A number of cryptocurrency regulatory bills supported by US President Trump failed to pass key procedural votes in the House of Representatives on Tuesday, causing the entire cryptocurrency industry to suffer a major setback.

The result of this vote was 196 votes in favor and 223 votes against. Among them, 13 Republican lawmakers stood on the same front as Democrats and vetoed the rule vote of this bill. Due to the failure to pass procedural rules, the bill cannot enter the formal debate and voting stage.

This move not only rarely shows the "resistance" of Republican members of the House of Representatives to Trump, but also stalls the bill that was originally widely expected by the market to pass smoothly. House leadership plans to make another attempt to push for a vote as early as Tuesday evening, but it's unclear whether changes will be made to the bill's content or rules to win the support of conservative lawmakers.

After losing the vote, encryption concept stocks fell. The stock price of stablecoin issuer Circle (CRCL.US) once fell by more than 7%, and finally closed down 4.58%; Coinbase (COIN.US) fell 1.52% and MARA Holdings (MARA.US) fell 2.34%. Still, Circle's shares have risen more than six times from their issue price since it went public last month.

The three bills put on hold this time include the GENIUS Act: it aims to establish a federal regulatory framework for stablecoins, require 100% reserves, monthly audits, and allow qualified private institutions to issue digital dollars with the approval of the U.S. government. The bill was passed in the Senate last month after receiving support from some Democrats and is regarded as the first federal-level stablecoin regulation proposal in the United States. "CLARITY Act": It is intended to define whether encrypted assets are securities or commodities, which are regulated by the Securities and Exchange Commission (SEC) or the Commodity Futures Commission (CFTC). The proposal to prohibit the Federal Reserve from issuing central bank digital currency (CBDC) is controversial within the Republican Party.

One of the voting opposition parties, Republican congressman Marjorie Taylor Greene from Georgia, wrote on social media: "I voted against the procedural rules of the GENIUS Act because the bill does not ban CBDC and because Speaker Johnson did not allow us to submit relevant amendments."

She stressed that Trump had explicitly requested a ban on CBDCs in his Jan. 23 executive order, so "Congress must also embody this ban in the GENIUS Act."

However, the differences between the Republican Party in the House of Representatives have dealt a blow to Trump's high-profile legislative action in "Encryption Week". Investors who hold short-term bearish views on digital currencies can consider the bear market bullish spread strategy.

What is a Bear Call Spread Strategy?

A bear call spread is an options strategy in which options traders expect the price of the underlying asset to fall for some time to come, the trader wants to short the underlying and wants to limit trading to a certain risk range.

Specifically, the bear market call spread is achieved by buying a call option at a specific strike price while selling the same number of call options with the same expiration date at a lower strike price.

Specific cases of shorting Coinbase

Take shorting Coinbase as an example. The current price of Coinbase is $443. Assuming that investors expect to fall to around 300 on August 15, investors can use the bear market spread strategy to short MSTR at this time.

Step 1: Sell the call option with an exercise price of 300 expiring on August 15th and get a $9,200 premium.

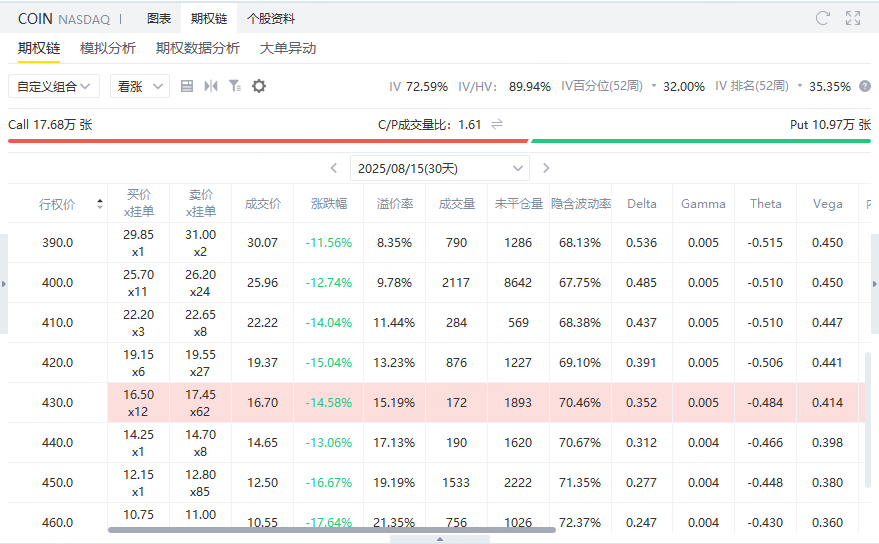

Step 2: Buy a call option with the same expiration date and an exercise price of 430, which costs $1,670 premium, and the bear market spread is established.

STRATEGY

Take shorting Coinbase (symbol: COIN) as an example, the current stock price is $443. Assuming that investors expect it to fall to around $300 by August 15, consider using the Bear Call Spread strategy to establish a bearish position.

Strategy Building

First step: Sell a contract expiring on August 15, 2024 with an exercise price of $300Call Option, obtained premium rights$9,200。

Second step: Buy one with the same expiration date and an exercise price of $430Call Option, pay premium$1670。

Premium Net Revenue

Gross Income = Put Option premium (9200)-Call Option premium (1670), Net Income =$7,530.

PROFIT AND LOSS

Maximum profit: If the COIN stock price is lower than $300 at expiration, neither option will be executed, the strategy expires and invalidates, and all premium income will be retained. → Maximum profit =$7530

Maximum loss: When the stock price is above $430 at expiration, both options are exercised, and the loss is the difference between the two strike prices minus premium net income. → Maximum loss = (430-300) × 100-7530 =US $5,470

Break-even point: The strategic break-even point is about the stock price → balance point = 300 + (7530 ÷ 100) =$375.30

Strategy Summary

This bear spread strategy is suitable for investors who are bearish on COIN but want to control potential losses by limiting risk. If the stock price falls below $300 at expiration, the maximum gain can be $7,530; If the stock price rises above $430, the maximum loss is $5,470; The breakeven point is roughly around $375.30.

Comments