Global streaming media giant Netflix will release its financial report after the market closes on July 17, Eastern Time (early morning on Friday, July 18, Beijing time).

The agency expects Netflix to achieve revenue of US $11.042 billion in 2025Q2, a year-on-year increase of 15.51%; Earnings per share are expected to be $7.066, a year-on-year increase of 44.8%.

Judging from the year-to-date stock price trend of Netflix, despite the impact of tariffs, the stock price briefly fell with the broader market, but Netflix was once known as a "safe haven for tariffs" for a period of time, and its stock price rose all the way from its low in April to June. A high of $1,341.15 in the month.

Highlights of Netflix's financial report

As of the beginning of 2025, Netflix's monthly active users reached 94 million, a double increase from 40 million in the same period last year. However, after the company stopped disclosing the number of users in Q1, its advertising business will become a catalyst for future performance growth. Management had expected advertising sales to double in 2025.

At the same time, the company's self-developed advertising technology platform Netflix AdsSuite can provide personalized advertisements with low ad load volume, which improves the user experience. This allows Netflix to capture a significant share of the global advertising market while maintaining its subscription growth momentum.

Netflix's layout in content diversification is attracting great attention from investors. Currently, Squid Game Season 3 has just been released less than two weeks ago, while Wednesday and Stranger Things are expected to release in the coming months. At the same time, the company continues to increase the copyright of live broadcast of sports events, including: WWE (World Wrestling Entertainment) events, NFL (American Professional Football League) selected events, and a broadcast agreement with the French broadcasting company TF1.

These live event programs (including sports partnerships and exclusive content) and new blockbuster releases may be able to maintain the number of subscription members, marking Netflix's strategic transformation from a pure on-demand platform to an integrated entertainment service. Even if Netflix no longer discloses these numbers now, the release of content will ensure that the number of subscribers is maintained. Investors will also look forward to any plans in the results meeting, especially in newly penetrated areas such as sports and entertainment.

In terms of games with new growth points, although the scale is not large at present, the goal is a consumer market opportunity of US $140 billion. Focus on IP-based games and mature games with the potential to increase engagement.

Investors should also pay close attention to any changes to Netflix's full-year guidance. As of the last update, the company was targeting total revenue between $43.5 billion and $44.5 billion by 2025, but if management increases that figure in its July 17 report, it could add to the bullish sentiment surrounding Netflix stock.

How has the stock price performed on previous earnings days?

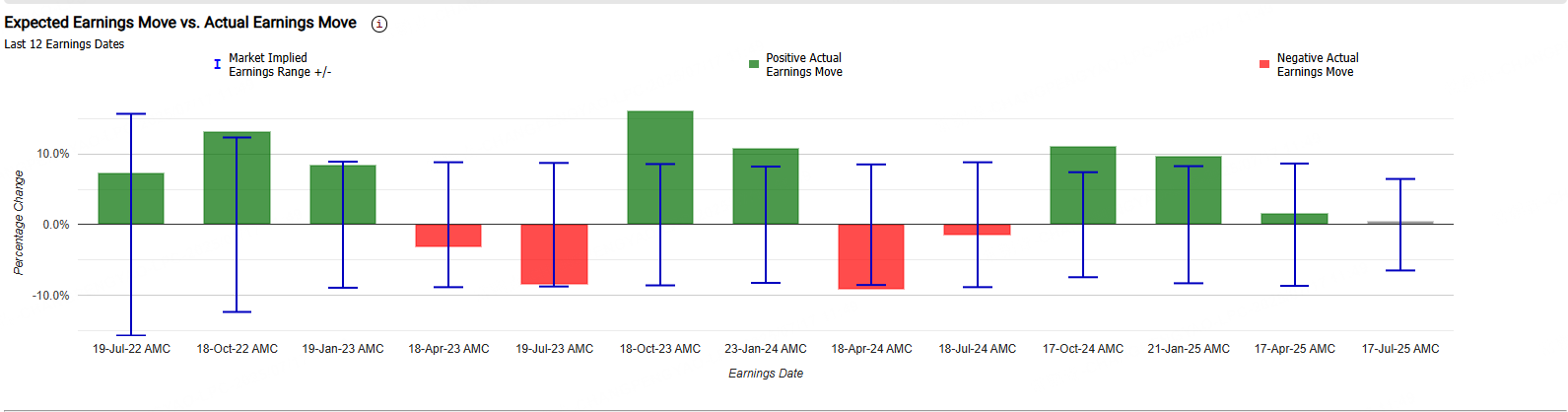

According to Market Chameleon, the implied change in Netflix's current stock price is ± 7. 1%, indicating that the options market bets on its single-day increase and decrease of 7.1% after its performance; In comparison, the post-performance stock price change in the first four quarters was about 8.3%, and the final actual change range reached 6%. Current option values are overvalued.

In the past 12 performance days, Netflix's probability of rising was 66.7%, the largest increase was +16.05%, and the largest decline was-9.09%. The options market underestimated Netflix's fluctuation range after the financial report was announced 50% of the time. The average fluctuation range after the financial report is announced is ± 9. 4%, while the average (absolute value) of the actual fluctuation range is ± 8. 3%.

In view of the upcoming Netflix financial report, investors can use the wide straddle strategy to trade.

What is the wide straddle strategy

In long wide straddle options, investors buy both out-of-the-money call options and out-of-the-money put options. The strike price of a call option is higher than the current market price of the underlying asset, while the strike price of a put option is lower than the market price of the underlying asset. This strategy has significant profit potential because the call option theoretically has unlimited upside if the price of the underlying asset rises, while the put option can make a profit if the price of the underlying asset falls. The risk of the trade is limited to the premium paid for these two options.

An investor shorting a wide straddle sells an out-of-the-money put and an out-of-the-money call at the same time. This approach is a neutral strategy with limited profit potential. Shorting a wide straddle option is profitable when the underlying stock price is trading within a narrow range between break-even points. The maximum profit is equal to the premium obtained by selling two options minus the transaction cost.

Netflix short-selling wide straddle strategy case

Stock Netflix is currently trading at $1,250. Investors can implement the short wide straddle strategy by:

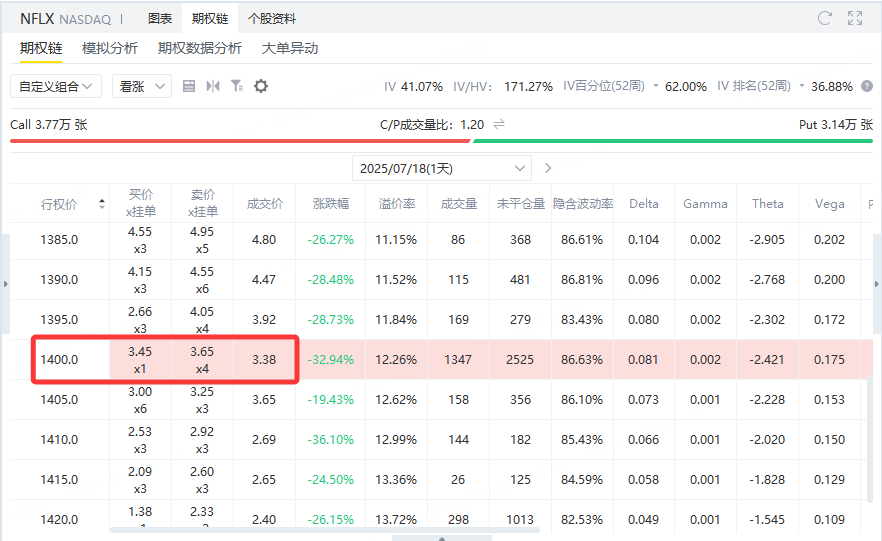

Selling a call option with an exercise price of $1,400, premium is $338.

Sell a put option with an exercise price of $1,125, and premium is $385.

Strategy type: Short Strangle

Investors' current operations are as follows:

Sell a Netflix call option with an exercise price of $1,400 and collect premium$338

Sell a Netflix put option with an exercise price of $1,125 and collect premium$385

Total premium: $723 (100 shares per option, total contract price)

Maximum benefit

The maximum benefit is all premium received, i.e.$723。 This maximum return can only be obtained when Netflix's stock price is between $1,125 and $1,400 when the option expires, and neither option will be executed.

Maximum loss

The maximum loss isUnlimited, because there is no protection:

If the stock price rises by more than 1400, loss = stock price − 1400 − 7. 23 (per share) × 100

If the stock price falls below 1125, loss = 1125 − stock price − 7. 23 (per share) × 100

Note: The premium per share here is723 ÷ 100 = $7.23

Break-even point

Above breakeven point = 1400 + 7.23 =$1407.23

Lower breakeven point = 1125 − 7. 23 =USD 1,117.77

As long as the stock price isBetween US $1117.77 and US $1407.23, the strategy is to make profits. It is suitable for investors to judge that Netflix's stock price will not fluctuate much and consolidate for a period of time in the future, and can earn premium.

Risk warning

This strategy has huge risks in the face of extreme market conditions (theoretically unlimited losses)

In actual transactions, it is recommended to:

Control positions to prevent liquidation

Set stop loss/automatic liquidation mechanism

Or build an "Iron Condor" strategy to limit losses in conjunction with buying protective options with further strike prices

Comments