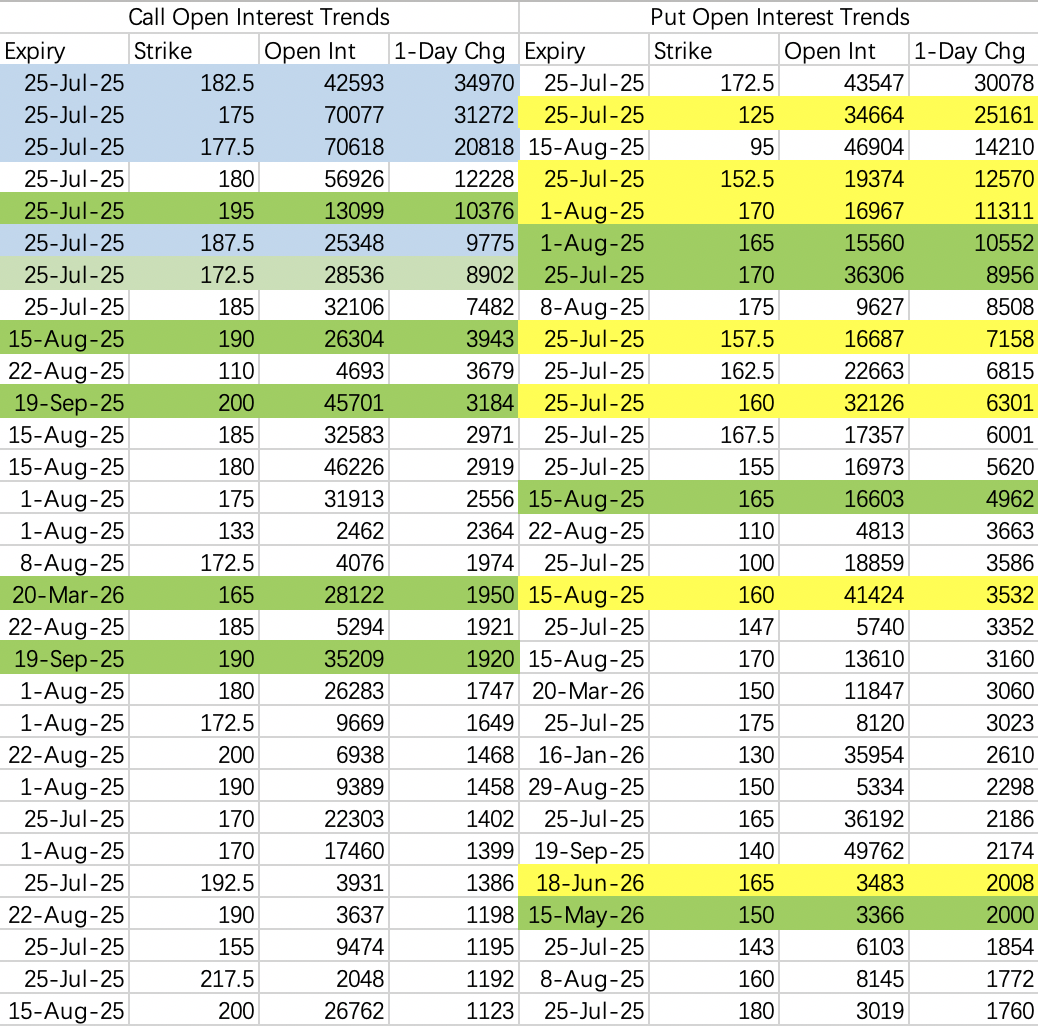

$NVIDIA(NVDA)$

Earnings season over the next two weeks may bring surprises.

Current options activity resembles a collar strategy: sell call + buy put.

Institutional Arbitrage Strategy:

Selling calls at $175 and $177.5.

Hedging by buying calls at $182.5 and $187.5.

Above $190: Most bullish call options are being sold off.

Bearish bets continue to anticipate a pullback, but there is no consensus among bears. The median target for a pullback is around $165, with most bets on the decline occurring this week or next. This aligns with what I mentioned last week: a spike after earnings, followed by a pullback.

$VanEck Semiconductor ETF(SMH)$ : Similar bearish bets are being placed, with deep out-of-the-money puts (e.g., $200 put) being bought, indicating a focus on volatility rather than fundamentals.

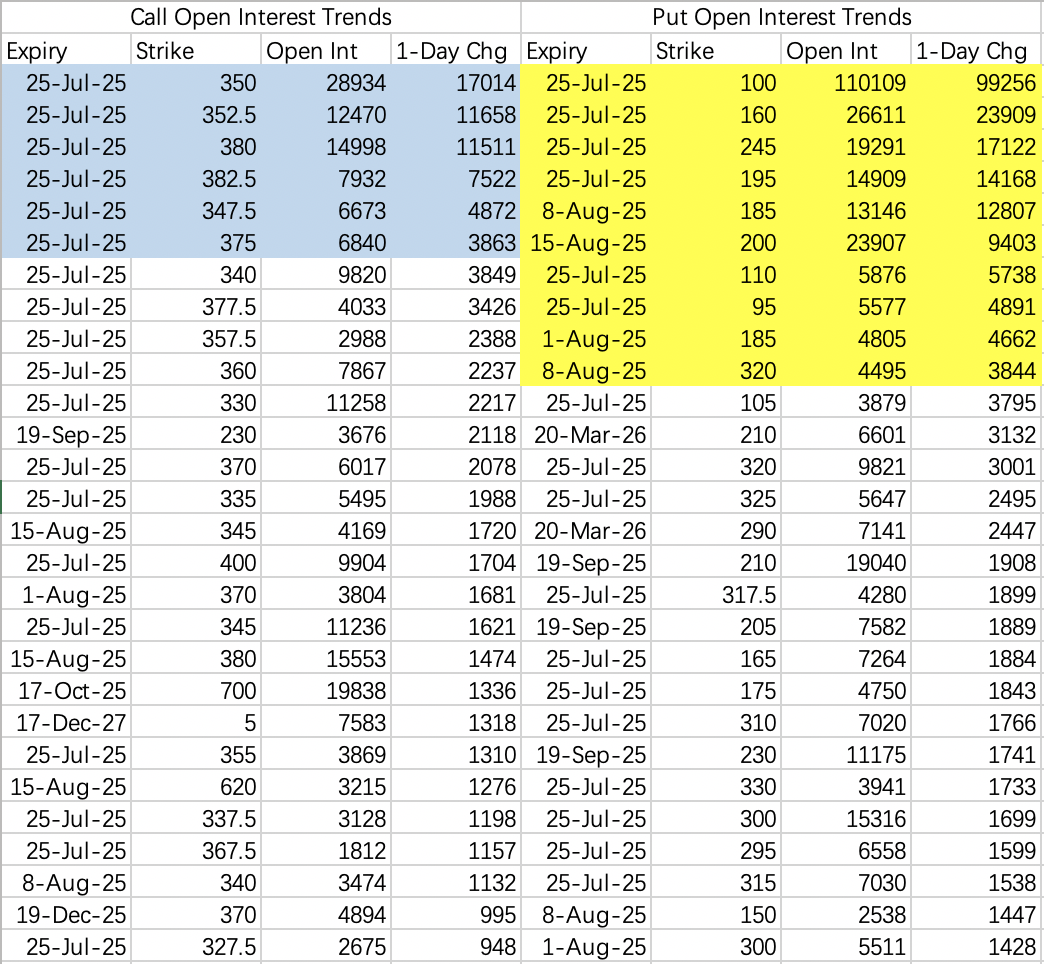

$Tesla Motors(TSLA)$

Tesla's earnings report does indeed contain positives, but the same data framed differently can translate into a bullish narrative:

According to Deutsche Bank, Tesla delivered 384,000 vehicles in Q2. While this represents a 13% year-over-year decline, it also marks a 14% quarter-over-quarter growth, potentially exceeding market expectations.

However, when the positives are priced in before earnings, the subsequent release of the "good news" often becomes a sell-the-news event.

Institutional Activity (Blue):

Selling calls expiring this week at $347.5, $350, and $352.5.

Hedging by buying calls at $375, $380, and $382.5.

Example: $TSLA 20250725 350.0 CALL$ .

Bearish Activity (Yellow):

All bearish positions involve buying puts, with no unified short-selling consensus. Instead, it’s essentially betting on a crash.

The market's dismissive attitude toward Tesla's earnings is almost palpable.

My View:

A crash isn’t guaranteed—it depends on how much Tesla’s stock rallies before earnings. I suggest focusing on bullish spread strategies, using institutional strike prices as a reference. While the probability of a significant rally is low, it’s still worth including the buy call leg in your strategy for balance.

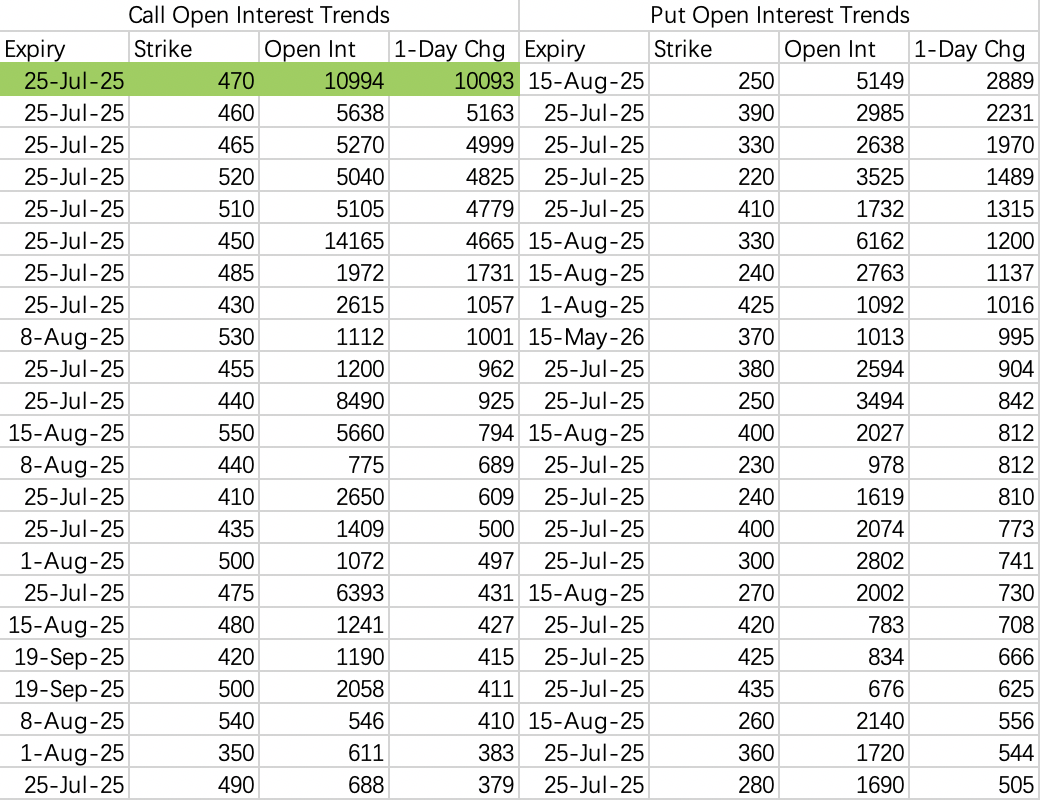

$Coinbase Global, Inc.(COIN)$

Last week saw an intense short squeeze, and the intent to offload shares was clear.

This week, it’s worth continuing to sell calls.

Tonight’s trade: Sell call at $470: $COIN 20250725 470.0 CALL$ .

Most other trades were executed last week. I’ll wait for more favorable prices to add to positions.

Comments