$Tesla (TSLA) $Will release earnings on July 23, 2025 (after hours).

The agency expects that 2025Q2 is expected to achieve revenue of US $22.36 billion, a year-on-year decrease of 12.32%, and expected earnings per share of US $0.322, a year-on-year decrease of 23.38%. The accounting standard used for the above data is US-GAAP.

For the upcoming Tesla second quarter report, analysts generally expect both revenue and profit to drop. Tesla will hold a conference call after the earnings report. The focus of the market is whether Musk can successfully rebuild investor confidence in Tesla.

Musk has recently been working to rebuild market confidence, including reiterating his full commitment to company affairs and hinting at strong competition in artificial intelligence.

Last Sunday, he posted on social media X that he would return to working seven days a week and sleeping in the office if small children weren't around. On the same day, he also posted, "I have resisted artificial intelligence for too long and have been living in denial. Now, the game begins". The analysis pointed out that Tesla investors should focus on three major highlights this Wednesday: the core auto business, the future of Robotaxi, and the prospect of affordable electric vehicles.

Core Automotive Business

Despite Musk's aggressive embrace of a robot-driven future, Tesla's core revenue stream remains its automotive business.

Previously, Tesla's global delivery volume in the second quarter was lower than market expectations, laying hidden worries for investors. In the second quarter, Tesla delivered a total of 384,100 vehicles, a year-on-year decrease of 13.5%, mainly due to declining sales in North America and continued weakness in the European market. In addition, the replacement pace of Model Y models also affects the overall delivery performance.

The future of Robotaxi

For Tesla, the bright side is Musk's big gamble on the future driverless taxi Robotaxi.Tesla and Musk are likely to focus on this business. During the earnings call, Musk may reveal more information about the business.

Tesla has expanded its Robotaxi testing in Austin, Texas, operating in a larger area, and more vehicles may be put into service in the future.

Musk recently said that the company will expand Robotaxi testing to the San Francisco Bay Area. However, there are reports that the relevant license application has not yet been submitted.

"The earnings call also provided an opportunity for Tesla's self-driving taxi/self-driving narrative, which has been at the heart of Tesla's stock strength." "We may see Musk discuss fleet growth targets or expansion plans," Barclays analyst Dan Levy wrote in a note to investors.

While Tesla's second-quarter earnings report is hardly optimistic, CEO Elon Musk is likely to fully describe his vision for the future on a conference call.

How has Tesla's earnings day history performed?

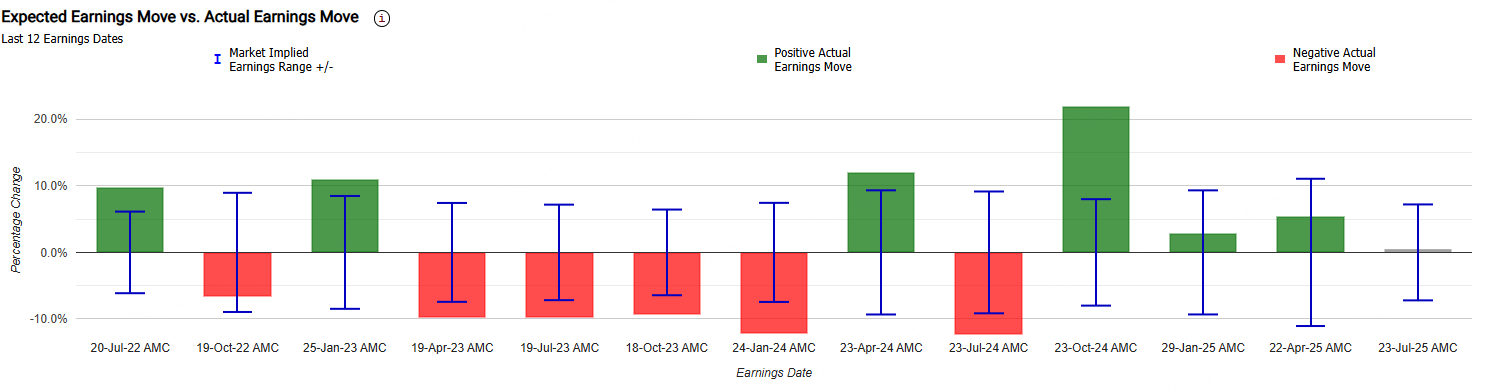

Tesla's post-performance volatility in the past few times has greatly exceeded market expectations.The options market has overestimated Tesla's (TSLA) post-earnings stock price volatility 25% of the time in the last 12 earnings quarters. The options market predicts that the average change in the stock price after the announcement of the earnings report is ± 8. 2%, while the average change in the actual stock price is 10.2% (in absolute terms). This suggests that Tesla's stock price reaction after the earnings report is usually more drastic than the options market predicts.

On the first four results release dates, Tesla rose and fell by-12.3%, 21.9%, 2.9%, and 5.4%.

Double-Buy Straddle Options Bet on Earnings

Tesla's current price is 333. Investors can sell a call option with an exercise price of 360 to get a premium of $325, and sell a put option with an exercise price of 300 at the same time, which costs $188.

Tesla's current stock price is $333

Sell a Call option (Call) with an exercise price of 360 and get premium $325

Sell a Put option with an exercise price of 300 and get premium $188

Total revenue is 325 + 188 =$513

Maximum profit:

When the stock price is between $300 and $360 at expiration, neither option will be exercised, and investors can retain all premium. Therefore,The maximum profit is $513.

Loss analysis during upward breakthrough:

If the stock price rises by more than $360 at expiration, the sell Call will be executed, and the investor needs to sell TSLA shares at a price of 360. The actual loss is the portion of the stock price exceeding 360.

Upward breakeven point = 360 + 5.13 = $365.13.

Analysis of losses when it plummets downward:

If the stock price falls below $300, the sell Put will be executed, and the investor needs to buy TSLA stock at $300, with a loss of 300 minus the difference between the current stock price.

Downward breakeven = 300 − 5.13 = $294.87

Summary and risk warning:

This is a high-winning, high-risk strategy, which is suitable for investors to judge that the stock price will fluctuate within a range. If TSLA rises or falls sharply, the loss may far exceed premium revenue.

If you want to control the risk, you can consider buying a Call at a higher price (such as 370) and a Put at a lower price (such as 290) to build an Iron Condor strategy to cap the risk.

Comments