$Taiwan Semiconductor Manufacturing(TSM)$

TSMC's (TSM) earnings report saw the stock price spike and then pull back. I believe the main issue is similar to what was mentioned yesterday: Q3 is expected to grow 4% quarter-over-quarter, but the numbers aren’t particularly enticing. Additionally, the stock had already hit new highs prior to the report. Even though management expressed strong optimism about AI prospects, the stock price gains remained within the forecast range.

This quarter’s earnings reports may exhibit a similar pattern across the board: Q2 significantly overdraws full-year expectations, leading to high openings followed by sell-offs after the disclosure.

It is worth paying attention to data center-related stocks. TSMC management indicated that demand for data centers is exceptionally strong, including $CoreWeave, Inc.(CRWV)$, and Q3 projections for data-center-related names may outperform AI chip stocks. We’ll have to wait and see.

$NVIDIA(NVDA)$

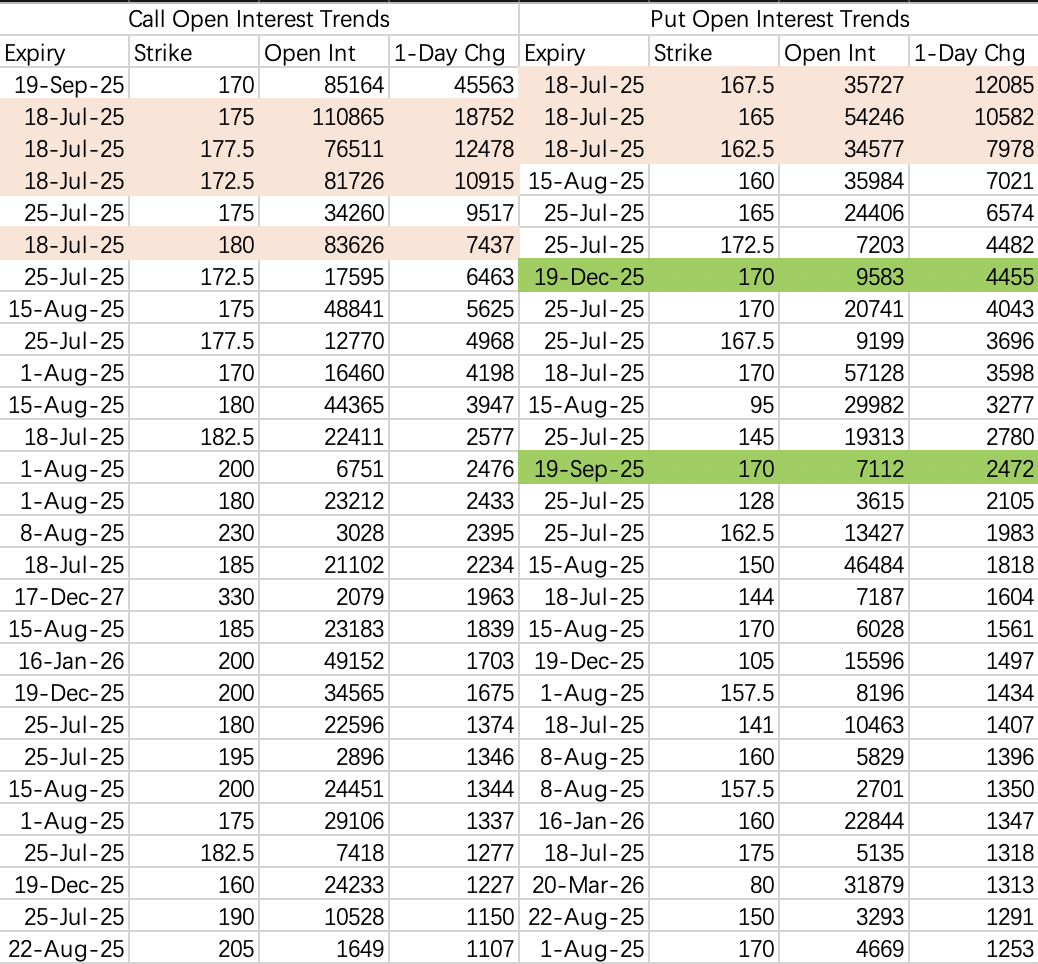

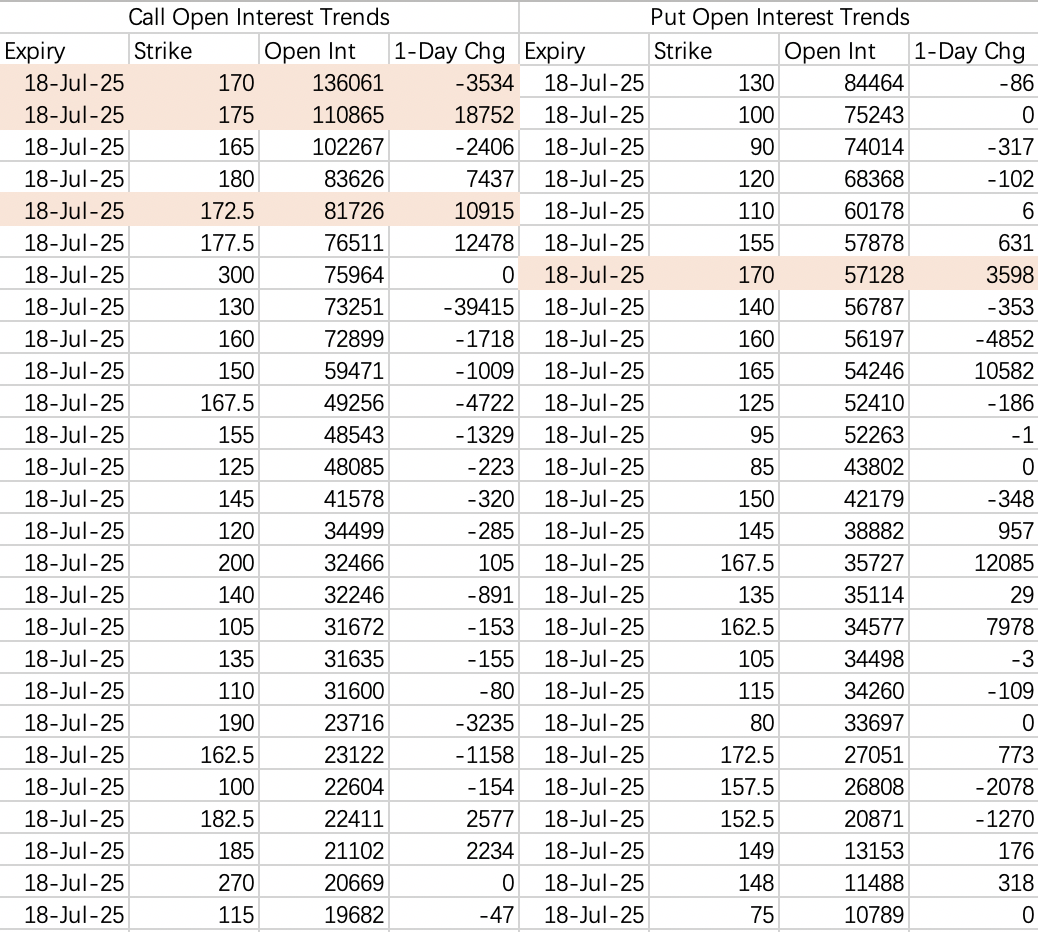

Bears have completely surrendered, now resorting to selling the $170 put.

This week’s bullish options activity shows signs of a short squeeze.

Large long call trades have rolled from the $130 call expiring July 18 to the $170 call expiring in September.

There’s a good chance tomorrow’s closing price will hover near $175, similar to last Friday (July 11).

For now, you could consider selling next week’s $170 put option:

$NVDA 20250725 170.0 PUT$

Avoid using leverage.

$Tesla Motors(TSLA)$

Tesla’s (TSLA) earnings expectations have changed—it might not be as bad as anticipated!

A trader betting on sub-$300 levels closed half of their bearish positions on Wednesday. Not sure what’s behind this move—could it be that Tesla’s breakout scared them, and they no longer want to short it directly?

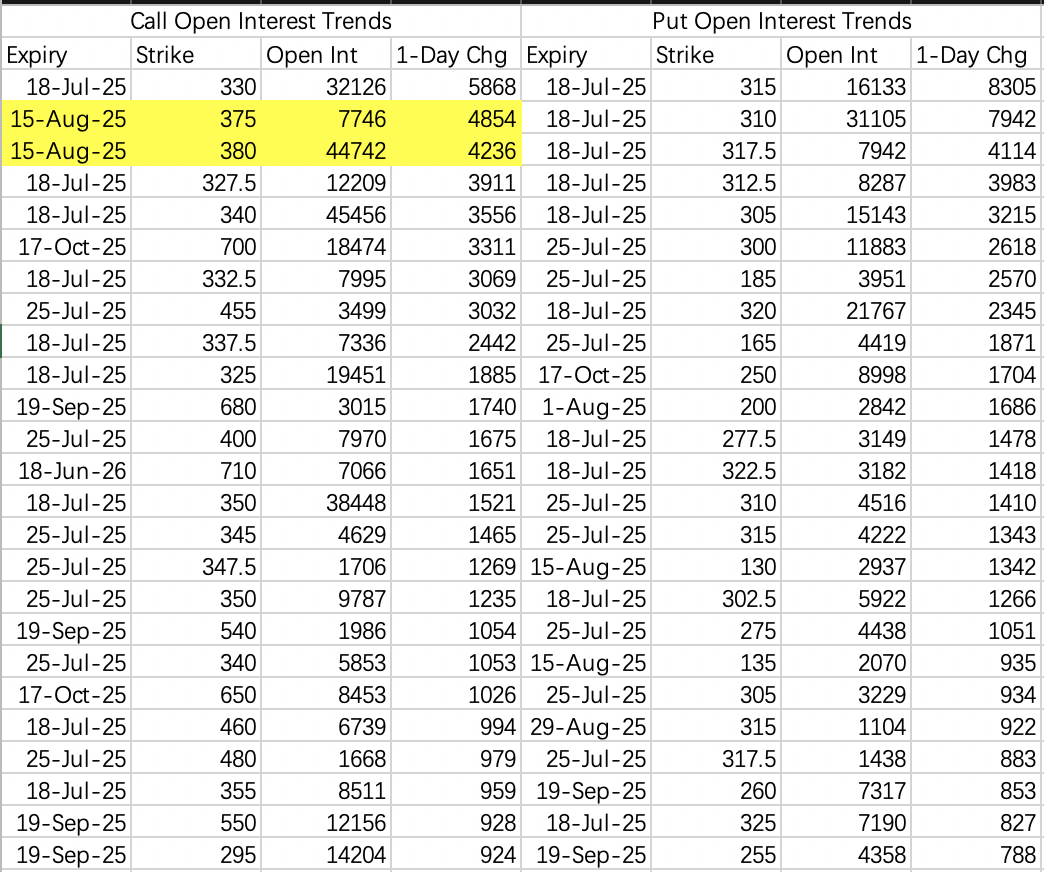

Additionally, it’s rare to see short-term bullish call buying in Tesla’s option flows, but there has been recent activity:

I’m still opting to sell the $350 call and will consider adding a sell put position depending on further developments.

$Circle Internet Corp.(CRCL)$

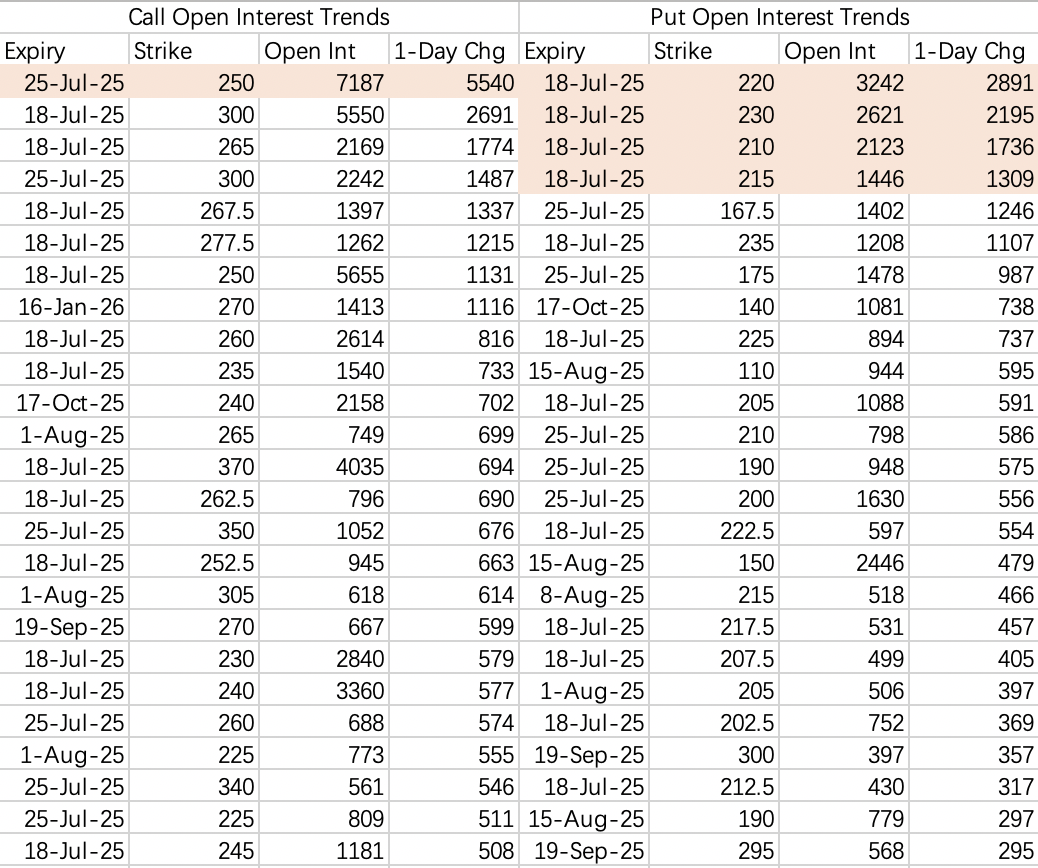

For options expiring on the 25th, there’s a notable increase in bullish activity, particularly for the $250 call.

Bearish positions opened this week have been relatively normal, with pullback targets around $210.

For stablecoin-related tickers, there are quite a few choices, including $COIN$, $CRCL$, and $HOOD$. I’ve chosen to sell the $HOOD$ $100 put option:

In addition to $HOOD$, I also sold the $NVDA$ $170 put:

I don’t plan to hold the $170 put until expiration. If the stock price surges above $175, I will close the position early.

Comments