Here’s a momentum strategy with an 83% win rate to consider!

NVIDIA’s Progress in the Chinese Market

In a recently published blog post, NVIDIA $NVIDIA(NVDA)$ stated that the U.S. government may soon approve its license to sell H20 GPU chips to China. While the license hasn’t been officially approved yet, the company expressed optimism.

After the news was released on July 15, NVIDIA’s stock surged as much as 5%, reaching a high of $172.53.

How Much Growth Can NVIDIA Recover?

Previously, the U.S. chip ban on China caused NVIDIA to lose approximately $8 billion in Q2 revenue.

If the ban is eased, NVIDIA is expected to recover part of those losses in the second half of the year.

Analyst estimates suggest that for every $10 billion increase in Chinese revenue, NVIDIA’s earnings per share (EPS) will increase by about $0.25.

In Q1, NVIDIA’s non-GAAP EPS was $0.81. After excluding H20-related expenses and tariffs, the adjusted EPS would have been $0.96.

The current consensus estimates suggest that NVIDIA’s overall business could grow by approximately 10%.

Evaluating the Ban Easing Expectation

This signals a potential easing of trade relations.

The license hasn’t been announced yet and may not align entirely with the H20 license.

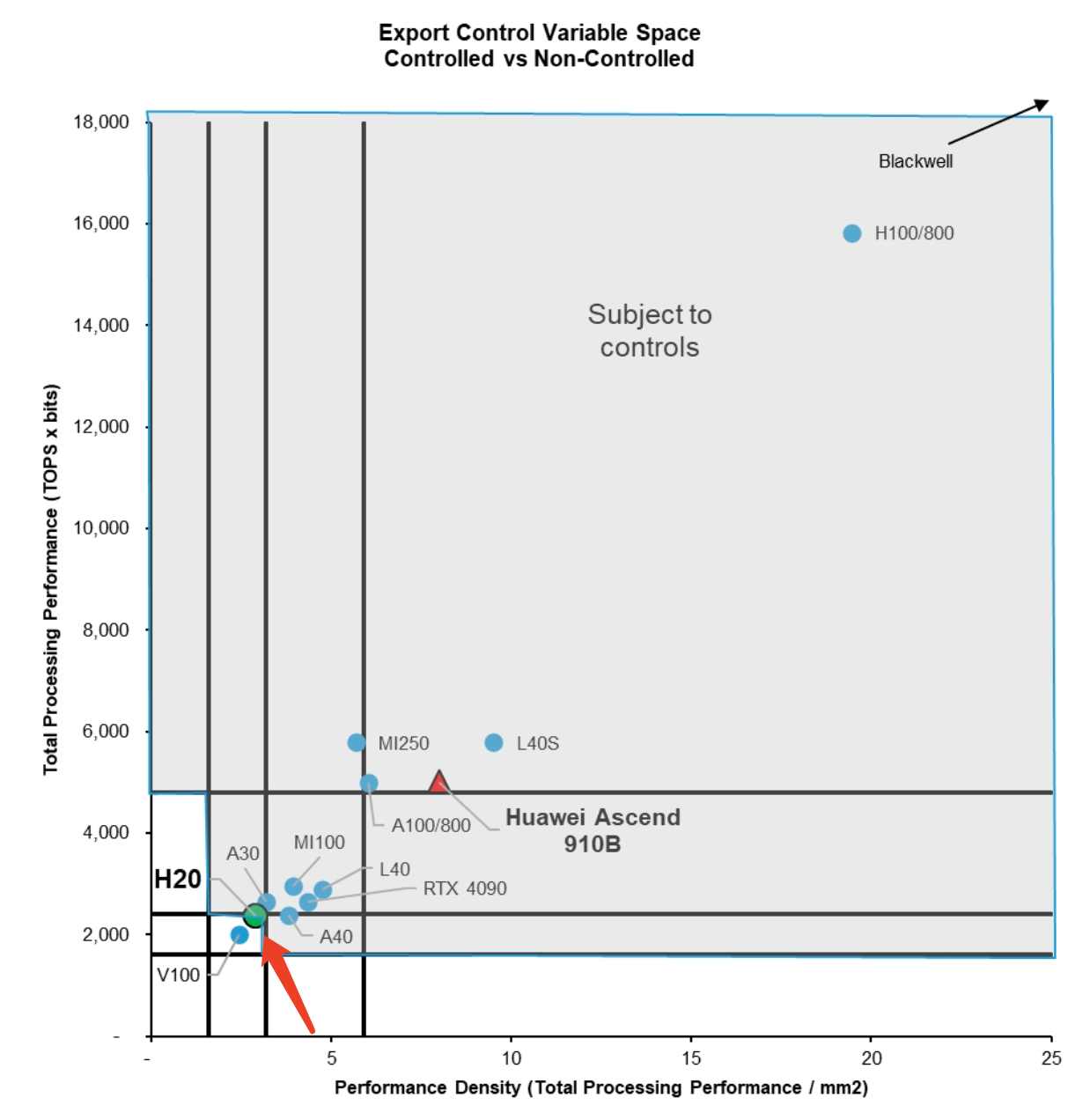

H20’s performance is already inferior to alternatives (see chart).

The competitiveness of the licensed chips remains to be validated, which directly impacts whether NVIDIA can achieve the expected 10% overall growth.

The 5% rally in stock price indicates the market sees the potential license as a driver of new business growth for NVIDIA.

Trading Strategies

If you hold NVIDIA stock:

If you’re concerned about the stock consolidating at higher levels, you can sell out-of-the-money calls to generate income during this phase.If you want to chase NVIDIA but fear buying at the top:

Consider selling out-of-the-money puts to capitalize on upward momentum while reducing your risk of being trapped at high prices.

Strike Price and Expiration References

Sell Call Option:

$NVDA 20250725 180.0 CALL (90% win rate)Sell Put Option:

$NVDA 20250718 165.0 PUT (83% win rate)

Comments