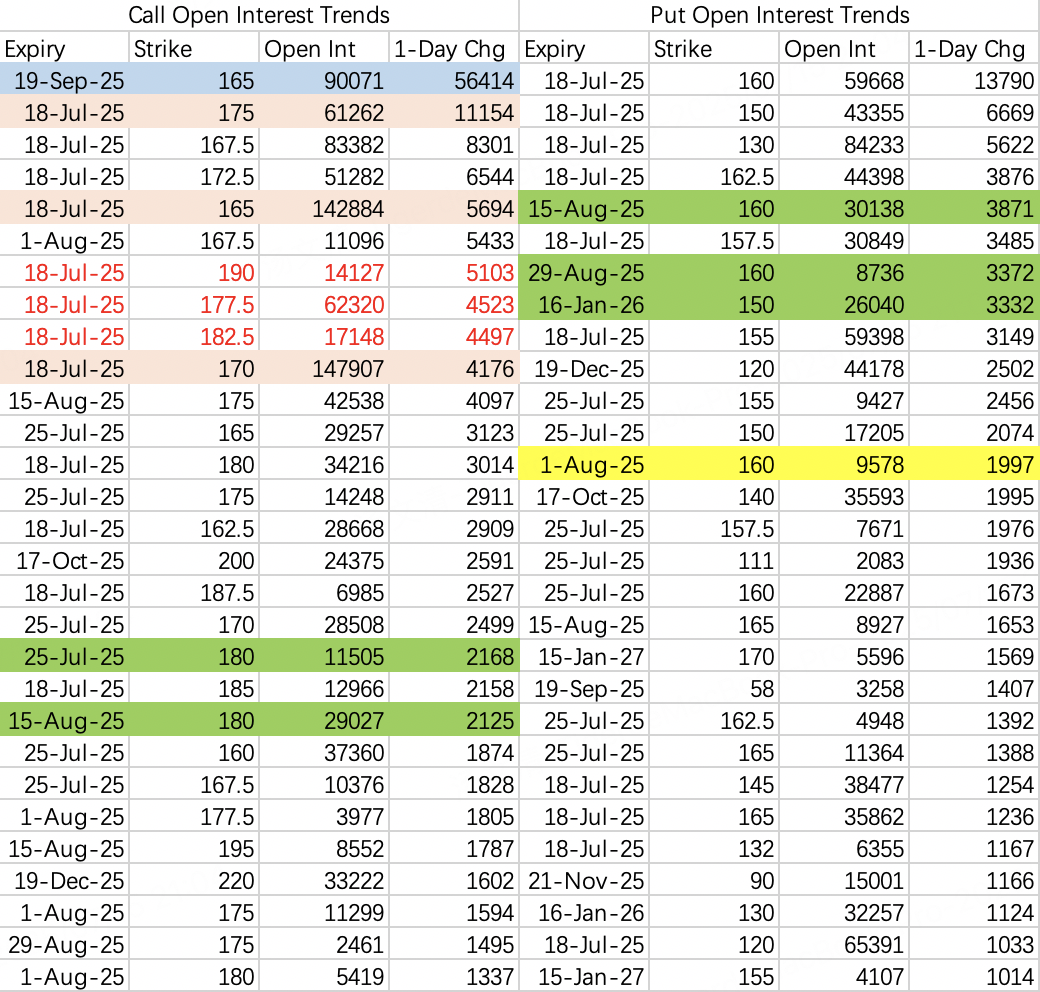

Key observations from Monday’s options activity:

Long call rollovers:

Open interest surged for the $NVDA 20250919 165.0 CALL, with 56,000 contracts opened.

Closed positions for the $NVDA 20250718 146.0 CALL.

H20-related trades:

Large bullish spreads opened for 165–175 calls expiring this week.

Heavy sell orders for the 180 call.

Suspicious activity:

Unusual opening positions for the $NVDA 20250721 177.5, 182.5, and 190 calls.

Bearish puts:

High open interest for the 160 put, mostly on the sell side.

New Range for Options

Given the above, a good range for selling options is:

Sell put at 160.

Sell call at 180.

I now understand why bears are targeting 160—it has become the new support level.

Today, I opened a sell call:

$NVDA 20250725 180.0 CALL, which I’ll hold through Friday.

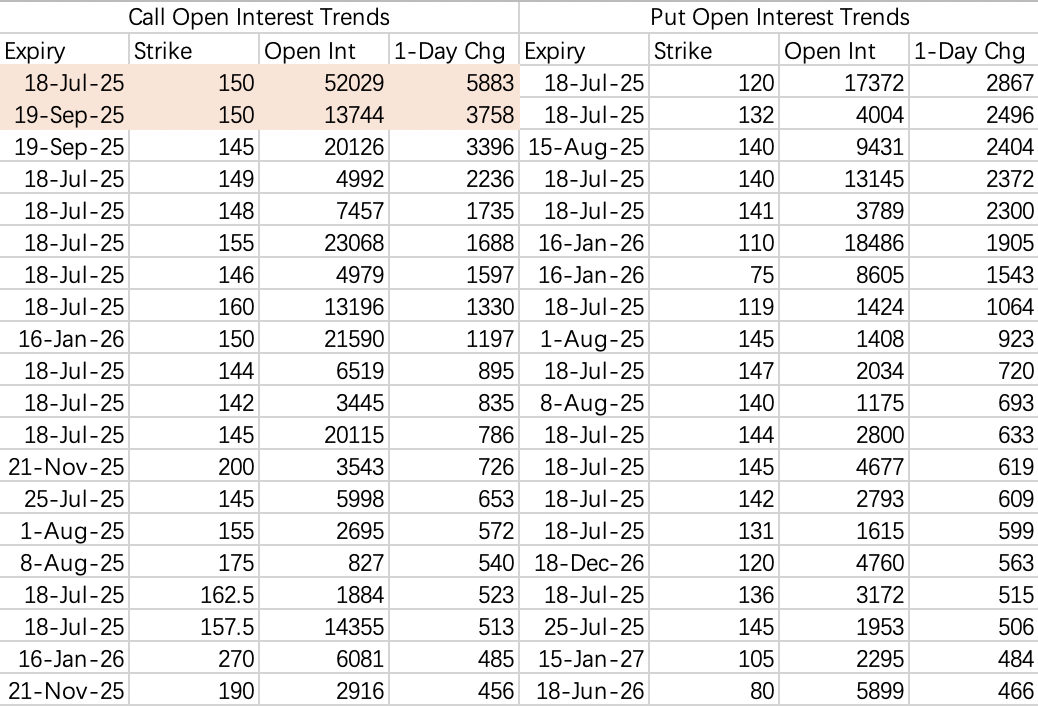

$Advanced Micro Devices (AMD)$

AMD’s open interest doesn’t show anything notable. The stock is trading at $157, and most of the market seems unprepared for any significant moves.

However, there is an interesting pattern. The $157 level aligns with the hedging price for institutional traders, who are selling the 150 call while buying the 157.5 call. This seems aimed at triggering institutional liquidations.

Today’s Trades

I executed two sell call trades:

$NVDA 20250725 180.0 CALL

$TSLA 20250725 350.0 CALL

Comments