$Taiwan Semiconductor Manufacturing(TSM)$

TSMC's (TSM) earnings report is scheduled for Thursday, with mixed expectations:

Earnings Positives: Strong Q2 data, with an 11% quarter-over-quarter growth; full-year revenue guidance may be raised.

Potential Earnings Negatives: Average performance expected for Q3 and Q4, with Q3 growth projected at 3-6% QoQ and a conservative outlook for Q4 at -6%.

Overall, the positives seem to have been priced in, such as the potential upward revision of full-year revenue guidance, while the earnings report may confirm the negative expectations.

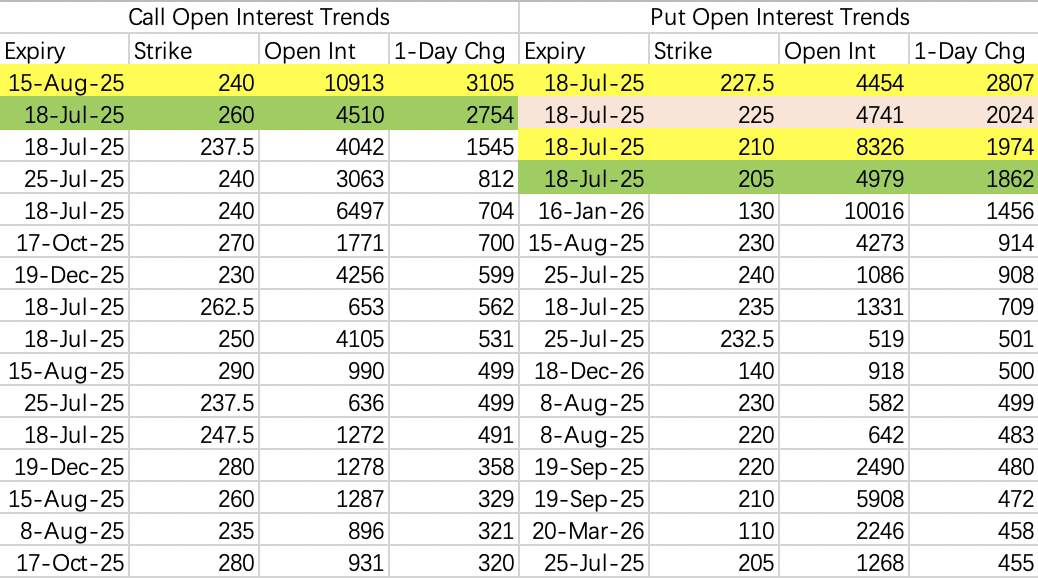

The anticipated volatility for this earnings report is 4.6%, with a trading range of $224–246.

Two main strategies are being adopted for this earnings report:

Simple bullish strategy: Buying the $240 call option:

Short-term bearish strategy: Selling the $260 call and buying the $227.5 put:

It’s worth noting that bearish traders failed with the $222.5 put last week and subsequently rolled their position to the $227.5 put.

Personally, I lean toward a straightforward spread trade:

Selling the $250 call and buying the $260 call:

$NVIDIA(NVDA)$

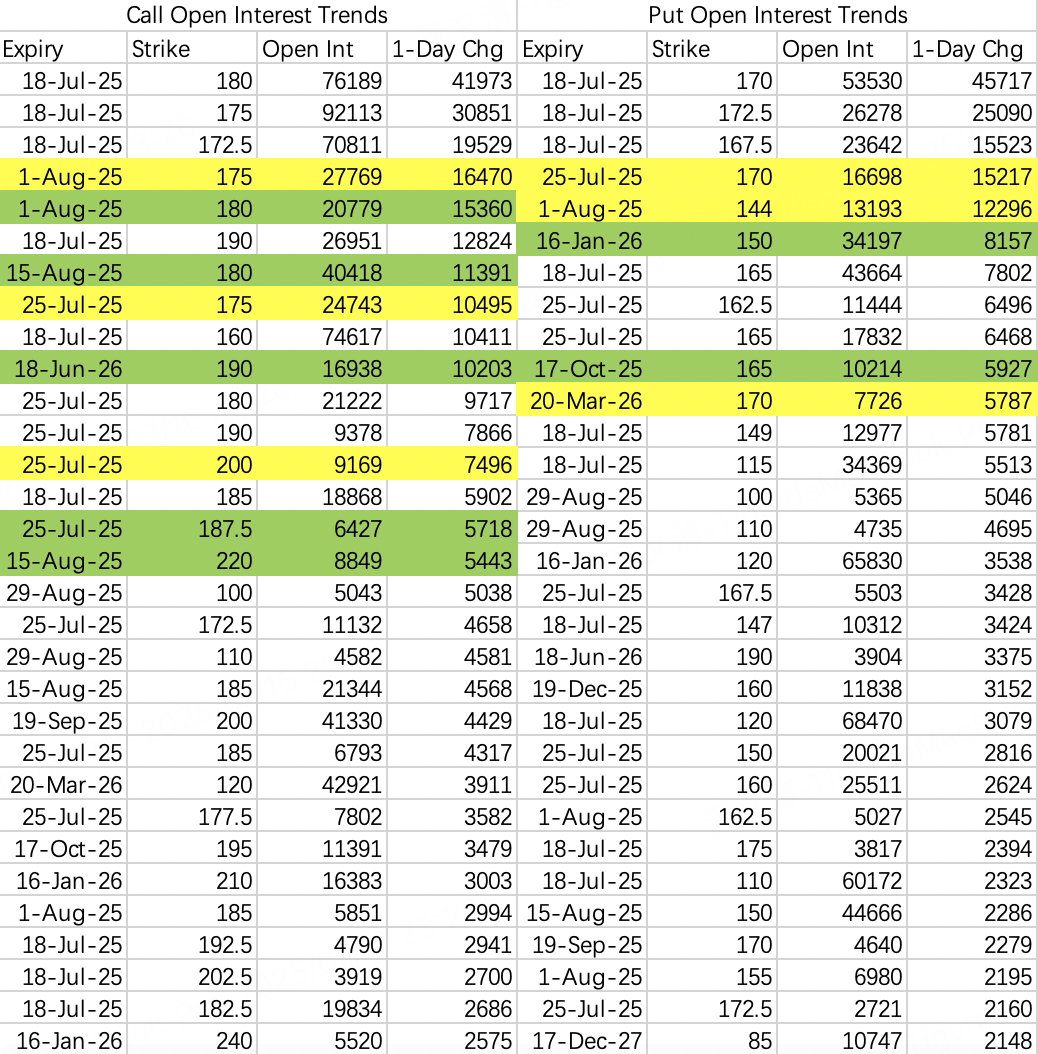

For NVIDIA (NVDA), it seems that traders are primarily focused on selling positions above $180. Over the past two weeks, there has been aggressive buying activity around the $175 level.

Bearish positions are being actively opened around $170.

The tighter the battle between bullish and bearish traders, the better the opportunities for selling options.

This week’s open interest data shows that the $170 call has the highest open interest, exceeding 100,000 contracts and reaching 139,000 contracts. The $175 call, due to significant new volume, may surpass the $170 level in open interest.

It’s possible we could see a repeat of last Friday's closing price action. Therefore, there may be an opportunity to execute an at-the-money straddle on Thursday or Friday, depending on market conditions.

$Advanced Micro Devices(AMD)$

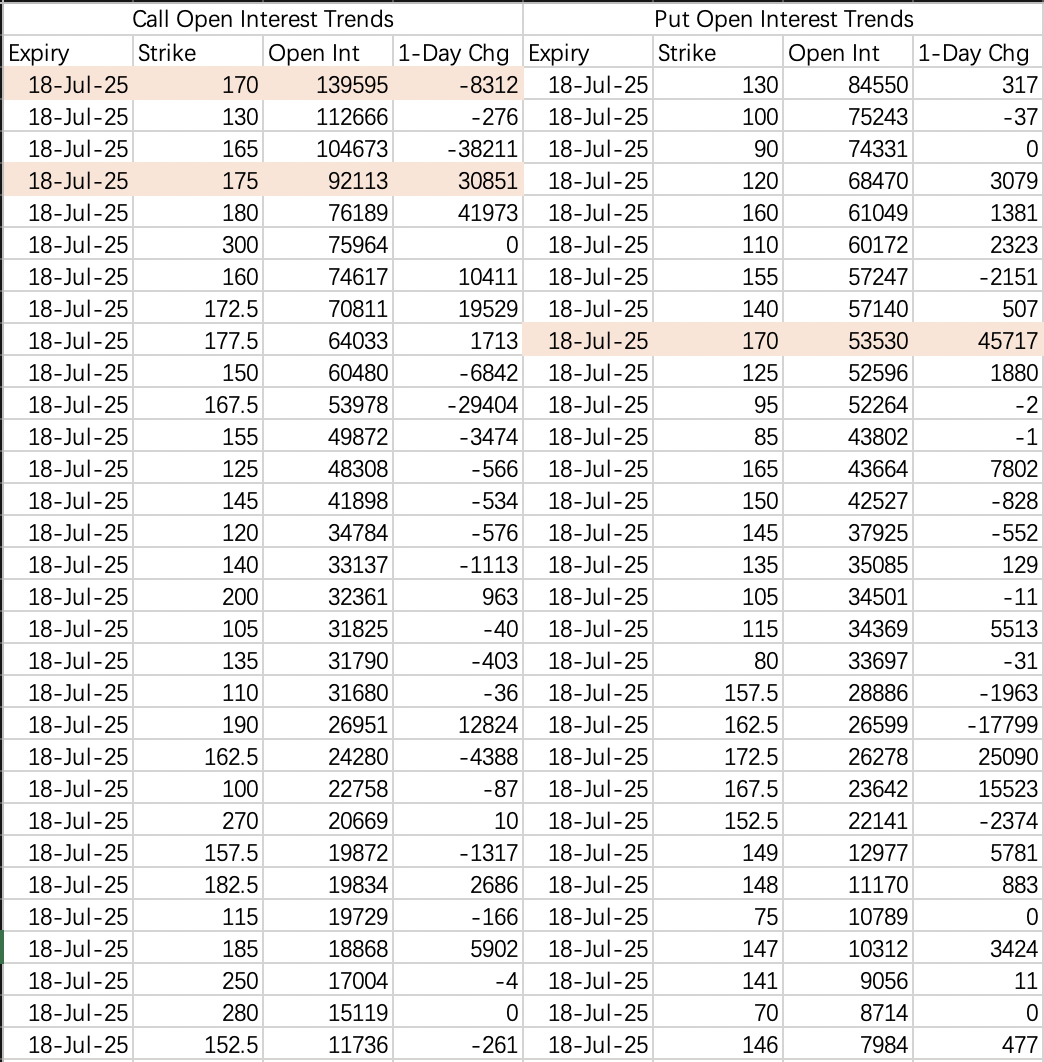

AMD's (AMD) stock price hit a high of $158.68 at 9:50 AM on Tuesday. Shortly after, at 9:55 AM, institutions rolled their $150–157.5 call positions into this week’s $165–170 range, specifically:

Selling the $165 call: $AMD 20250718 165.0 CALL$

Buying the $170 call: $AMD 20250718 170.0 CALL$

Following this roll, the stock price quickly pulled back.

Typically, such roll strategies target options expiring next week. However, possibly due to caution over a potential surprise rally from TSMC’s earnings, they chose this week’s options, which experience the highest time decay.

Today, I plan to execute a simple spread trade on TSMC:

This strategy carries a bit of risk.

Comments