$Alphabet(GOOGL)$ $Alphabet(GOOG)$

On Wednesday, I wasn’t feeling well and didn’t get to review the options data for new positions, but I had a hunch that Google’s earnings would be decent.

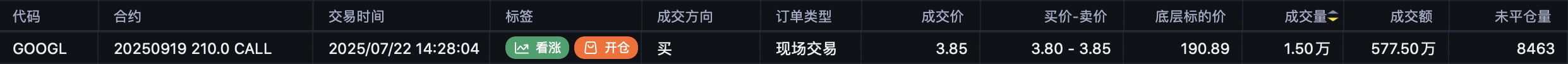

Out of curiosity, I checked my phone, and to my surprise, someone opened a massive position the day before the earnings report: 60,000 contracts of the $GOOGL 20250919 210.0 CALL$ , with a total transaction value of over $23 million—executed as an on-exchange trade.

Theoretically, this signals extremely bullish sentiment. However, I held back from going all in. While the earnings were unlikely to disappoint, I wasn’t convinced there would be a massive rally either.

As it turns out, the earnings report was solid, but the stock’s gains didn’t exceed the expected volatility range. So, where did this massive bullish confidence come from?

AI compute demand is skyrocketing: The average monthly token generation surged from 480 trillion in May (after the I/O conference) to 980 trillion now.

Capital expenditures for the year were raised by another $10 billion.

With these two pieces of news, while I can't guarantee explosive gains for other chip and AI-related sectors, selling puts over the next two weeks seems like a solid strategy.

For those asking, “What happened to the expected pullback?” Well, plans can’t keep up with changes.

$NVIDIA(NVDA)$

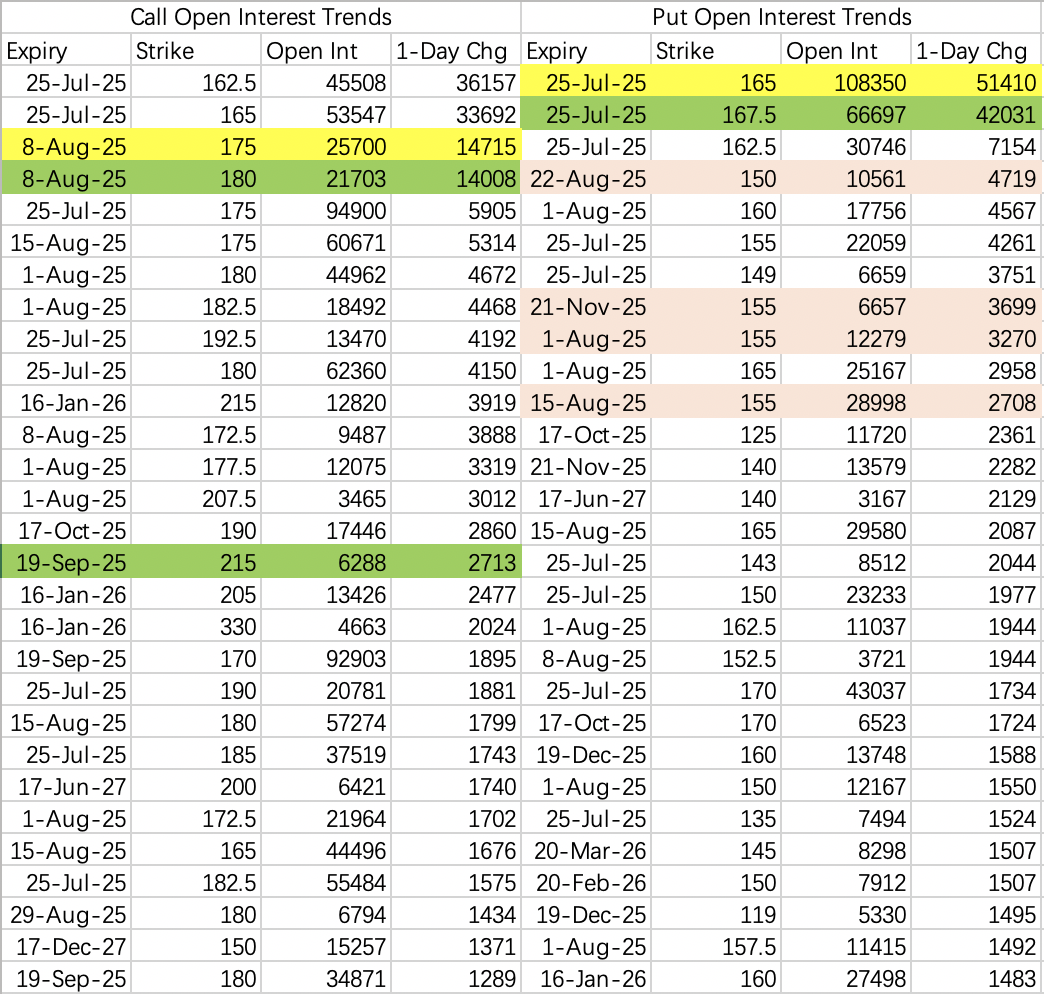

This week, NVDA’s range is $167.5–$177.5.

Large bullish positions point to a range of $175–$180 for the week after next:

Given the compute growth numbers disclosed by Google, I believe other major companies should see similar tailwinds. However, I opted for a more conservative strategy by selling puts:

Bears are still active, but I think it’s better to consider bearish strategies only after next week.

$Tesla Motors(TSLA)$

Tesla’s earnings were quite mediocre, and surprisingly, Elon Musk didn’t offer his usual ambitious promises.

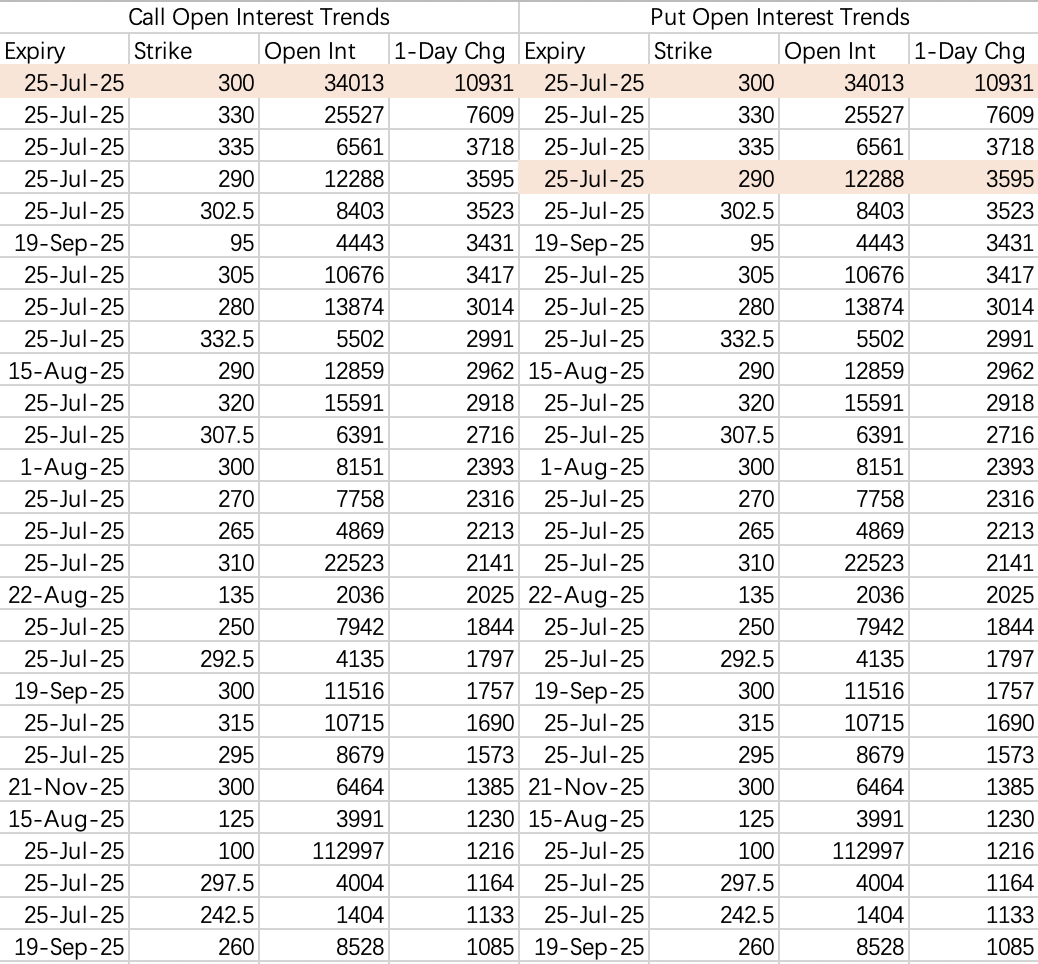

Interestingly, pre-earnings bearish positions were fairly accurate, with expectations aligning to a drop toward $300.

With Tesla’s July delivery report due in a week, the market will be watching closely to see if July can sustain June’s growth. This expectation serves as support for the stock price.

For now, I see an opportunity to sell puts on sharp pullbacks:

Today’s Trades

I’m selling puts on:

Comments